TSMC may increase wafer pricing by 10% for 2025: Report

Chips are getting more expensive.

Due to the high demand for advanced processors in consumer electronics and high performance computing, TSMC is looking to hike its wafer pricing for all types of customers in 2025, according to a Morgan Stanley note to clients cited by Eric Jhonsa , an investor. Apparently, the world's largest contract maker of chips plans to hike its prices by up to around 10% next year. Keep in mind that the information comes from an unofficial source though so apply the required amount of skepticism.

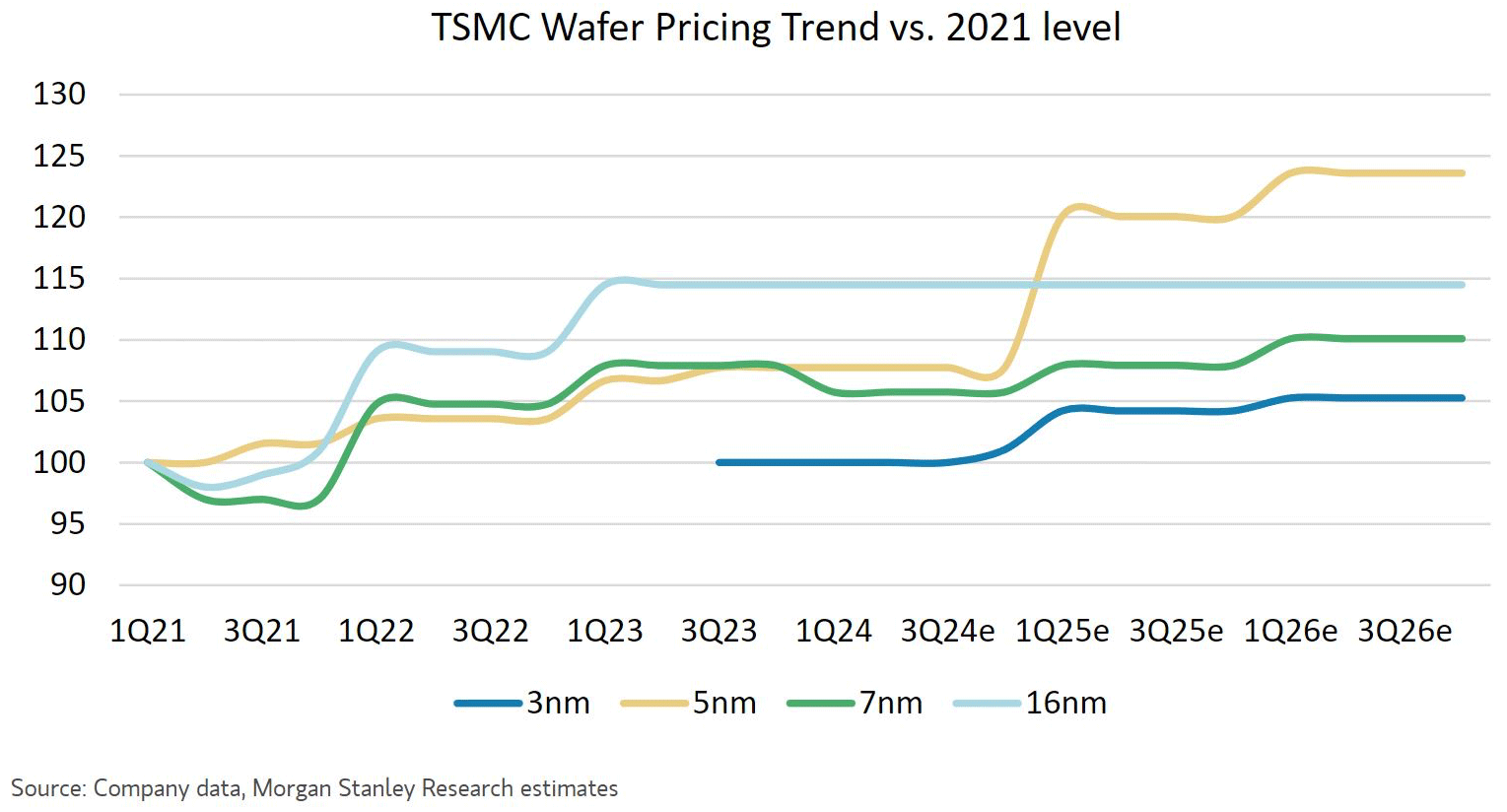

Negotiations with AI and HPC customers, such as Nvidia, suggest these clients can tolerate approximately 10% price hikes for 4nm-class wafers from around $18,000 per wafer to around $20,000 per wafer. As a result, the 4nm and 5nm nodes, primarily used by companies like AMD and Nvidia, are expected to see an 11% blended average selling price (ASP) hike. This means that prices of N4/N5 wafers may increase by approximately 25% since Q1 2021, at least for some customers.

Although discussions with smartphone and consumer electronics clients, such as Apple, have been challenging, there are signs of acceptance for modest price increases, the report claims. Morgan Stanley expects a 4% ASP increase for 3nm wafers in 2025. While wafer prices depend on actual agreement and volumes, some believe that a wafer produced on TSMC's N3 node costs around $20,000 or higher, but will increase next year. Morgan Stanley believes that companies should be room for companies to 'pass through the additional costs to end users.'

Contrarywise, mature nodes like 16nm are unlikely to experience price increases due to sufficient capacity.

To possibly make its customers a bit more willing to pay extra, Morgan Stanley's recent supply chain investigations indicate that TSMC is signalling a potential shortage of leading-edge capacity unless its customers 'appreciate TSMC's value' to secure their capacity allocation.

Additionally, prices for advanced chip-on-wafer-on-substrate (CoWoS) packaging may surge by 20% over the next two years, Morgan Stanley analysts believe.

In 2022, TSMC raised wafer prices by 10%, followed by an additional 5% in 2023. Looking ahead, another 5% blended increase is anticipated for 2025 in a bid to help TSMC's gross margin rebound to 53% - 54% by 2025.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Thunder64 This is what happens when there is a near monopoly. Step it up Samsung and/or Intel.Reply -

usertests Reply

There's also enormous demand because of the AI bubble, with talk of trillions being spent on GPUs/accelerators. It's also affecting the memory market with companies like Samsung stepping up and shifting production from DRAM to HBM.Thunder64 said:This is what happens when there is a near monopoly. Step it up Samsung and/or Intel. -

redgarl Reply

10% of the price of the chip, not the whole graphic card...magbarn said:$1999 price for 5090 confirmed. -

DS426 Reply

Yes, and the article noted those approximate amounts. 10% here, 5% here, and another 10% now coming, so it's definitely adding up.hotaru251 said:havent they raised prices nearly every yr for past 2 or 3?

I don't know why they wouldn't just hold the line on existing nodes but increase new nodes that come online more than in the past, i.e. the bleeding edge takers just have to pay the lion's share. Boo hoo if Apple or nVidia are complaining.

Glad Intel finally has new capacity coming online this year and over the next several years as TSMC definitely needs to get rechecked. Samsung has some too but I think they're gaining less than TSMC and Intel based on current plans if I correctly recall. -

thisisaname Reply

You think it is going to be that cheap :ROFLMAO:magbarn said:$1999 price for 5090 confirmed. -

magbarn Reply

Jensen uses any excuse to jack up the prices. Now that AMD has entirely bowed out of the high end in the next upcoming generation, sky's the limit. The more you buy, the more you save. TMredgarl said:10% of the price of the chip, not the whole graphic card...