Mobile: Intel Will Overtake Qualcomm In Three Years

The Turn: Fabrication

The reason ARM is dominant on the mobile side is that, to date, Intel has been unable to demonstrate a power-efficient MSoC. In this world, trumpeting impressive performance-per-watt numbers isn’t enough. You actually have to be able to show off a full day’s worth of talk time and impressive standby numbers in order to be functional. With Medfield, Intel demonstrates that its team has the technical know-how to produce an MSoC within striking distance of ARM. As Intel put it, Medfield buys the company a seat at the table.

You hear a lot about the relative pros and cons of the ARM and x86 architectures, and it is true that Qualcomm and ARM have more success with low power consumption. Until Medfield, no one was sure how much better-off those companies were compared to Intel. Now we can say that they had a four-year head start, since it took Intel that long after the launch of Atom to come up with a competitive mobile platform.

What happens in the next three years, though? Given that Medfield is competitive with currently-shipping ARM MSoCs, we have to look to the next generation. On the previous page, we suggested that ARM and Qualcomm face at least as significant of a challenge scaling performance up as Intel faces in scaling power down.

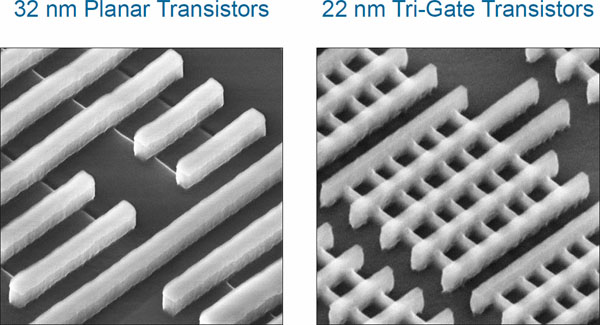

We can be perhaps most objective in looking at manufacturing technology. Intel has the best chip fabs in the industry, which allowed it to out-compete AMD during the K6 and K7 era, and maintain its position when AMD introduced the successful K8-era processors. Medfield is currently based on a 32 nm node and is already competitive with ARM-based solutions. Intel’s next move is to make a jump to 22 nm on a 3D FinFET design, representing two steps forward in process technology. Intel has never failed to execute with a fabrication process, and it will already have plenty of experience from its Ivy Bridge-based processors. If the company stays on track, it’s about 18 months ahead of the competition in manufacturing. As soon as the competition starts shipping 28 nm, Intel will follow with 22 nm, and it will be even longer before competing fabs can implement FinFET. This gives Intel another 20-30% improvement in power consumption over its current technology, while basically doubling density.

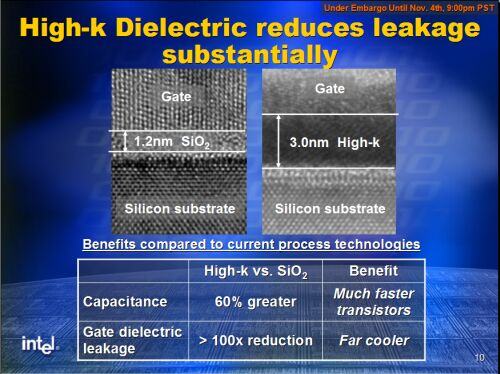

High-K/Metal Gate

ARM-based vendors are also in a race to enable MSoCS manufactured with high-K/metal gate technology. Besides Intel and Samsung, all of the other players are dependent on outside foundries like IBM, Globalfoundries, and TSMC. Samsung opens its foundries to other companies, so they’re on that list too.

Qualcomm signed on with Globalfoundries to manufacture its 28 nm MSoCs. Globalfoundries uses a “gate-first” high-k/metal gate 28 nm process. This is also what IBM and Samsung will be doing. They won’t attempt to make the switch to “gate-last” until 20 nm lithography is available. TSMC, the original foundry-for-hire (and the expected manufacturing partner for Apple’s A6) is going with a “gate-last” approach. Intel has always gone with a gate-last approach.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

“Gate-first” and “gate-last” describe the way you implement modern high-k insulators with metal gates, and the layman’s explanation is that we’re talking about a shift from pure silicon dioxide-based chips to those containing a different insulator called hafnium. In a gate-first design, you put the metal gate and hafnium components on the wafer before heating it, and in a gate-last design (like Intel’s) you do the replacement afterwards.

Gate-first buys you more density, which is great for performance, but it comes at the expense of yield. You have more failures in manufacturing. Gate-last is more reliable for manufacturing. But there are more restrictive design rules that you have to get around. Intel has been shipping high-k chips since its Penryn core in 2007. Globalfoundries didn’t successfully ship high-k chips until 2011.

Intel isn’t wrong for choosing gate-last. It has a proven track record with its Penryn, Nehalem, and Sandy Bridge architectures. Qualcomm may be wrong for choosing gate-first. Globalfoundries has a working gate-first process, used to manufacture AMD’s APUs. Unfortunately, as noted in AMD’s third quarter earnings report, yields weren’t as good as previously hoped, leading to lower-than-expected revenue growth.

Current page: The Turn: Fabrication

Prev Page Raw Platform Performance Next Page That's Two For Intel-

DjEaZy Intel Will Overtake Qualcomm In Three Years, If Qualcomm sits on hiz balls and do noothing.Reply -

Tamz_msc ReplyThree years ago, Internet Explorer was the industry’s dominant Web browser. Today, Google Chrome is in the lead.

Really?

Putting this sentence aside, its an interesting article. -

kjm15213 There seems to be a lot of speculation in the article and some assumptions that people apparently only buy what is to be considered the best technology? For one, if intel has the stigma of not having the ability to manage the power threshold, how hard are they going to have to fight to change that for consumers to buy their product? How well is windows phone doing to fight their stigmas? Secondly, the markets where the phones are sold are important and I have seen other articles break them down more regionally. I have read, and may be wrong, that the initial medfield phones are motorola and lenovo designs for Chinese consumers. If this is the limited market for adoption, they may sell volume, but it might not be a global volume. Another thing is how low is intel to go for return on their price for chips verses, will it be more cost effective for them to really ramp up on the cloud/platform support side for all of these new devices to come online. This may provide more ROI and atoms might not be worth the cost and marketing effort. I honestly think they have a problem as hardware becomes good enough for a decent experience and software needing less processing power, intels X86 processes are less useful for the everyday user and the added cost to a chip. I don't think that it is due to their inability to create a great product, but the need for them to be there if the margins are small and there is no significant performance/experience advantages (I could see them benefit in tablets, but not as much as phones...but that could be my bias...), they might not pay a premium if they expect that. I think as devices become more convergent, there is a desire for any large company to enter into that field and hope to get a piece, but it really may be an ill fit for the company at large.Reply

Finally, I would say I did not like these global claims that intel has never failed in fab as I think they have been delayed for a bit on their last process or always demonstrated great platforms (since the original atoms I would not consider great to use for running windows...). I like intel and own their stock so I hope they do well, but I think they face more of an uphill battle that you see. I don't think that people did not think they would come into the market at a somewhat competitive place in analysis, but I really feel they are a disconnected fit (and this could just be me...) to this market. I have read money market people say that they will have a harder time entering into the smartphone market with ARMS market share expanding greatly in the next 3 years. I like the idea of the pairing with motorola for their chips because I think that will a) tie them to android (as I think meego is dead...) b) may let them offer solution akin to what the Atrix ideal could have been. Overall, an interesting article about future challenges with FAB/Design -

this article suggest that intel is holding back in its mobile design, b/c it views the competition to be insignificant. Thus if intel can make a SOC designed from the simplest archeticture, in-order pentium, they can spit out yearly updates of newer pentiums up to the current sandy bridge-like mobile cpu without much worry. they basically have half a decade in design spec'ed out. and if any of the competitors happen to hit all marks and make a good chip, intel can skip a generation to leap frog them.Reply

-

You don't look at the economic aspect at all (Intel can't afford to sell cheap,low margins chips) and you just assume the traditional CPU core ,GPU (GPU wise,anyone can license PowerVR,Intel has no advantage and other major players can always block Intel from buying Imagination) and wireless are the parts that will matter most.Reply

You look at just Intel and Qualcomm,ignoring players that are more than capable to compete.

You also assume that performance is the most important aspect when in the end the reality is that CPUs are getting cheaper,a lot cheaper and those cheap chips will keep gaining market share while Intel can't match those prices without getting crippled. Servers and a growing market will help Intel for a while but at some point the funds available for R&D and fabs will start to shrink.(BTW my post,unlike this article,is not sponsored by anyone.) -

What other parts of ARM ecosystem will do during those 3 years? They are already competing with Qualcomm quite heavily. And besides Qualcomm there is another ARM architecture license player: Marvell.Reply

Also (and more importantly) will the software help Intel in the same way as during the Wintel dominance? Microsoft itself has planned Windows 8 for less resource requirements than Windows 7 has now. Will there any need be for "above the ARM level" of performance in the coming years?

Also (and even more importantly) how Intel will cope with the mounting pressure on its chip prices? If Intel will not be able to held those prices high enough it could fast loose the revenue it is getting now.

In other words: during those three years Intel's ware may become a commodity where only price or Price/performance what is counting. Even now, as noted in today's news by Digitimes:

"TSMC seeing 3G chip orders boom, sources say

...

Qualcomm, MediaTek and Broadcom have all introduced their more integrated single-chip solutions targeted at the market for low-priced 3G smartphones in China. Each of the new chips - manufactured using 40nm and below node technologies - accounts for less than US$10 of total component cost a model would carry, the sources pointed out."

How Intel will compete with that, not in 3 years, but in 2012? Than in 2013? And finally in 2014?

So, given all that above I could subscribe to your prophecy at all! -

dragonsqrrl Has anyone taken a look at the early performance previews of Medfield? It looks very promising, and contrary to popular belief power consumption seems to be in line with modern SOC's based on dual-core Cortex A9's.Reply

http://www.anandtech.com/show/5365/intels-medfield-atom-z2460-arrive-for-smartphones -

RazorBurn I am more interested with the BitBoys guys and its new start-ups with Siru and Vire Labs.. During the 90's, I was amazed of how this 4k and 64k demos do such things with such low file-size.. These guys are such Geniuses..Reply -

de5_Roy interesting article. very enjoyable read, especially the bitboys history.Reply

though at the end of the article, christian bale didn't have a twin. -

Tomtompiper "To that end, the future of MSoCs will depend on, first, SoC architecture, second, fabrication skill, and third, graphics technology."Reply

The most important piece of the Jigsaw is missing, power consumption. But you would expect thaf from somebody fixated on performance. Intel will struggle to make X86 work in anything other than tablets and High end handsets, it will have a tiny niche in three years, if it is lucky. And with MS opening up Windows they will lose share in thin clients and laptops.