AMD Sets All-Time CPU Market Share Record as Intel Gains in Desktop and Notebook PCs

Enter the Alder Lake

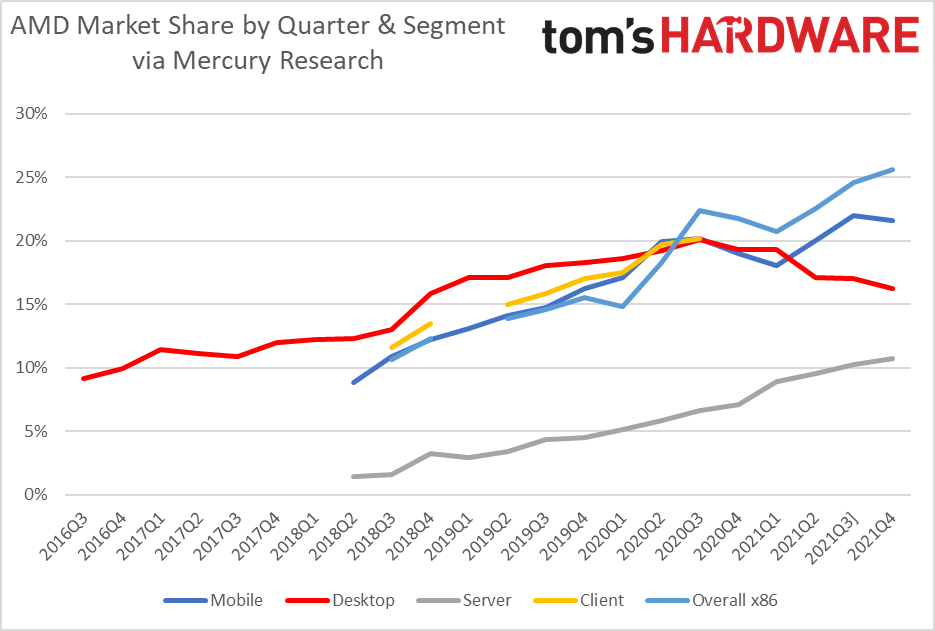

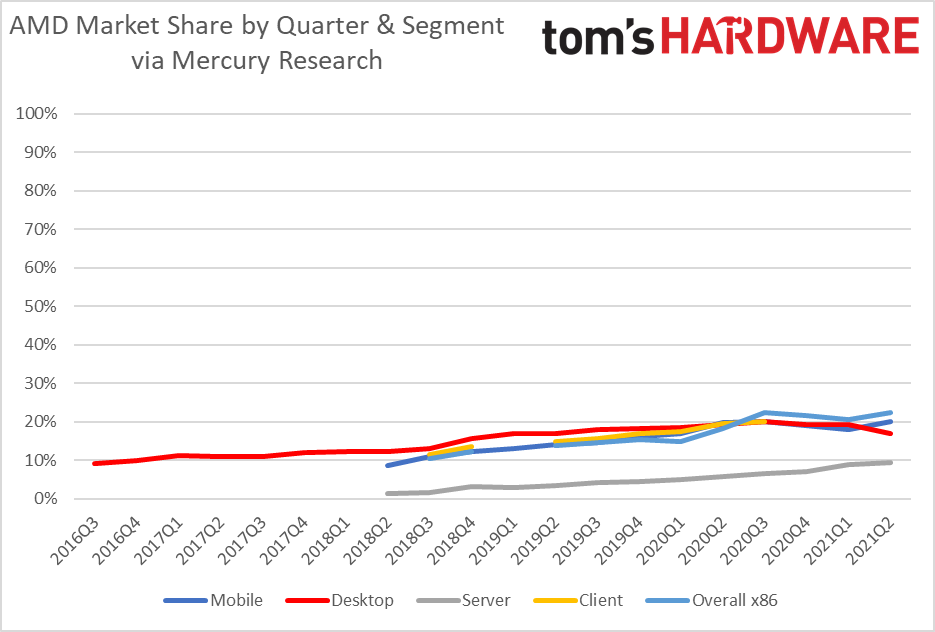

The Mercury Research CPU market share results are in for the fourth quarter of 2021, showing that AMD now comprises 25.6% of the overall x86 market, its highest share ever, partially on the strength of its increasing gaming console shipments. That beats AMD's prior overall record of 25.3% that it reached 15 years ago in 2006. Meanwhile, Intel has gained unit share in desktop and notebook PCs as it continues to wrest some of its losses back from AMD. However, Intel continues to slowly lose share in the lucrative server market.

Intel's unit growth isn't entirely surprising given that AMD appears to be more impacted by shortages, prompting the company to focus on its higher-margin products to maximize profitability. However, that ultimately restricts shipment volumes for some segments, especially as AMD also has to accommodate the incredible demand for console chips, a key driver behind its record overall market share in the quarter. In either case, AMD has continued to grow revenue share in the desktop PC market due to its focus on higher-end chips, with CEO Lisa Su saying at the company's recent earnings call that "we believe we gained client processor revenue share for the seventh straight quarter."

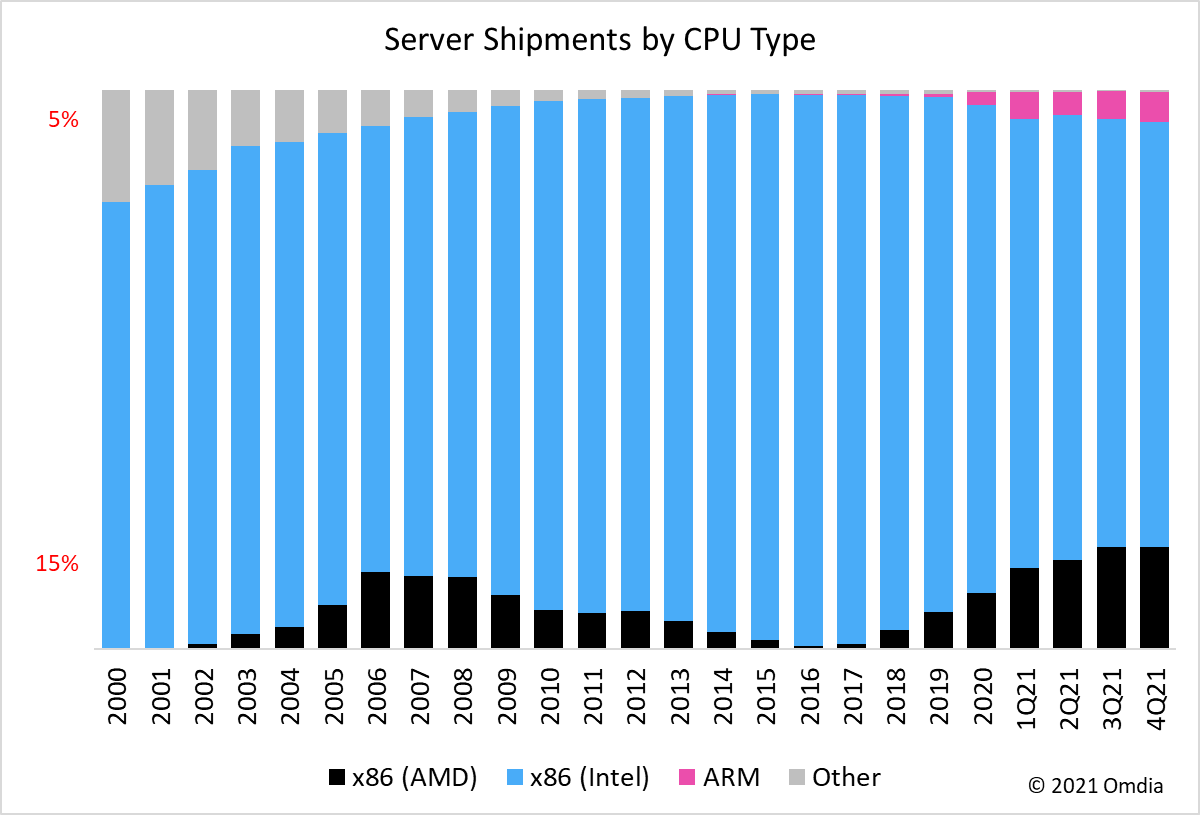

AMD's server business also continues to grow despite supply shortages, notching its 11th straight quarter of server CPU growth. AMD gained share during this period (+0.6pp), reaching 10.7% of the market, a high for recent times.

However, as we'll cover a bit more in-depth in the server breakout below, McCarron's numbers include all types of servers, whereas some reports that narrow the competitive landscape down report that AMD has reached higher levels of the server market. For instance, the share report provided by Omdia pegs AMD's data center share at 18.3% compared to Mercury Research's 10.7%.

According to Mercury Research, the market share jockeying comes amid an all-time record x86 CPU market in both the number of units shipped and the amount of revenue generated across all segments. That ultimately benefits both AMD and Intel as the overall 2021 revenue for x86 chips increased by 10.7% to $74 billion for the year, up from $66.6 billion in 2021.

Expanding the view to all x86 CPUs and Arm chips (including Apples M1-based Macs) but excluding IoT and consoles, the market shipped over 500 million units in 2021, with x86 chips accounting for 471 million units.

Speaking of Apple, Dean McCarron of Mercury Research provided the following update on Arm's progress:

"Our estimate for ARM PC client share (including Chromebooks and Apple's M1 based Macs with X86 desktop and mobile CPUs in the total client size estimate) is 9.5 percent, up from 8.3 percent last quarter and nearly triple the 3.4 percent from a year ago. Apple had very strong growth in the quarter, so the gains were driven by higher M1 unit volumes rather than Chromebook ARM processors."

Additionally, Omdia pegs Arm's data center share at 5.4%, an all-time high. You'll find the segment-by-segment breakdowns below with a bit of additional commentary.

AMD vs. Intel Desktop PC Market Share Q4 2021

| Row 0 - Cell 0 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

AMD's desktop PC unit share decreased by 15% in 2021. That's likely due to production shortages that spurred the company to focus on lower-volume but higher-profit client CPU models, thus leading to the increased revenue share in the desktop PC market. Additionally, the company has likely shifted some of its production to its more margin-rich server products.

Intel's previous-gen Rocket Lake and Comet Lake chips continue to have moved the most units for Intel in commercial desktop PCs during the quarter. Still, Alder Lake has begun to have a material impact on the consumer desktop PC market. In addition, Intel recently launched the remainder of its Alder Lake chips, and those models comprise the highest-volume models. As such, we expect that Alder Lake will have a larger impact in following quarters, especially given that the chips have overtaken AMD's Ryzen 5000 and taken the lead in CPU benchmarks and best CPU recommendations.

AMD vs. Intel Notebook / Mobile Market Share Q4 2021

| Row 0 - Cell 0 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 13 | Row 2 - Cell 14 | Row 2 - Cell 15 |

Intel's "performance" Tiger Lake models were a big factor in its Q4 growth in the mobile segment, while the "value" models didn't have as much of an impact. Intel recently released its Alder Lake mobile products, so we'll see those begin to have an impact in the following quarters.

Notably, according to IDC, the Chromebook market lost more than 63% due to oversaturation and the lack of new demand. The Chromebook market collapse has naturally impacted both the x86 and Arm ecosystems.

AMD vs. Intel Server Unit Market Share Q4 2021

| Row 0 - Cell 0 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 15 | Row 2 - Cell 16 |

AMD bases its server share projections on IDC's forecasts but only accounts for the single- and dual-socket market, which eliminates four-socket (and beyond) servers, networking infrastructure and Xeon D's (edge). As such, Mercury's numbers differ from the numbers cited by AMD, which predict a higher market share. Here is AMD's comment on the matter: "Mercury Research captures all x86 server-class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers."

Below we can see a bit of a different take with a different methodology:

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

| Row 0 - Cell 0 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 2020 | 2019 | 2018 | 2017 | 2016 |

| Intel | 76% | 76.7% | 79.7% | 80.3% | 87.4% | 92.1% | 95.7% | 98.2% | 98.6% |

| AMD | 18.3% | 18.2% | 15.9% | 14.5% | 10.1% | 6.7% | 3.3% | 0.9% | 0.5% |

| Arm | 5.4% | 4.9% | 4.1% | 4.8% | 2.2% | 0.7% | 0.3% | 0.2% | 0.1% |

This information comes from research firm Omdia, which uses different measurement methodologies. Omdia measures Intel at 76% of the data center market, AMD at 18.3%, and Arm at a record 5.4%. (0.3% goes to 'other.') Notably, Omdia says that it is still collecting data for 4Q21, but it doesn't expect the data to change.

AMD vs. Intel Overall x86 Market Share Q4 2021

| Row 0 - Cell 0 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 4Q18 | 3Q18 |

| AMD Overall x86 | 25.6% | 24.6% | 22.5% | 20.7% | 21.7% | 22.4% | 18.3% | 14.8% | 15.1% | 14.6% | 13.9% | 12.3% | 10.6% |

| Overall PP Change QoQ / YoY | +1.0 / +3.9 | +2.1 / +2.2 | +1.8 / +4.2 | -1.0 / +6.0 | -0.7 / +6.2 | +4.1 / +6.6 | +3.5 / +1.2 (+3.7?) | -0.7 / ? | +0.9 / +3.2 | +0.7 / +4 | ? | ? | - |

Whereas other segments exclude IoT and semi-custom (like AMD's game console business), this accounting of the overall x86 market also includes those products and is focused primarily on the broader AMD vs Intel competition.

Mercury Research provided the following commentary: "For all-inclusive share, which counts not only PC client CPUs and servers but also IoT and semi-custom products used in items like gaming consoles, AMD gained share in the fourth quarter, largely due to a very large increase in gaming console shipments. As a result of that increase, AMD reached a new record high for overall share -- 25.6 percent -- in the fourth quarter of 2021, beating the prior record of 25.3 percent set fifteen years ago in the fourth quarter of 2006."

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

VforV Reply

What kind of logic is that? Why should they lower prices if they still sell better than intel?JayNor said:AMD didn't see all the Alder Lake benchmarks, I guess...

You mean customers did not see them, or more likely customers saw the benchmarks, but were not impressed and continued to buy Zen CPUs. That's what happened.

Plus all the other non-atractive parts AL has: more expensive system as a whole, missing lower end MBs until now, DDR5 with all the issues, Win11 necessity... All that vs the easyness for almost every AM4 owner to just upgarde the CPU on their current MB... how about those reasons? -

shady28 ReplyVforV said:What kind of logic is that? Why should they lower prices if they still sell better than intel?

You mean customers did not see them, or more likely customers saw the benchmarks, but were not impressed and continued to buy Zen CPUs. That's what happened.

Plus all the other non-atractive parts AL has: more expensive system as a whole, missing lower end MBs until now, DDR5 with all the issues, Win11 necessity... All that vs the easyness for almost every AM4 owner to just upgarde the CPU on their current MB... how about those reasons?

Actually AMD is bleeding in the desktop space, and up until now that is all that AL has been in. I expect them to start bleeding in the laptop space as AL hits laptops as well. That will probably continue through 2022. Zen 4 might reverse that in early 2023, but if Intel gets its new node online and Meteor Lake launched that might be short lived.

Server space is where AMD is currently strong, their client (desktop / laptop) offerings are really no longer competitive from a performance nor performance / price perspective. Until Intel can get Sapphire Rapids out the door in volume though, AMD will stay strong in server.

So really the next big fight will be in 2023, with Zen 4 architecture vs Sapphire Rapids servers / and Meteor Lake client. If Intel is able to get their new node online and Meteor Lake out in mid 2023 then I think we'll see AMD lose market share all over. That's a big if though, Intel does not have a good track record on getting new nodes online. -

VforV Reply

1. Bleeding, yet as of today Zen3 still selling better than AL. When will they lower prices, who knows? Maybe only when AL actually occupies all the top 5 places of the best selling CPUs, if it gets to that, not just 1 out of 5, like it is now.shady28 said:Actually AMD is bleeding in the desktop space, and up until now that is all that AL has been in. I expect them to start bleeding in the laptop space as AL hits laptops as well. That will probably continue through 2022. Zen 4 might reverse that in early 2023, but if Intel gets its new node online and Meteor Lake launched that might be short lived.

2. Correction, Zen4 will reverse this, not "might" and in Q3 2022, not 2023. We are much closer to Zen4 launch than intel fanbois want us to be...

removed by moderator -

shady28 ReplyVforV said:1. Bleeding, yet as of today Zen3 still selling better than AL. When will they lower prices, who knows? Maybe only when AL actually occupies all the top 5 places of the best selling CPUs, if it gets to that, not just 1 out of 5, like it is now.

2. Correction, Zen4 will reverse this, not "might" and in Q3 2022, not 2023. We are much closer to Zen4 launch than intel fanbois want us to be...

P.S. Love how that muppet likes all the pro intel posts. :ROFLMAO:

Some facts :

AMD Desktop market share Q4 2021 16.1% vs Q4 2020 19.3% a 3.2% decline in one year, while Intel went from 80.7 to 83.8% a +2.9% showing for Intel.

AMD Laptop market share Q4 2021 21.6% vs Q3 2021 22%, a 0.4% decline in the quarter, while Intel was +0.4%

These numbers are per Mercury Research.

So yes AMD has been bleeding market share in desktop most of 2021 and is now showing initial signs of bleeding laptop market share, which I think will get much worse when AL is widely available on laptops. Like I said server is where they are strong at, for now. -

VforV Reply

And like I said, on desktop they are still selling better than intel as of today. 4 out of top 5 best sellers are Zen3, only one is AL (from top shops BB, newegg, etc). Also facts, it was in the news a few days ago.shady28 said:Some facts :

AMD Desktop market share Q4 2021 16.1% vs Q4 2020 19.3% a 3.2% decline in one year, while Intel went from 80.7 to 83.8% a +2.9% showing for Intel.

AMD Laptop market share Q4 2021 21.6% vs Q3 2021 22%, a 0.4% decline in the quarter, while Intel was +0.4%

These numbers are per Mercury Research.

So yes AMD has been bleeding market share in desktop most of 2021 and is now showing initial signs of bleeding laptop market share, which I think will get much worse when AL is widely available on laptops. Like I said server is where they are strong at, for now. -

TerryLaze Currently 16 out of the top 20 bestselling AIO PCs on newegg are intel.Reply

And BestBuy is a similar story.

Which is somewhat in line with this article where AMD sales are around 15-25% of the different markets.

Also 3 against 4 out of the 7 best selling CPUs on newegg are intel and all 3 of them are AL.

On bestbuy 5 out of the 5 best selling CPUs are intel, 3 of them AL.

Out of the top 10 there are 3 AMD cpus. -

Crericper Seems like someone has been banned...Reply

On the other hand, it's 2 weeks later, and more AL-M reviews are suggesting that battery life wasn't good on their H series at least for MSI's GE76 (performance was excellent though). This might suggest the arch isn't well optimized for low-power (<25W) operations, or not? Who knows because Intel still hasn't rolled out their P and U series which is the low power series.

I wish they would roll out these chips quicker since for Intel, R6k is really a big threat for them in the mainstream laptops because of these characteristics: good enough performance, efficient, and very strong iGPU performance that further extends battery life and reduces laptop price tags (since no more dedicated graphics for the performance ultrabooks).