TSMC Expects Chip Shortages Into 2022, Ups CapEx to $30 Billion

TSMC expects chip supply crisis to ease in 2023.

TSMC this week published its financial results for the first quarter and shared some of its expectations regarding the ongoing chip shortage. The company believes that chip shortages will continue well into 2022 and will only ease in 2023. Meanwhile, TSMC will provide some additional allocation for automakers shortly to boost supply to the clients that are important for the economies of counties like the U.S. and Germany. Also, TSMC intends to increase its capital expenditures beyond the planned $28 billion in 2020.

Supply Crisis to Ease in 2023

TSMC operated at an "over 100% utilization" during the quarter, though it could not fulfill all of its customers' orders. When asked about expectations when the shortages were going to end, the management responded that it expected the deficit to persist throughout 2021 and into 2022. It is impossible for TSMC to quickly respond to growing demand as it has to buy land, prepare the sites, construct new fabs, procure manufacturing equipment, install these tools, and ramp up the facilities. All of these steps take a long time, and TSMC expects its supply abilities to improve tangibly only in 2023.

"We see the demand continue to be high," C. C. Wei, CEO of TSMC, told analysts and investors during the company's earning's call. "We have acquired land and equipment, and started construction of new facilities. We are hiring thousands of employees and expanding our capacity at multiple sites. […] In 2023, I hope we can offer more capacity to support our customers. At that time, we'll start to see the supply chain tightness release a little bit."

To support the expansion, TSMC increased its CapEx budget from the previously planned $25 – $28 billion to around $30 billion in 2020.

Revenues Hit $12.92 Billion, Demand for HPC Up

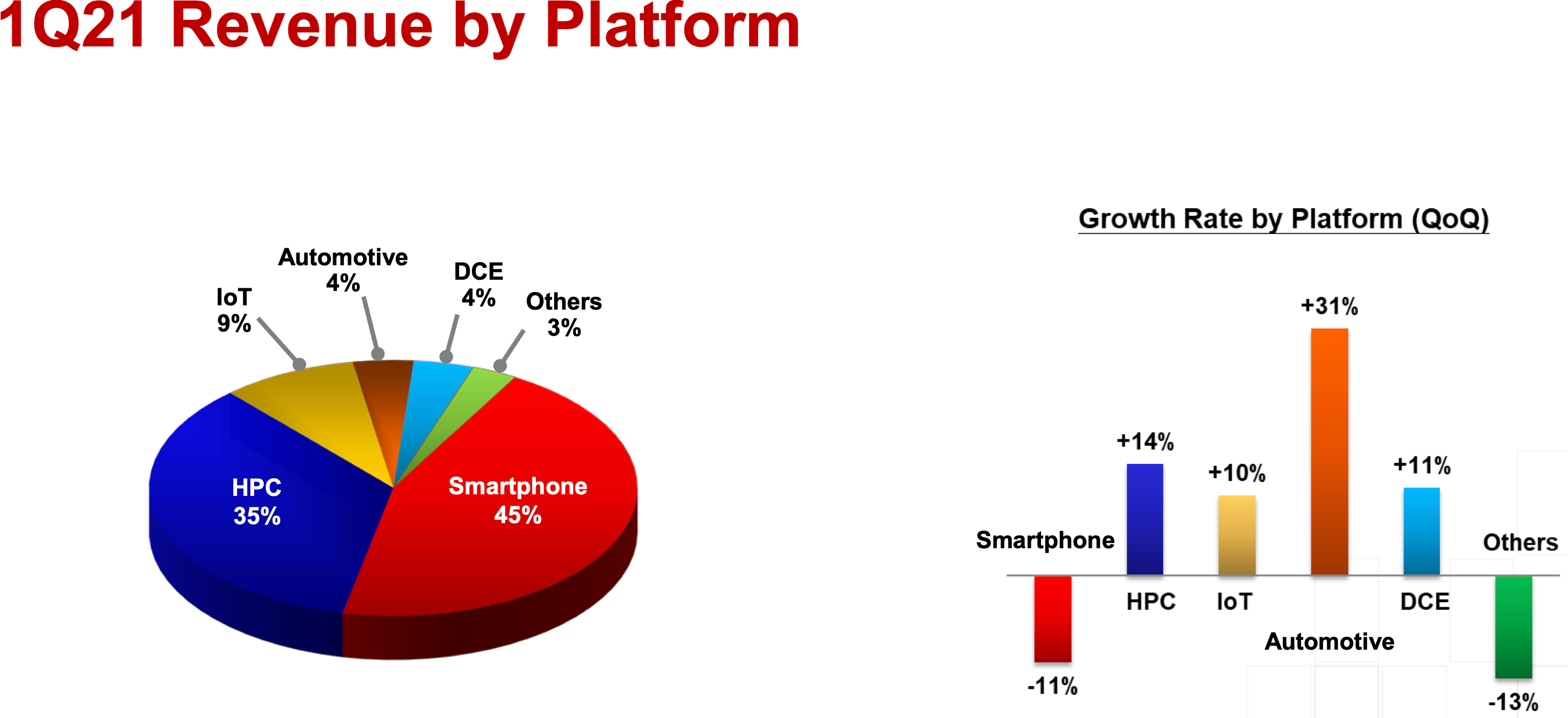

TSMC reported revenue of NT$362.41 billion ($12.92 billion), up 25.4% year-over-year, and net income of NT$139.69 billion ($4.932 billion) for the first quarter that ended on March 31, 2021.

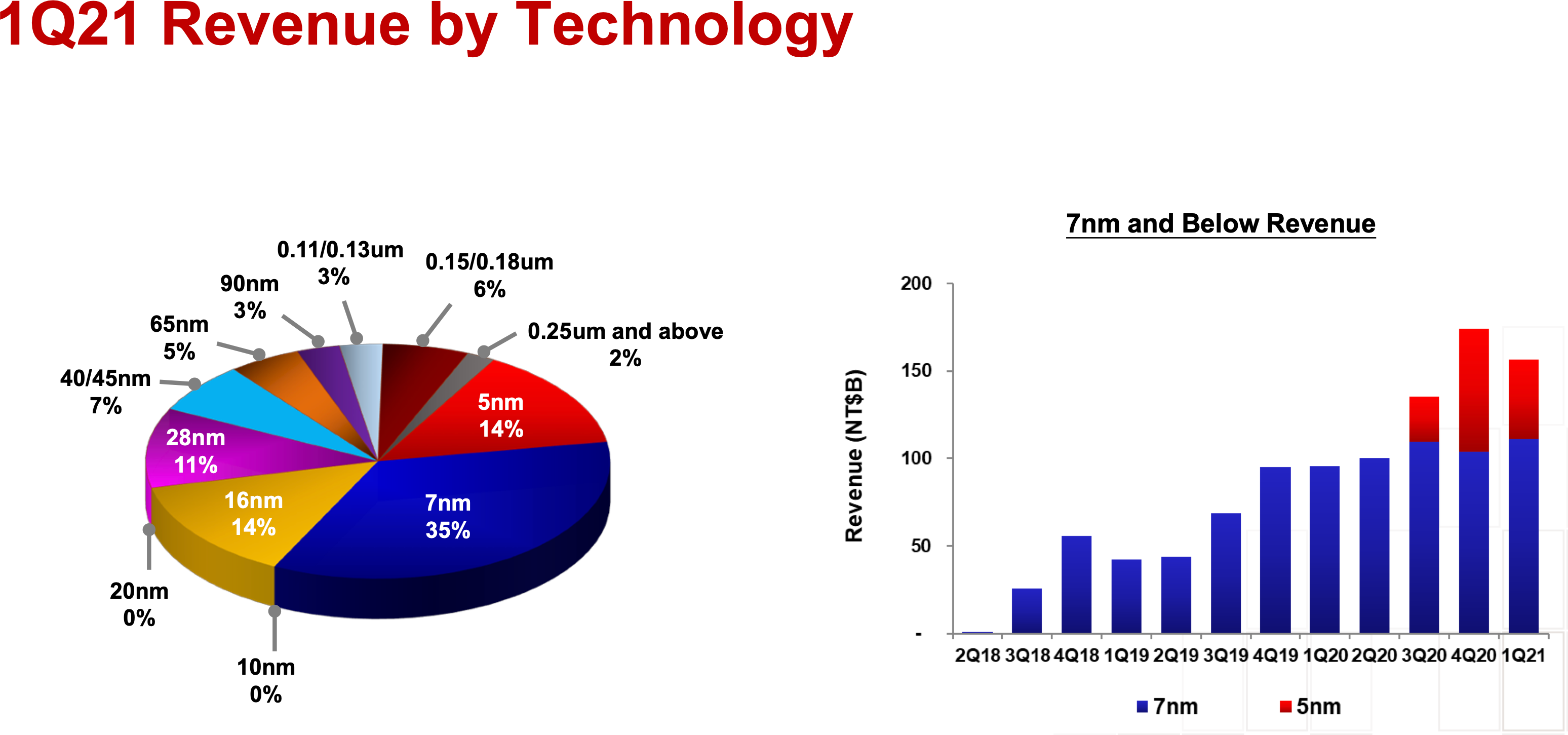

TSMC's N7 lineup of manufacturing technologies accounted for 35% of the company's earnings, whereas the N5 node and N16 family of processes accounted for 14% each of TSMC's revenue. N28 technologies continued to be fairly popular, so the node was responsible for 11% of TSMC's revenue.

It's noteworthy that N5 dropped from 20% of TSMC's consolidated revenue in Q4 2020 to 14% in Q1 2021, whereas N7 increased from 29% to 35%. This happened because Apple lowered orders for its 5 nm chips for smartphones and tablets, whereas companies from PC and server spaces (which TSMC collectively calls HPC) increased their orders for APUs, CPUs, GPUs, network processors, SoCs, and other components.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Multiple Megatrends Ahead, Automakers Get a Preference

TSMC has multiple growth opportunities ahead of it. Obviously, demand for PCs and other client devices is rising, so traditional customers like AMD, Broadcom, Nvidia, and Qualcomm are increasing their orders to the foundry. Also, there are impending 5G, AI, HPC, IoT, and edge computing megatrends that will further spur demand for semiconductors as all of these applications require brand-new chips produced using fairly advanced process technologies.

Cars are among the applications set to get smarter, as they now use rather sophisticated chips and are set to use even more complex SoCs as they become autonomous. Automotive applications accounted for about 4% of TSMC's revenue in Q1 2021, perhaps not a big deal for the company. But the absence of chips made by TSMC essentially stops car manufacturing in Europe and the U.S., which hits not only automakers but also hundreds of their subcontractors and economies in general. Given the importance of automakers, TSMC vowed to increase its allocation for automotive chips next quarter.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

watzupken Thanks for the heads up TSMC. Its good time to save money. No more upgrade itch until hardware manufacturers decide that they can't pull a fast one on consumers anymore.Reply