Broadcom reportedly disappointed with Intel 18A process technology — spokesperson confirms evaluation is still in process

18A might not be as healthy as Intel claimed.

According to Reuters, Intel’s ambitions to become the world’s second-largest contract chipmaker by 2030 seem to have encountered a major hurdle after Broadcom’s trial runs using Intel’s 18A fabrication technology did not purportedly meet expectations. This setback adds pressure to Intel’s revival plan and a goal to leave TSMC behind in manufacturing process advancements, but the situation is not that dramatic.

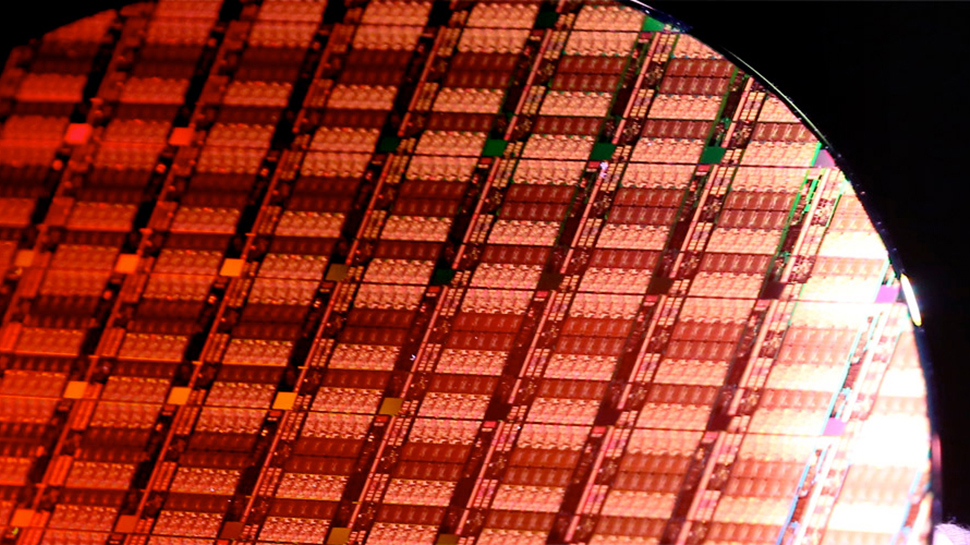

To test Intel’s 18A (1.8nm-class) process technology, Broadcom produced wafers with test patterns typical of the products it designs. After the company received these shuttle wafers, its engineers and executives were allegedly unsatisfied with the production node, claiming it was ‘not yet viable to move to high-volume production,’ according to Reuters' sources. It could be a blow for Intel’s foundry unit, but Intel disclosed defect density for its 18A process last week, and it looks healthy enough for a node that will enter mass production two or three quarters down the road.

“I am happy to update the audience that that we are now, for this production process, we are now below 0.4 d0 defect density, this is now a healthy process,” said Pat Gelsinger, chief executive of Intel, at the Deutsche Bank’s 2024 Technology Conference.

Generally, it is considered that a defect density below 0.5 defects per square centimeter is a good result, so even keeping in mind that defect density varies by process and application, Intel 18A’s defect density of 0.4 defects per square centimeter is a reasonably good result considering its timing. Yet, TSMC’s N7 and N5 technologies had a defect density of 0.33 at a similar development stage, and when TSMC’s N5 reached mass production, its defect density dropped to 0.1. Yet, TSMC’s N3 started with a higher defect density but matched N5’s defect rate after five to six quarters.

Also, Broadcom has yet to finalize its assessment of Intel’s 18A manufacturing technology, signaling that its evaluation is ongoing, the company’s spokesperson told Reuters.

Broadcom is a major supplier of chips for telecommunication equipment as well as one of the world’s leading contract chip designers, which develops TPU AI processors for Google and is rumored to be working on AI processors for OpenAI, which makes Broadcom a particularly important customer for TSMC and a desired client for other foundries, including Intel. But it takes a lot to serve Broadcom properly.

Earlier this year, Broadcom demonstrated what was considered the world’s largest processor at the time. The XPU used two near the reticle limit (858mm^2, 26 mm by 33 mm) to compute chiplets with six HBM3 memory stacks each (i.e., 12 HBM3 stacks total). In context, Nvidia’s B200 GPU consists of two near-reticle limits compute chiplets and eight HBM3E stacks.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Creating a chiplet of this size is a significant achievement. Achieving a good yield with such a chiplet is another milestone, and Broadcom’s and Nvidia’s foundry partner TSMC has succeeded in this. It means that to serve Broadcom using its 18A process technology, Intel needs to be able to make chaplets of this scale with good yields, which is not easy. Whether or not the company will be able to meet Broadcom’s requirements for defects and yields of big chips with its 18A in 2025 remains to be seen, but for now, Broadcom does not seem to be satisfied.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Lucky_SLS Correction needed : chaplets > chipletsReply

"Intel needs to be able to make chaplets of this scale with good yields" -

magbarn I guess Intel went full GM/Boeing in the last 5-10 years. Don't understand how the company could allow itself to screw up in so many levels. Did they replace all their management with useless MBA's in the last decade?Reply -

TheSecondPower I don't know what to make of this article. What can I compare it to? When else has foundry satisfaction been in news? When Samsung and TSMC were both making iPhone chips? I guess more recently when Nvidia 3000 chips were made on the Samsung 8nm node. Does Broadcom make a lot of chips? Are they unhappy with the rate of progress, the tooling, the defect rate, or the performance of the defect-free parts? Or is piling on Intel just what'd popular today? What's the purpose in saying anything at all, since having Intel as an alternative is no worse than having no alternative. Publicly giving a bad report about Intel shouldn't help Broadcom.Reply -

Marlin1975 ReplyTheSecondPower said:I don't know what to make of this article. What can I compare it to? When else has foundry satisfaction been in news? When Samsung and TSMC were both making iPhone chips? I guess more recently when Nvidia 3000 chips were made on the Samsung 8nm node. Does Broadcom make a lot of chips? Are they unhappy with the rate of progress, the tooling, the defect rate, or the performance of the defect-free parts? Or is piling on Intel just what'd popular today? What's the purpose in saying anything at all, since having Intel as an alternative is no worse than having no alternative. Publicly giving a bad report about Intel shouldn't help Broadcom.

You have it backwards, Intel needs broadcom not the other way.

Intel is desperate for cash flow and having a 3rd party say your "company saving" node is not good is a bad sign. Broadcom can go else where like you said. Intel needs money so it has few options. -

Lucky_SLS I guess it depends on how the wafer contract is made. If Intel is willing to absorb the defective wafer cost, it can be a good deal and might attract customers from TSMC.Reply -

TheSecondPower Reply

My point is simply that Broadcam has nothing to gain by giving a bad report about Intel. Since there are only 3 foundry providers outside of China it's unwise to alienate one. Whoever gave this report to Reuters is rogue or stupid.Marlin1975 said:You have it backwards, Intel needs broadcom not the other way.

Intel is desperate for cash flow and having a 3rd party say your "company saving" node is not good is a bad sign. Broadcom can go else where like you said. Intel needs money so it has few options.

And my larger point is that without more context, this bad report about Intel is meaningless. Many things could explain the dissatisfaction, and Intel is still new to catering to foundry customers. -

bit_user Reply

Intel is not currently in a position to absorb more losses, though. They need customers, but they also need to recoup the upfront investment in these nodes. Poor yields put them between a rock and a hard place.Lucky_SLS said:I guess it depends on how the wafer contract is made. If Intel is willing to absorb the defective wafer cost, it can be a good deal and might attract customers from TSMC. -

ThomasKinsley Reply

Definitely 10 years. The Downfall, Spectre and Meltdown bugs crippled Intel chips by 30%-50%. Since Intel was making only incremental gains in performance every year, these exploits set Intel back by years. They also struggled for years to get beyond 10nm capability - something even China managed to do using DUV machines. It's the same old story. They were so far ahead of AMD that they became apathetic. I'm convinced now that the Core 2 Duo and Quad series were an accident. Before that Intel was running Pentium 4 chips that were hot and slow.magbarn said:I guess Intel went full GM/Boeing in the last 5-10 years. Don't understand how the company could allow itself to screw up in so many levels. Did they replace all their management with useless MBA's in the last decade?

Call it the BlackBerry effect. Bad press reduces prospects, which generates further bad press, which reduces further prospects, etc. Intel can get out of this viscous cycle if they produce a good node.TheSecondPower said:My point is simply that Broadcam has nothing to gain by giving a bad report about Intel. Since there are only 3 foundry providers outside of China it's unwise to alienate one. Whoever gave this report to Reuters is rogue or stupid. -

Pierce2623 Reply

Intel is no longer sitting on the necessary cash pile for deals like that. They’re hemorrhaging over a billion a quarter right now.Lucky_SLS said:I guess it depends on how the wafer contract is made. If Intel is willing to absorb the defective wafer cost, it can be a good deal and might attract customers from TSMC. -

why_wolf Reply

Yeah it all depends on how low of a price they can offer, while still turning a profit. Intel has historically shown they have a problem with charging anything less than 1st tier pricing even when the product isn't worth that. Which results in the product under selling and eventually being cancelled. Wasting time and money.Lucky_SLS said:I guess it depends on how the wafer contract is made. If Intel is willing to absorb the defective wafer cost, it can be a good deal and might attract customers from TSMC.

Of course if they have to offer a price lower than production cost than that isn't sustainable long term unless they are sure they can reduce the waste quickly and turn the contract profitable in the longer term.

Acquiring customers for the foundry business is beyond critical for Intel. Even if their node was pumping out wafers with .1 defect density they still need to offer pricing lower than TSMC to win customer contracts.

Intel is for all intents and purposes the new guy on the block that nobody knows or trusts. They have to offer discounts until they earn a reputation for doing a good job.