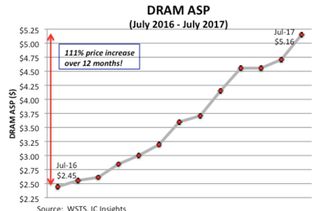

IC Insights Predicts DRAM Prices To Jump A Record 40% In 2017

According to IC Insights, DRAM prices will continue to increase even though they have more than doubled (+111%) over the last 12 months. IC Insights predicts that by the end of the calendar year DRAM's price per bit will have jumped a record 40% (or more).

Things change quickly in the DRAM market; just last year we were amid an oversupply that brought low prices for your favorite kits. Unfortunately, IC Insights claims the oversupply was one of the contributors to the latest price hikes. Wholesalers gobbled up stock during the oversupply at low prices, but then sat on the stockpiles as the shortage deepened. Now, the wholesalers are cashing in on their bets and reaping the benefits. Meanwhile, enthusiasts can expect to pay top dollar for the latest blinky RAM kits.

Of course, the record pricing levels are great for our friends at the major foundries. Samsung, Micron, and Sk Hynix are also raking in their own record profits and enjoying healthy margins. We have both DRAM and NAND shortages occurring at the same time, which is great for the foundries, and unless a player breaks ranks to gain market share, we can expect more foot-dragging before any of the foundries increases output.

The booming mobile industry and server markets are exacerbating the issue, so you would expect that the fabs would boost DRAM output. Unfortunately, the three primary fabs (Micron bought Elpida, reducing the number of players) don't share the same vision.

IC Insights indicates that Micron will not increase production capacity, instead relying upon improvements in yields and shrinking down to smaller nodes to boost its DRAM bit output. Sk Hynix has expressed its desire to boost DRAM output but hasn't set a firm timeline for fab expansion (unlikely to occur in the near term). Samsung is as tight-lipped as usual, so we aren't sure of its intentions.

In the 1980's there were 23 major DRAM suppliers, but cutthroat pricing and continual oversupplies eventually led to the wave of consolidation that left us with the current three suppliers. Due to the nature of the DRAM oligarchy, Sk Hynix's plans could be the catalyst for future DRAM expansion at Samsung and Micron. Unfortunately, due to the complexity of today's latest DRAM nodes, these capacity expansions usually require an extended amount of time before the price reductions trickle down to us. We can expect a six month ramp time for an existing fab to reallocate space to DRAM production, or a two year process to build an entirely new fab.

In other words, if you plan on a new build in the near future it might be best to grab a RAM kit now before the prices increase further. Unless the dynamics of market demand change drastically we can expect the shortage to continue over the next six months, and even possibly longer.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Paul Alcorn is the Managing Editor: News and Emerging Tech for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

plateLunch Just buy some Micron (MU) stock and let the price appreciation pay for your next RAM kit.Reply -

blazorthon Basically, haha, we decided to collude to force prices up and we have no intention of bringing them down because record profits. We already killed off and bought out all of our competition, so there'e nothing anyone can do about it. Oh right, aren't there supposed to be laws against this? Something about collusion, price fixing, artificial shortages, and all that?Reply -

Sn3akr Corporate greed, screwing over the consumers once more!.. They know PC's can't be built without RAM, and it's relatively cheap to buy up large amounts, and then artificially inflate the prices. Wish samsung, Hynix, etc. would bump up production and give them a solid slap in the face, since those price inflations reflects poorly on them too.Reply

Why is it legal for -

Sn3akr Why is it legal for big moneypits to manipulate the markets like that?? You can't do it to the stock market because it can potentially hurt some other rich douche, but using the same trick to screw over consumers.. Feel free, their just sheeps!Reply

Society is so completely broken and the free market doesn't exist anymore.. If anyone tries to threaten the market of the big corporates, they, A: get sued into oblivion or.. B: Get bought up, so they can keep their massive earnings. Free market is just an illusion to make the public think things are fair..

Might be a bit of tin foil in this, but i bet more is going on in the political offices, than any basic Joe could ever imagine. Lobbyists rule the world, not the electees.