US Leads Semiconductor R&D Investment for 2021; Asia Gains Ground

Intel remains the leading investor, with 19% of 2021's invested total.

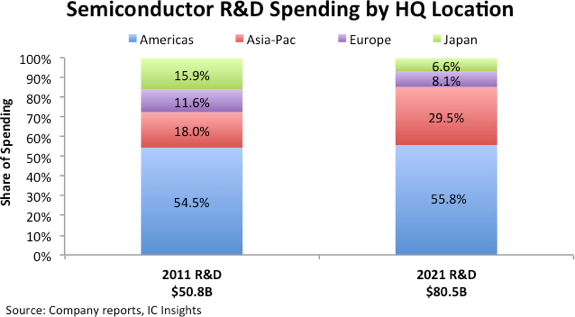

The Americas - more specifically, the United States - are still the globe's biggest investors into semiconductor R&D. According to updated global data from IC Insights, the Americas in 2021 led with their 55.8% slice of the total $80.5 billion sunk into technological research and development. But the data shows that Asia-Pacific countries have been increasing their spending at a much more radical pace, leading them to gain 11.5% of the pie. It would seem this market too is approaching a duopoly, setting trends for decades to come.

Even as the worldwide investment into semiconductor R&D almost doubled from 2011 ($50.8 billion) to 2021 ($80.5 billion), the US saw a mostly sideways growth, increasing its spending from 54.5% of the total towards 55.8% (a mere 1.3% increase). Intel, naturally, is one of the regions biggest spenders; it alone uplifted 19% of the total 2021 investment, at $15.30 billion.

But the U.S. wants to accelerate its dominion on leading-edge tech; despite delays and languishings in Congress, the country has approved nothing less than a $52 billion-worth injection on local manufacturing capability. Intel too is heavily investing in its home country, but the company's patience is seemingly growing short. Some of its investments might even more towards seemingly greener European pastures, according to Intel's CEO. A portion of this money will undoubtedly be channeled towards refining the company's Integrated Device Manufacturing (IDM) 2.0 strategy, ushering us into the Angstrom-era.

The US is benefitting from being a leading-edge development hub - top R&D companies such as Intel, Nvidia and AMD all have significant R&D facilities within the US. But it's also taking dividends from geopolitical instability and security concerns surrounding both Russia and China. There's a reason (besides tax breaks) that Samsung is eyeing a $200 billion manufacturing investment in the country, alongside TSMC's similar investments. That reason stems from reducing operational impact in wake of aggressive moves from Russia - or China - that could impact their production, throwing the world's technological development into turmoil. China officials have even publicly described TSMC as if it were a juicy fruit, ripe for the taking.

Despite the U.S. holding the investment record, its last-decade growth is negligible compared to that of the Asia-Pacific region, which managed to capture an extra 11.5% of the total, leading it to achieve 29.5% of the pie. This growth has been mostly led by Taiwan - home to TSMC, which injected 14.4% ($11.52 billion) of the industry's total. A close second is South Korea - home to Samsung - who represented 11.9% ($9.9 billion) of the sum.

But China has been increasingly pulling its weight on the global market, as its aggressive investment strategy - buoyed by government funding - has captured 3.1% ($2 billion) poured onto its local R&D efforts - in a bid to divest itself from Western suppliers, strong-armed sanctions and leading-edge technology blockades. All this serves its aim of achieving a production market that's strong enough to furnish its territory with leading silicon - and then some. China's goals are helped by its control of most of the rare metal extraction and routing across the globe's supply chain.

Europe invested $5.89 billion in 2011 (11.6%), while its 8.1% cut in the 2021 numbers amount to $6.52 billion. So Europe didn't so much stop investing; it simply stayed on its spending lane. A big turn of events is in store for the next decade, however, as Europe is doubling down on technological development and in bringing volume production of the latest semiconductor technologies towards its shores. Its recently-announced Chips Act will see the European Union set aside some $43 billion worth of investment in local companies and facilities. While total independence from the US and Asia-Pacific has already been deemed impossible, reducing its vulnerability to global supply chain disruptions is a key element for Europe's renewed focus in this field.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel too is aiding Europe's effort with its announcement of Silicon Junction, a further $80 billion-worth investment that will see it increasing R&D and manufacturing facilities all across the continent throughout the same time frame. Together, these investments are expected to bring Europe's total share of the global semiconductor investment table to around 20% by 2030 - a 12% explosion in less than a decade.

All in all, the worldwide R&D investment hasn't changed too much in the last decade. But overclocked investments across the US and Europe could begin to stem the Asia-Pacific tide, which is sure to increasingly pivot towards Chinese investments. All these moves will surely be important from the perspective of geopolitics, but they'll have a primary effect of accelerating innovation throughout tech sectors - that's the proverbial cherry on top of the cake. The knock-on addition of increased resiliency to conflict and pandemics is but the filling. But we've seen stranger, more unexpected things happen.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.