AMD rakes in cash with best quarterly revenue ever amid datacenter business rise, but gaming business craters

$6.819 billion, up 18% year-over-year

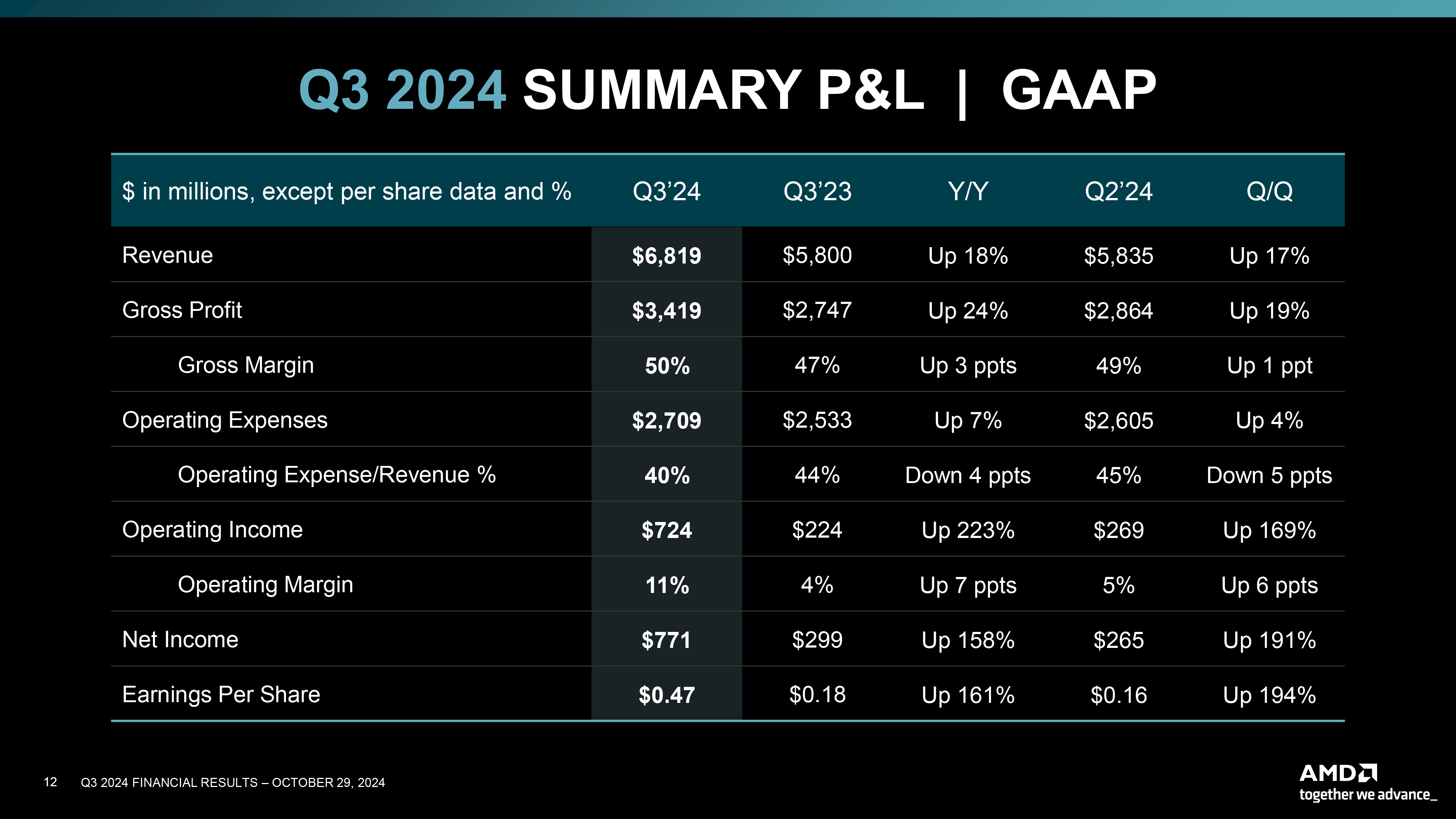

AMD on Tuesday announced its financial results for the third quarter of 2024. With a revenue of $6.819 billion, the company posted its best quarter ever as its datacenter unit enjoyed record sales. While the company's client business also performed well year-over-year, its gaming and embedded businesses were down rather dramatically compared to the same quarter a year ago.

AMD's revenue reached $6.819 billion, up 18% year-over-year, in the third quarter of 2024, whereas its net income increased to $771 million, a 158% rise compared to the same quarter in 2023. AMD's gross margin rose to 50%, up 3% year-over-year.

"We delivered strong third quarter financial results with record revenue led by higher sales of EPYC and Instinct datacenter products and robust demand for our Ryzen PC processors," said Dr. Lisa Su, chief executive of AMD. "Looking forward, we see significant growth opportunities across our datacenter, client and embedded businesses driven by the insatiable demand for more compute."

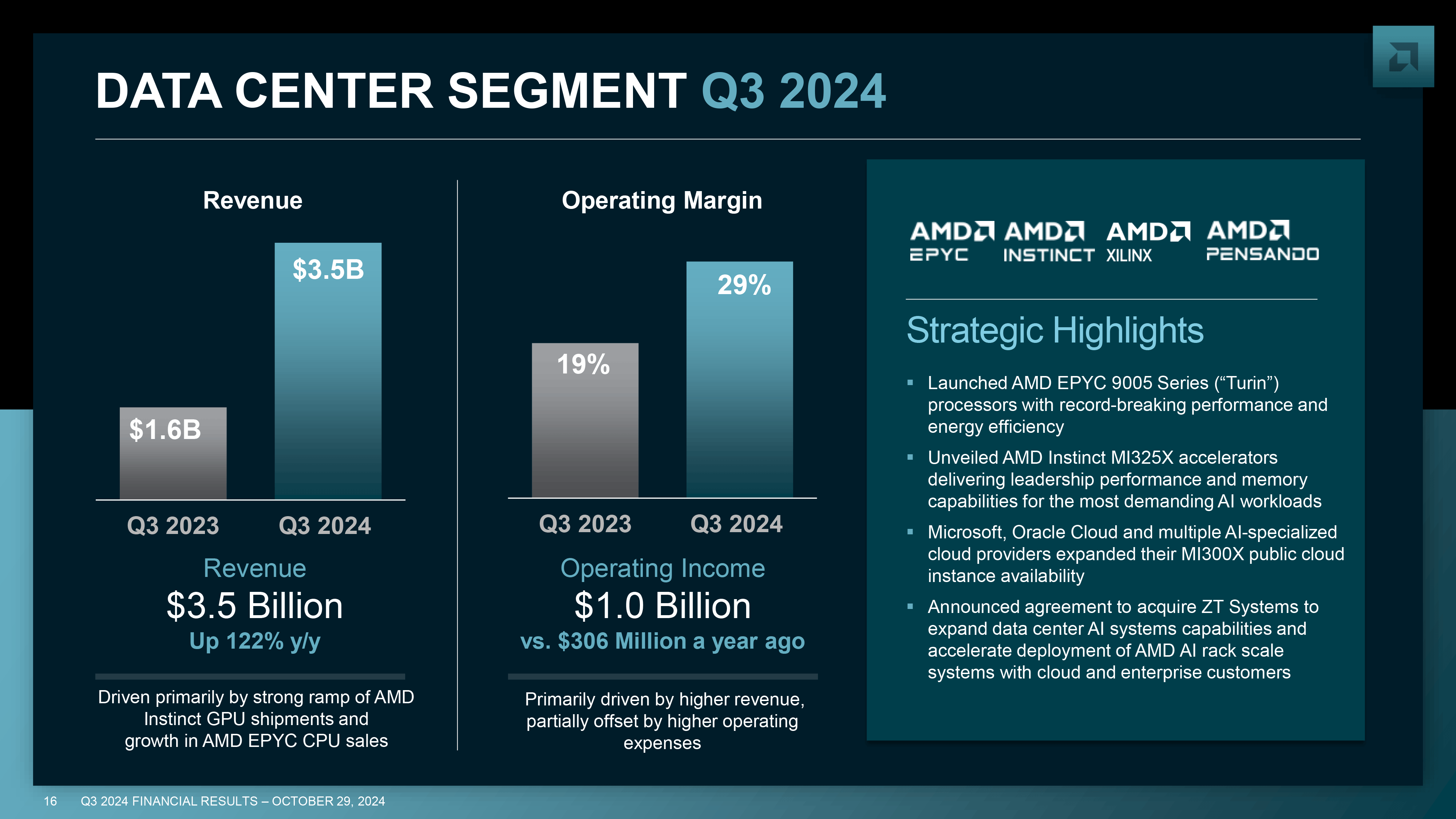

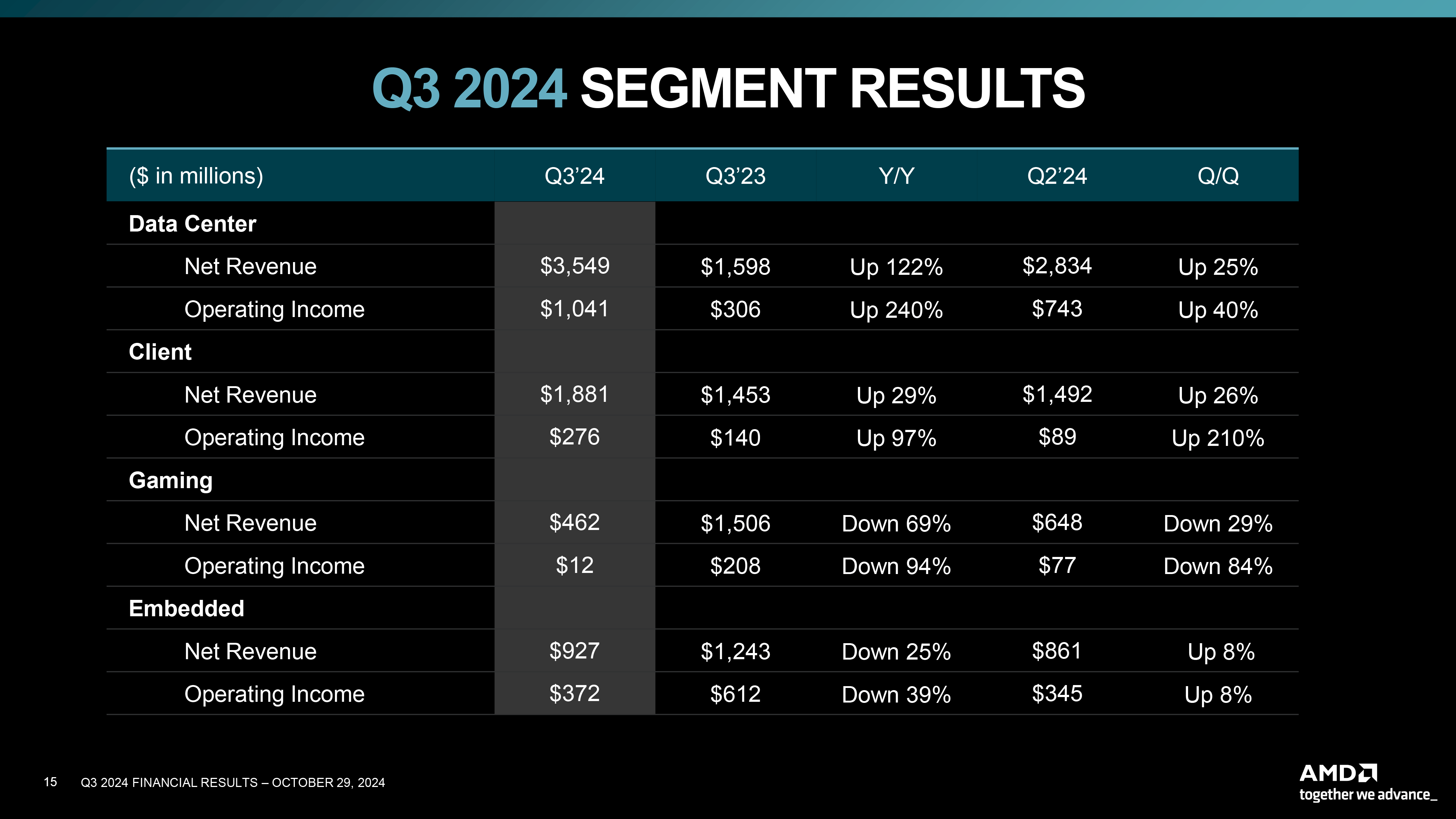

Datacenter CPUs and GPUs set records

AMD's datacenter business earned $3.5 billion in revenue, up 122% year-over-year, as the company ramped up production of its EPYC 'Turin' processors based on the Zen 5 microarchitecture as well as increasing sales of its Instinct MI300X accelerators for AI and HPC workloads that have now be adopted by Microsoft, Oracle, and AI-specialized cloud service providers. Operating income of this unit exceeded a billion of dollars and reached $1.041 billion (up 240% YoY), another first for the company.

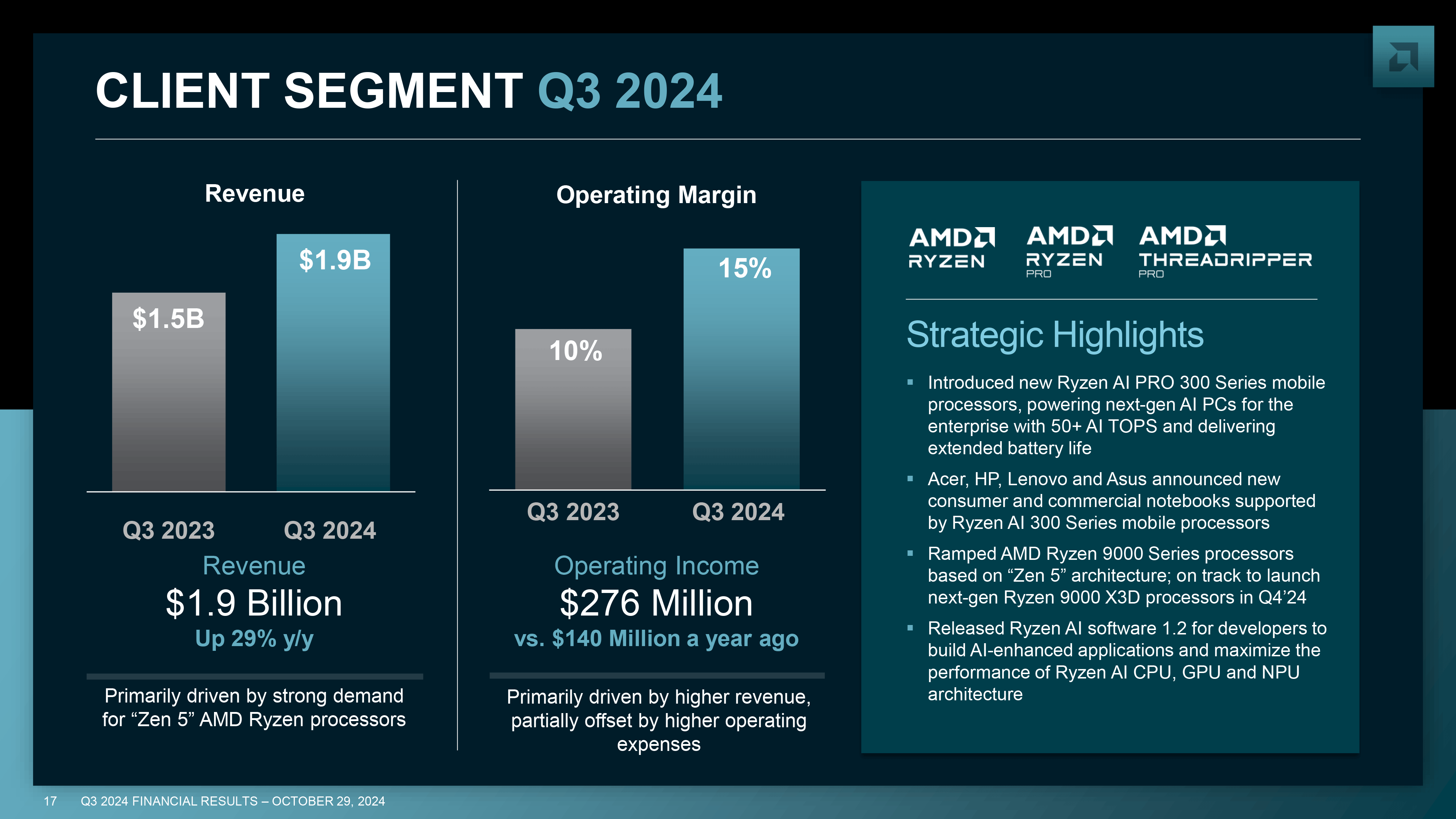

Client business unit remains strong

Sales of AMD's client business unit totaled $1,881 billion in Q3 2024, up 29% from the third quarter of 2023. During the quarter AMD began to sell its Zen 5-based CPUs for desktops and laptops, which almost certainly had an effect on its revenue. Yet, it is likely that recovery of the PC market and expected demand for client processors also played a role.

Gaming business collapses 69% year-over-year

While AMD's datacenter business unit pleases with its results, the company's gaming business is nothing but a disappointment, something that the company pre-announced earlier this year.

During the third quarter, AMD's gaming business earned $462 million, down from $1.506 billion in the third quarter of the previous year as a result of dropping sales of Radeon graphics processors as well as inventory adjustments by Microsoft and Sony as their gaming consoles enter their fourth year on the market. So far, Sony's PlayStation 5 Pro did not have any positive impact on AMD's performance, it seems. Despite its massive revenue drop, AMD's gaming unit remained profitable with an operating income of $12 million.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

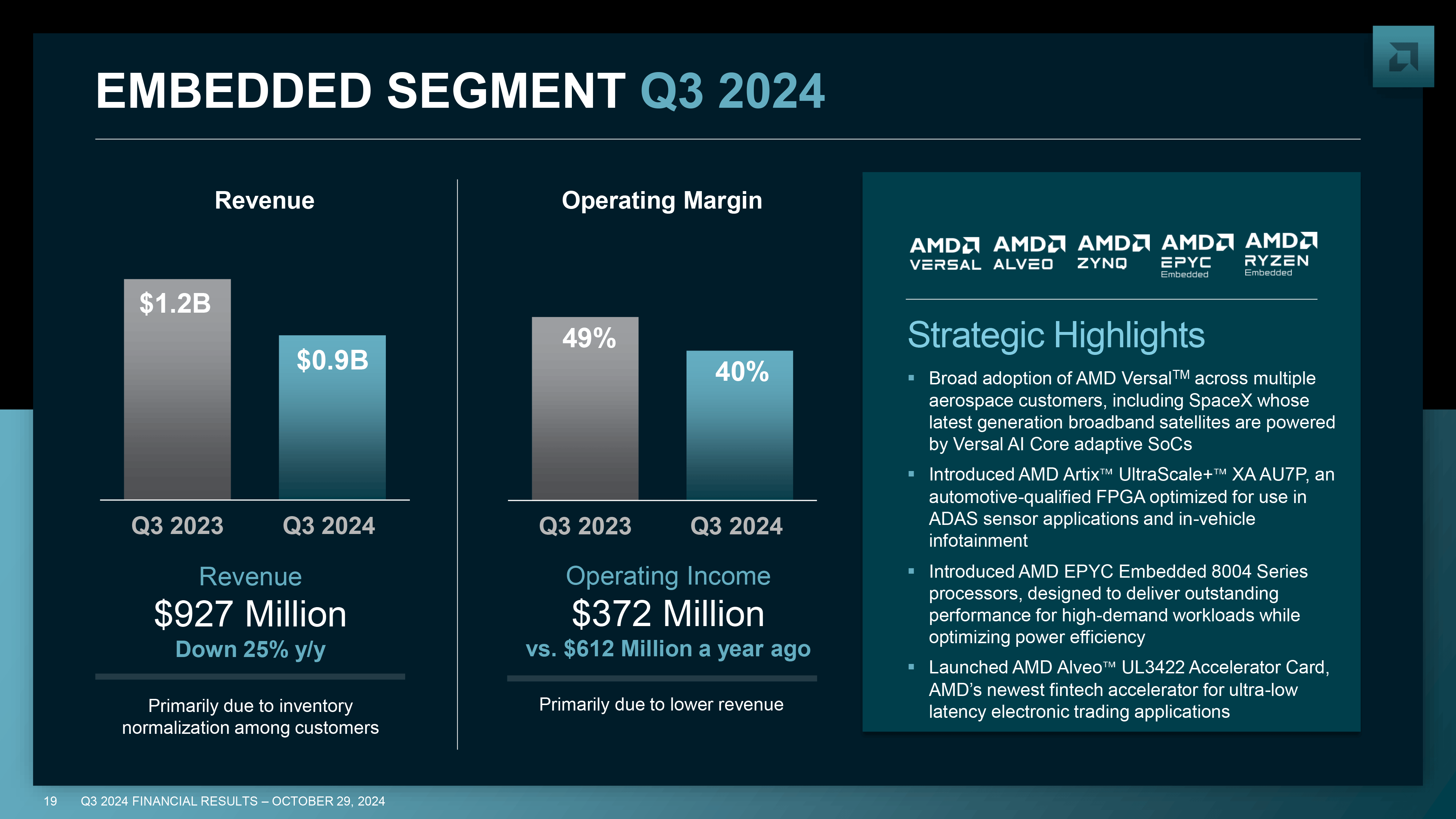

Embedded business also down

AMD's Embedded division — formerly Xilinx — posted $927 million in revenue, reflecting a 25% decrease from the same quarter a year ago, but slightly up from $861 million in the previous quarter. Operating income of the business unit was $372 million, down 39% YoY.

Outlook

AMD anticipates that its revenue for the fourth quarter of 2024 will be approximately $7.5 billion ±$300 million, whereas its gross margin is projected to increase to 54% as sales of its datacenter hardware gets higher. This projection reflects an estimated year-over-year revenue growth of around 20% and a sequential increase of about 10% at the midpoint of the forecast range.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

hotaru251 not a shock tbh.Reply

AMD's basically got datacenter on lock down w/ EPYC. (and datacenter is most profitable of the groups)

Gaming also not shock as consoles are big chunk & sales drop off heavily after a while. Just keep hope amd doesnt do an nvidia and only care about ai. -

Eg0 It seems you will never see Lisa do anything that really challenges her cousin. Every time they have a something with a potential of impacting Nv's lead they pull it.Reply -

bit_user Reply

First of all, too much is made of the family relation, as they're actually like second or 3rd cousins. I think they didn't even know they were related, until someone pointed it out to them. Even then, I still don't see why she would hold back from competing with him, especially when he clearly feels no such obligation. If anyone needs "protecting", it's surely not Jensen/Nvidia!Eg0 said:It seems you will never see Lisa do anything that really challenges her cousin.

Secondly, RDNA2 actually managed to take a slight lead on raster performance over RTX 3000. Go back and look at the benchmarks of RX 6950X vs. RTX 3090!

The simple fact is that Nvidia is very good at graphics and a very aggressive competitor. With RDNA, AMD made huge strides in competitiveness at gaming performance, but it's just not easy to beat Nvidia. If you need further evidence, just look at how the mighty Intel has struggled to match even AMD on dGPU performance! It's not that AMD is bad, just that Nvidia is really good and ruthlessly competitive.

You're talking about their die-stacked RDNA4 GPU? I think they pulled it because it wasn't competitive on perf/$ or perf/W, or maybe there were manufacturing problems.Eg0 said:Every time they have a something with a potential of impacting Nv's lead they pull it. -

EzzyB Reply

I think it already has. The reason they announced they simply won't compete Nvidia's high end gaming cards is that those resources are better spent on datacenter AI.hotaru251 said:not a shock tbh.

AMD's basically got datacenter on lock down w/ EPYC. (and datacenter is most profitable of the groups)

Gaming also not shock as consoles are big chunk & sales drop off heavily after a while. Just keep hope amd doesnt do an nvidia and only care about ai.

There's only so much design and manufacturing resources available at that top end and the AI stuff makes more money. -

redgarl It doesn't matter, the stock is down 9% from yesterday. Wallstreet is at it again, and the news of SMCI is literally sinking the whole semiconductor sector.Reply -

suryasans The profit margins on AMD's data center products are higher than its consumer products. So, it's not a surprise if the scheduled IC wafers productions for AMD in TSMC's leading edge fabs have been placed for its data center products.Reply -

logainofhades AMD's terrible marketing is why their gaming side has went down. Price/performance unless RT is involved, is often superior to that of Nvidia, along with AMD often being more generous on the vram, at a given price tier.Reply -

pug_s Reply

I would disagree. It is purely because of profit and AMD just decided to put its R&D and other resources into making CPU's. The latest 7000 radeon GPU's are still stuck on 6nm while its 9000 cpu's are already on 3nm. Its GPU dies are larger and don't make much profit compared to smaller CPU dies.logainofhades said:AMD's terrible marketing is why their gaming side has went down. Price/performance unless RT is involved, is often superior to that of Nvidia, along with AMD often being more generous on the vram, at a given price tier. -

logainofhades Replypug_s said:I would disagree. It is purely because of profit and AMD just decided to put its R&D and other resources into making CPU's. The latest 7000 radeon GPU's are still stuck on 6nm while its 9000 cpu's are already on 3nm. Its GPU dies are larger and don't make much profit compared to smaller CPU dies.

Their market share keeps dwindling, despite plenty of stock. That's why I say it's poor marketing. -

thestryker As far as being a profitable tech company is concerned the datacenter focus shows letting gaming go hasn't been to their detriment. It will be interesting to see if AMD really wants to gain in gaming. I suppose we'll find out when RDNA 4 is launched as that should tell us everything.Reply

While their marketing certainly plays a part as it's been pretty terrible when you're not the dominant player pricing between your competition isn't going to gain you marketshare. If AMD wants to gain marketshare in gaming it will have to be by offering a truly superior choice and the quickest way to do so is simply price. If the 7000 series launches lower priced (ex: 7600 @ $200, 7900 XT @ $600 and 7900 XTX @ $800) we're likely looking at a whole different market. They wouldn't overtake Nvidia because as @bit_user points out they've been executing almost perfectly, but they'd be gaining.logainofhades said:AMD's terrible marketing is why their gaming side has went down. Price/performance unless RT is involved, is often superior to that of Nvidia, along with AMD often being more generous on the vram, at a given price tier.

I don't think AMD's had anything particularly bad the last few generations if you toss out the crypto fueled mobile rebrands, but their prices just don't make them worth it (outside of sales). When I got my 3080 12GB it and the 6800 XT were the same price and raster performance, but 3080 RT much further ahead so AMD wasn't really a logical choice.

Even if AMD has performance and feature parity nvidia controls so much of the market they'd still need a good price advantage to make an impact.