Over 200 Billion Arm-Based Chips Shipped

Setting its sights on one trillion.

Arm announced that its ecosystem partners have shipped over 200 billion chips based on its architecture, an immense yet hardly surprising number as Arm commands the markets of microcontrollers and smartphones. But while Arm has the world's most popular CPU architecture, there are a lot of challenges ahead of it.

Pervasive Architecture

Nowadays it is close to impossible not to use at least one Arm-based device throughout the day, since computers in general and the Arm architecture in particular have become ubiquitous. Arm is one of a few companies with technologies that can power almost any device. Arm's Cortex-A, Cortex-R, Cortex-M, and Mali IP are used for myriads of CPUs, controllers, microcontrollers, and GPUs from over 1,600 developers globally. Whether you use a smartphone or a car, chances are that they feature an Arm-based chip inside.

Adoption of Arm continues to accelerate. It took the company's partners about 23 years — from 1991 to 2014 — to ship the first 50 billion of chips, then it took them three years — from 2014 to 2017 — to ship another 50 billion. Now, it took the Arm ecosystem about 4.5 years to ship another 100 billion chips. Arm says that every second around 900 chips based on its architecture are produced.

With 200 billion Arm-based chips shipped, the obvious questions are how quickly Arm can get to 500 billion and one trillion chips. While we can hazard a guess that with megatrends like AI, HPC, edge computing, robotics, and IoT, Arm's partners could ship the trillionth Arm-based chip within the next 10 years or so, there are a number of challenges Arm faces on the road ahead.

Challenges Ahead

Arm knows how to compete. The company has managed to leave behind Arc and MIPS CPU architectures that were available for licensing and rather successfully competes against Imagination Technologies and its PowerVR GPU architecture. But in a bid to grow further financially, Arm needs to address premium applications, such as client PCs and datacenters. Meanwhile, Arm also has to defend its positions in its traditional markets of small chips, such as controllers and microcontrollers that are cheap yet used everywhere and sold in mind-boggling quantities.

Client PCs and Datacenters

From an architecture point of view, Arm's 64-bit Armv8 could address PCs and servers since 2011, but so far only a handful of companies, including Apple, Qualcomm, Ampere, and AWS have introduced system-on-chips that can offer decent performance for such applications and compete against CPUs from AMD and Intel. To enable other vendors to offer SoCs for performance-hungry applications, Arm introduced its Neoverse-branded performance-focused core in 2019, yet the success of this design has been rather mediocre to this point.

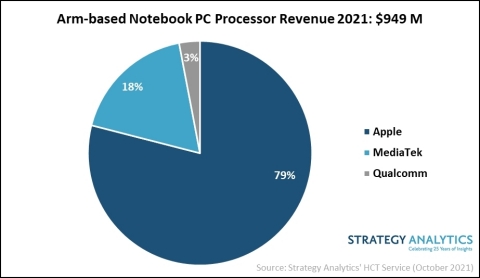

Since Apple began transitioning its Macs to Arm-based SoCs, it is not surprising that Arm's share in the PC space is growing. Strategy Analytics believes that Arm-based notebook SoC revenue will grow three times in 2021 compared to 2020 and will reach $949 million. The analysts believe that already this year Arm-powered SoCs will command 10% of the laptop market thanks to Apple's M1-series SoCs for MacBooks, MediaTek's SoCs for Chromebooks, and Qualcomm's SoCs for Windows-on-Arm machines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Keeping in mind that Chromebooks are sold mostly in the U.S. and generally to students, this market is pretty limited. Meanwhile, Qualcomm's platform for Windows has yet to become competitive against those from AMD and Intel. As a result, Arm's success in the PC space will largely depend on the success of Apple in this market.

"Qualcomm, despite its close partnership with Microsoft on Windows OS, couldn't make a dent in the notebook PC market so far," said Sravan Kundojjala, Associate Director of Handset Component Technologies service at Strategy Analytics. "Qualcomm is investing heavily in the computing market with its Nuvia acquisition, and we will see results only in 2023. In the near term, Qualcomm can focus on Chromebooks to capture share from MediaTek. Strategy Analytics believes that Arm-based notebook PC processor vendors will need to step up software investment and branding efforts to compete effectively with x86-based vendors Intel and AMD."

As for servers, Arm has numerous ambitious partners like Ampere that are developing server SoCs, but software compatibility is obviously something that slows down adoption of such chips. To actually become a strong data center player, Arm and its partners will have to ensure that the software stack is there. Fortunately, the situation is getting better for Arm. For instance, AWS and Oracle are deploying their own or Ampere's processors, respectively.

Obviously, AMD and Intel know their advantages and realize what kind of benefits Arm designs can provide, so they will do everything to maintain their performance leadership and add flexibility to address emerging workloads. We expect to see a lot of this from Intel's upcoming Alder Lake architecture.

RISC-V: A Major Risk Factor for Arm

But maintaining its positions in existing markets is just as important as entering new ones. This is where Arm is going to face challenges from the rapidly developing RISC-V ecosystem. Just three or four years ago, the available RISC-V cores could only address simple microcontrollers, but today they can run rich operating systems like Linux.

The key advantage that the RISC-V instruction set architecture (ISA) has over Arm is that it is royalty free and many designs are open source (and also free). Assuming that a company can develop a software stack for RISC-V, it can migrate from Arm to RISC-V chips to save some money. For example, Apple, one of Arm's most important customers, is exploring RISC-V and is looking forward to implementing RISC-V hardware in the coming years. While Arm can offer software compatibility and familiar design, it will be tricky for the company to compete with something that is free.

At the same time, it's hard to expect RISC-V solutions to challenge Arm (not to mention x86) in the performance-demanding space any time soon. But with dozens of companies contributing to the ISA, we can only wonder when the first high-performance RISC-V designs will emerge. While we do not expect Tenstorrent's AI-focused SoCs featuring SiFive's X280 64-bit RISC-V cores with 512-bit wide RISC-V Vector Extensions to offer breakthrough performance in general-purpose workloads, these chips are certainly a good example how RISC-V can challenge both Arm and x86 in emerging applications.

Summary

Arm's CPU architecture has become the world's most pervasive ISA and probably outsold all the remaining architectures — Arc, MIPS, Power, x86, etc. — combined. Since processors are used almost everywhere these days, the success of Arm's architecture will only grow in the coming years.

But Arm has multiple challenges ahead of it. First, it needs to find its place in data centers and challenge the x86 ISA that has been dominating servers for a couple of decades now. Second, it needs to maintain its existing markets and stay competitive against RISC-V, an open-source royalty-free architecture. The coming years will determine how well Arm can manage these tasks — with or without Nvidia's help.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

korekan probably it will consume x86 as well until only gaming left. after that the cost to develop gaming too expensive, the developer of games move on to arm then x86 no moreReply -

JWNoctis Chances are your average enthusiast PC already had more ARM cores in it than x86 cores in the form of storage and peripheral controllers.Reply

Not that's a useful figure of merit. -

watzupken This is Intel's biggest nemesis, not AMD, as you can clearly tell. Even Alibaba is moving towards creating their own SOC, so eventually, Intel is going to lose even more market share.Reply -

3arn0wl Hehe I wonder if this headline is meant to rebuff stats emerging about RISC-V sales?Reply

Alibaba's T-Head have sold over 2.5billion APU-level open source RISC-V XuanTie chips

Andes Technology, by the end of last year, had sold 8billion and

SiFive another couple of billion. (And there are lots of other companies selling RISC-V chips.)

Arm have already had to change their business practice in response to RISC-V MPUs -

"It's said that ARM had canceled license fees for the companies with financing amount lower than $5 million, to compete with its opponent RISC-V on the aspects of pricing," - Geng Bo, deputy secretary-general of the China Solid State Lighting Alliance

There will come a point where the proprietary business model simply won't be able to compete against the open source rivals. And that moment might come sooner than people imagine. -

jakjawagon ReplyQualcomm's platform for Windows has yet to become competitive against those from AMD and Intel

Arm-based notebook PC processor vendors will need to step up software investment and branding efforts to compete effectively with x86-based vendors Intel and AMD.

Or maybe price them competitively relative to performance. Pretty much all the Windows on Arm devices cost upwards of £1000, but were easily matched by devices that cost less than half that. -

TerryLaze Reply

Because they need a much stronger arm cpu to handle the emulation/jit whatever they use to run windows.jakjawagon said:Or maybe price them competitively relative to performance. Pretty much all the Windows on Arm devices cost upwards of £1000, but were easily matched by devices that cost less than half that.

They would have to lose a lot of money per unit to price them competitively.