Global PC Shipments are Growing Again Despite (or Thanks to) Pandemic

Strong mobile PC demand brings the PC market back in full force

Global PC sales are growing again as 2020 exits its second quarter, with reports from both Gartner and the International Data Corporation pointing to strong mobile form factor and work-from-home demand as the chief cause for the rebound.

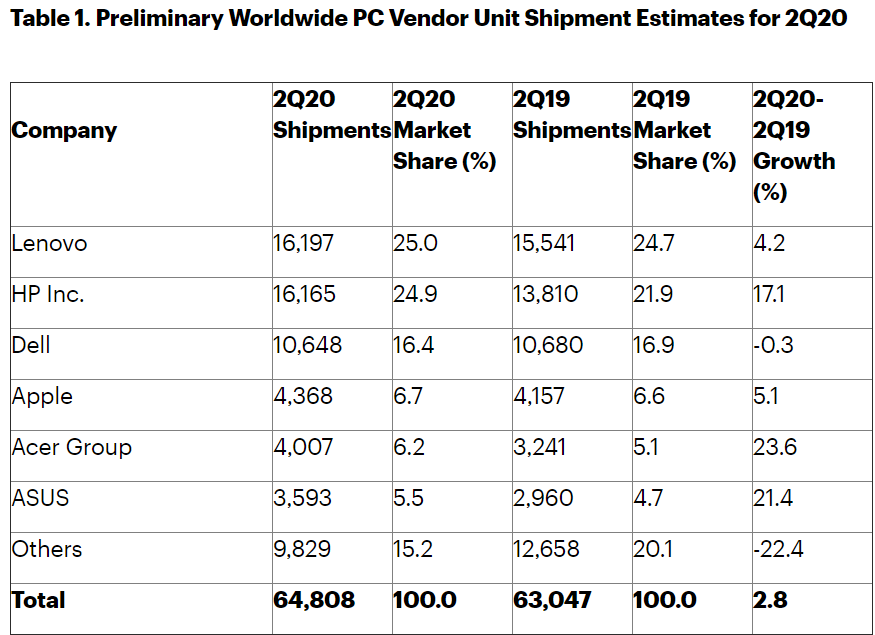

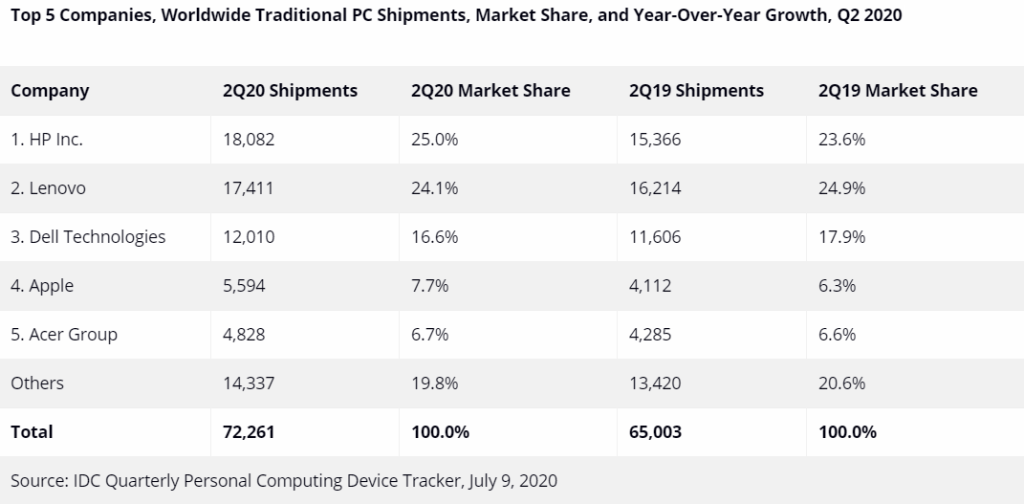

Overall, the year-over-year PC sales growth for 2020’s second quarter seems to fall between roughly 3 to 11%, depending on the reporting organization. Gartner, for instance, estimates 2.8% sales growth over the second quarter of 2019, placing total sales at around 64.8 million units. IDC, meanwhile, is more optimistic, claiming 11.2% sales growth and 72.3 million units worth of sales. (Note that IDC measures tablets and Chromebooks among mobile computers, while Gartner doesn't.)

Regardless, all of this is well over the sales data for Quarter 1 of 2020, which saw between a 10-12% decline in sales as the pandemic disrupted supply lines. It’s also good news coming off of mixed sales in 2018 and 2019 overall.

“The second quarter of 2020 represented a short-term recovery for the worldwide PC market,” explained Gartner research director Mikako Kitagawa. “After the PC supply chain was severely disrupted in early 2020 due to the COVID-19 pandemic, some of the growth this quarter was due to distributors and retail channels restocking their supplies back to near-normal levels.”

She also cited mobile PC growth- think laptops and notebooks- as “particularly strong,” thanks to the recent need for remote working solutions, online education equipment and home entertainment options, though she warns that “this uptick in mobile PC demand will not continue beyond 2020.”

IDC research manager Jitesh Ubrani also pointed to work-for-home and e-learning needs as major drivers for this quarter’s growth, though he cautioned against setting expectations too high given the potential for a deepening post-pandemic recession. “What remains to be seen is if this demand and high level of usage continues during a recession and into the post-COVID world.”

Both companies showed strong gains for HP, as Gartner estimated it just behind Lenovo’s first place while IDC put it at the top of its sales list. Apple rounded out the middle of each company’s chart, and Asus came towards the bottom of Gartner’s best sellers list while not even warranting mention on IDC’s.

Gartner’s Kitagawa said that this data marks the “fifth consecutive quarter of growth” in the US specifically, which also saw a shift in the types of systems buyers demanded.

“Double-digit mobile PC growth was offset by a 44% decline in deskbased PCs,” Kitagawa stated. “Strong mobile PC demand in the U.S was driven by shelter in place rules.”

At first blush, mobile PCs like laptops and notebooks might seem like the least likely form factor to succeed in a home working environment, though their all-in-one nature as well as their included webcams makes them an attractive choice for individual consumers in a market filled with shortages. Given that closed offices no longer needed new desktops during the first half of 2020, it’s easy to see laptops and notebooks surging ahead.

The overall takeaway here seems to be that the pandemic has proven to be a double-edged sword when it comes to hardware. While it drastically hampered shipment, it also created new sources of demand. Still, as both Gartner and IDC warned, that demand isn’t guaranteed to continue into the rest of the year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Michelle Ehrhardt is an editor at Tom's Hardware. She's been following tech since her family got a Gateway running Windows 95, and is now on her third custom-built system. Her work has been published in publications like Paste, The Atlantic, and Kill Screen, just to name a few. She also holds a master's degree in game design from NYU.