XPoint Shakeup: Intel and Micron to Cease Joint Development of 3D XPoint Next Year

Intel and Micron have announced they have updated the terms of their 3D XPoint joint development partnership and will cease joint development after the second generation of 3D XPoint is completed in the first half of 2019. The two companies also recently announced they would cease joint development of NAND through their Intel-Micron Flash Technologies (IMFT) partnership after the third generation of flash technology, but the storied IMFT franchise will apparently soldier on through shared production facilities.

Intel and Micron will continue to develop new generations of 3D XPoint independently "in order to optimize the technology for their respective product and business needs." Intel representatives confirmed to us that the company will still produce 3D XPoint out of the jointly-operated IMFT fab in Lehi, Utah even after the companies develop their respective third-generation products, but Intel still has the option to produce the memory at other facilities if needed.

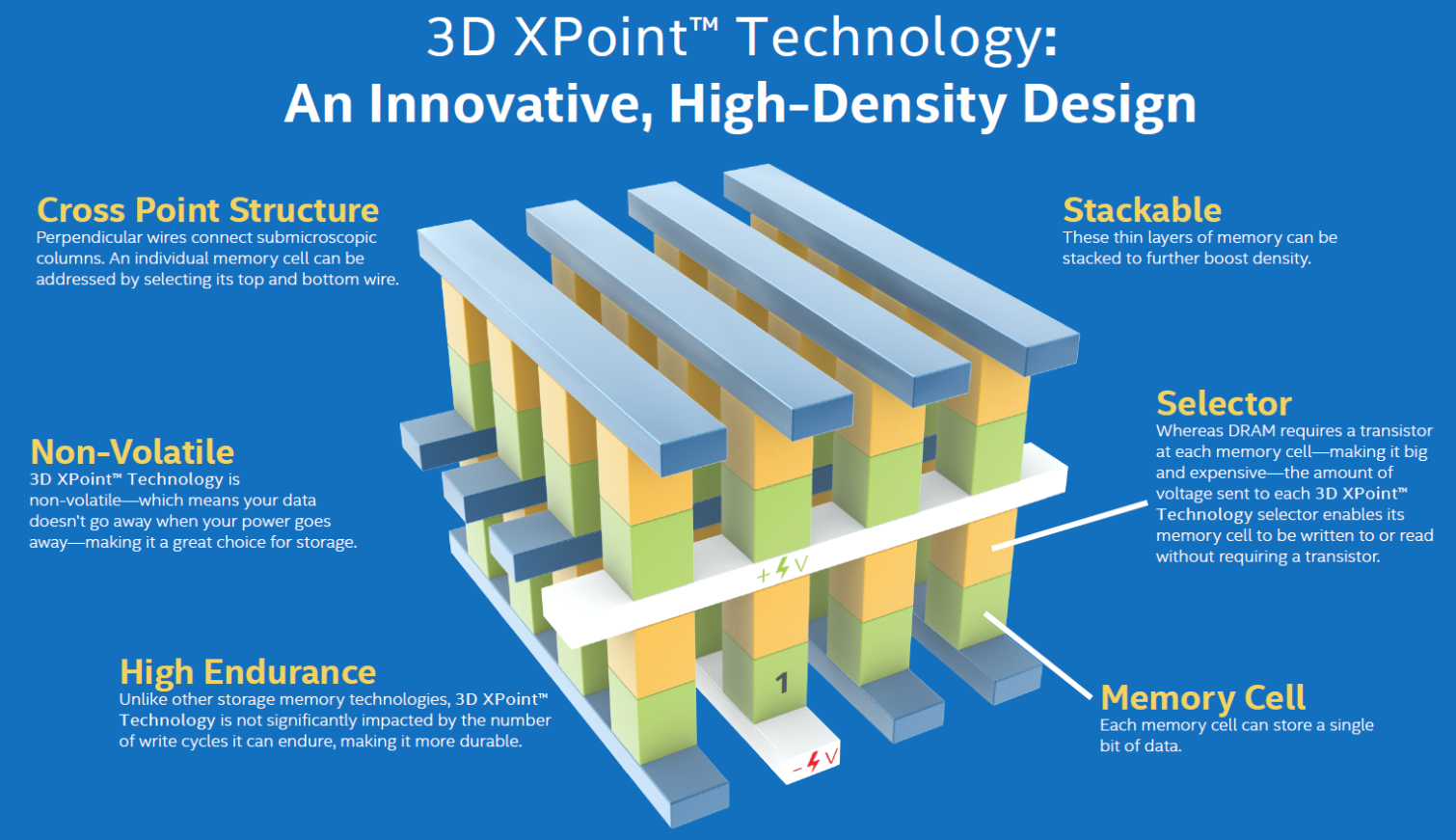

Intel and Micron announced 3D XPoint in July 2015. The companies designed the new memory to bridge the performance gap between NAND and DRAM, and because of 3D XPoint's persistence (it retains data after power is removed), it can serve in both memory and storage roles.

Micron announced its 3D XPoint-based QuantX products in 2016, and we even tracked down the finer details of the design, but the SSDs did not make it to market. As a result, Intel is the only company selling 3D XPoint-based products and Micron has relied on Intel to purchase its excess 3D XPoint production capacity.

However, during a recent earnings call, Micron CEO Sanjay Mehrotra revealed that 3D XPoint sales to Intel were flagging, thus incurring under-utilization charges that impacted Micron's bottom line. Micron even indicated that it was possible that the company wouldn't sell any 3D XPoint to Intel in the future. As such, Mehrotra announced that Micron would re-negotiate the terms of future 3D XPoint development with Intel. That means the split in product development is likely the outcome of the renegotiation.

Sales of 3D XPoint have obviously been under expectations. Intel has brought the new memory to market in various SSD form factors, but pricing has been a concern as prices for traditional flash-based SSDs have continued to plummet. Intel has even taken to offering "Core+" processors that come bundled with 3D XPoint drives in an apparent effort to spur sales.

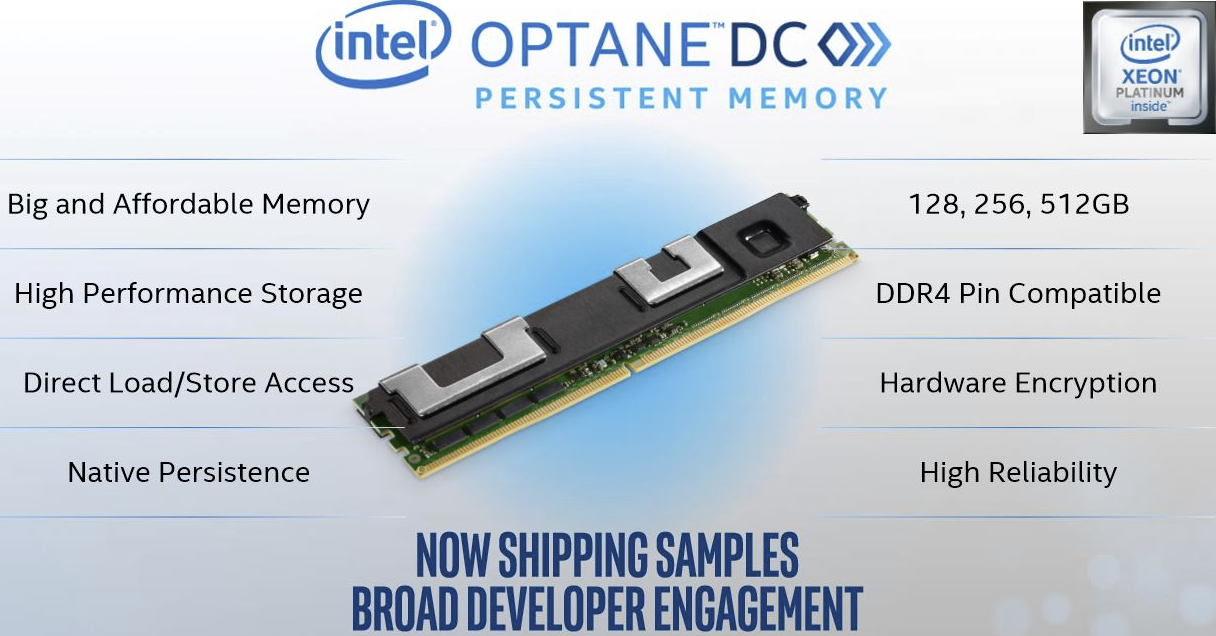

Analysts have long predicted that the debut of Optane DC Persistent Memory DIMMs, which bring the speedy memory to the DIMM form factor to enable explosive memory capacity increases, would mark the true turning point for 3D XPoint adoption. Unfortunately, Intel's 3D XPoint DIMMs have been plagued by delays, which ultimately has led to lower-than-expected sales.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel is currently ramping production of its long-overdue DIMMs and claims that several hyperscalers and cloud service providers are committed to deploying its products. Micron says that it will bring its first 3D XPoint-based products to market by the end of 2019, with meaningful revenue occurring in 2020.

Both Intel and Micron have sunk a tremendous amount of R&D into the skunkworks-class project over the course of a decade, so it is unlikely that either will cease development and production. Intel and Micron have repeatedly stated that 3D XPoint is an inherently scalable design: the companies can either add more layers, shrink lithography, or store more bits per cell to boost capacity and performance. That leaves plenty of room for improvements in the future. Given the announced timeline for the second-gen products in early 2019, we could see faster, cheaper, and more capacious 3D XPoint products soon.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

takeshi7 "Sales of 3D XPoint have obviously been under expectations."Reply

That's what happens when you price it so ridiculously high that no one wants to pay for it. -

manleysteele The first product out the doors was something no one was asking for.Reply

The second product out the door was something no one was asking for.

The third product out the door was something no one was asking for.

The fourth product out the door was something no one was asking for.

The fifth product out the door was something no one was asking for.

Meanwhile I still can't buy the only Xpoint product I'm interested in buying.

Thanks a lot, Intel. -

kenjitamura Wonder if Intel's 2020 graphics cards will be affordable or if they plan on keeping the "1.5x the performance at 2.5x the price" trend on high end products.Reply -

sykozis Reply21147682 said:"Sales of 3D XPoint have obviously been under expectations."

That's what happens when you price it so ridiculously high that no one wants to pay for it.

Isn't there also an issue of compatibility? Or did I misread that? -

Marlin Schwanke Complete disconnect between the breathless hype of several years ago and the actual product on offer today.Reply

I have no interest in purchasing anything Intel has released or announced. -

TheSecondPower I would've seriously considered buying an Optane drive. It's expensive for the capacity, yes, but for under $100 I could've had more than enough capacity for a Linux install and run it on the fastest SSD available. But none of that matters, because I have a computer with a Ryzen processor, and Intel's Optane drives only work with specific Intel processors.Reply

Intel can't sell Optane because they closed the door on a lot of potential customers and because— as if it wasn't enough to only sell to certain customers with very new and high-end Intel processors— they marketed the drives as an HDD cache. So the only people who can buy it are people who would've already spent money on a nice SSD. As several reviewers pointed out when the product launched, it was a great device without a reasonable target market.

I also can't help but think they missed a big opportunity with the memory shortages these last couple years. Many SSDs are being sold without a DRAM cache. What about an XPoint cache? It's much cheaper than DRAM and also has a much longer life. It'd be a perfect cache for a budget SSD to get a lot of the benefits of having a DRAM cache. -

takeshi7 Reply21148093 said:I would've seriously considered buying an Optane drive. It's expensive for the capacity, yes, but for under $100 I could've had more than enough capacity for a Linux install and run it on the fastest SSD available. But none of that matters, because I have a computer with a Ryzen processor, and Intel's Optane drives only work with specific Intel processors.

You're a victim of Intel's failed marketing. You definitely can use an Optane drive on Ryzen. It works just like any other NVMe SSD. And even though Intel allows you to use it as an Optane cache on their Coffee Lake and Kaby Lake motherboards, there's no reason you can't use it with AMD's StoreMI software to accomplish a similar tiered storage solution on Ryzen.

So you could have definitely gotten an Optane drive and installed Linux on it. Maybe Intel just didn't make that clear enough.

-

JamesSneed Reply21148159 said:21148093 said:I would've seriously considered buying an Optane drive. It's expensive for the capacity, yes, but for under $100 I could've had more than enough capacity for a Linux install and run it on the fastest SSD available. But none of that matters, because I have a computer with a Ryzen processor, and Intel's Optane drives only work with specific Intel processors.

You're a victim of Intel's failed marketing. You definitely can use an Optane drive on Ryzen. It works just like any other NVMe SSD. And even though Intel allows you to use it as an Optane cache on their Coffee Lake and Kaby Lake motherboards, there's no reason you can't use it with AMD's StoreMI software to accomplish a similar tiered storage solution on Ryzen.

So you could have definitely gotten an Optane drive and installed Linux on it. Maybe Intel just didn't make that clear enough.

Optane drives work with AMD just fine and are supported. The Optane memory on the other hand is not supported on AMD. Intel did a poor job differentiating the two products so people confuse these regularly.