Ukraine Halts Output of Neon Gas, Chip Production at Risk

For now, chipmakers have enough high-purity.

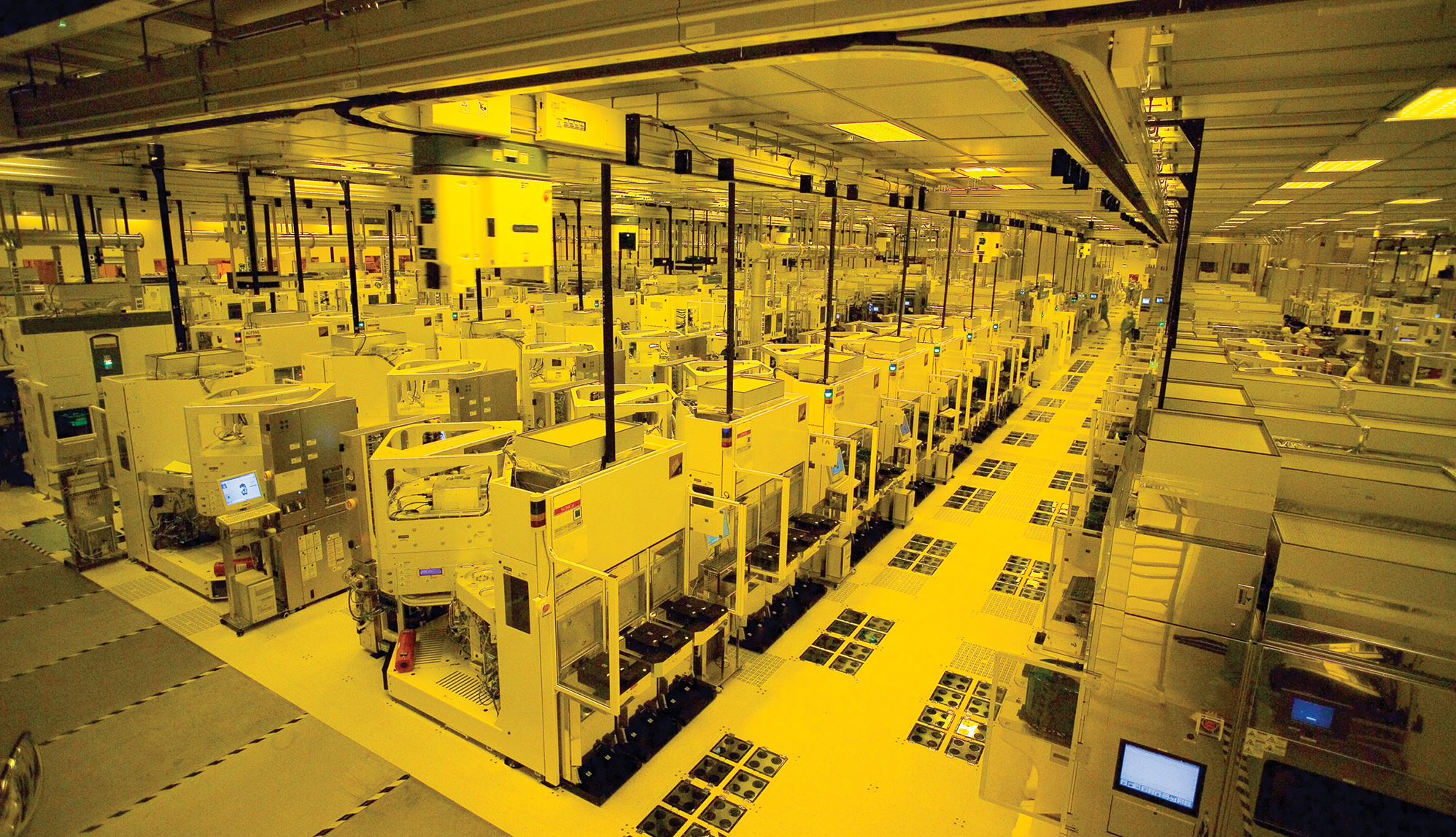

Two Ukrainian companies — Ingas and Cryoin — have halted shipments of high-purity neon gas used in semiconductor manufacturing due to the ongoing Russian invasion. The two companies account for a sizeable portion of global high-purity and ultra-high-purity neon supply. For now, chipmakers say they have enough high-purity neon, but the situation is dynamic. However, neon is just one of the problems facing the electronics industry.

According to estimates, these two suppliers of gases control roughly 50% of the global high-purity neon supply to the semiconductor industry in 2022. With Cryoin and Ingas sidelined, the price of semiconductor-grade neon will inevitably increase as their rivals will need to increase output to meet growing demand.

Two Leading Producers of High-Purity Neon Stop Production

Before the war began on February 24, Cryoin produced between 10,000 and 15,000 m3 of high-purity Grade 5.0 (HP, with neon contents of 99.9990%), high-purity Grade 5.5 (HP, with neon contents of 99.9995%), and ultra-high-purity Grade 6.0 (UHP with neon contents of 99.9999%) neon per month (120,000 – 180,000 m3 per year). Grade 5.0 neon is good enough for the semiconductor industry and laser eye surgery, whereas Grade 6.0 is aimed chiefly at research facilities.

According to data cited by Reuters, Ingas produced 15,000 to 20,000 m3 of Grade 5.0 and Grade 6.0 neon per month (180,000 – 240,000 m3 per year). Ingas served customers in Germany, Taiwan, South Korea, China, and the U.S., with 75% of the output supplied to various chipmakers.

Electronic materials advisory firm Techcet estimates that the global semiconductor industry consumed about 540,000 metric tons of high-purity neon gas last year (which roughly equals to 550,080 m3). Assuming that the two companies shipped 360,000 m3 of high-purity neon last year and 75% of their output went to chipmakers, they controlled around 49% of the semiconductor industry-bound neon in 2021. However, their share in the semiconductor-grade neon gas market could be significantly lower as they also produce neon of various purity for other industries.

Cryoin is located in Odessa, which is currently under heavy attack by Russian military forces, whereas Ingas is based in Mariupol, which has been under heavy bombings for days. Cryoin shut down its operations on February 24, when Russia attacked Odessa and other cities in Ukraine. As a result, according to Larissa Bondarenko, business development director at Cryoin, the company will be unable to fill orders for 13,000 m3 in March. Furthermore, even if the violence stops now (which is not going to happen), the company is unsure whether it can access appropriate raw materials to produce neon (which is a byproduct of steel manufacturing).

Chipmakers Have Enough Neon… For Now

Taiwan's Economy Ministry told Reuters that Taiwanese makers of logic and memory chips (TSMC, UMC, Micron, VIS, Winbond, etc.) had secured safety stock of high-purity neon but declined to elaborate. Intel, GlobalFoundries, and Micron earlier said that they have a diversified supply chain and stocks of high-purity neon at fabs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"If stockpiles are depleted by April and chipmakers don't have orders locked up in other regions of the world, it likely means further constraints for the broader supply chain and inability to manufacture the end-product for many key customers," said Angelo Zino, an analyst at CFRA, in a conversation with Reuters.

As remaining makers of high-purity neon gas are ramping up their production to meet demand, prices of the gas are increasing. Cryoin says that prices of high-purity neon had climbed by up to 500% from December.

ArF immersion lasers used to make fairly advanced chips that require deep ultraviolet (DUV) lithography use a mixture of neon, fluorine, and argon gases. Neon accounts for over 95% of the blend; however, the good news is that modern production tools feature neon recycle systems that reduce actual consumption by over 90%. But while each ArF/DUV scanner does not consume a lot of gases, there are tens of thousands of such scanners installed globally and all of them need neon, fluorine, and argon gases.

Raw Materials Prices Shooting Up

Semiconductor manufacturing is a complex process that takes thousands of steps and plenty of various materials. Modern chips and the electronics industry in general use copper, aluminum, nickel, palladium, platinum, gold, and tin, just to name a few. While prices of raw materials may not have a drastic impact on the price of every chip, they still affect costs.

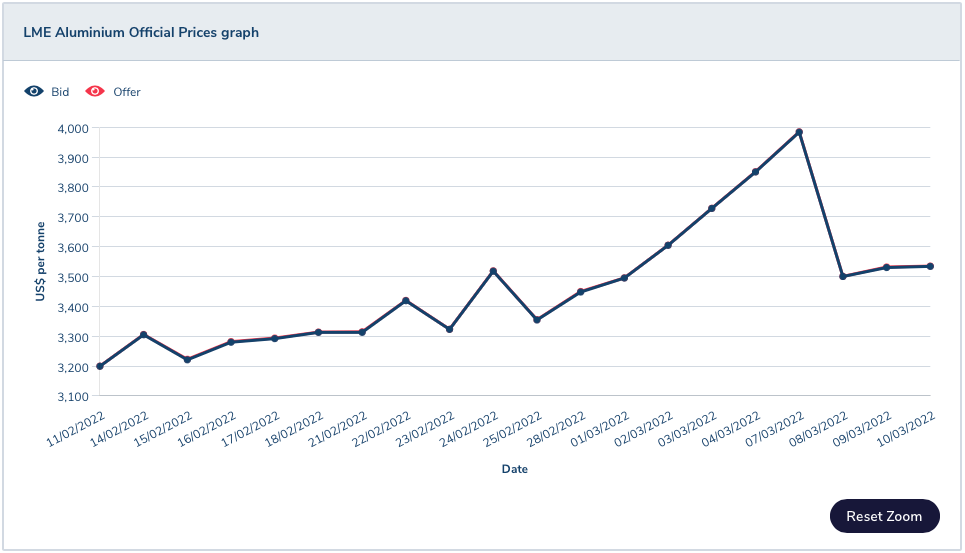

Prices of aluminum and nickel are increasing because the production of these metals uses a lot of energy, and prices of energy carriers are on the rise. Meanwhile, 37% of palladium and 9% of global platinum output comes from Russia. So, if their supplies are banned, shortages may arise; therefore, everyone is increasing quotes right now.

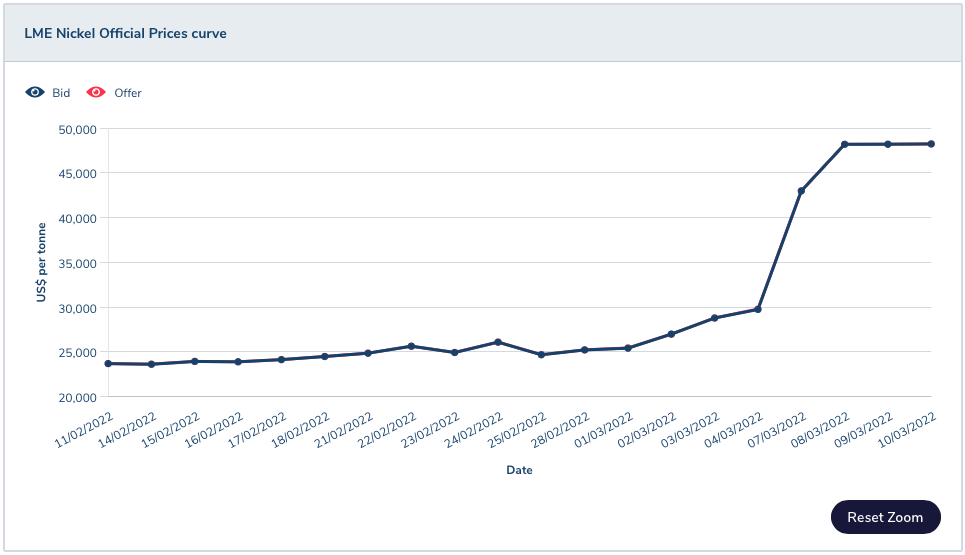

According to Bloomberg, the London Metal Exchange (LME) had to suspend all nickel trades on March 8 after the price of the metal skyrocketed as much as 250% in two days. Nickel price increased from $23,705 per ton on February 11, 2022, to $48,241 per ton on March 11, 2022 at LME. Prices of aluminum seem to follow a similar trend. In February 2022, this metal cost $3,200 per ton and gradually increased to 3,313 per ton on February 21, 2022. The metal topped $3,984 on March 4, but dropped back to $3,535 on March 9 at LME.

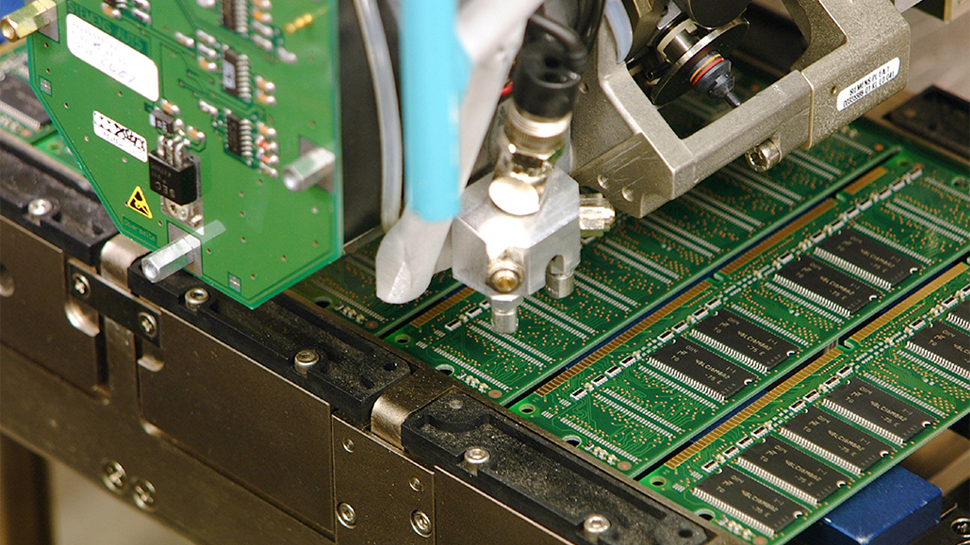

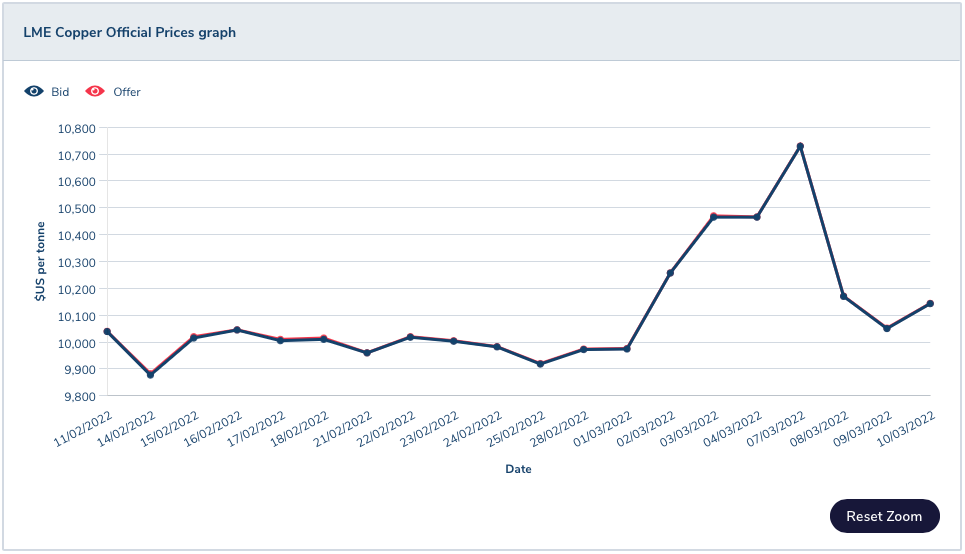

All electronics devices use printed-circuit boards (PCBs) and all PCBs use copper foil (and modern high-end motherboards and graphics cards use loads of copper foil). The price of copper went up from $7,755 per ton in December 2020 to $9,974 – $10,729 per ton in March 2022 at LME.

However, we are talking about spot prices here, and they depend on multiple factors, including geopolitics and energy. Meanwhile, manufacturers tend to have long-term supply agreements, so prices of raw materials do not affect their operations for now. But since spot prices are increasing, contract prices will eventually increase too (albeit not overnight).

DigiTimes reports that makers of SMT (surface mount technology) equipment used to make PCBs were ready to face challenges like components shortages and inflation, but not rising metal prices. Makers of other equipment are conducting operational adjustments, waiting for metal prices to return to acceptable levels, and are modifying purchase and inventory buildup strategies. Due to shortages of electronics, equipment makers are filled with orders for quarters to come.

Impact Unclear

For now, it is hard to determine the impact of high-purity neon supply and its quotes on prices of logic chips, such as CPUs and GPUs since the main components of their cost is IP and performance. Meanwhile, any disruption in the supply chain tends to affect the prices of DRAM and NAND memory.

As for prices of raw materials, their surging tends to gradually impact prices of electronics, but the problem is that we have an ongoing war in Europe, which now involves three countries, so the situation is unpredictable.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

jkflipflop98 Oh lawd! The neon! The neon!Reply

All you have to do is freeze the air until it condenses and skim off the top. Is there some reason you can't make a cryofreezing setup in Oklahoma? Why are we so reliant on our enemy for something that's so easy to make? This sounds like a problem that would be solvable in under a month with a little government funding. -

InvalidError Reply

Neon is 0.0018% of the atmosphere and since it is lighter than N2 and O2, most of it is in high altitude. Condensing enough sea-level air to retrieve a meaningful amount of neon is extremely energy-intensive and then you still have to refine it to the required purity afterwards. If getting neon from air was easy, chip fabs would capture their own exhaust to retrieve and re-refine it themselves.jkflipflop98 said:All you have to do is freeze the air until it condenses and skim off the top. Is there some reason you can't make a cryofreezing setup in Oklahoma? Why are we so reliant on our enemy for something that's so easy to make? This sounds like a problem that would be solvable in under a month with a little government funding. -

bigdragon Maybe we should learn a lesson from this. Specifically, maybe we should have producers spread out all around the world in a variety of locations instead of concentrating them in the cheapest and most financially efficient locations. Optimizing things for maximum profit and efficiency at the cost of redundancy and flexibility appears to be an ongoing systemic flaw no one has dared to take action on.Reply -

Co BIY Optimizing for efficiency globally is why we have such large increases in global wealth.Reply

Your proposed solution only looks at one simple straight forward but expensive way to solve the problem. (and takes the problem away from those most effected by it)

Allowing the price to rise incentivizes everyone with an interest in high purity Neon production to look at an infinite number of solutions.

Working without it.

Reducing requirements.

Figuring out how to work with lower purity.

Substitution.

Recycling.

New methods of production.

Dozens of ideas I can't imagine because I'm far from the problem and don't know much about any of it. (although I'm probably as knowledgeable as the politicians who would be involved in subsidizing and planning any strategic neon production plan). -

Chung Leong Replyjkflipflop98 said:All you have to do is freeze the air until it condenses and skim off the top. Is there some reason you can't make a cryofreezing setup in Oklahoma? Why are we so reliant on our enemy for something that's so easy to make? This sounds like a problem that would be solvable in under a month with a little government funding.

I don't think such an operation would be economically viable when there're no steel mills around to use up the oxygen and nitrogen, the bulk of what gets produced. -

Co BIY CRYOIN WEBSITE - PatentsReply

Apparently it's not just about global efficiency but also about Intellectual Property.

US Patent 9,168,467 - Owned by CRYOIN - The invention relates to cryogenic technology, specifically, to devices for obtaining components of gas mixtures by rectification method, particularly, gas mixtures characterized by a small value of separation factor, for example, neon isotopes.

They know how to celebrate the rare gasses in Odessa ! - Also from the company Website

I hope the region sees peace soon. -

They should doReply

But still we must be independent necessity is the mother of invention and we must find a way around this or we are all screwedInvalidError said:Neon is 0.0018% of the atmosphere and since it is lighter than N2 and O2, most of it is in high altitude. Condensing enough sea-level air to retrieve a meaningful amount of neon is extremely energy-intensive and then you still have to refine it to the required purity afterwards. If getting neon from air was easy, chip fabs would capture their own exhaust to retrieve and re-refine it themselves. -

Co BIY Apparently the concentration of Noble gas production in Russia and the Ukraine is a remnant of Soviet Military Industrial Policy.Reply

"Neon was regarded as a strategic resource in the former Soviet Union, because it was believed to be required for the intended production of laser weapons for missile and satellite defense purposes in the 1980s. Accordingly, all major air separation units in the Soviet Union were equipped with neon, but also krypton and xenon, enrichment facilities or, in some cases, purification plants (cf. Sections 5.4 and 5.5). The domestic Soviet supply of neon was extremely large but demand low."

DERA Rohstoffinformationen Noble gases – supply really critical? -

InvalidError Reply

As far as chip fabrication is concerned, the reason high purity noble gasses are required is for things like metal vapor deposition and ion implantation which require a shielding/carrier gas that won't react with or contaminate metal/dopant ions. The only possible substitute for one high-purity noble gas there would be another high-purity noble gas, which wouldn't help much since they are all refined by the same companies. With how monstrously accurate ion deposition processes need to be to make 5nm work, I doubt any fab wants to have to re-tool and re-tune their process for different gasses even if there were viable substitutions.Co BIY said:Allowing the price to rise incentivizes everyone with an interest in high purity Neon production to look at an infinite number of solutions.

Working without it.

Reducing requirements.

Figuring out how to work with lower purity.

Substitution.

Recycling.

New methods of production.

Dozens of ideas I can't imagine because I'm far from the problem and don't know much about any of it. (although I'm probably as knowledgeable as the politicians who would be involved in subsidizing and planning any strategic neon production plan).

The most likely solution would be along the reuse, recycle and recover axis - avoid getting it direct from air as much as possible.. -

jkflipflop98 ReplyInvalidError said:Neon is 0.0018% of the atmosphere and since it is lighter than N2 and O2, most of it is in high altitude. Condensing enough sea-level air to retrieve a meaningful amount of neon is extremely energy-intensive and then you still have to refine it to the required purity afterwards. If getting neon from air was easy, chip fabs would capture their own exhaust to retrieve and re-refine it themselves.

And how, exactly, do you think it's currently produced for industrial application?

It's not very hard to do at all. Again, there's no reason you couldn't setup a neon production facility in North Dakota and have it operational in a month.