300mm Fab Spend Skyrocketing: 38 New Fabs Expected by 2024

The semiconductor industry spending is booming, due to increasing demand.

Demand for advanced chips has been increasing gradually in the recent years and is expected to snowball faster in the coming years, due to trends like 5G, artificial intelligence, high-performance computing and edge computing. A report from SEMI, an association of chip design and manufacturing supply chain companies, announced this week predicts that at least 38 new 300mm fabs will come online by 2024, significantly increasing available capacity.

"The projected record spending and 38 new fabs reinforce the role of semiconductors as the bedrock of leading-edge technologies that are driving this transformation and promise to help solve some of the world’s greatest challenges," Ajit Manocha, SEMI president and CEO, said in a statement accompanying SEMI's announcement of its 300mm Fab Outlook to 2024 report.

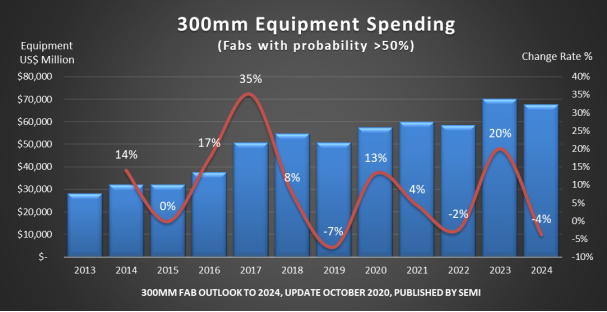

Over $250 Billion Spent on 300mm Equipment by 2024

SEMI predicts that over $250 billion will be spent on 300mm fab equipment from 2019-2024, with equipment budgets hitting an all-time-record $70 billion in 2023.

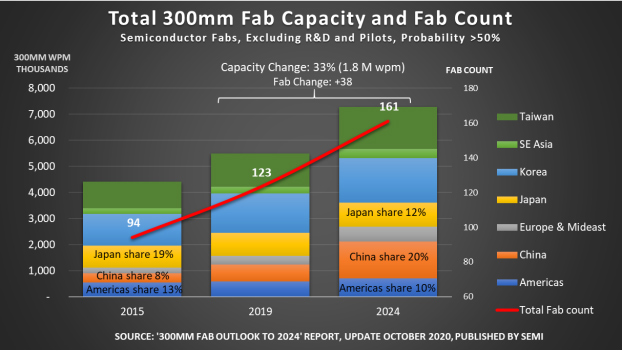

At least 38 new 300mm fabs will be built and dozens upgraded to produce chips using more advanced nodes, SEMI's conservative projection says. After the new and upgraded fabs come online by the end of 2024, the global 300mm fab capacity will reach over 7 million wafer starts per month (WSPM). In total, 161 300mm fabs will be operational by the end of 2024, up from 123 in 2019, if SEMI's predictions prove true.

Another factor associated with the projected spending boost is the industry's slow transition to extreme ultraviolet (EUV) lithography tools that are more expensive than traditional deep ultraviolet (DUV) scanners and also require other advanced equipment in the fab. EUV is currently used only for logic, but Samsung recently started production of DRAM using a process that features some EUV layers.

Taiwan to Lead the Pack

Taiwan and South Korea have long been leading in terms of the number of operational 300mm fabs. Amid consolidation of the foundry industry and growing demand for leading-edge nodes, Taiwan Semiconductor Manufacturing Co. has been increasing its capital expenditures rather rapidly. Taiwan will add 11 new 300mm fabs by 2024 (when compared to 2019), SEMI said, which is well ahead of other countries and even smaller regions.

China, which is trying to meet its Made in China 2025 goals, is expected to build eight new 300mm fabs and dramatically increase its 300mm fab capacity market share to 20% by the end of 2024 (up from 8% in 2015).

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

South Korean companies — namely Samsung and SK Hynix — will also pour in tens of billions of dollars in new fabs and equipment by 2024, but SEMI did not disclose the number of new fabs to be built.

Memory Ahead of Logic

SEMI said that 3D NAND and DRAM will account for the bulk of the increase in 300mm fab spending. Considering that there is intense competition between four major makers of memory — Micron, Samsung, SK Hynix and Western Digital/Kioxia — and there are multiple new players emerging in China, this isn't surprising.

Companies producing logic chips, such as Intel, GlobalFoundries, TSMC, UMC and others, are also expected to increase budgets significantly, though some will prefer to upgrade existing fabs rather than build new ones.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.