U.S. Senators Close to Inking $52 Billion Semiconductor Funding Plan

Joe Biden's $50 billion semiconductor plan is about to become law

According to a Reuters report, a group of four U.S. senators might unveil their $52-billion microelectronics industry backing proposal on Friday or early next week. The chip industry support plan is set to include funding of R&D and production and the establishment of national programs. The $52 billion five-year plan pales in comparison to South Korea's intention to support its semiconductor industry with $450 billion over the next 10 years. Still, the real question is if we can compare the plans directly.

$52 Billion U.S. Semiconductor Bill

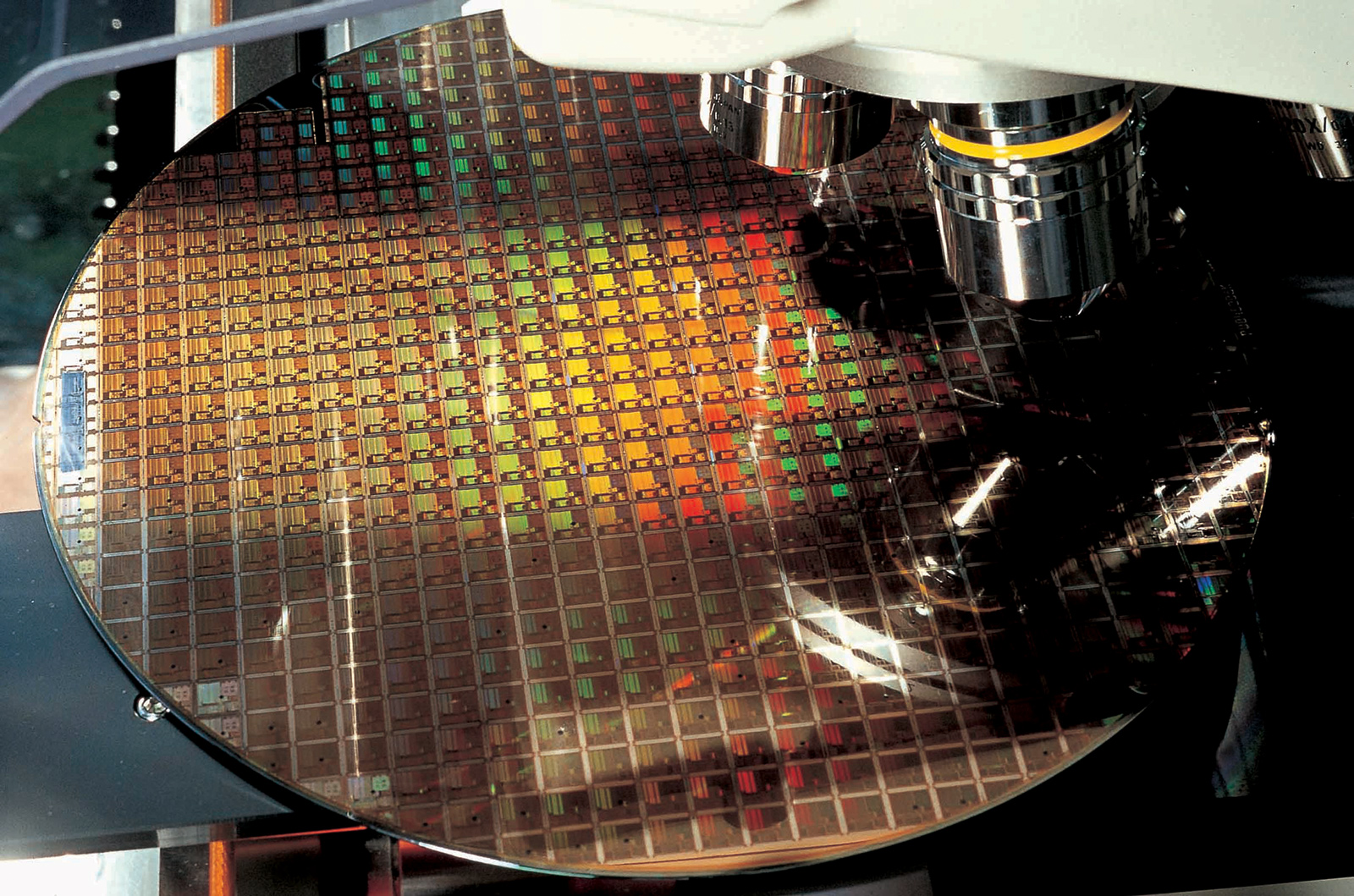

Various companies in the U.S. design the vast majority of chips used globally, yet only 12% of semiconductors are produced on American soil. The microelectronics industry funding bill is designed to at least partially change that and bring more chip production back to the USA.

The U.S. semiconductor industry funding law is developed by senators Mark Kelly, John Cornyn, Mark Warner, and Tom Cotton. According to a draft document seen by Reuters, the plan is expected to include $39 billion in production and R&D incentives and $10.5 billion to implement various national programs over a five-year period. Among the government-supported R&D initiatives are the National Semiconductor Technology Center and National Advanced Packaging Manufacturing Program.

The chip industry supporting bill will be a part of a bigger $110 billion effort to fund U.S. technology research in a bid to better compete with China. The same bill is also set to include semiconductor requirements of this year's National Defense Authorization Act, which will obviously somewhat help the American microelectronics industry, too.

"There is an urgent need for our economic and national security to provide funding to swiftly implement these critical programs," the summary of the bill seen by Reuters reportedly reads. "The Chinese Communist Party is aggressively investing over $150 billion in semiconductor manufacturing so they can control this key technology."

Typically, when a semiconductor company builds a fab in the U.S. and Europe, it gets incentives from federal and local governments. As a result, expect states to provide incentives to companies like Intel, so in the end, these chipmakers will get considerably more than $39 billion. Yet, even when federal and state chip funding initiatives are combined, the total sum will be considerably lower than South Korea's planned spending on its microelectronics industry.

$450 Billion South Korean Chip Plan

Earlier this week South Korea unveiled an intention to support its local chip industry with $450 billion over the next 10 years.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Historically, automotive and chemical/petrochemical products were South Korea's main export items. Today, semiconductor sales account for around 14.6% of Korea's exports and represent the largest exports category. Furthermore, since chips enable the vast majority of today's products, from mice to TVs and from smartphones to vehicles, the importance of the semiconductor industry is hard to overestimate, especially for South Korea.

There is a catch, though. Samsung and SK Hynix — Korea's largest chip companies — mostly export commodity DRAM and 3D NAND memory chips, not advanced logic chips, like CPUs and SoCs. Samsung, of course, has leading-edge process technologies, yet it produces chips developed by others and in different parts of the world. In fact, there aren't many designers of sophisticated processors in South Korea – even parts of Samsung's Exynos SoCs are designed in the USA.

The multifaceted $450 billion plan is set to change this. In a bid to revamp its domestic semiconductor industry, South Korea intends to help train 36,000 engineers between 2022 and 2031 and contribute $133 billion (1.5 trillion won) to semiconductor R&D programs. Furthermore, the country will help chip designers, manufacturers, and suppliers with tax breaks, lower interest rates, eased regulations, and strengthened infrastructure (which includes ensuring adequate water and power supply for chip makers), reports Bloomberg. South Korea has already gained endorsements from ASML and LAM Research that announced plans to expand their presence in the country.

In general, South Korea wants to build a vertically integrated semiconductor industry that will include leading-edge R&D operations, the development of world-class processors, and the production of chips using the most advanced fabrication technologies.

Different Goals

While the U.S. and South Korean semiconductor industry supporting plans are both unveiled in May and are aimed at the same industry, they are designed for different purposes, and to that end should not be compared directly as they pursue different goals.

American companies like AMD and Nvidia are focused on developing advanced logic chips that they can sell for thousands of U.S. dollars per unit and earn great margins. Some other U.S.-based companies like Apple and Tesla design chips so they could add unique capabilities to their products, such as smartphones, PCs, and automobiles. Manufacturing in the USA is something that these companies might prefer, yet their business efforts are focused on the development of products (which includes hardware and software) that they actually sell, not on the production of microelectronics.

For the U.S. as a country, manufacturing advanced semiconductors at home makes a lot of sense both from commercial and national security points of view. The USA already has the world's leading developers of CPUs, GPUs, SoCs, and process technologies. Hence, the $52 billion bill is mostly designed to support domestic manufacturing, perhaps not the most lucrative (yet crucially important) portion of the global semiconductor supply chain. Considering that companies like TSMC and Samsung spend around $30 billion a year on capital expenditures (i.e., building new fabs and upgrading existing ones), $39 billion planned to help U.S. chip production over a five-year period is not much, though.

South Korea is the world's leading producer of commodity memory chips. In contrast, it is not known for leading-edge microprocessors and system-on-chips. Refocusing the industry from commodities to premium products requires investments in education, the attraction of foreign companies and talent, and stimulating local chip designers, all while helping Samsung and SK Hynix to remain the world's leading makers of memory and logic chips.

South Korea's plan is much more ambitious and much more complex than the one U.S. senators are about to announce, which is why it costs a lot more money.

There are two big questions here. Can the U.S. remain on top of the global semiconductor supply chain now that other countries are pouring in hundreds of billions in their microelectronics industries? Can South Korea buy its way into the major league with money? Only time will tell.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

spongiemaster Reply

I understand not giving free money to wealthy billionaires, but would you be ok giving free money to poor billionaires?ezst036 said:Free money for wealthy billionaires -

waltc3 Let's hope this isn't an Intel welfare package in disguise. Oh, brother. The one thing Intel excels at doing these days is burning through money like there's no tomorrow. Let's hope a good chunk goes to AMD--a company obviously capable of doing much more than Intel with far less money (If AMD had lost as much as Intel on various projects--like Itanium and Rdram, just to name a couple--AMD would have been out of business years ago.) Whatever happens, the US needs to move a great chunk of chip manufacturing home where China is not a problem. We don't know what is going to happen in Hong Kong.Reply -

spongiemaster Reply

I think you're missing what this money is for even though you stated it in your post. It's for increasing semiconductor production in the US. AMD is not in that business, what are they going to do with the money? Outbid Apple for more wafer starts at TSMC? How does that fix anything? Do you remember why AMD is producing chips on a foreign company's superior node? Because their own foundry that they spun off, Global Foundries, let AMD out their contracts when GloFlo threw in the towel on 7nm development and gave up moving beyond 12nm. Intel is certainly have its problems moving beyond 14nm, but they are doing infinitely better than AMD is.waltc3 said:Let's hope this isn't an Intel welfare package in disguise. Oh, brother. The one thing Intel excels at doing these days is burning through money like there's no tomorrow. Let's hope a good chunk goes to AMD--a company obviously capable of doing much more than Intel with far less money (If AMD had lost as much as Intel on various projects--like Itanium and Rdram, just to name a couple--AMD would have been out of business years ago.) Whatever happens, the US needs to move a great chunk of chip manufacturing home where China is not a problem. We don't know what is going to happen in Hong Kong. -

thisisaname So much and at the same time so little.Reply

52 billions sounds like a lot but United States spends $51 billion annually on the largely ineffective War On Drugs. Since 1971, the war on drugs has cost the United States an estimated $1 trillion.

South Korea's government announced a support package worth 510 trillion won (US$451bn) to bolster in-country chip production with the hopes of becoming a global supply chain leader.

Now that is a stimulus package not some small change.

https://www.theregister.com/2021/05/14/south_korea_semiconductor_stimulus/ -

spongiemaster Replythisisaname said:So much and at the same time so little.

52 billions sounds like a lot but United States

It is a lot to individuals, but in relation to the tech industry, this is very little. Not sure how it is going to be determined how this money gets disbursed to tech companies over the next 5 years. Every one gets a check for $2000? Intel claims they are really going to be ramping up Capex and R&D expenditures over the next few years. Over the previous 5 years, Intel spent over $66 billion on R&D. So how much is $54 billion over 5 years really going to help the industry? -

-Fran- So, this means tax payers will help foundries make even more money, but this time in their own soil? That... Makes perfect sense... Yeah... They'll probably give them free water and electricity rights for like 100 years or something. That's very common as well. So they'll be free to screw the environment so we can have our gadgets.Reply

I wonder if there is some sort of stipulation the US companies would get those waffers at a discount so consumers see some of the $52K Million back? Haha! Yeah, right.

As sour as I sound, at least I understand why they're trying to do this. Still, sounds a bit... Strange.

Cheers!