Intel-Micron 3D XPoint At Xroads

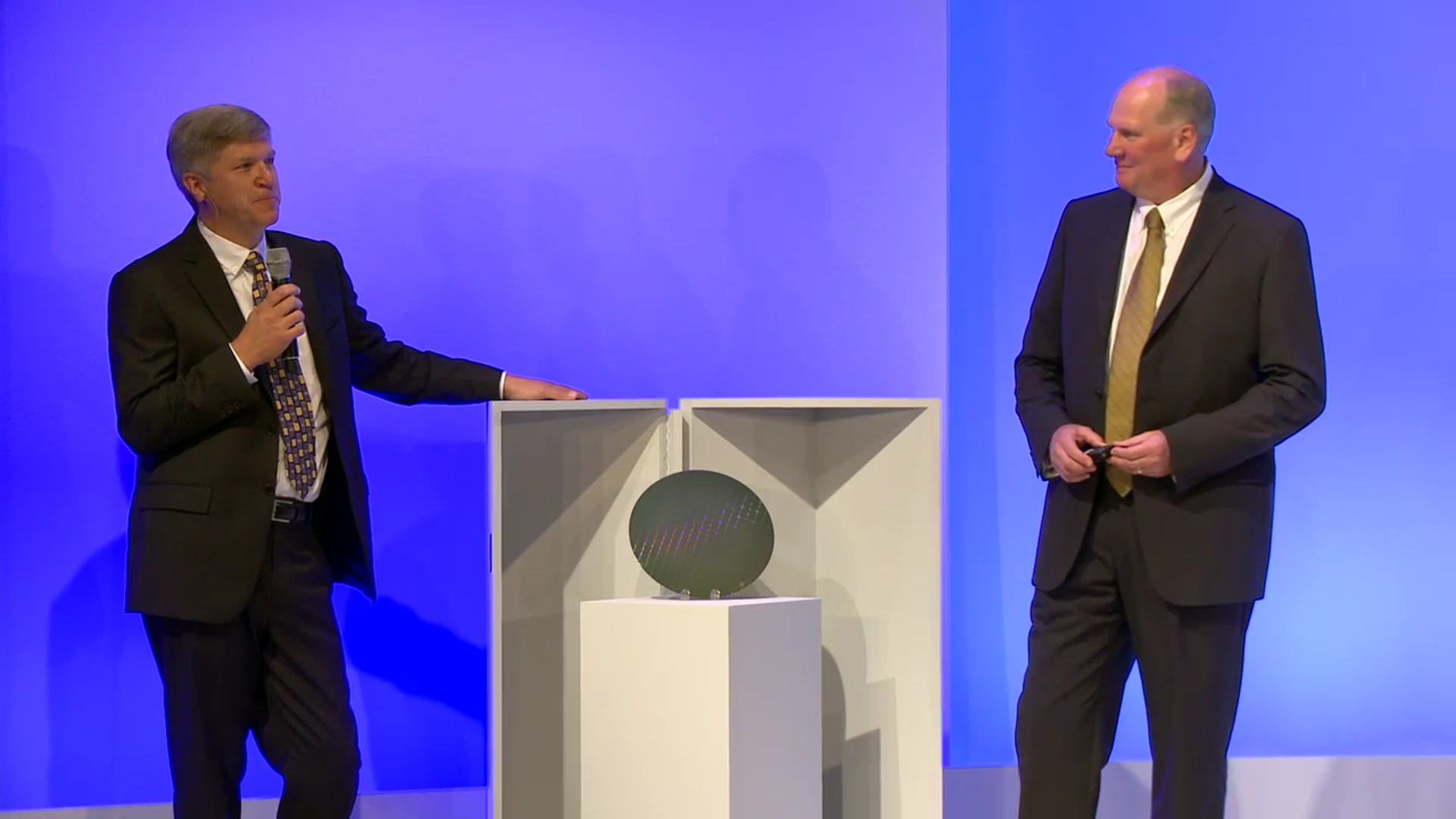

Today we're sorting out what's happened with Intel and Micron's 3D XPoint collaboration since it was announced in late July.

DRAM/NAND Market Impact

Surprisingly, during Micron's Summer Analyst Conference, CEO Mark Durcan indicated that 3D XPoint could equate to almost half of Micron's DRAM business in 2018, saying: "In terms of how quickly will this market grow and how quickly we’ll become significant, I think that is hard to know exactly today...the 2018 timeframe could easily be of the same order of magnitude as our DRAM businesses in that timeframe. So maybe not the same size, maybe half the size in 2018, but it will be a significant additive revenue stream to Micron at the time."

Durcan could be referring to the revenue 3D XPoint generates, or he could be referencing the bit output, which leaves his statement open to interpretation. In either case, Durcan is indicating 3D XPoint will be comparable to Micron’s $40+ billion DRAM business in two short years. This is an incredibly bullish statement, and it is hard to imagine that amount of production will not affect the DRAM or NAND segments.

The DRAM and NAND markets serve as an oasis of stability for Micron, and both it and Intel have gone to great pains to assuage skittish investors by indicating that 3D Xpoint will not cannibalize DRAM or NAND markets, but will be additive. This, too, is quite optimistic, and it would be more realistic to imagine it eating into a little of both.

The more interesting side effects of 3D XPoint will likely come from IMFT’s competition. Samsung, in particular, is in a nice spot to flood the market with either of the opposing NAND or DRAM mediums. It is in the process of building a $23 billion fab that will be operational by 2017, and that, by some estimates, is large enough to equal the 300mm wafer production of SK Hynix and SanDisk combined.

Samsung isn’t commenting on what its "superfab" will be used for, but it can pump out either NAND or DRAM. If Samsung chooses to flood the market with cheap NAND on one end and cheap DRAM on the opposite end, it can create enough price pressure to relegate 3D XPoint to niche applications, at least until Samsung is ready to roll out its competing technology.

Cue the return of the zero-margin DRAM market endured by the memory manufacturers over the last decade. Admittedly, this would be a bit of a nuclear option for Samsung, as it would also pay dearly in margins, but the key takeaway is that the company has the option of pushing the red button.

SK Hynix also recently announced it is investing $38.9 billion for three semiconductor fabs, so the attacks could come from multiple angles. Another possibility is that IMFT’s competitors could embrace, or create, an industry standard protocol for their own non-volatile products, which would fly in the face of Intel's proprietary interconnects.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Current page: DRAM/NAND Market Impact

Prev Page Other Things We’ve Wondered About… Next Page Back To Square One-

JeanLuc Is there any danger of you guys ever fixing how viewers enlarge pictures on your site?Reply

Seriously I don't know how many times I've commented on this issue but it seems to fall on deaf ears and given this is meant to be one of the larger tech site it's even more absurd. -

Bartendalot Very well written piece.Reply

Seems like it could be positioned as part of the purely platform as a future proofing connector.

While I don't think we will see true consumer products until 2018 at the earliest, are we looking at the main disruptive tech of the 10nm platform, or later?

The pressure coming from other market segments might give Intel a reason to get this out quickly. -

megiv The most important number is missing : Expected price per GB. I mean, they must have this number roughly already, or else they wouldn't go public with such big announcementsReply -

PaulyAlcorn ReplyThe most important number is missing : Expected price per GB. I mean, they must have this number roughly already, or else they wouldn't go public with such big announcements

I agree, it is the most important number! IMFT is merely saying that it will be between the price of NAND and DRAM, which gives them plenty of wiggle room - and isn't specific at all. -

Eggz I think this is going to be the kind of storage tech upgrade that will have a perceived impact akin to that of the HDD --> SSD tech upgrade - except better. The capacity decrease we felt when switching to SSDs was much more dramatic than that stated in the materials for Xpoint. I really hope it comes to market soon, but this time with a more attractive set of purchase options than early SSDs did.Reply -

Achoo22 I thought the trend of putting a capital X in a product title in hopes of catching the attention of the hipster crowd died away at the turn of the millennium. Will this product be compatible with XP running on Xtreme Xaggerated Xenthusuiast hardware?Reply -

kancaras Reply10X denser M.2 that's also 1000X faster? My dreams are coming true!

its 10x denser than dram, not nand, nand is also 10x denser than dram. i wouldnt expect affordable ssds with 3d Xpoint anytime soon. maybe cheaper but abit slower ram?

-

turkey3_scratch Reply16749024 said:Is there any danger of you guys ever fixing how viewers enlarge pictures on your site?

Seriously I don't know how many times I've commented on this issue but it seems to fall on deaf ears and given this is meant to be one of the larger tech site it's even more absurd.

Just right-click on the image and select "open image in new tab" to see it in full. -

SteelCity1981 looks like high speed storage is about to get a lot cheaper with xpoint if it can hold a lot more capacity than DRAM. might end of being the final nail in the coffin for HDD.Reply