Intel to lay off more than 15% of workforce — 15,000 or more employees — encountered Meteor Lake yield issues, suspends dividend

From bad to worse.

Intel plans to lay off more than 15% of its workforce by the end of the year, the company announced today, meaning roughly 15,000 employees or more (potentially up to 17,475 based on recent Intel headcount numbers of 116,500) — a vast restructuring that comes amid troubling financial results this quarter. The layoffs rank among the most severe in Intel's 56-year history.

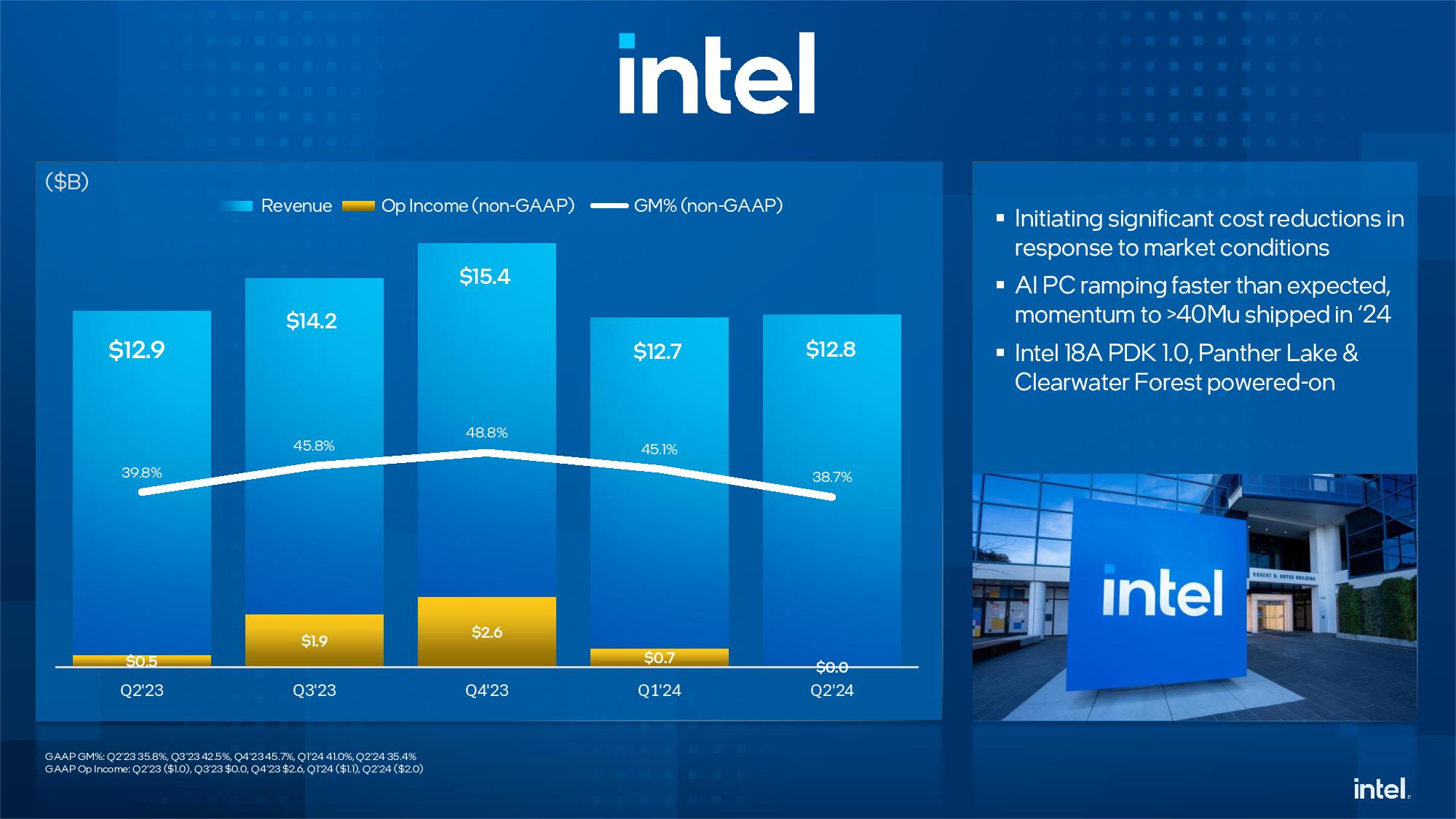

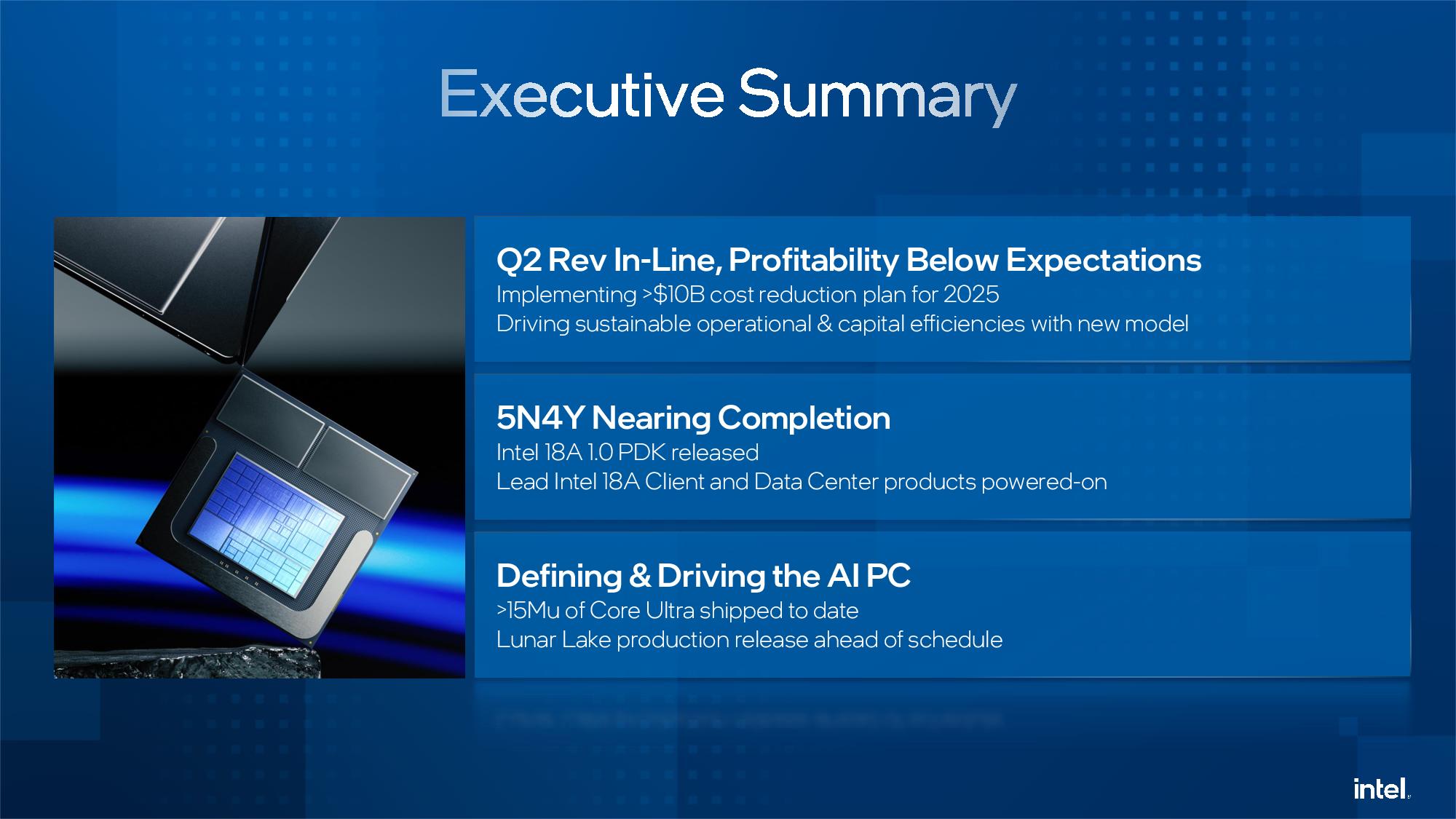

The news came during an earnings call for the semiconductor giant, which also announced that it has encountered yield issues with its Meteor Lake processors, problems that negatively impacted the bottom line. The company lost $1.6 billion in the quarter. Intel said it will cancel some 'underperforming' products in a bid to save costs and plans to suspend its seemingly sacred dividend in the fourth quarter. At the time of publication, Intel's stock had dropped 19% in after-hours trading.

These decisions have challenged me to my core

Pat Gelsinger, Intel CEO

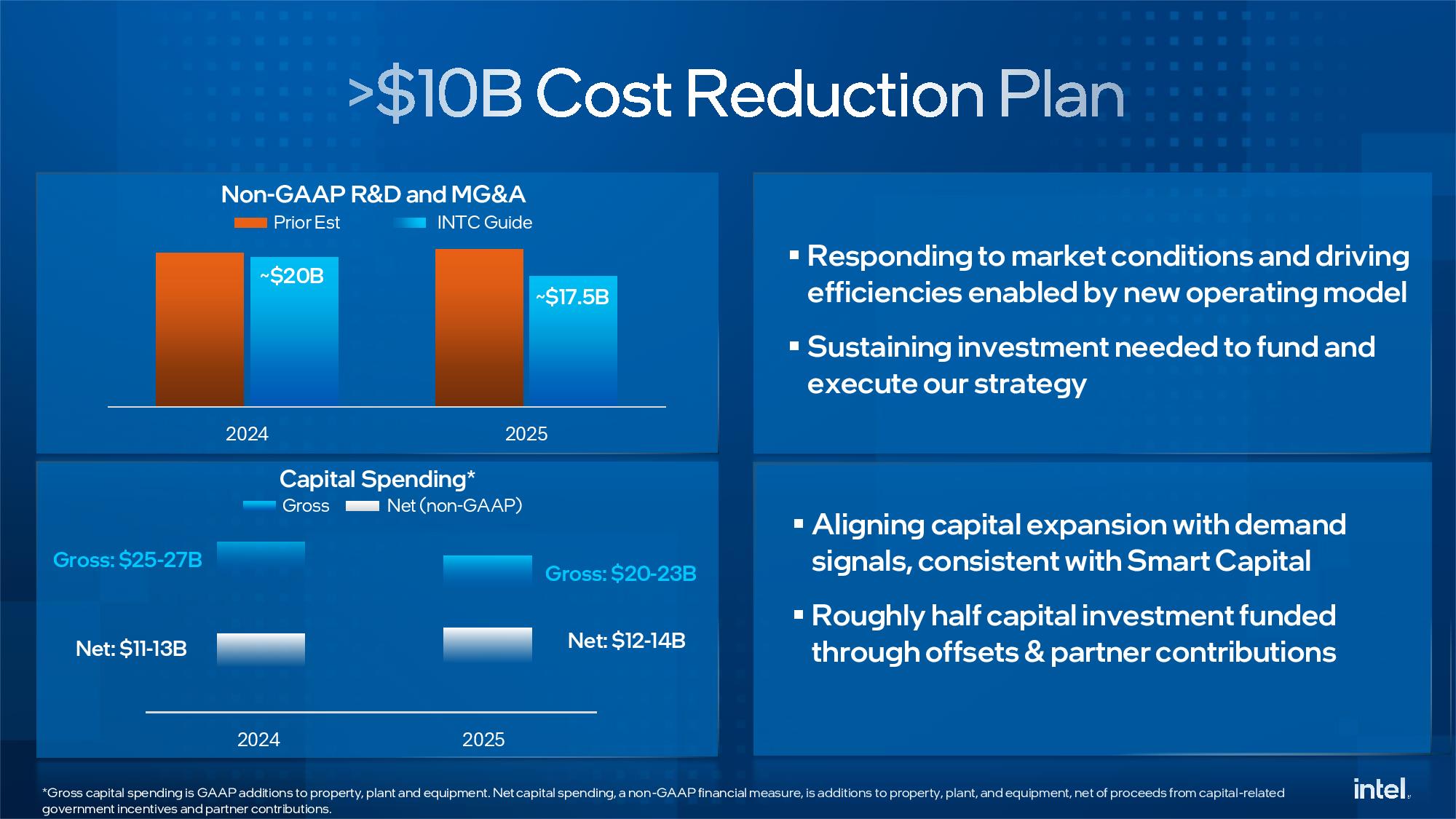

CEO Pat Gelsinger outlined the changes and the rationale behind them in a blog post to Intel.com; he noted that the company aims to reduce spending by $10 billion in 2025 with the move. Intel will offer employees buyouts and early retirement options but will inevitably sever other employees via layoffs. Intel specifically called out looming cuts to marketing and R&D, the latter being a concerning development for a company that's reliant on developing new tech, along with reductions in general and administrative staff.

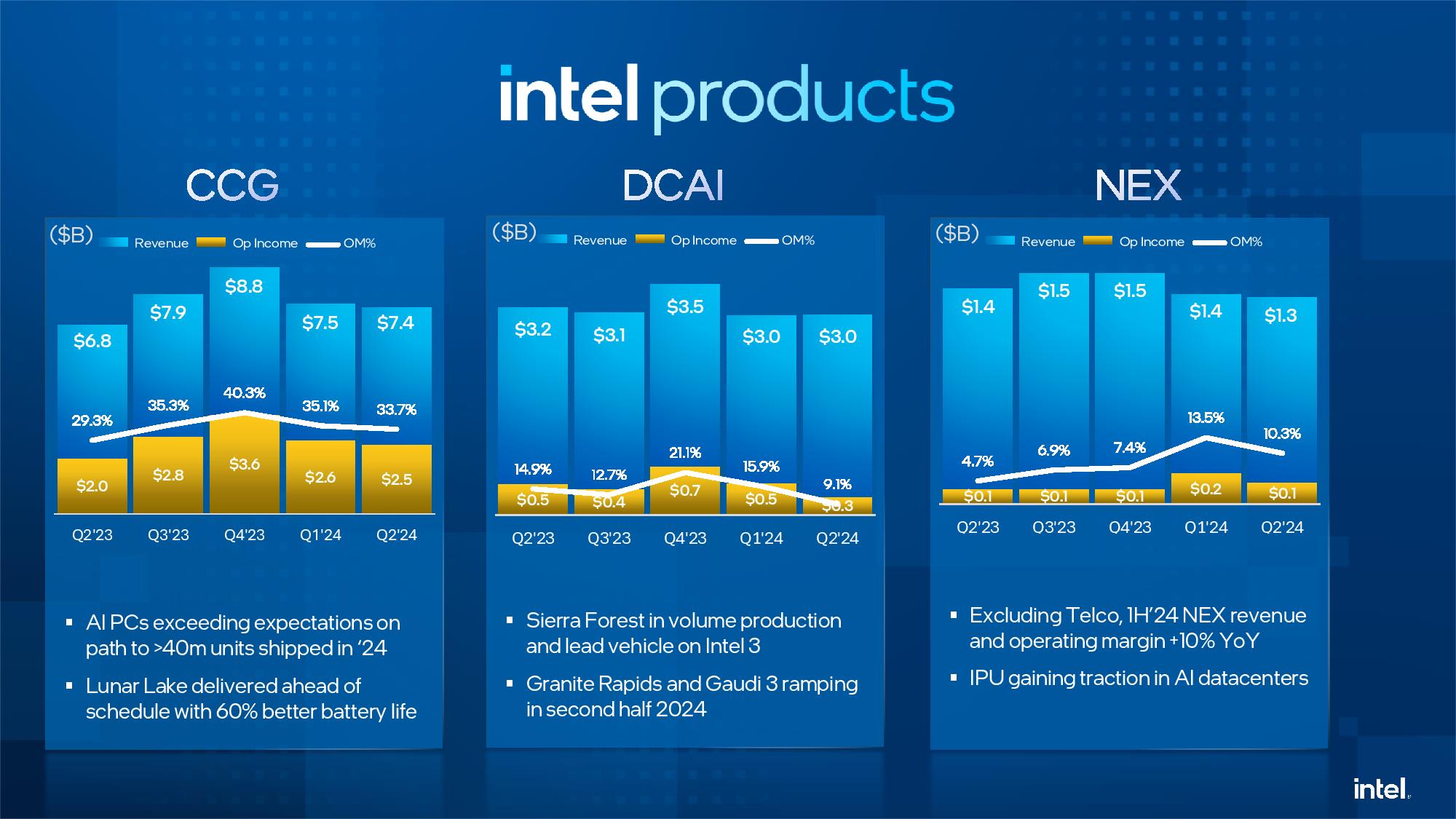

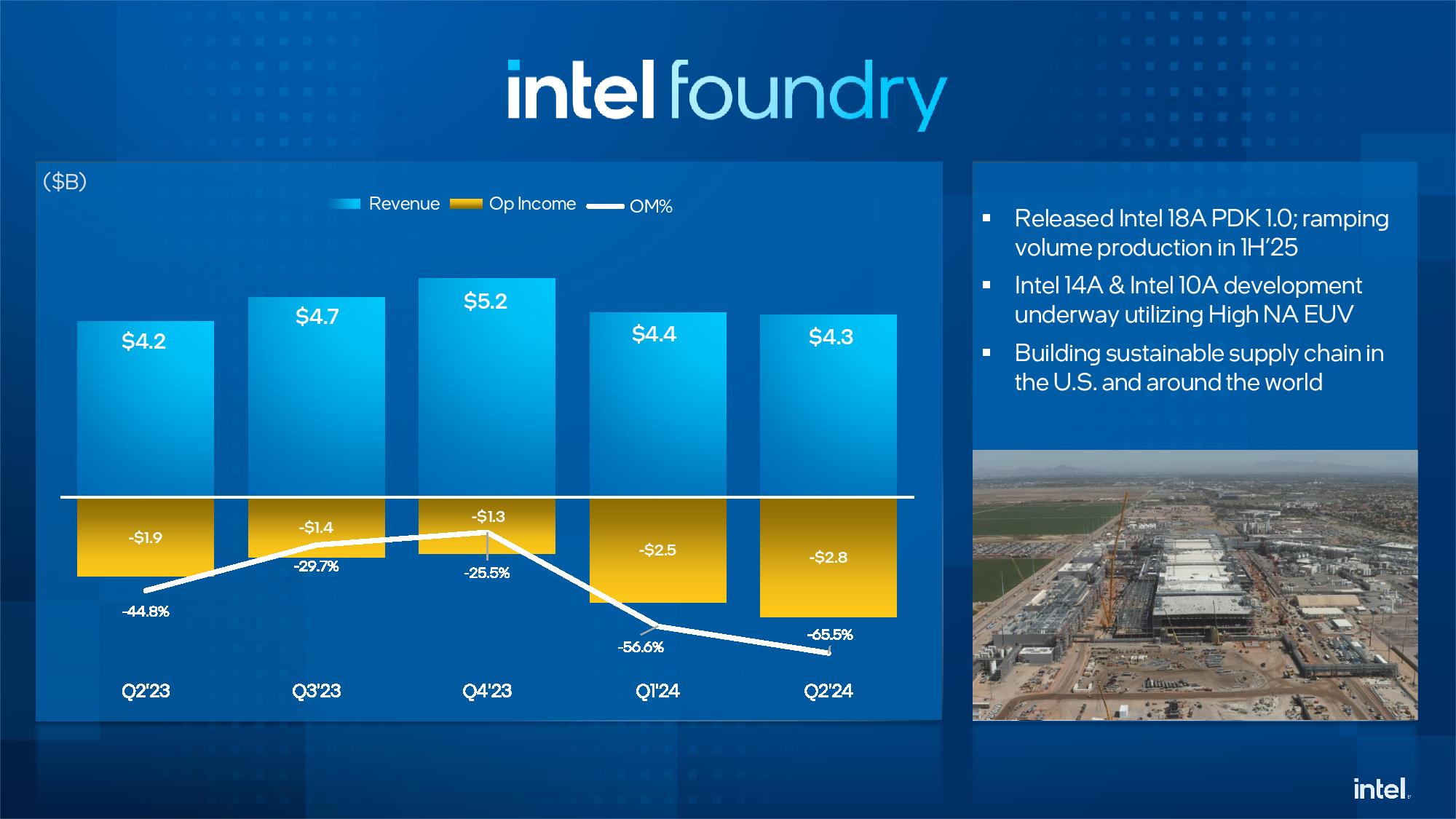

Intel did say that its 18A process node, which is exceedingly important to its success as a fledgling custom foundry, remains on track. The company recently released its 1.0 process design kit (PDK), a critical set of design rules that defines how its customers can produce chips using the node. Intel also says its next-gen Panther Lake and Clearwater Forest processors remain on track.

Analyst Patrick Moorhead Tweeted that Gelsinger told him about the Meteor Lake yield issue. It's unclear if these issues are related to the widespread crashing and instability problems Intel has encountered with its 13th- and 14th-gen desktop processors. The company had previously cited a shortage of packaging capacity for its inability to meet OEM demand for the Meteor Lake processors, but Moorhead says Gelsinger told him that yield issues fueled the need for 'hot lots,' or accelerated wafer runs of chips that incur excessive cost relative to normally scheduled operations.

It was a very rough Q2 for $INTC. And that guide... Thanks, @Pgelsinger, for the time to discuss.It appears that there were yield/throughput issues on Meteor Lake, negatively impacting gross margins. When you have to get the product to your customers, and you have wafers to… pic.twitter.com/pHU66xvFe7August 1, 2024

Here are the most relevant bullet points from the company's press release:

- Implementing comprehensive reduction in spending, including a more than 15% headcount reduction, to resize and refocus.

- Suspending dividend starting in the fourth quarter of 2024. The company reiterates its long-term commitment to a competitive dividend as cash flows improve to sustainably higher levels.

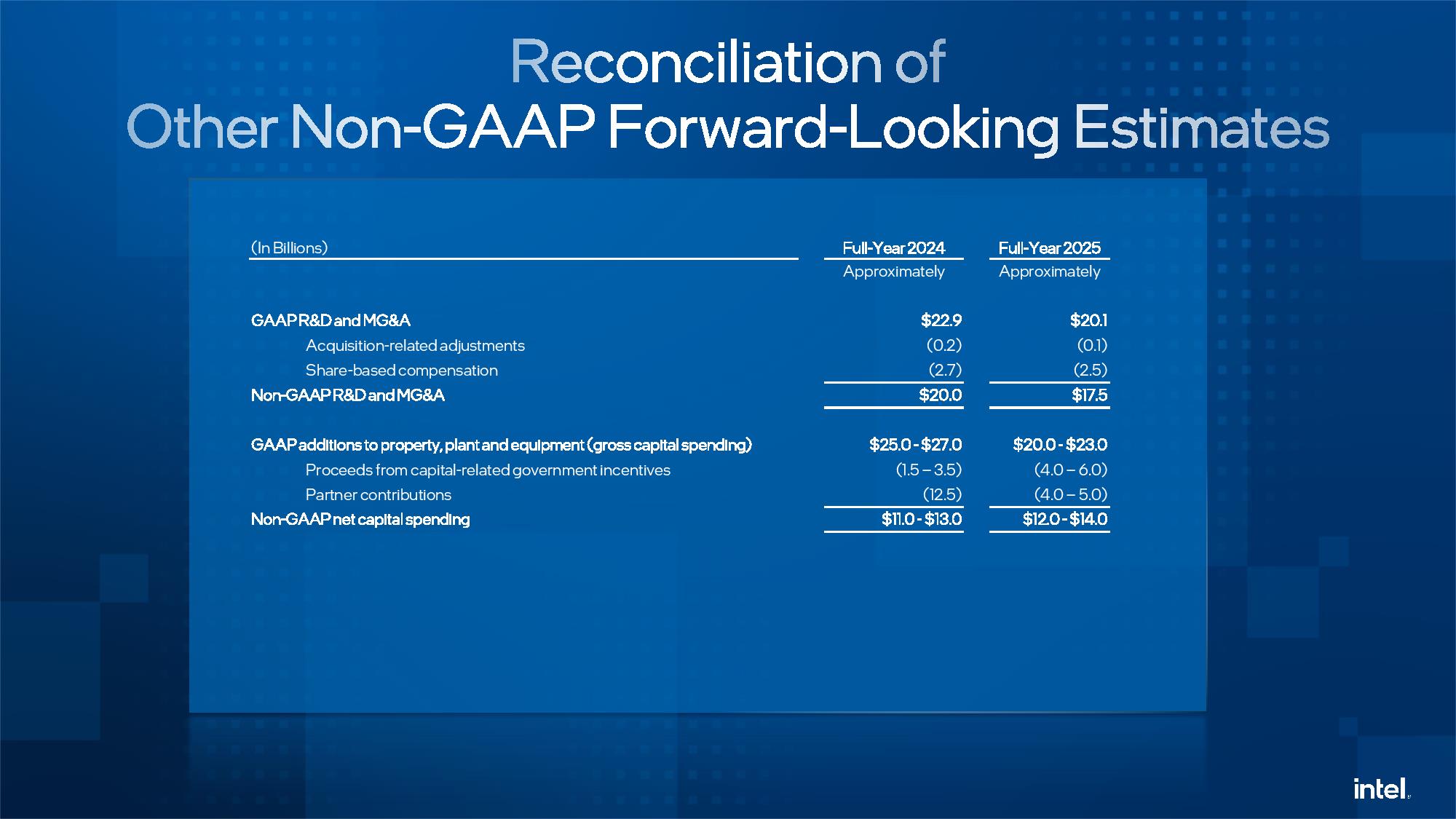

- Reducing Operating Expenses: The company will streamline its operations and meaningfully cut spending and headcount, reducing non-GAAP R&D and marketing, general and administrative (MG&A) to approximately $20 billion in 2024 and approximately $17.5 billion in 2025, with further reductions expected in 2026. Intel expects to reduce headcount by greater than 15% with the majority completed by the end of 2024.

- Reducing Capital Expenditures: With the end of its historic five-nodes-in-four-years journey firmly in sight, Intel is now shifting its focus toward capital efficiency and investment levels aligned to market requirements. This will reduce gross capital expenditures* in 2024 by more than 20% from prior projections, bringing gross capital expenditures in 2024 to between $25 billion and $27 billion. Intel expects net capital spending* in 2024 of between $11 billion and $13 billion. In 2025, the company is targeting gross capital expenditures between $20 billion and $23 billion and net capital spending between $12 billion and $14 billion.

- Reducing Cost of Sales: The company expects to generate $1 billion in savings in non-variable cost of sales in 2025. Product mix will continue to be a headwind next year, contributing to modest YoY improvements to 2025's gross margin.

- Maintaining Core Investments to Execute Strategy: The company continues to advance its long-term innovation and path to leadership across process technology and products, and the increased efficiency from its actions is expected to further support its execution. In addition, Intel continues to sustain investments to build a resilient and sustainable semiconductor supply chain in the United States and around the world.

- Intel is nearing the completion of its promised five-nodes-in-four-years strategy, with Intel 18A on track to be manufacturing-ready by the end of this year and production wafer start volumes in the first half of 2025. In July 2024, Intel released to foundry customers the 1.0 PDK for Intel 18A. The company’s first two Intel 18A products, Panther Lake for client — the first microprocessor to use RibbonFet, PowerVia and advanced packaging — and Clearwater Forest for servers, are on track to launch in 2025.

- Simplifying Our Portfolio: We will complete actions this month to simplify our businesses. Each business unit is conducting a portfolio review and identifying underperforming products. We are also integrating key software assets into our business units so we accelerate our shift to systems-based solutions. And we will narrow our incubation focus on fewer, more impactful projects.

"These decisions have challenged me to my core, and this is the hardest thing I’ve done in my career. My pledge to you is that we will prioritize a culture of honesty, transparency and respect in the weeks and months to come," Gelsinger said in his blog post.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

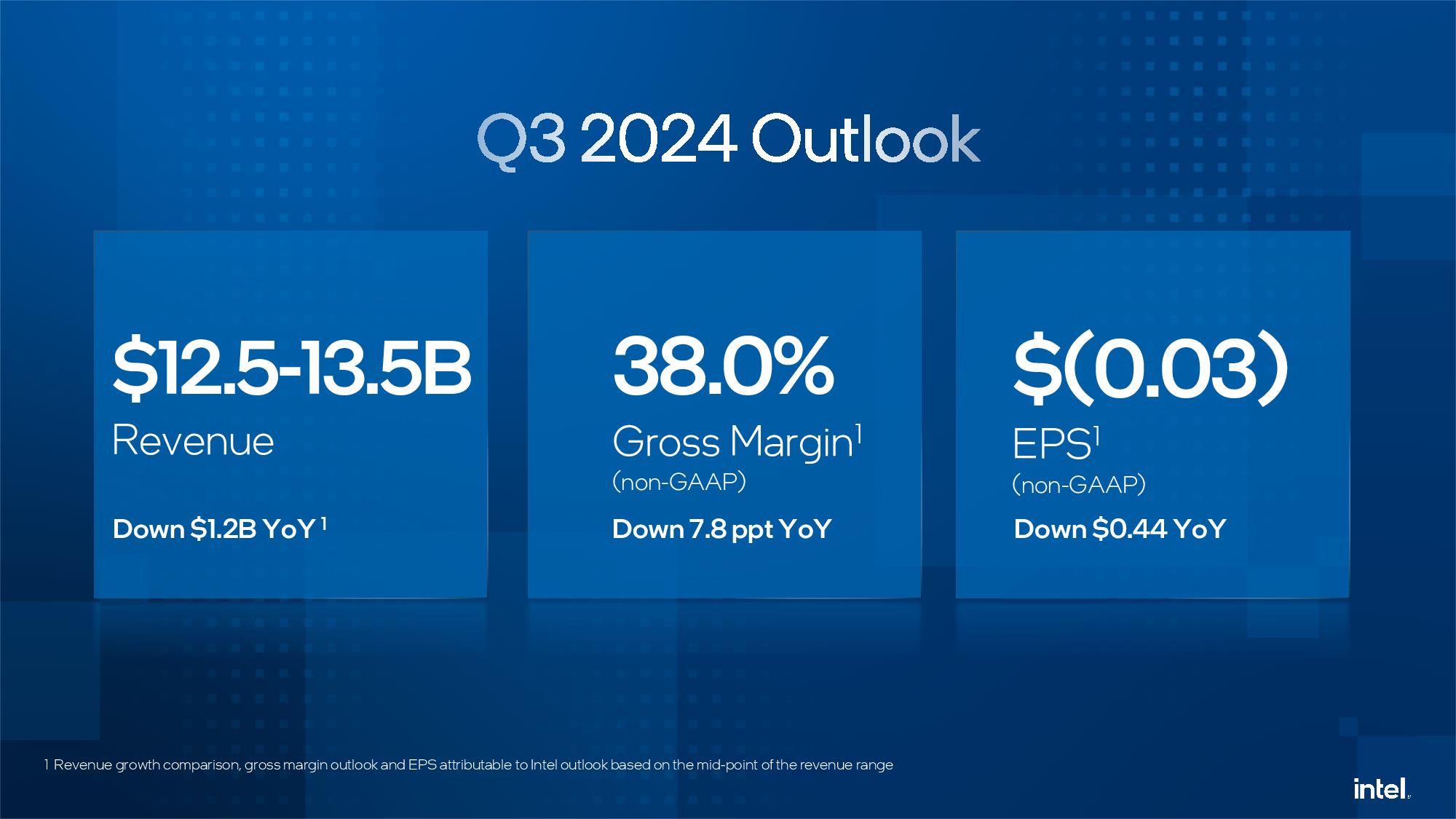

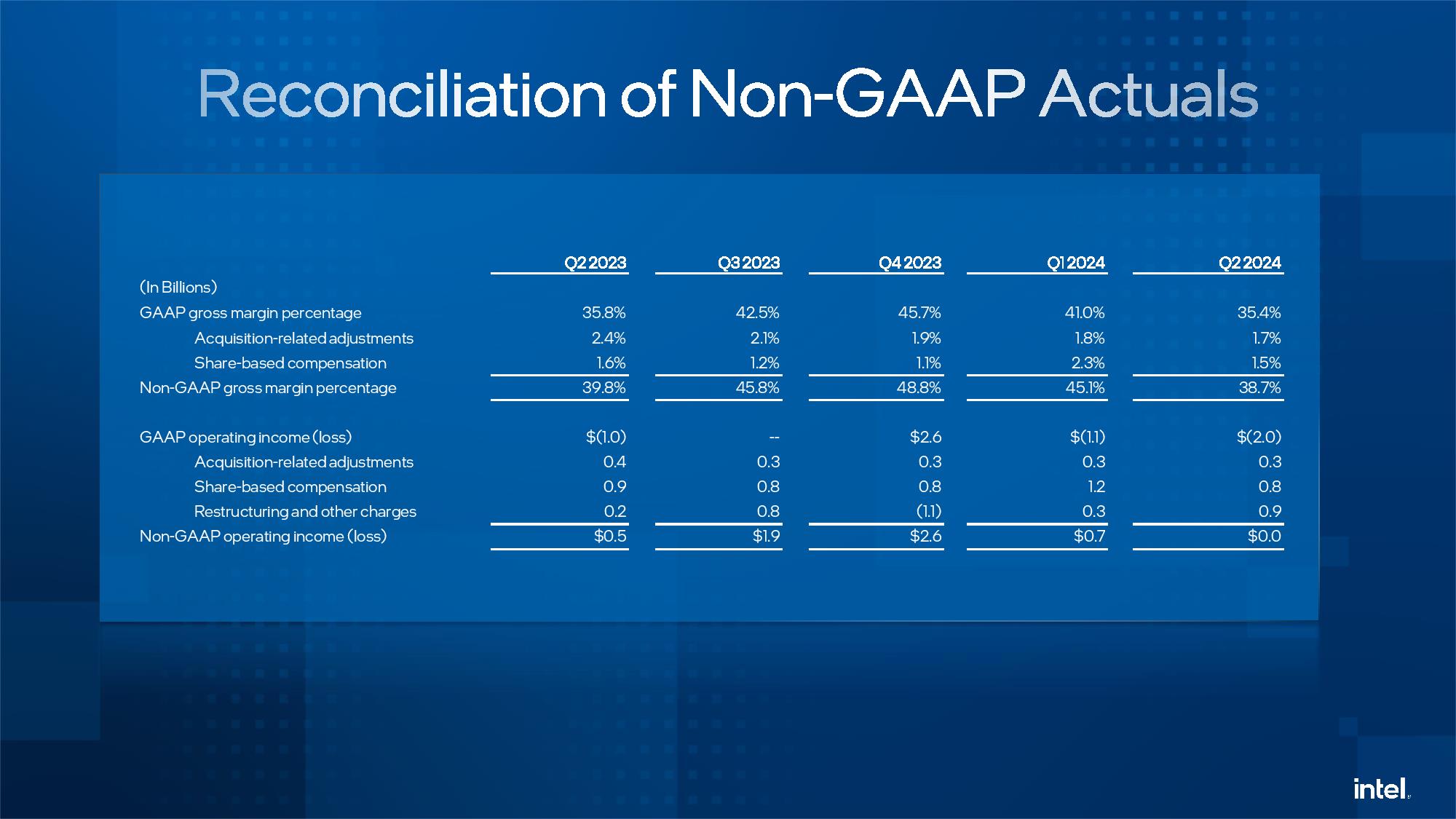

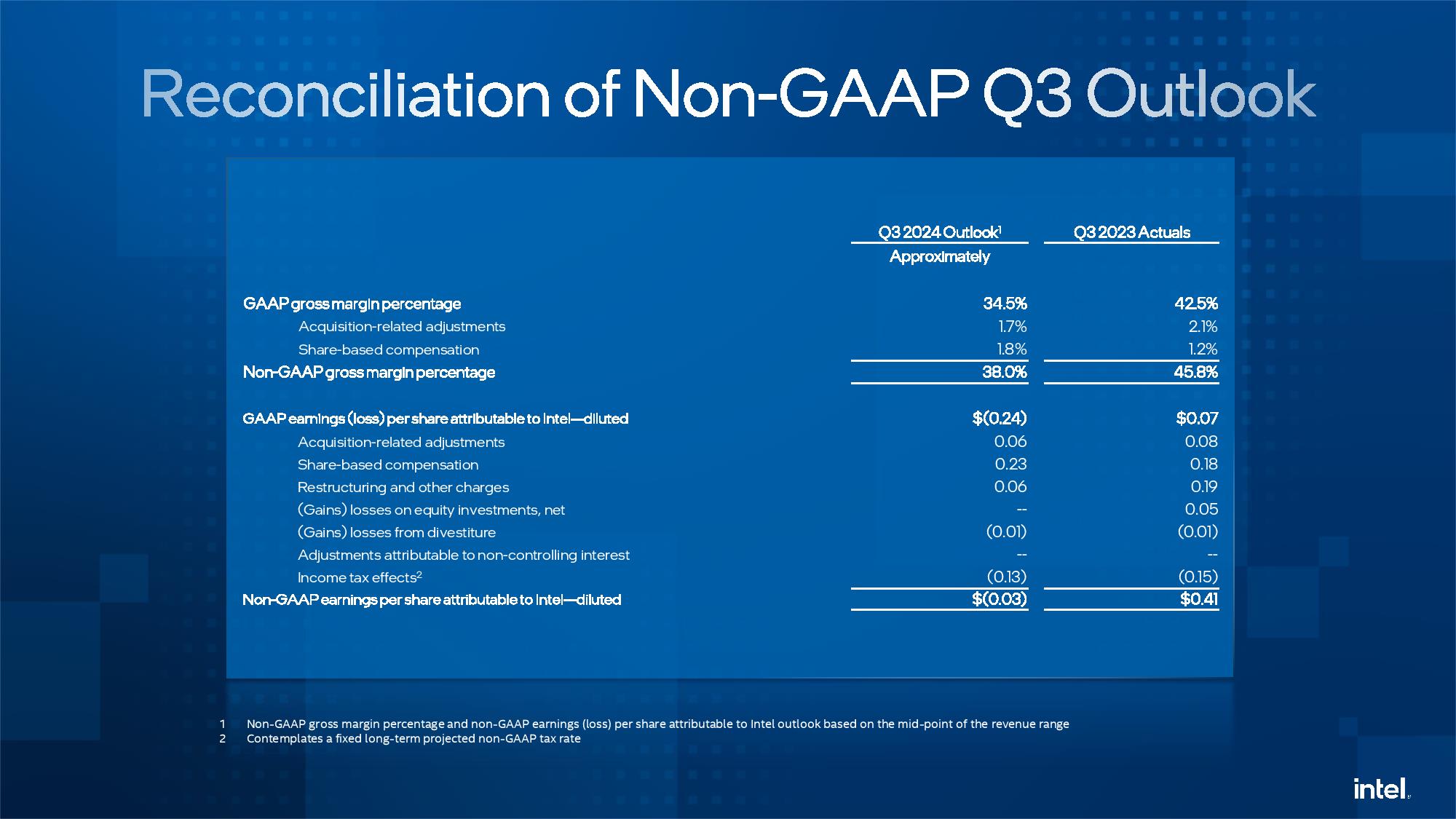

Intel missed its Q2 2024 projections as revenue declined 1% year-over-year, contributing to a $1.61 billion net loss. Intel posted a 38.7% gross margin, a notable 4.8 percentage points below guide. Intel also reported a much lower-than-expected guide for its third quarter of $12.5 to $13.5 billion and forecasts a disappointing 38% gross margin.

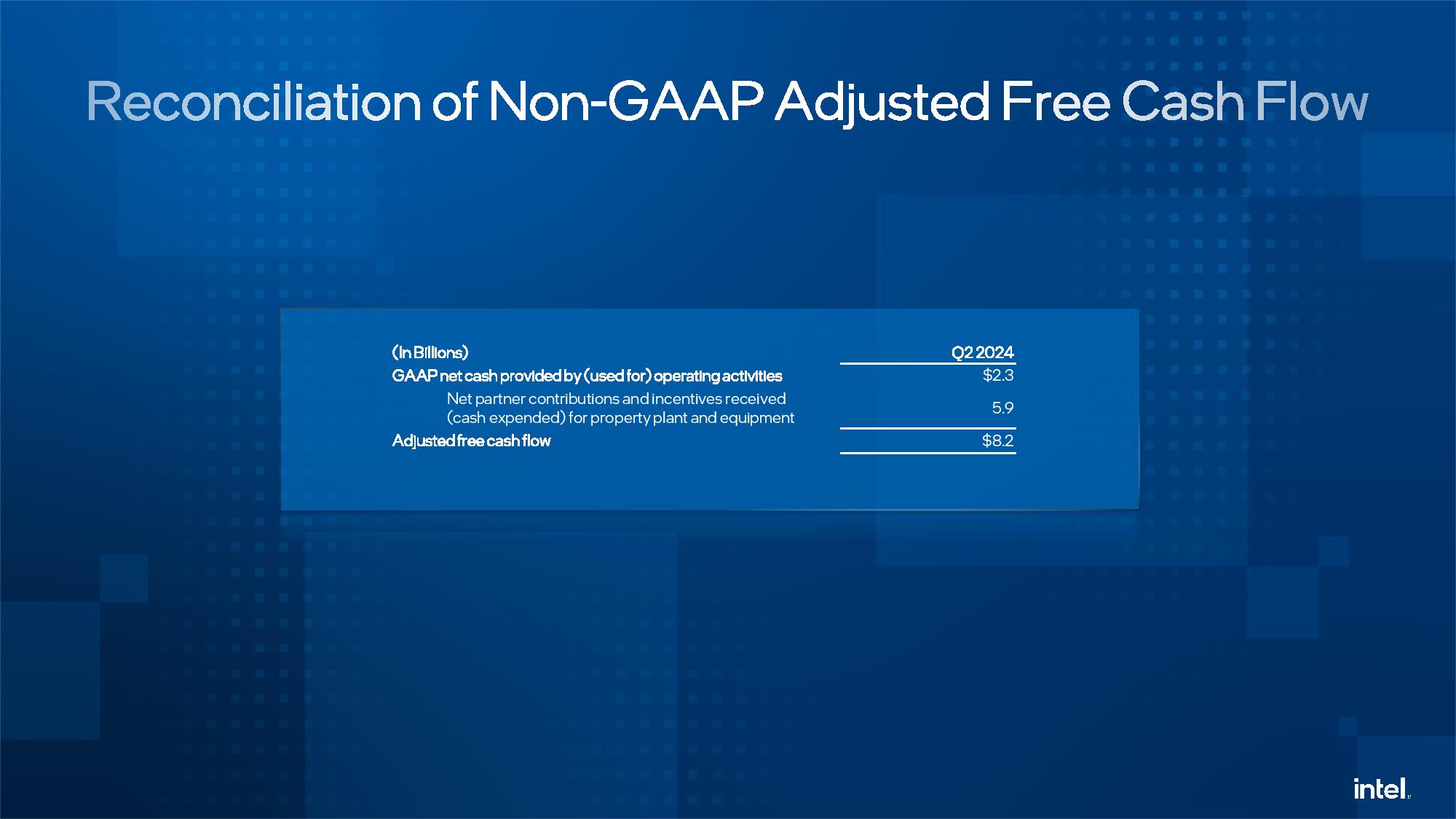

You can see Intel's slide deck for its second-quarter 2024 results in the above album.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

umeng2002_2 I'm always shocked how executives think firing thousands of employees magically makes a company able to make better products.Reply -

ThomasKinsley It's going to take some time to turn the ship around . . . assuming it can be turned without running it aground.Reply -

elforeign "These decisions have challenged me to my core, and this is the hardest thing I’ve done in my career. My pledge to you is that we will prioritize a culture of honesty, transparency and respect in the weeks and months to come," Gelsinger said in his blog post.Reply

Such mindless drivel, these people do not care one iota about the meaning of the words honesty, respect, or transparency. Like many large companies they are morally bankrupt and only beholden to the shareholders and how they feel about the bottom line. Their whole corporate ethos has been bottom of the barrel, monopolistic, rife with illegality, anti-competitive behavior. -

-Fran- Welp... This here: "...reducing non-GAAP R&D and..." is all the "doom & gloom" you need to lose hope in a Company that, supposedly, needs to innovate constantly to stay relevant.Reply

There's still time for Pat to correct that mistake, so I hope he manages to convince the board that R&D should not go down, unless they want to strip Intel down and sell it for parts now.

Well, as always, the R&D budget is not all CPU or the "bread and butter" elements, but it still feels (at least) like a terrible idea with no deeper context.

I'm sorry for the engineers which may be affected... Not so much for marketing :)

Regards. -

greymaterial firing R&D engineers might be the last straw to the crisis, im hoping to hear more "intels" about the RPL(r) cross-generational disaster from them.Reply -

thestryker Reply

For publicly traded companies these moves are always about appeasing shareholders as you can see it happen even when companies are having successful quarters etc.umeng2002_2 said:I'm always shocked how executives think firing thousands of employees magically makes a company able to make better products. -

thestryker ReplyAnalyst Patrick Moorhead said that Gelsinger told him about the Meteor Lake yield issues, as you can read if you expand the tweet below.

I don't really think this should surprise anyone who's been following the progress of MTL and Intel 4. The Intel 4 process has only been used for MTL in mass production and I believe the next largest volume was the chip they did for Ericsson and that is physically small which should limit yield issues to some degree. Then of course there was the cancelation of MTL desktop which came late relatively speaking.

...

The company had previously cited a shortage of packaging capacity for its inability to meet OEM demand for the Meteor Lake processors, but Moorhead says Gelsinger told him that yield issues fueled the need for 'hot lots,' which are accelerated wafer runs of chips that incur excessive cost relative to normally-scheduled operations. -

CelicaGT Crappy news, especially for those about to lose their jobs. Hopefully they are able to find work quickly. As for Intel, they need to cut as much fat as possible, focus on their core business and come back lean and mean. I'm big into AMD like many enthusiasts right now, but a strong Intel and a strong AMD are the best for everyones interests.Reply