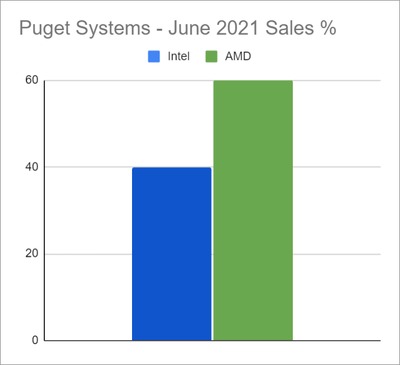

Puget Systems: AMD-based Workstations Achieve 60% of Total Sales

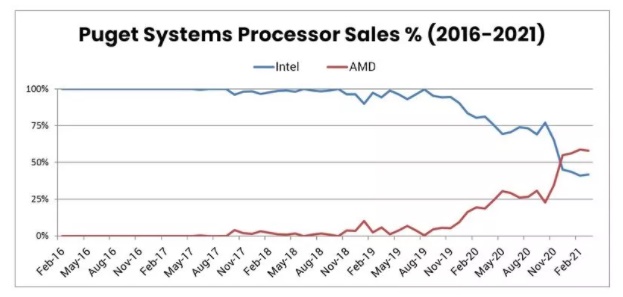

In two years, AMD skyrocketed from under 5% of systems sold to a commanding 60% share.

Puget Systems, one of the best-established players in the workstation assembly and delivery market, has just released a "State of the CPU" report on the distribution of its AMD and Intel systems for June 2021, and it looks very good for AMD.

The last report, released in February of this year, had AMD at an already leading 59% of total systems sold, compared to Intel's 41% share. This June, AMD has reached the 60% share. While that may seem like a negligible gain, there's a deeper significance behind the numbers.

That deeper significance pertains to system and CPU availability. AMD has been placed between a rock and a hard place in the supply vs demand equation, with supply shortages affecting everything from its graphics cards to CPUs. Part of this is the fault of the pandemic, as it stretched supply chains to the breaking point. Another part pertains to TSMC's 7nm output and the need to supply not only AMD, but other customers as well. The final piece of the puzzle lays with AMD itself, who moved virtually all of its portfolio to TSMC's 7nm manufacturing process.

This means that AMD has had to provide for entire markets on a constrained, single node while sharing capacity with other customers. This includes current-gen consoles (with Xbox, for instance, achieving historic sales records last month), as well as system integrators across the supercomputing, workstation, business and personal computing fields. It's a lot of demand for too little supply. Compare that to Intel, who haven't faced any supply issues during this year due to its incredibly mature 14nm process over which it has full control, undercutting AMD and selling a CPU anywhere there's an AMD shortage.

If AMD could provide for those CPUs or GPUs without losing sales on the top end, it would. In this market, that 1% extra market share — and possibly much more than that — could have had easily been provided by Intel, if AMD was not be able to supply Puget with enough hardware. But AMD has been playing its cards well and it knows how important the lead here is for its professional market image.

Puget Systems further states that the 60-40 split in AMD's favor perfectly matches the company's current available configurations. It offers 32 AMD systems compared to Intel's 22, which in itself is a win for AMD. And looking at the historical delivery data from Puget reveals just how far AMD has come. In just two years, the company went from a <5% market share in June 2020 to its current 60%. It's a sight to behold, but AMD can't rest on its laurels. We've seen what happens when giants trip, and AMD can't afford as big a fall as Intel.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

spongiemaster That's pretty sad when you consider Intel has given up on the workstation market and hasn't released a new CPU for its HEDT platform since it paper launched Cascade Lake X in 2019. Intel cared so little about those that they didn't even bother selling them for months after "launch." Next HEDT release from Intel isn't rumored to be launched until mid 2022.Reply -

ezst036 Intel is not in an envious position, but I'm confident of their ability to pull through.Reply

They have AMD thrashing them on the ultra high end with the upper Ryzens and Threadrippers, and they have ARM based processors pushing the envelope in mobility and IOT single board devices for hobbyist software devs.

Intel prioritized Alder Lake and getting their own big.little (coming soon)out the door, so its clear which one they believe to be the bigger threat over the long term. It's mobility, mobility, mobility.(energy efficiency) -

watzupken Reply

The past few years have been tough for Intel. I believe their CPU roadmap along with issues with 10nm yields simply did not allow them to produce products that they can slice and dice finely in order to carve out chips specific for HEDT platform. In fact, I feel most of the time, they are busy trying hard to fend off competition with 14nm chips across their retail and data center chips. 10nm was unfortunately only limited to mobile CPUs then.spongiemaster said:That's pretty sad when you consider Intel has given up on the workstation market and hasn't released a new CPU for its HEDT platform since it paper launched Cascade Lake X in 2019. Intel cared so little about those that they didn't even bother selling them for months after "launch." Next HEDT release from Intel isn't rumored to be launched until mid 2022. -

Sleepy_Hollowed If I were building data centers, I’d only be buying them for a very specific set of requirements (instruction sets not available in AMD for developers, SQL CPU intensive loads, etc).Reply

Everything else in AMD64 required it would be AMD, and management systems ARM.

I would be sweating bullets if I was Intel. -

watzupken Reply

Actually ARM is eating them at the top and low power/ mobile segment. You would have seen quite a number of announcements from big organizations moving on to custom cores, which utilizes ARM chips. AMD have some very compelling products, but I don't believe AMD is able to produce that many chips to fill the gap where Intel lost market share.ezst036 said:Intel is not in an envious position, but I'm confident of their ability to pull through.

They have AMD thrashing them on the ultra high end with the upper Ryzens and Threadrippers, and they have ARM based processors pushing the envelope in mobility and IOT single board devices for hobbyist software devs.

Intel prioritized Alder Lake and getting their own big.little (coming soon)out the door, so its clear which one they believe to be the bigger threat over the long term. It's mobility, mobility, mobility.(energy efficiency)