It's Official, Intel Sells NAND Fab, SSD Business to SK hynix for $9 Billion

Dumping the chips

UPDATE 10/19/2020 5:50pm PT:

Today, SK hynix issued a press release stating that it has signed an agreement to buy Intel's NAND memory and storage business. The sale includes Intel's SSD business, NAND IP, and wafer production, all for a tidy sum of USD 9 billion - but it comes in the form of two payments. The sale includes Intel's Dalian fab in China, but the deal's final step won't complete until March 2025. In the meantime, Intel will still manufacture NAND wafers at the Dalian facility.

Intel has yet to comment on the matter, but it appears that it will soon exit the NAND flash SSD business entirely. Intel will retain its Optane memory business and IP, which isn't surprising given that the exotic underlying 3D XPoint technology is jointly-designed by Intel and Micron and not available to other memory producers. Intel currently doesn't manufacture Optane memory in high volumes – it simply purchases the memory from Micron.

SK hynix and Intel will seek governmental approvals and hope to gain permission for the sale in late 2021. At that time, SK hynix will issue an initial $7 billion payment and gain Intel's NAND SSD-associated IP, SSD business, employees, and Dalian facility.

The second payment of $2 billion in March 2025 will grant SK hynix the remaining assets, including NAND manufacturing IP, R&D employees, and the remainder of the Dalian workforce. At that point, Intel will stop manufacturing wafers at the Dalian plant.

Intel CEO Bob Swan weighed in, “I am proud of the NAND memory business we have built and believe this combination with SK hynix will grow the memory ecosystem for the benefit of customers, partners and employees. For Intel, this transaction will allow us to further prioritize our investments in differentiated technology where we can play a bigger role in the success of our customers and deliver attractive returns to our stockholders.”

The SK Hynix press release includes the following statement (machine translated):

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"As the global leader in the semiconductor industry, Intel possesses industry-leading NAND SSD technology and quadruple level cell (QLC) NAND flash products. For the first six months ended June 27, 2020, the NAND businesses represented approximately US $2.8 billion of the revenue for Intel`s Non-volatile Memory Solutions Group (NSG) and contributed approximately US $600 million to NSG operating income."

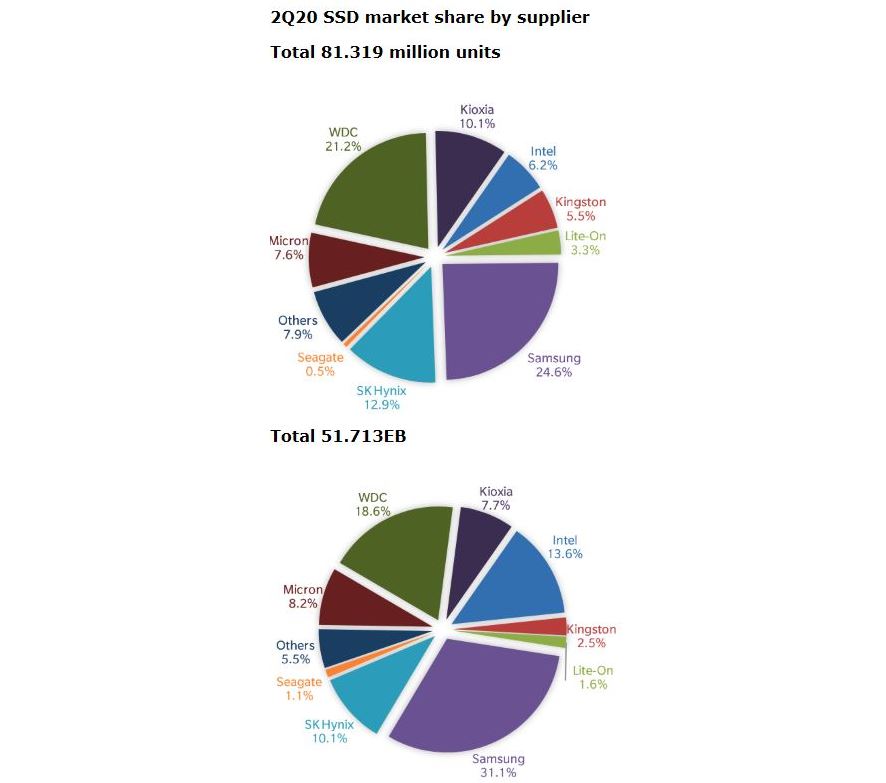

As shown below (via Trendfocus), Samsung currently dominates the SSD market in both the number of units sold and the total capacity of NAND shipped in exabytes (EB). If SK hynix's purchase of Intel's flash business completed today, SK hynix would have 19.1% of the market unit share, trailing Samsung's 24.6% and WD's 21.2%. Sk hynix would also ship 23.7% of the world's NAND flash capacity, beating WDC but still trailing Samsung's 31.1%.

Original Article:

Intel has stated in past earnings calls that it was looking at options to reduce its exposure to the ups and downs of the storage business, so it comes as no surprise that the Wall Street Journal today reports that Intel is negotiating to sell its NAND production unit to SK hynix for roughly $10 billion.

Intel has long been rumored to be in talks with its rival NAND chipmaker SK hynix, and today's report seemingly confirms that Intel will divest itself of at least part of its storage business to the South Korean firm. Analysts expect the deal could be announced as soon as today.

Intel CEO Bob Swan has said in the past that Intel was exploring either forging a partnership or spinning off its NAND fabrication business, largely because the low-profit flash memory business is capital-intensive and subject to extreme pricing volatility.

Intel makes both NAND flash, the most common form of non-volatile memory in SSDs, and the exotic 3D XPoint memory that is only manufactured by Intel and Micron. The WSJ reports that details are slight on exactly what Intel would sell to SK hynix. Still, it is unlikely that Intel will part ways with its 3D XPoint business, largely because it gives Intel a unique advantage over competitors, and its Optane Persistent Memory Modules are closely tied in with its Xeon processors.

Instead, Intel is likely to either enter into a NAND production partnership with SK hynix, much like its old partnership with Micron, or sell its NSG (Non-Volatile Memory Storage Group) flash production unit outright.

Intel already sources some of its NAND from SK hynix, which then makes its way into some of Intel's consumer SSDs. It's unclear if Intel will cease developing and selling its own SSDs, or just sell off the flash production arm of its business while securing a long-term supply agreement from SK hynix so it can continue to sell Intel-branded SSDs.

The low-margin storage business doesn't fit well with Intel's company goals of operating at a ~60% margin. The company was previously rumored to be in talks with China-based Tsinghua Unigroup, but that obviously wouldn't pass regulatory scrutiny in the midst of the US-China trade war.

The move comes not long after Intel parted ways with Micron, which was its joint partner in the now-defunct IMFT partnership that helped pave the way for the SSD era. Micron bought Intel out of that partnership for $1.5 billion in January 2020, which followed the decision to cease the joint development of 3D XPoint memory with Micron in 2018. However, Intel continues to fabricate NAND, though that may obviously come to an end soon.

This is breaking news...more to come.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

PeterDru ReplyThe sale includes Intel's Dalin fab in China, but the deal's final step won't complete until March 2025. In the meantime, Intel will still manufacture NAND wafers at the Dalian facility.

Are there two fabs in two places, one in Dalin and another in Dalian? Or it is an orthographic error?

Russians controlled the area around 1900 and build the city as Dal'nii (from proto-Slavic word, that means "far-away'). Later Japan controlled the area and wrote the name as "大連" using traditional characters, that is pronounce as "Dairen" in Japan. Now it is written as "大连" in simplified characters and "Dàlián" in pinyin that is the official romanization system for the Standard Chinese. Therefore the name of Dalian city ends with 'lian'. -

DZIrl Time for XMas bonus but company is not selling much and high management found way how to get bonus. Bravo!Reply -

TerryLaze Let's hope that this means that intel will push optane hard as soon as this deal completes.Reply -

InvalidError Reply

It'll push Optane hard in markets willing to pay big bucks for it. If your "push hard" was in hopes of becoming affordable, that would be antithetical to the reason Intel is getting rid of plebeian NAND in the first place. With Intel being in a duopoly position with Micron there, it won't be in any hurry to drive prices down.TerryLaze said:Let's hope that this means that intel will push optane hard as soon as this deal completes. -

JamesSneed Intel is just making its 4th quarter numbers look better as AMD is set to destroy them. Intel will look great on paper at least for another quarter. Its a smart move if Intel can get competitive by the time the luster wears off but I have my doubtsReply -

spongiemaster Reply

How would this have any affect on their 4th quarter numbers?JamesSneed said:Intel is just making its 4th quarter numbers look better as AMD is set to destroy them. Intel will look great on paper at least for another quarter. Its a smart move if Intel can get competitive by the time the luster wears off but I have my doubts -

dalek1234 Replyspongiemaster said:How would this have any affect on their 4th quarter numbers?

Intel is currently in its 4th fiscal quarter.

In the previous reported quarter, Intel made 19 billion USD of revenue. Let's say that it will continue to make 19 billion in Q4 , with the 9 billion sale quoted in this article, it means that Intel will make 28 billion worth of revenue in q4 - a considerable increase. So the financial numbers for q4, and the entire 2020, will look better than they actually are.

It is entirely possible, that the q4 number are expected to be so bad, that the sale of 9 billion to Hynix is just to make up for the shortcomings. We will know in about 3 months when Intel reports on q4. -

Endymio Reply

Except that Intel won't receive even the first payment from this sale until late 2021 ... and final payment not until 2025. The sale isn't even approved yet by regulators.dalek1234 said:Intel is currently in its 4th fiscal quarter. ..with the 9 billion sale quoted in this article, it means that Intel will make 28 billion worth of revenue in q4 - a considerable increase.