China Increases Investment in Domestic Memory Maker to $5.4 Billion: Report

China continues to invest in memory makers.

Last week we reported that Changxin Xinqiao got ¥14.56 billion (approximately $1.99 billion) from the China Integrated Circuit Industry Investment Fund — the Big Fund. Bloomberg today reported that the company actually got considerably more money, which is an indicator that the Chinese government continues to invest in production of commodity memory, despite U.S. sanctions against the country's semiconductor sector.

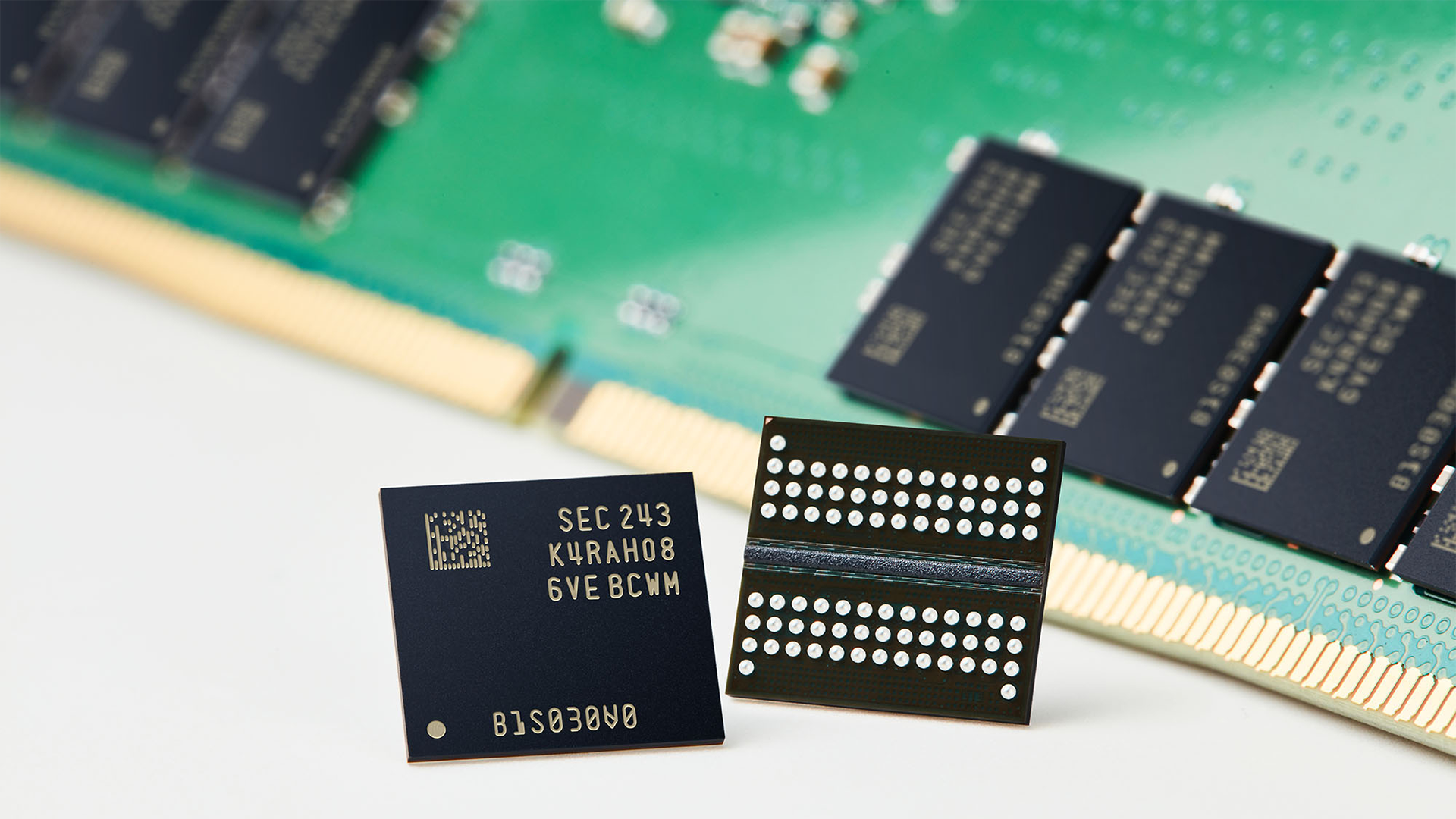

As it turns out, Changxin Xinqiao Memory Technologies raised ¥39 billion ($5.4 billion) from the state-backed China Integrated Circuit Industry Investment Fund Phase II and two additional investors affiliated with the local government from the eastern Chinese city of Hefei. The money will be spent on building a fab that will produce dynamic random access memory (DRAM).

All that said, neither $1.99 billion nor $5.4 billion is enough to build a leading-edge DRAM fab, since modern memory production facilities use expensive tools that are also used to make logic chips. It is enough to start building a fab, however, and having invested $5.4 billion, investors of the project will be less likely give up, so Changxin Xinqiao Memory Technologies will likely get its fab at some point.

It should be noted that Changxin Memory is managed by Zhao Lun, who happens to be chief executive of ChangXin Memory Technologies (CXMT), another DRAM maker funded by the Chinese government. Meanwhile, it is unclear whether the companies are affiliated or whether their investors expect the two companies to collaborate. For example, the two companies could share R&D expenses.

The capital influx from the Big Fund is part of China's continued aim toward semiconductor self-sufficiency. Being the world's largest electronics manufacturing base, China consumes much more memory than it produces, so it makes a lot of sense to produce DRAM and 3D NAND memory in the country. But it remains to be seen whether these Chinese memory makers can produce competitive products, and at sufficient volume, given the fact that they cannot procure leading-edge wafer fab equipment from American, Dutch, and Japanese companies.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.