Fire at ASML Could Disrupt EUV Fab Tool Supply

ASML is still assessing the impact of the January 3 fire.

Earlier this week, a fire occurred inside the section of ASML's Berlin factory that makes optical components for the company's lithography scanners. While the fire did not cause much damage to the facility itself, it affected a part of the production area that makes components for extreme ultraviolet (EUV) scanners. So far, ASML has not completed its recovery plan for the site, but if the supply of EUV tools or components for existing systems is disrupted for a significant time, this will impact chipmakers.

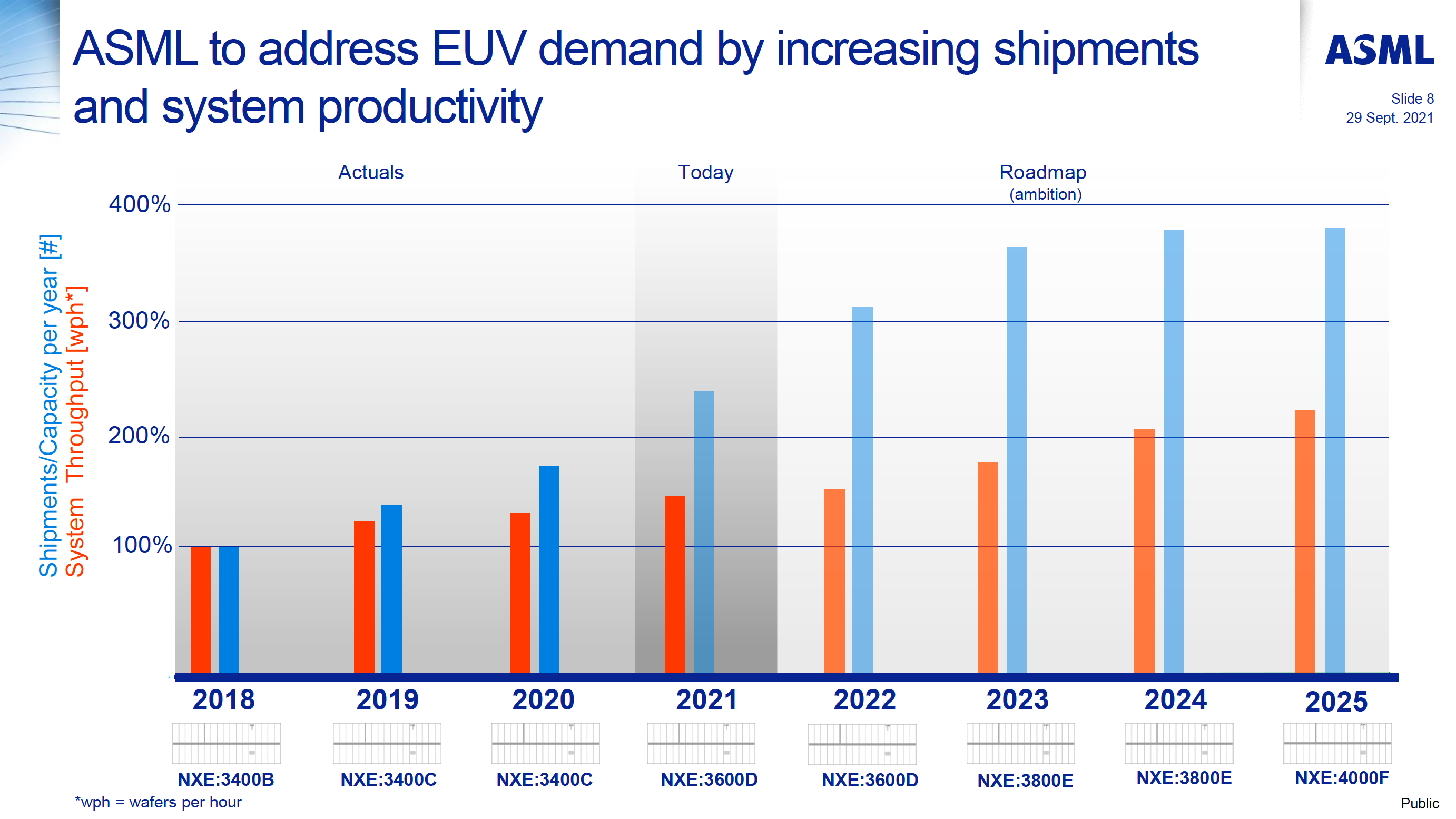

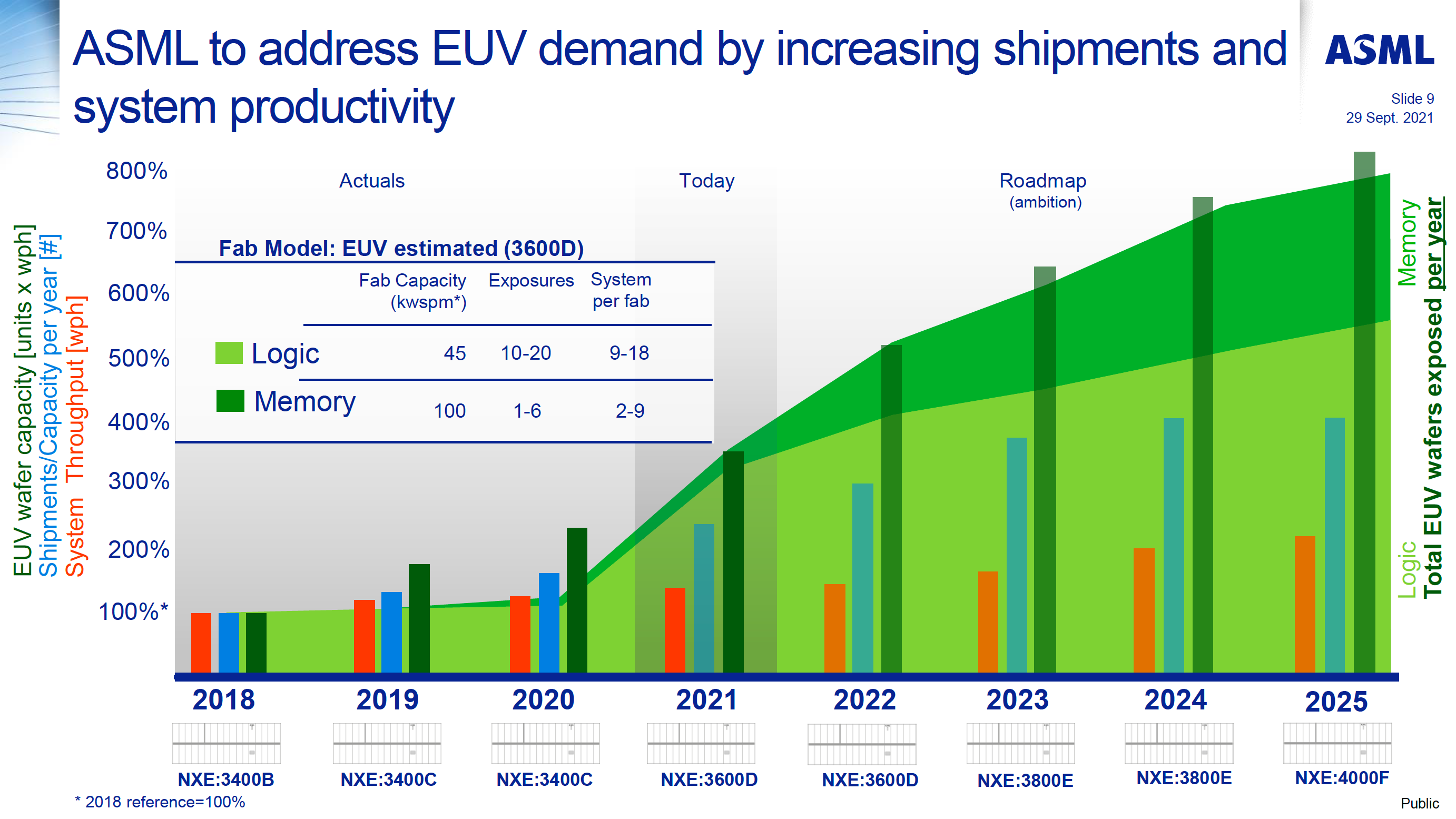

ASML's plan for 2022 is to ship 55 Twinscan NXE:3600D EUV scanners. Meanwhile, ASML estimates that a modern logic fab requires 9 to 18 NXE:3600D machines depending on capacity, whereas a memory fab needs 2 to 9 of such systems. Given the requirements and capacity limitations, any disruption of EUV tools supply will impact makers of leading-edge logic chips or on producers of advanced memory. Still, keep in mind that the damage caused by fire is unknown at this point.

A 200 Square Meters Fire…

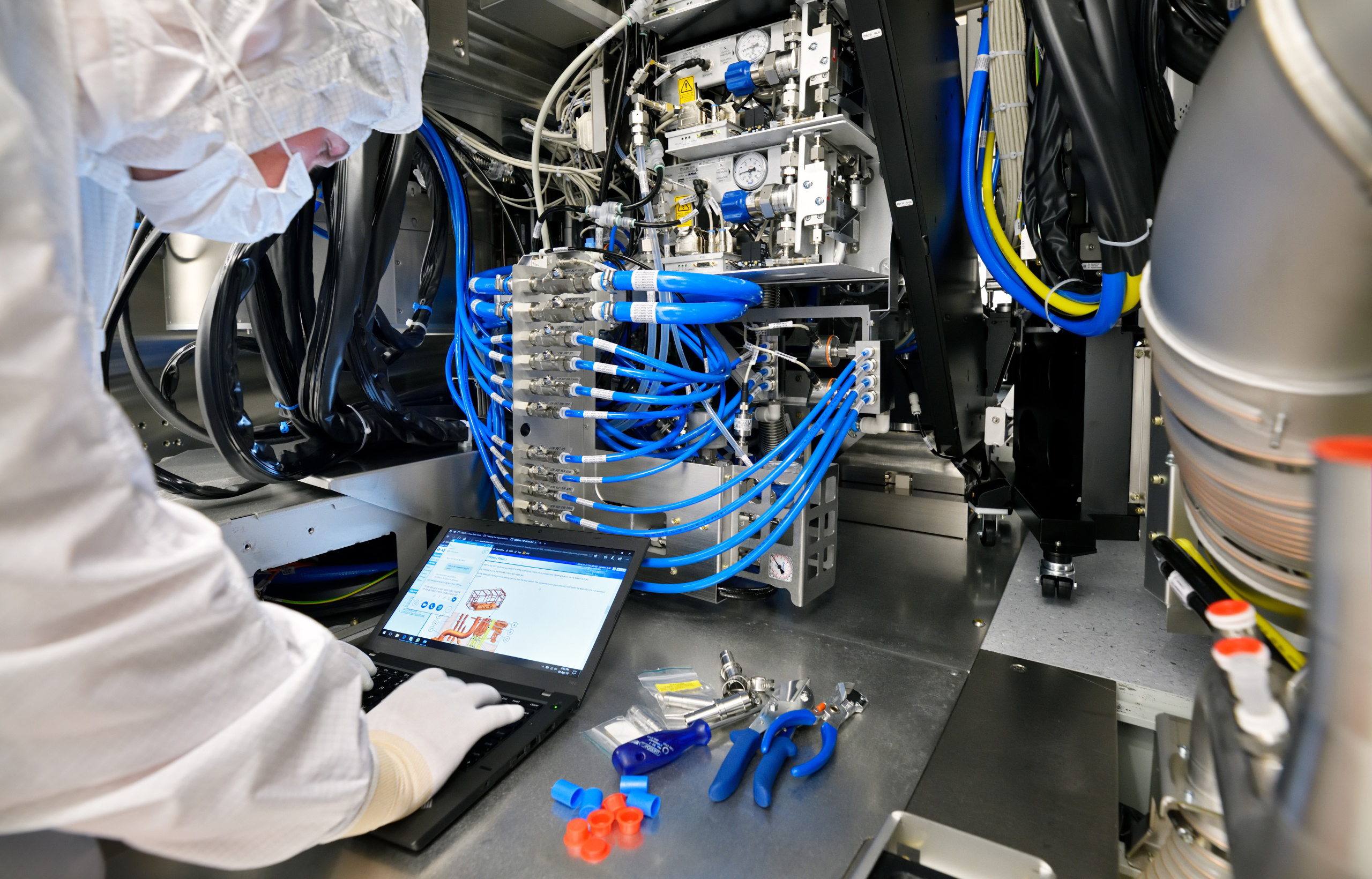

ASML's production facility in Berlin, Germany, has eight buildings and a factory floor space of around 32,000 m2. Only 200 m2 were affected by the fire, according to TrendForce. However, the smoke also partly impacted an adjacent building, ASML claims. The factory specializes in the production of optical components such as wafer tables and clamps, reticle chucks and mirror blocks used for both DUV (deep ultraviolet) and EUV scanners.

ASML has since restarted the production of components for DUV tools. So while production was disrupted for a few days, the company expects to mitigate this, so its shipments of DUV equipment is not going to be disrupted. But the problem is that the fire apparently affected part of the production area where wafer clamp modules for EUV systems are made. A disruption of wafer clamps production affects ASML's ability to ship its Twinscan NXE EUV scanners and supply spare components to its customers.

"We are still in the process of completing the recovery plan for this production area and determining how to minimize any potential impact for our EUV customers, both in our output plan and in our field service," a statement by ASML reads.

… Could Disrupt Supply of Next-Generation Chips

There are only four companies in the world that either use (or will begin using) EUV lithography — Intel, Samsung, SK Hynix and TSMC. Eventually, more companies intend to adopt the technology like Micron, SMIC, etc. But for now, there are only two makers of logic (TSMC, Samsung Foundry) and two makers of memory (Samsung Semiconductor and SK Hynix) that use EUV for mass production.

TrendForce believes that Intel, TSMC, and Samsung Foundry are ASML's biggest customers for EUV tools, so any disruption of Twinscan NXE supply will impact their ability to transit to more sophisticated process technologies that use EUV scanners for additional layers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

According to an ASML estimate from 2018, one EUV layer required one Twinscan NXE:3400B EUV system for every 45K logic wafer starts per month (WSPM) for 5 nm and 7 nm-class nodes. TSMC's N5 family can use EUV for up to 14 layers (we doubt anyone uses that many EUV layers these days), so ideally, an N5-capable GigaFab (a fab with a capacity of 100K WSPM) should be equipped with approximately 31 NXE:3400B EUV scanners.

ASML started to ship its higher performance Twinscan NXE:3600D scanners in 2021, and since they have a ~50% higher wafer throughput per hour, 20 of such machines will be enough for a GigaFab.

In fact, ASML's estimates from last year show that a modern logic fab needs 9 to 18 Twinscan NXE:3600D scanners depending on capacity, whereas a DRAM fab requires 2 to 9 of such systems. To put these numbers into context: ASML planned to ship 45 – 50 EUV tools in 2021 and then increase the number to 55 in 2022. Therefore, any disruption or delay of NXE:3600D shipments essentially delays ramping up of EUV-capable fabs to their full capacity and consequently slow down the adoption of newer fabrication processes.

In particular, delays of NXE:3600D shipments could affect capacities available for TSMC's N3 (it is safe to say that N3 is capable of using EUV for over 14 layers) and Samsung's 3GAE (3nm gate all around early) manufacturing technologies that are set to enter high volume manufacturing (HVM) stage in the second half of this year. Keep in mind that we are speculating here, though.

The Sole Supplier

One of the biggest issues for leading chipmakers — Intel, TSMC, Samsung, SK Hynix — is that ASML is the only supplier of EUV scanners and ASML-owned Cymer is the only provider of EUV light sources. So far, neither Canon nor Nikon have introduced a commercial EUV tool. Gigaphoton, which was once considered as the second supplier for EUV light sources, also never introduced a commercial device. To that end, any problem at ASML becomes an industry-wide problem.

For now, ASML is assessing the damage, but the very fact that it has not restarted production of wafer clamps for EUV scanners by now indicates that some of its equipment has been somehow damaged. Therefore, the questions are how fast can the company can fix its tools and restart production and whether the disruption will have any impact on its ability to ship EUV tools.

"On January 19, 2022, we will present our Q4 and full-year 2021 results, as well as our initial view on the year 2022 and we expect to then also provide a further update on the incident," a statement by ASML reads.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Co BIY As a monopoly ASML's incentives to produce machines are different than a standard company in a competitive market.Reply

They are in no rush to produce these machines.

Joke about an old bull and a young bull comes to mind ... I just realized it has economic implications. -

shady28 Why does this make me think of this:Reply

NuAKnbIr6TEView: https://www.youtube.com/watch?v=NuAKnbIr6TE