Toshiba NAND Sale Moves Forward, WD Cooperates

Toshiba and WD have announced a truce after a year-long legal saga. The disagreements between the two companies began earlier this year when Toshiba announced that it planned to sell off Toshiba Memory Company (TMC), which is the company's stake in the "Flash Forward" joint NAND manufacturing venture with WD. Toshiba's failed investments in U.S.-based nuclear initiatives left the company badly in debt and mired in an accounting scandal. Toshiba's accounting indiscretions placed the company in perilous territory with the Tokyo Stock Exchange, leaving it with no recourse but selling valuable assets.

WD inherited its partnership in the venture when it purchased SanDisk for $19 billion in 2015. Industry analysts initially predicted that WD would purchase the Toshiba Memory Company, thus bringing the entire operation under its umbrella. Toshiba instead opened a bidding process with several suitors. WD immediately filed for arbitration, claiming that, under the terms of the joint venture, Toshiba could not make a unilateral decision to sell off its stake.

Toshiba also took steps to prevent WD from investing in its new Fab 6, which threatened to choke WD out of future NAND supply. That's a particularly alarming position for WD, which has invested heavily in diversifying from its HDD-only business model into a combined flash and HDD powerhouse.

In the interim, Toshiba decided to sell its partnership stake for $18 billion to a consortium led by Bain Capital. The consortium includes industry heavyweights such as Dell EMC and Apple. This decision intensified the ill will between Toshiba and WD largely because the consortium also includes their competitor SK Hynix. WD has severe objections to granting SK Hynix access to the company's IP, intentional or otherwise.

The mounting tension between the companies left both in a bad position. If Toshiba effectively locked WD out of investing in future production lines, it could force the company to source NAND elsewhere. For Toshiba, WDs arbitration could drag any plans for the sale out into months, and even years, which wouldn't allow the company to restructure in time to avoid further regulatory oversight from the Tokyo Stock Exchange.

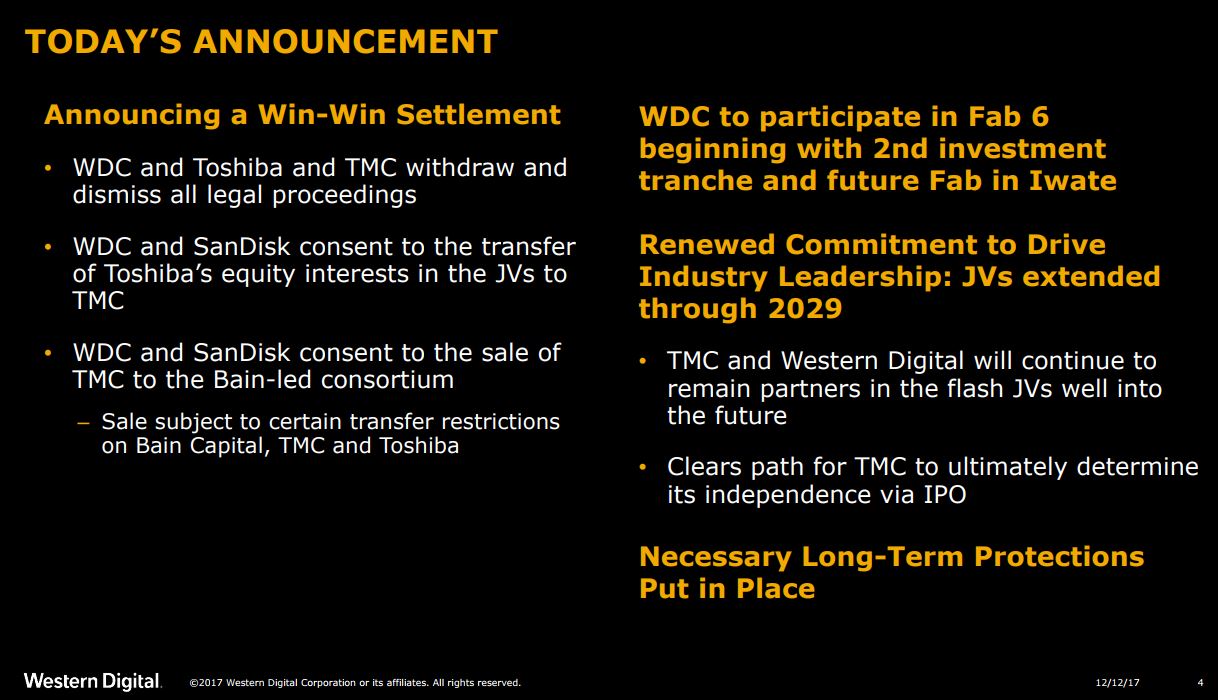

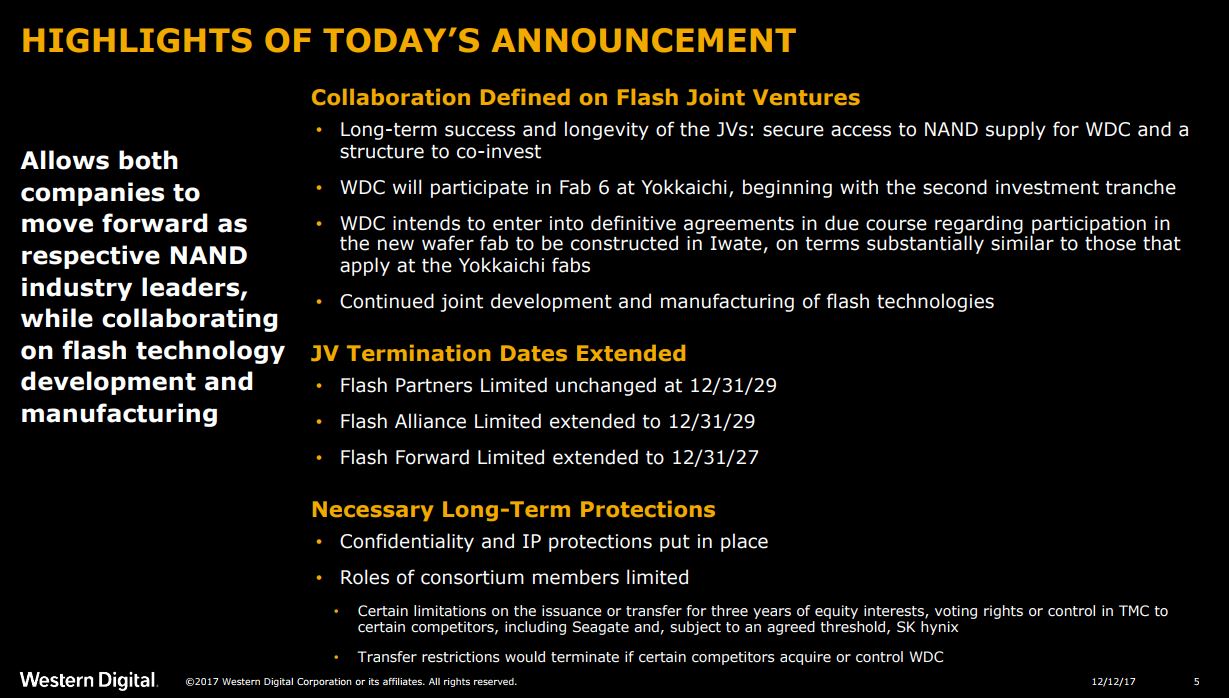

Now, the two companies have came to terms that allow WD to invest in the new Fab 6 venture, thus assuring its access to future NAND production. The two companies will also participate in another future fab in Iwate, Japan. As such, the companies have extended the Flash Forward agreement to 2027. They extended their other joint venture, Flash Alliance, to 2029. The two companies also agreed to protect mutual assets and IP, thus quashing WD's concerns about SK Hynix.

With these conditions in place, WD no longer objects to the sale of Toshiba Memory Company and will drop all pending legal and arbitration action. Of course, Toshiba will do likewise. In the end, the agreement was a foregone conclusion. WD cannot afford to lose access to flash, and Toshiba can't afford to have the sale delayed further.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The contentious nature of the process highlights the reality of fabricating flash. Each generation of flash becomes more expensive to develop and produce, and the stakes have risen even further in the 3D NAND era. That means that even large companies, like Intel, Micron, Toshiba, and WD, have to forge alliances to spread out the investment. Very few companies have the heft of Samsung and SK Hynix, which are the only companies left that produce NAND flash as standalone entities.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

hellwig Don't be fooled, there are only really two storage companies left, WD and Seagate. Keeping Toshiba around made it look a little less like a duopoly, but WD was clearly calling the shots, since they filed a lawsuit anytime Toshiba did something an independent company would do.Reply

Of course, Seagate doesn't have a good presence in the flash world, so maybe a future purchase is in the works. I thought I heard something about Intel shopping around their storage division?

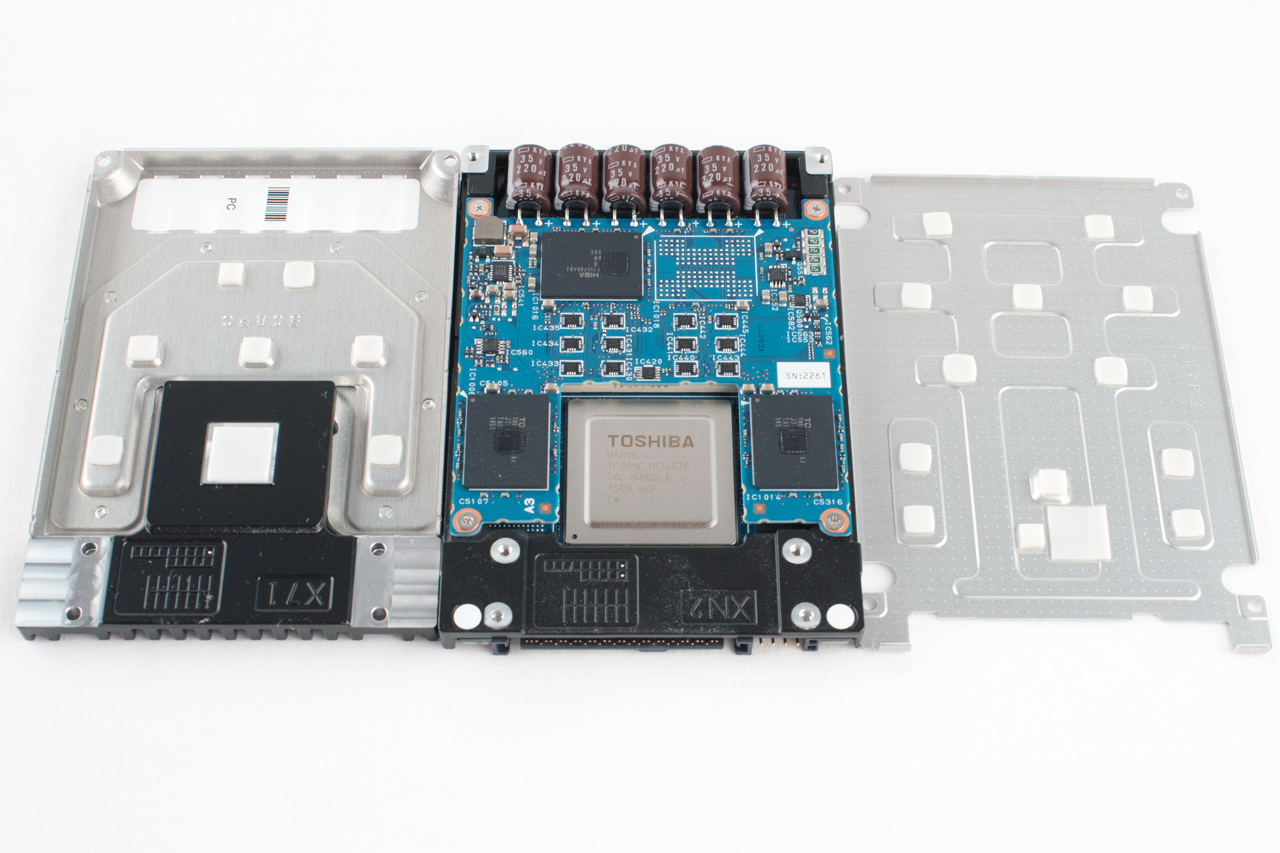

BTW, what is that huge Toshiba chip in that SSD for? Thought tech was getting smaller. -

supremelaw Paul, what's the model number of that Toshiba SSD shown in the photo at the beginning of this report?Reply -

Kennyy Evony I remember buying a new NEC 200MHz pc with a 2GB SEAGATE hard drive and out of the bat it had 15% bad sectors on it from out of the box. After i went through the warranty process and security deposit cost to sent it back for replacement; Two days after a new one arrived, it got bad sectors on it AGAIN! From then on i only had 1 other seagate drive which also had bad sectors on it and never have I purchased another one. I have actually never seen a Seagate drive without bad sectors on it.Reply