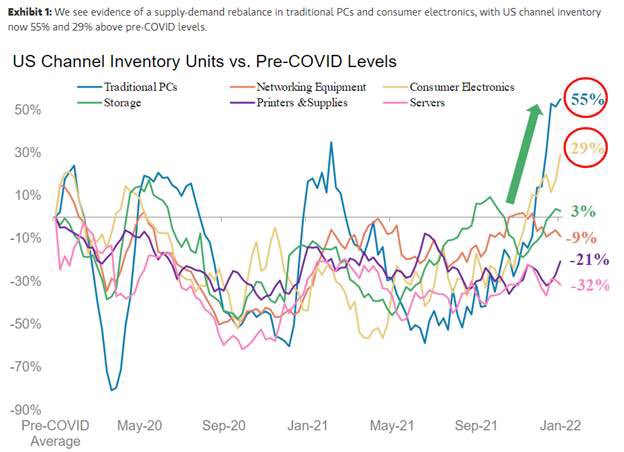

PC, Consumer Electronics Inventories Climb Above Pre-Pandemic Levels

At last. But will prices drop?

The PC and consumer electronics market inventory may be reaching a turning point. Gavin Baker, a partner in investment firm Atreides Management, tweeted an infographic analyzing inventory history since the start of the COVID-19 pandemic.

Through it, we can see that some segments of the technology industry are still struggling with inventory levels that are below pre-pandemic levels. However, the PC and consumer electronics segments have seen inventory surges, with existing stocks now reaching 29% higher volumes for the PC segment, and 55% higher for consumer electronics.

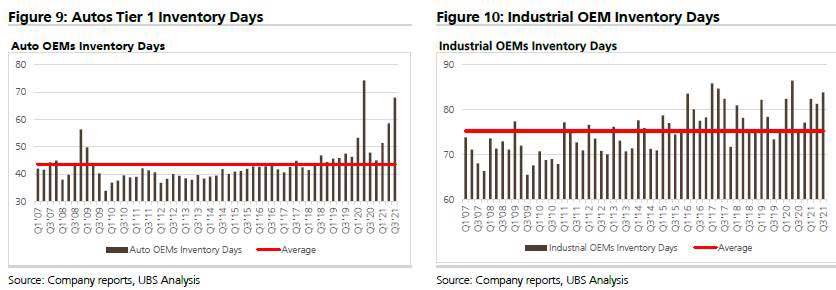

The pandemic showcased the impact of a black-swan type of event, following the sudden explosion of consumer demand for electronics, as work-from-home and isolation policies were implemented around the world. Combine that with the boom in server requirements for AI and HPC workloads, and manufacturers' estimates on demand were rendered wildly inaccurate. That has led to a number of issues across industries as there simply wasn't enough product to go around.

Actual data on semiconductor end market inventory levels.Going up everywhere. When there are long lead times, there will be buffer inventories and double ordering. pic.twitter.com/572kU4fyDwFebruary 2, 2022

Skyrocketing prices for the Best Graphics cards; supply constraints on latest-gen consoles; cryptocurrency-boosted hardware demands; all of these elements colluded in increasing prices across the board for PC enthusiasts. The knock-on effect was that companies focused on shipping highest-margin products first. The absence of any Ryzen 3 CPUs in AMD's 5000-series portfolio is a telling point here, as is the late introduction of lower-end RX 6500 and RTX 3050 cards.

We've been seeing the effects of the supply build-ups already, as graphics cards, for instance, have been increasingly in stock. The inventory data paints a picture where the most urgent consumer demand has been filled. What remains are users that might need and want new products, but apparently aren't willing to purchase them at the currently inflated prices.

Supply and demand tends to be cyclical, and it could very well be that companies will be stockpiling more product than they can actually sell, which could lead to supply gluts in the future. All companies want to avoid that kind of situation, which means they will likely soon have to start reducing pricing in order to onboard the remaining demand in a smooth manner.

However, it could also be the case that suppliers are transitioning from their just-in-time stockpile model (where they try to keep as close to the projected product demand in stock as possible) to a just-in-case one. That would mean that companies would be willing to take the risk of carrying more supply so that eventual demand spikes aren't as costly as what has happened during the pandemic.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Whatever the eventual outcome, increasing stock is good news for consumers, and should mean that prices and availability of PC hardware will be improving. After spending the last couple years watching major hardware companies raking in record profits as demand outstripped supply, at the very least it's going to be interesting to see what happens next.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.