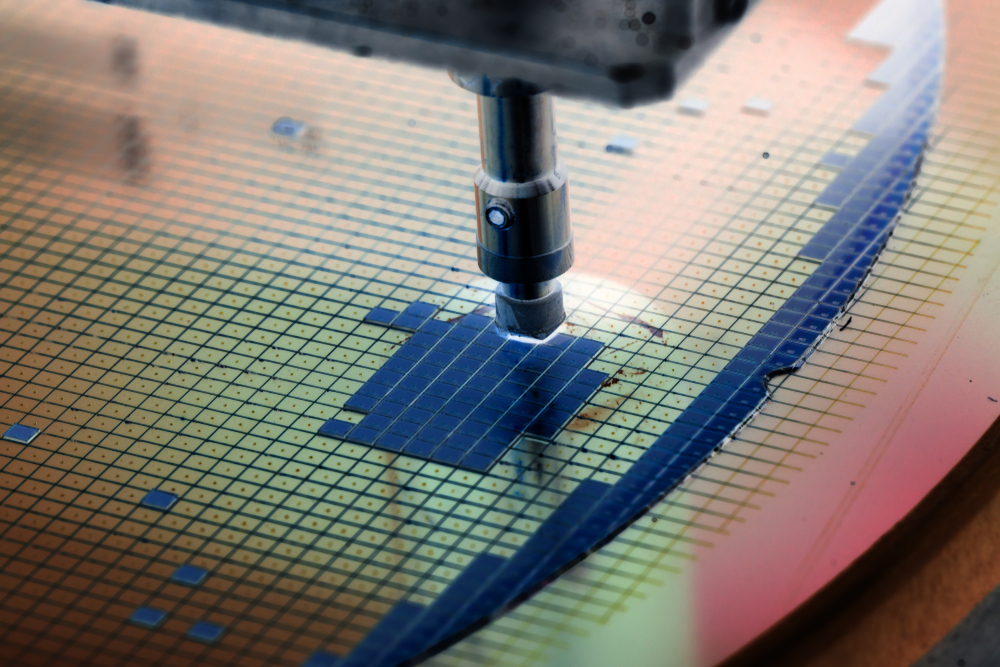

Semiconductors Showed an Epic Slump in 2019

Market revenue saw its biggest decline since 2001.

The Semiconductor Industry Association (SIA) announced on Monday that chip revenues fell 12% from 2018 to $412 billion in 2019. This is the biggest fall since 2001, when chip revenues fell 32% once the Dot-Com Bubble crashed, as Bloomberg noted.

Global sales grew slightly (0.9%) in Q4 2019 compared to Q3 2019. But when compared to Q4 2018, there was a 5.5% drop. The Americas represented the largest sales decline, decreasing 23.8% compared to 2018. In China, which represents a third of global electronic components consumption, sales fell 8.7% compared to 2018.

The SIA pointed to U.S. foreign relations as having an important impact on the market. In a statement, SIA president and CEO John Neuffer said that the "phase one" trade agreement the U.S. and China signed last month and the ratification of the U.S.-Mexico-Canada Agreement "are positive steps."

According to Bloomberg, despite the decline in the industry’s total chip sales, some players still drastically increased revenues last year. Five of the top 10 performers in the S&P 500 Index were chip companies. That includes AMD, which saw its revenues increase 148% year-over-year. From recent reports, it looks like 2020 will be a good year for AMD too.

Memory chip makers saw the biggest losses, with memory revenue dropping 32.6% year-over-year.

"Memory unit volume increased slightly, however. Within the memory category, sales of DRAM products decreased 37.1%, and sales of NAND flash products decreased 25.9%," SIA explained.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

AlistairAB There were no new Intel products, that didn't help. And revenue declines are not necessarily bad, as that can mean finally decreased cost / reduced pricing in DDR4 and SSDs. Not actual decrease in demand. Just a more competitive environment.Reply