Toshiba To Spin Off Semiconductor Business, WD Possible Beneficiary

Toshiba is considering spinning off its semiconductor operations into its own separate company as it struggles to recover from a series of missteps. Toshiba and WD already cooperate in the joint Flash Forward NAND production business, and insider reports indicate that WD is involved in the restructuring efforts.

WD was already in a superb position as it transitions away from the flagging HDD business into the lucrative SSD market, and an increased presence in Toshiba's operations will only strengthen its position. In this case, Toshiba's struggles are great news for WD, but very bad news for Seagate.

WD appears to be in the NAND driver's seat while Seagate falls behind in the rearview mirror. Seagate has failed to integrate flash into its core business, and even after hefty investments and a strategic alliance with Micron, it still accounts for only 0.1% of the SSD market (per Trendforce). Seagate is still in the midst of executing its restructuring plan, which includes a recent closing of its Suzhou, China plant, as it struggles to resurface after its own financial problems.

Toshiba's woes began two years ago after the discovery of an accounting scandal that involved $1.2 billion in misstated earnings. Toshiba's accounting indiscretions placed the company in perilous territory with the Tokyo Stock Exchange, which hamstrings its ability to recover from any other potential missteps.

Unfortunately, that possibility came to fruition earlier this month as news filtered out that Toshiba, which has vast holdings in a number of market segments, had encountered difficulties with its U.S.-based Westinghouse Electric nuclear plant subsidiary. The company is facing cost overruns and construction delays in the wake of the 2011 Fukushima nuclear disaster, and it made a strategic acquisition in 2015 of nuclear construction outfit CB&I Stone and Webster to clear the hurdles. Unfortunately, Toshiba pegged the "goodwill" booking at $87 million but recently restated the charges as a roughly-defined "several billion U.S. dollars."

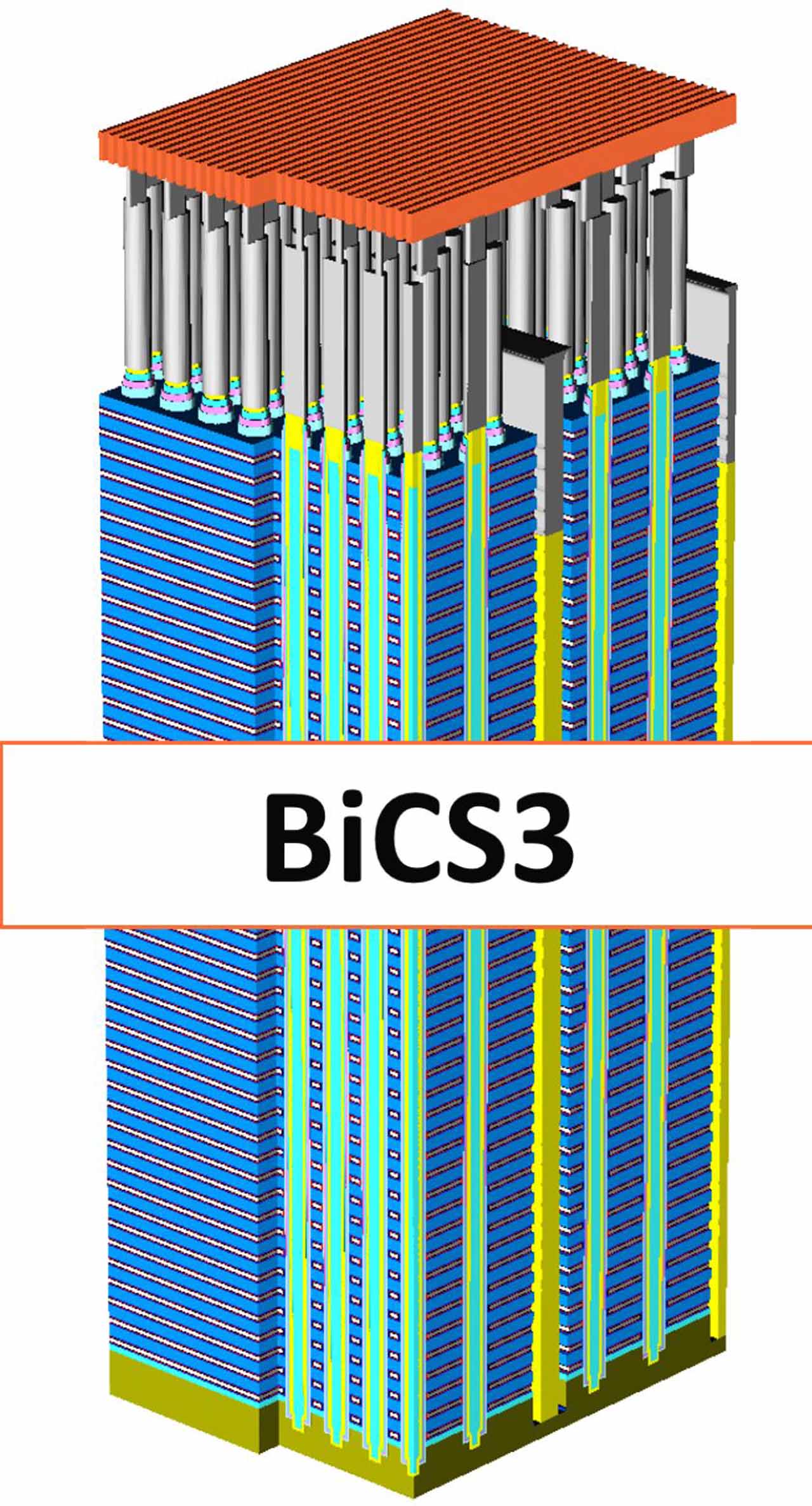

Toshiba's crushing burden of expanded losses in the wake of the accounting scandal is forcing the company to explore several options, with the most likely outcome involving spinning off its lucrative semiconductor business. Toshiba's semiconductor operations, which includes the joint NAND production business with WD/Toshiba, accounts for nearly 80% of its operating profit, so completely divesting the unit would have dire long-term consequences. Instead, Toshiba has confirmed widespread insider reports that it is "studying the possibility of splitting it into a separate company."

The move would allow Toshiba to sell a partial stake, estimated at 20%, in the new company to generate a predicted ~$2.5 billion. Toshiba has had a long history of flash production with SanDisk, which WD acquired for $19 billion in 2015. The Flash Forward initiative is critical to WD's long-term prospects, and as such, WD is the most likely to invest in Toshiba's spinoff.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

WD amassed a treasure trove of flash-oriented businesses over several years, and the coup de grace came in the form of its SanDisk acquisition. If WD chooses to invest in the Toshiba venture, it will allow the company to protect its own vital interests while also expanding its footprint and control of the joint venture.

The NAND industry is booming as we plow through the worst NAND shortage in history, but it's clear the playing field is still being defined. Toshiba plans to announce the extent of its poorly-defined losses next month, and we expect more news about its chip spinoff soon thereafter.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

dgingeri It looks like Toshiba got sick of having a decent and reliable product on their books.Reply -

anbello262 It feels a bit more like a Toshiba is going down, so it would rather not take the only productive sector with it. Let's hope they can actually recover with the money the would get.Reply -

dgingeri If they would be willing to put in some effort to make reliable products, they'd probably do better. That's not a money thing. That's an attitude thing, and it HAS to start with top level management. If top level management takes the attitude that reliable products are their top priority, a REAL attitude, not just lip service, employees will follow suit and make them that way. The continuing failure of that company is right in the hands of top level management.Reply -

ssdpro Agree with some comments above. This is basic stuff. If the semiconductor/storage business is 80% of operating profit it looks like they are spinning it off as the "real" Toshiba. The old "Toshiba" takes all the debt, problems, and herpes.Reply -

teamninja WD is just there just taking in everything in this entire article trouble is following seagate and Toshiba... Toshiba is thinking of splitting its only profitable business WD takes a cut... Seagate closed down half their production well 2/5 of HDD... WD takes a cut... Shortage of Nand WD takes a cut....Reply