Global GPU market to hit $100 billion in 2024: JPR

AI GPUs are leading the market.

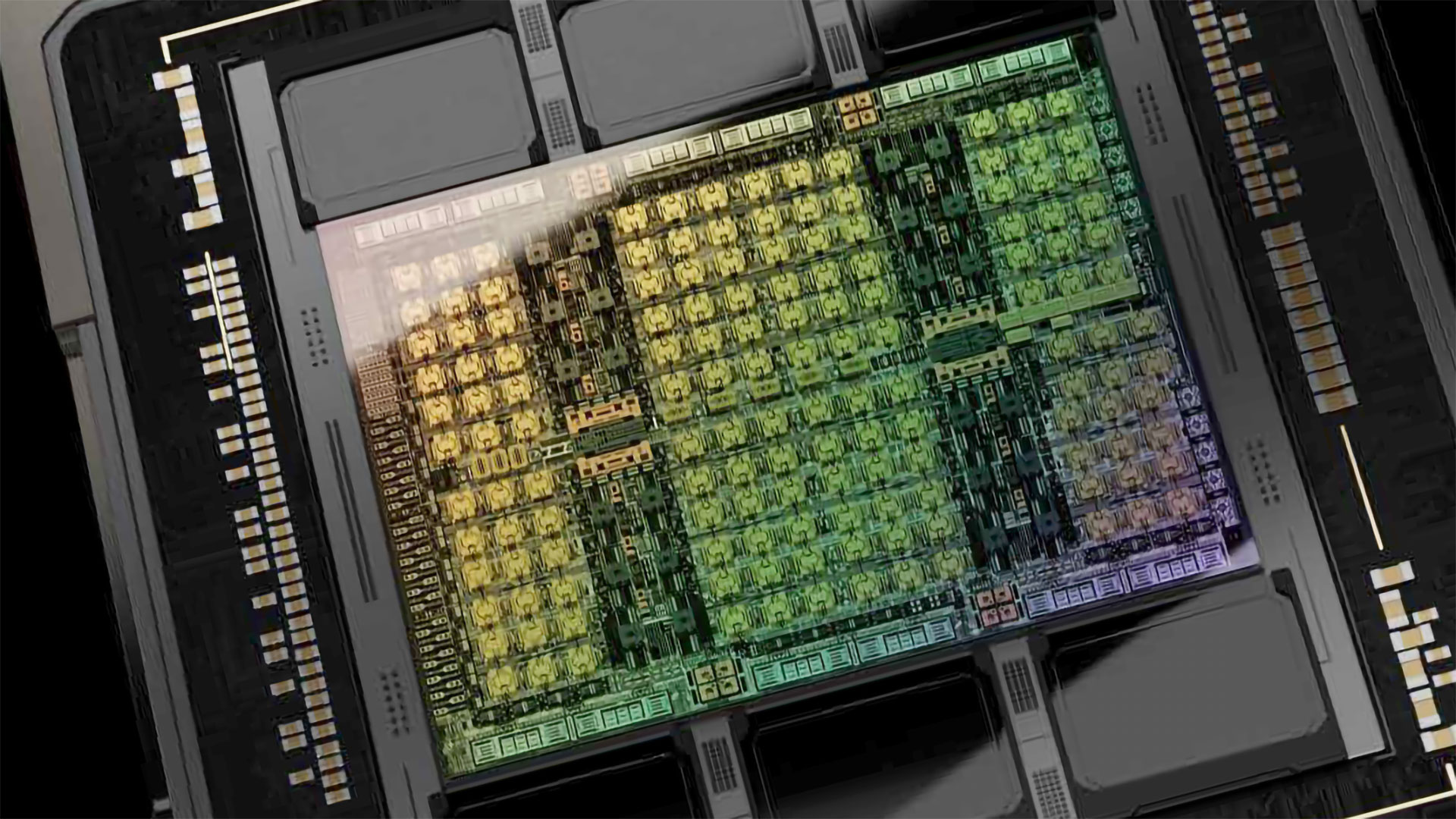

Graphics processing units (GPUs) are ubiquitous and found in many of the devices that we interact with on a daily basis. In addition, GPUs are used for AI and supercomputer workloads, and high-end processors from companies like AMD or Nvidia can cost $10,000–$30,000 or more. Demand for these units is increasing rapidly. As a result, the revenue of GPU developers is growing, and this year the global GPU market is expected to exceed $98.5 billion, according to Jon Peddie Research.

Currently, there are 20 companies and seven IP vendors developing discrete, integrated, and embedded GPUs, JPR reports. Most of these graphics processors are entry-level integrated GPUs, and only a few companies develop standalone GPUs for gamers including the best graphics cards. However, most of the revenue is earned from GPUs that are not used for graphics: sales of AI and HPC GPUs total only several million units per year, but since they are sold for tens of thousands of dollars per unit, they bring in tens of billions for Nvidia and billions for AMD.

In just two quarters of its fiscal 2025, Nvidia earned $42 billion from its AI and HPC GPUs, and for the whole year, sales of its compute GPUs could exceed $90 billion. AMD expects sales of its AI GPUs to exceed $3 billion. It is hard to estimate the revenues of companies like Biren or MetaX, but we doubt their compute GPU sales come close to those of AMD.

"Graphics processing units (GPUs) have become ubiquitous and can be found in almost every industrial, scientific, commercial, and consumer product made today," said Dr. Jon Peddie, the president of Jon Peddie Research. "Some market segments, like AI, have grabbed headlines because of their rapid growth and high average selling price (ASP), but they are low-volume compared to other market segments."

However, while the market for AI GPUs is low volume compared to other segments, all newcomers to the GPU market — particularly those from China — are focused on datacenter AI GPUs rather than on GPUs for gaming. Of course, these companies face restrictions from the U.S. government, which does not want China to access leading-edge AI technologies, but apparently, they are willing to take the risks as the potential of the AI market is very significant.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.