Intel foundry unit loses $7 billion in 2023, company outsources 30% of its production to TSMC, others

Intel aims to reduce outsourcing to below 20%.

About one-third of Intel's products are now made by the company's foundry partners, mainly TSMC. This has a negative effect on the company's margins since Intel has to pay premiums to contract chip makers. Meanwhile, Intel re-released its financials for the last three years, which shows that its own foundry unit lost some $7 billion last year as it invested in new capacity and tools for next-generation process technologies. It's noteworthy that the foundry unit did not operate as a separate entity during the entire 2023 time frame, meaning the re-factored numbers aren't entirely indicative of the units' performance, or the cost-saving measures that will take place as it now operates as its own independent unit. Once the new nodes come online, Intel hopes to reduce outsourcing to below 20%, its traditional percentage of outsourcing, which will significantly improve its margins.

"It is in the order of 30% of our wafers today that we bring in externally, will be in-sourcing some level, as I said, [when] a couple of fab modules we expect over this period of time [come online]," said Pat Gelsinger, chief executive of Intel at the company's webinar dedicated to new reporting structure.

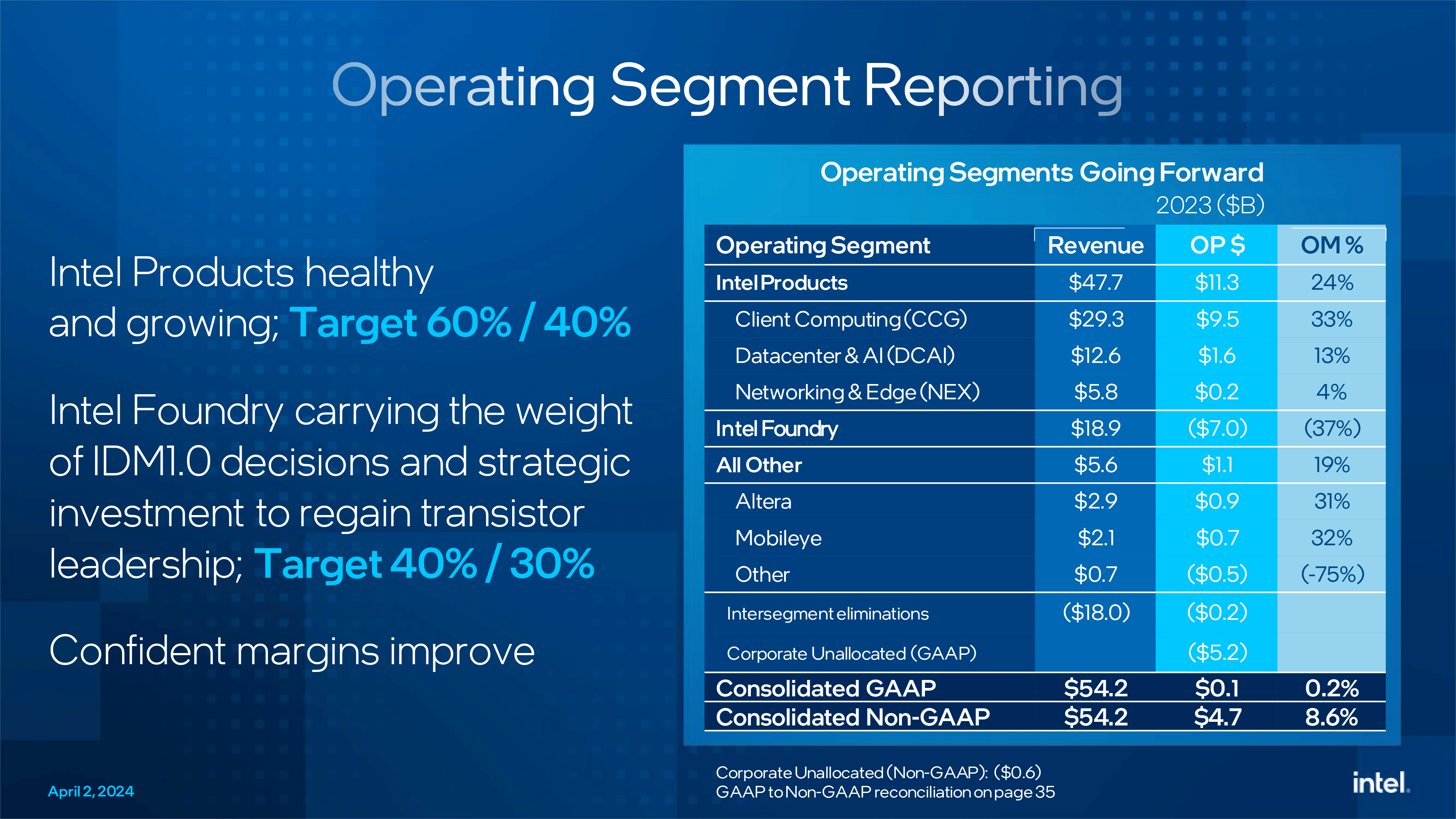

Starting from Q1 2024, Intel will adopt a new operating model that establishes a foundry relationship between Intel Foundry, the company’s manufacturing organization, and Intel Products, which includes the company's business units. As a result, results for the Foundry and Products units will be reported separately. The company also recast results for the last few years in accordance with the new reporting structure.

The results for 2023 reported in the new way reveal that Intel's product groups are all profitable, driven by the client computing group, which alone earned $9.5 billion in profit in 2023. Meanwhile, the gross margin and operating margin of Intel's Products are below historical levels, so the company wants non-GAAP gross margin to increase to 60% and non-GAAP operating margins to increase to 40% in 2030.

By contrast, Intel Foundry lost $7 billion last year as the unit invested heavily in new process technologies, new manufacturing capacity (i.e., new fabs), and new tools (e.g., ASML's Twinscan EXE:5000 High-NA EUV lithography system). Intel's target for its foundry unit is 40% non-GAAP gross margin and 30% non-GAAP operating margin in 2030.

Intel is building multiple fabs in the U.S. and is gearing up to kick off construction of its semiconductor manufacturing facility near Magdeburg in Germany. In the U.S., the company is expected to start ramping up its new fabs in Arizona in 2024 – 2025, whereas the fabs in Ohio are expected to start operations in 2026. Once Intel's new fabs are operations and yields hit decent levels, the company's Foundry and Products margins will improve as the company brings more production back home.

The company hopes that as its own process technologies get more competitive, it will be able to increase the proportion of its own production and decrease the proportion of outsourcing in its product mix, which will improve its profitability as a company.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"We expect [outsourcing to drop] down below 20% over the period [till 2030]", Gelsinger said. "[…] External foundries [will continue to be] an important part of our business strategy, but we will be bringing more of those wafers home. That helps us in a number of dimensions, in terms of cost, obviously, the consolidation benefits that we get from that, it also will allow us to extend the life of some of the factory nodes as well."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

wkm001 I guess now we know why Intel was begging for another $10,000,000,000 from the US government. They don't have a viable business model. No tax dollars should be given to a company with a nonviable business model.Reply -

DavidMV Reply

Taking a loss because you are investing in equipment and facilities for the future isn't a bad thing.wkm001 said:I guess now we know why Intel was begging for another $10,000,000,000 from the US government. They don't have a viable business model. No tax dollars should be given to a company with a nonviable business model. -

parkerthon Reply

How do you know that? Were you expecting a massive new business investment in western geographies that don’t traditionally run foundaries to not come with a massive up front cost? Either way, the incentives are there to absorb this huge up front cost in exchange for gaining geopolitical strategically important redundancies to critical defense and industry supply chains. We won’t know if it’s a boondoggle until 2027 or thereabouts really. Do you have alternative solution to achieve this goal that’s less expensive? Maybe perhaps we start paying China tribute?wkm001 said:I guess now we know why Intel was begging for another $10,000,000,000 from the US government. They don't have a viable business model. No tax dollars should be given to a company with a nonviable business model. -

JarredWaltonGPU Reply

Yes. Exactly. But wkm isn't totally off either. Intel wants this news to look as bad as possible to get as much money from the government as possible. It stands to make far more than the losses over the past few years once the foundry side of things is really moving, and if it can get the US govt to pay for it, so much the better.DavidMV said:Taking a loss because you are investing in equipment and facilities for the future isn't a bad thing.

The US meanwhile wants to get away from being so dependent on Taiwan, China, etc. for tech manufacturing. It needs Intel to succeed perhaps even more than Intel needs to succeed. $10 billion (or more) is a pittance compared to where other money goes. -

KyaraM Reply

Yeah, but I think we both know that the post wasn't meant that way, but just as another "INTEL IS DOOMED, DOOMED I SAY, YOU HEAR ME?!?"-post. The article literally says that every other division was profitable, so why claim there is no viable business model when the only losses are investments for the future?JarredWaltonGPU said:Yes. Exactly. But wkm isn't totally off either. Intel wants this news to look as bad as possible to get as much money from the government as possible. It stands to make far more than the losses over the past few years once the foundry side of things is really moving, and if it can get the US govt to pay for it, so much the better.

The US meanwhile wants to get away from being so dependent on Taiwan, China, etc. for tech manufacturing. It needs Intel to succeed perhaps even more than Intel needs to succeed. $10 billion (or more) is a pittance compared to where other money goes. -

TechLurker I wonder what are the odds Intel just ends up keeping a 30% outsource rate for transitionary periods and for certain products that their own fabs just can't meet the performance/efficiency minimums for.Reply

That said, such an expense loss does explain why they'd want to open up their fabs, even to competitors. They need to keep the fabs operating, and all that matters is keeping the fab books full, esp. to recoup upgrade costs. Making up that missing 20-30% would help them recoup costs much faster. -

artk2219 Reply

Honestly for some non essential or low margin parts, if you can get someone to make it quickly, and at around the same cost or lower than you could manage. Then it makes sense to free up your capacity for more sensitive and likely more profitable parts.TechLurker said:I wonder what are the odds Intel just ends up keeping a 30% outsource rate for transitionary periods and for certain products that their own fabs just can't meet the performance/efficiency minimums for.

That said, such an expense loss does explain why they'd want to open up their fabs, even to competitors. They need to keep the fabs operating, and all that matters is keeping the fab books full, esp. to recoup upgrade costs. Making up that missing 20-30% would help them recoup costs much faster. -

Notton If you want GPU prices to come down, Intel having a competitive node would be a good thing. Even if they need a little bit of help right now.Reply

It would free up TSMC from producing ARC, and Intel could sell their GPUs for profit, rather than at cost. -

TerryLaze Reply

Even if it turns out more expensive than making it yourself, if it frees up capacity for something you can sell for a higher margin, or plain more money than the extra cost, then it's still worth it.artk2219 said:Honestly for some non essential or low margin parts, if you can get someone to make it quickly, and at the same cost or lower than you could manage. Then it makes sense to free up your capacity for more sensitive and more likely profitable parts.

I mean even if iGPUs/GPUs that are made at tsmc are more expensive, if that allows them to make more 14900ks (or whatever, server parts) then it's still worth it. -

daris98 The 10nm node has been a disaster from Intel. The reason why, will never revealed, but it's interesting to ponder.Reply

In my perspective, the foundry business has been an extremely risky cut-throat industry since entering the sub-100 nm era.

At this stage, the size of investments no longer matters, and (with a more controversial note) I'd also argue that talent/expertise do not even matter. Things can easily go wrong; one wrong decision, say betting on the wrong material or not implementing a technology sooner, can completely destroy a fab's effort to chase the leading-edge. For a company like Intel, this could be fatal to their very existence.

A bit of history:

Intel had been quite confident early on about their 10 nm process. They showed a working wafer and process in IEDM (Dec 2017), only to meaningfully release it in (very late) 2020 in the form of Tiger Lake which went up to only 45 W (except the special ed. -HK). Sapphire Rapids was released very late at 2021, but was known to be a failure both in performance and economics. Only its improved derivative (later rebranded as Intel 7) was decent, though immense damage was inevitable as Intel lost its long-held advantage.

Currently:

Intel 4 (or 3) worries me as the only meaningful product fabbed with this specification to date is the compute/CPU "chiplet" of Meteor Lake. It's both not much (in quantity), and not impressive (in performance). Granite Rapids, slated for late this year, might be the make-or-break situation, because it's going to be very hard for Intel to cover its fab tech deficit with ambiguous message when GNR replicates Sapphire Rapids.

Let's not begin about 20A yet. This thing is, chronologically, an order of magnitude more ambitious than Intel's 10 nm, and not even close to TSMC's N3. They have to go through that almost impossible window of success to successfully mass produce this as they promised (2H 2024). It's also very hard to see them coming back to lead when 20A only ends up in "real products" in 2H 2026 or later.

It's hard to predict the success, because it's more like shooting from the halfway line. No matter how good you are, you have to have a lot of luck. I'd say that the last ditch effort for Intel is to increase this "outsourcing percentage" and become fabless once and for all. I'd even argue that this might be the most likely decision that they've to take.

Unless of course, the US govt steps in and gave tens of billions to them. That kind of "bail-out" hasn't happened to a fab before, like ever, so honestly couldn't comment on that.