AMD Earnings: Next-Gen RDNA in 2020, Quarterly Revenue up 50 Percent

AMD announces its fourth quarter 2019 and full year results

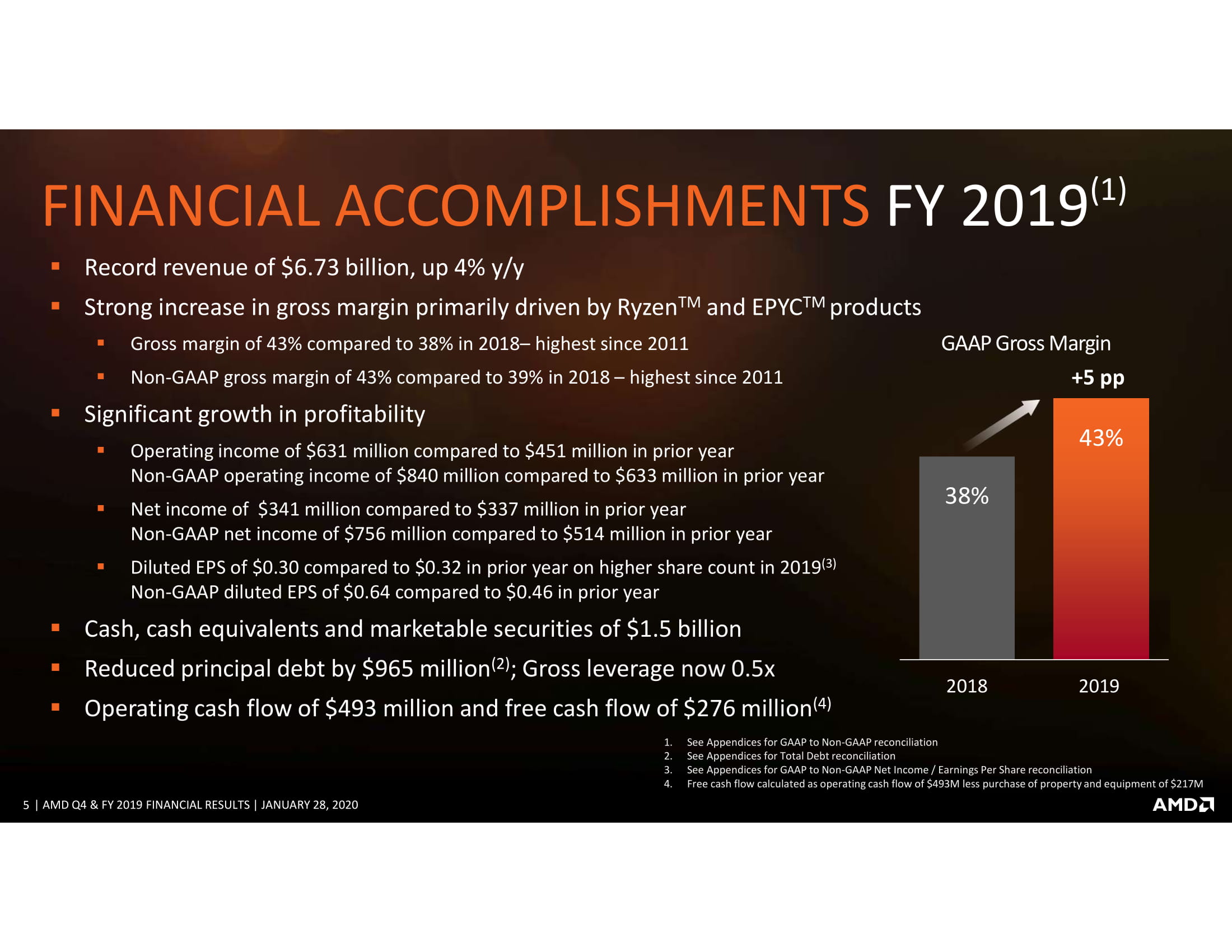

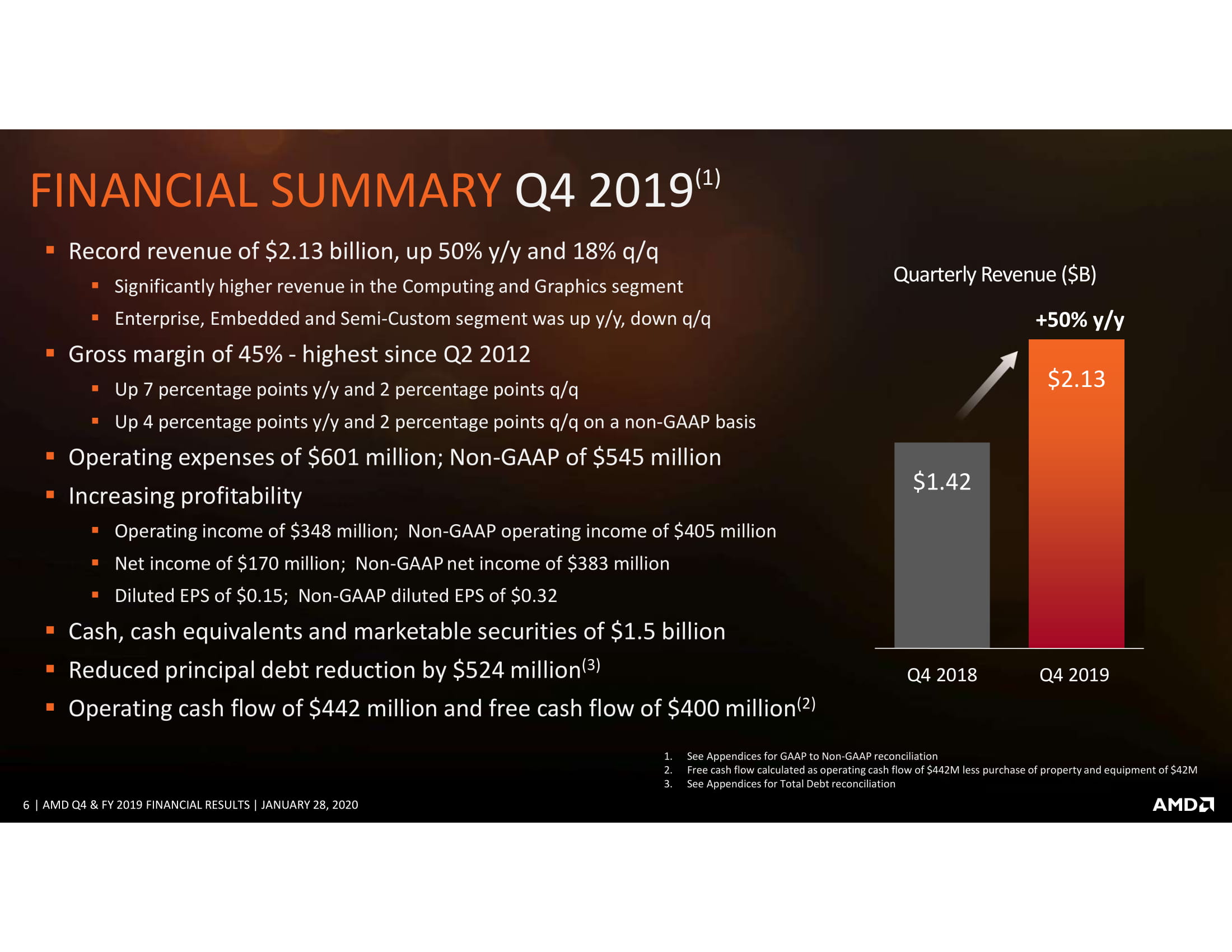

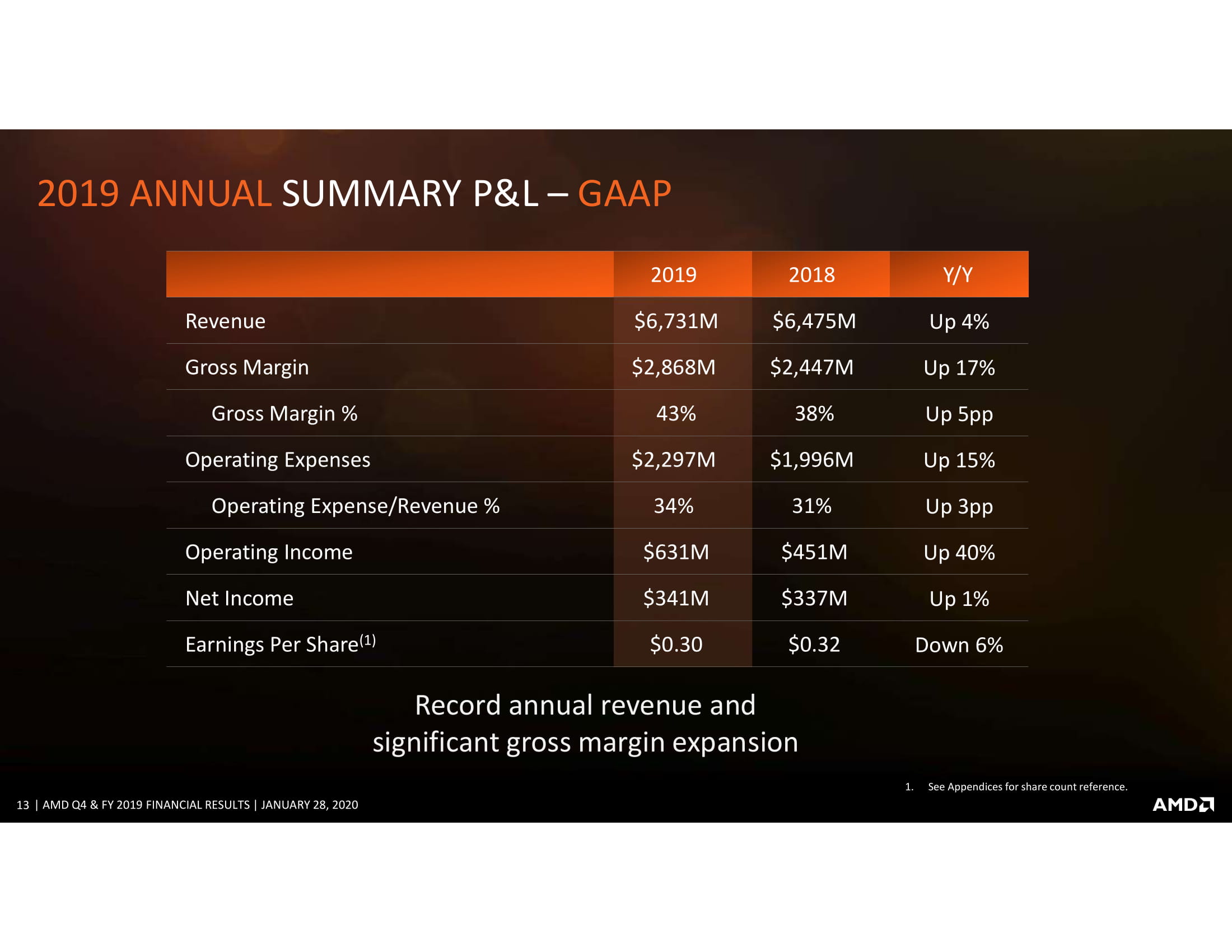

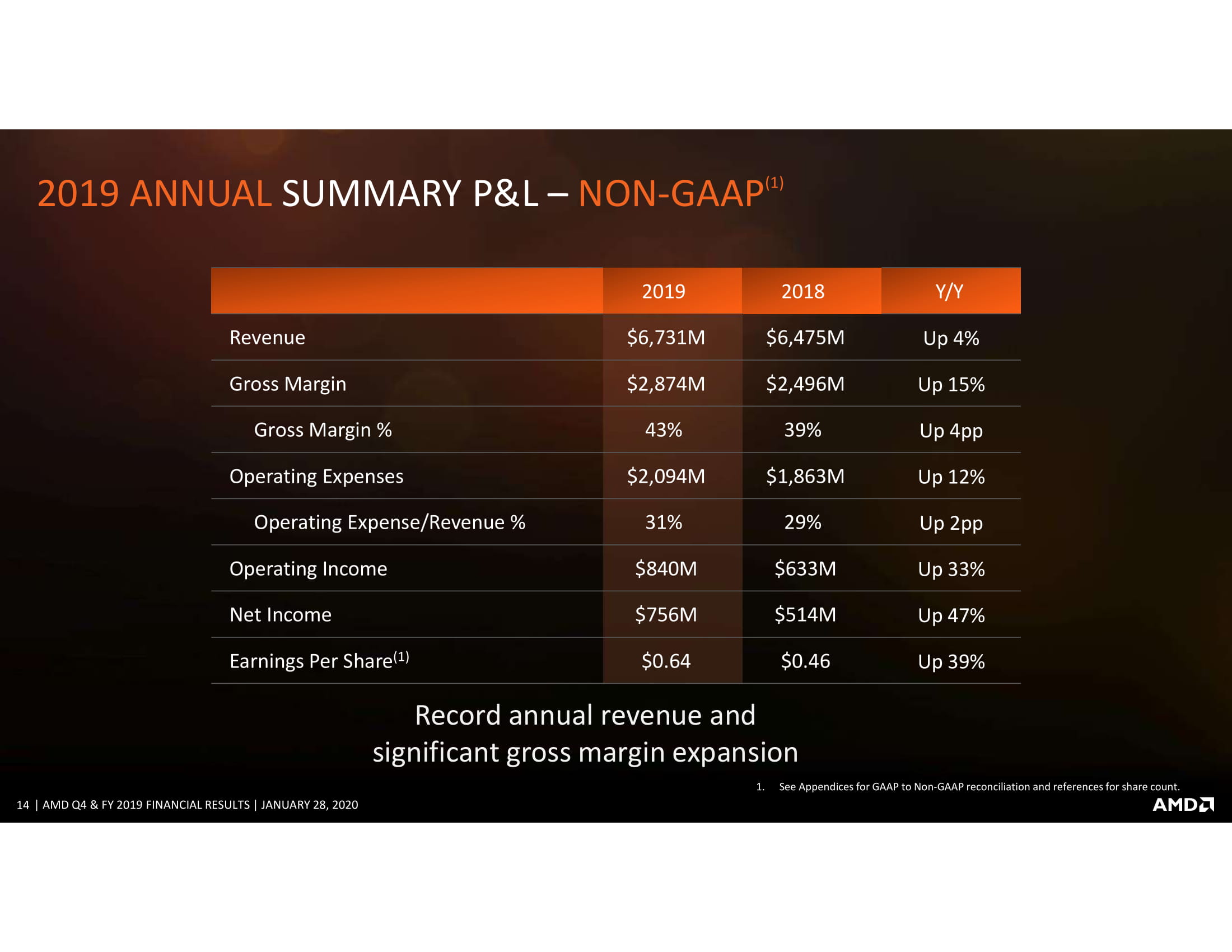

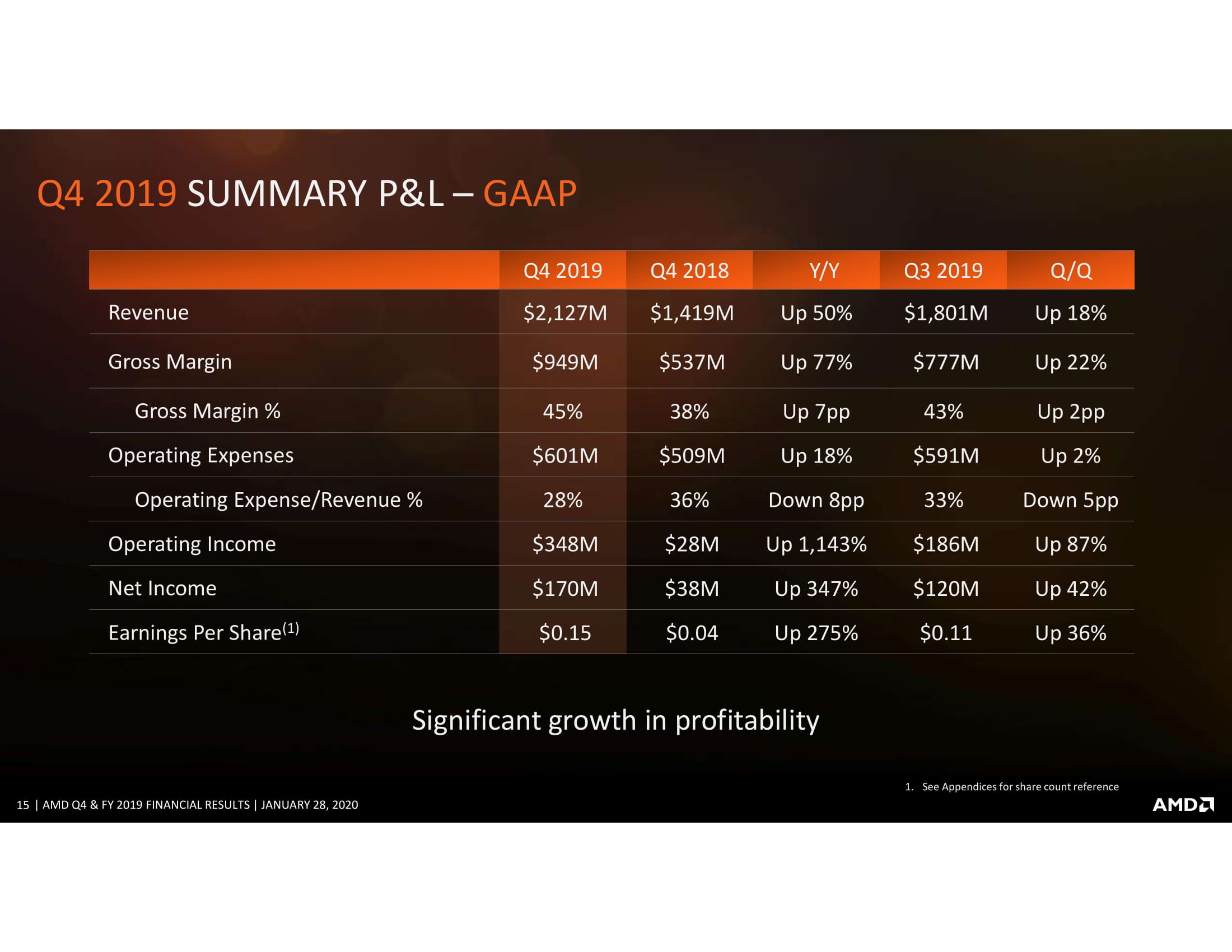

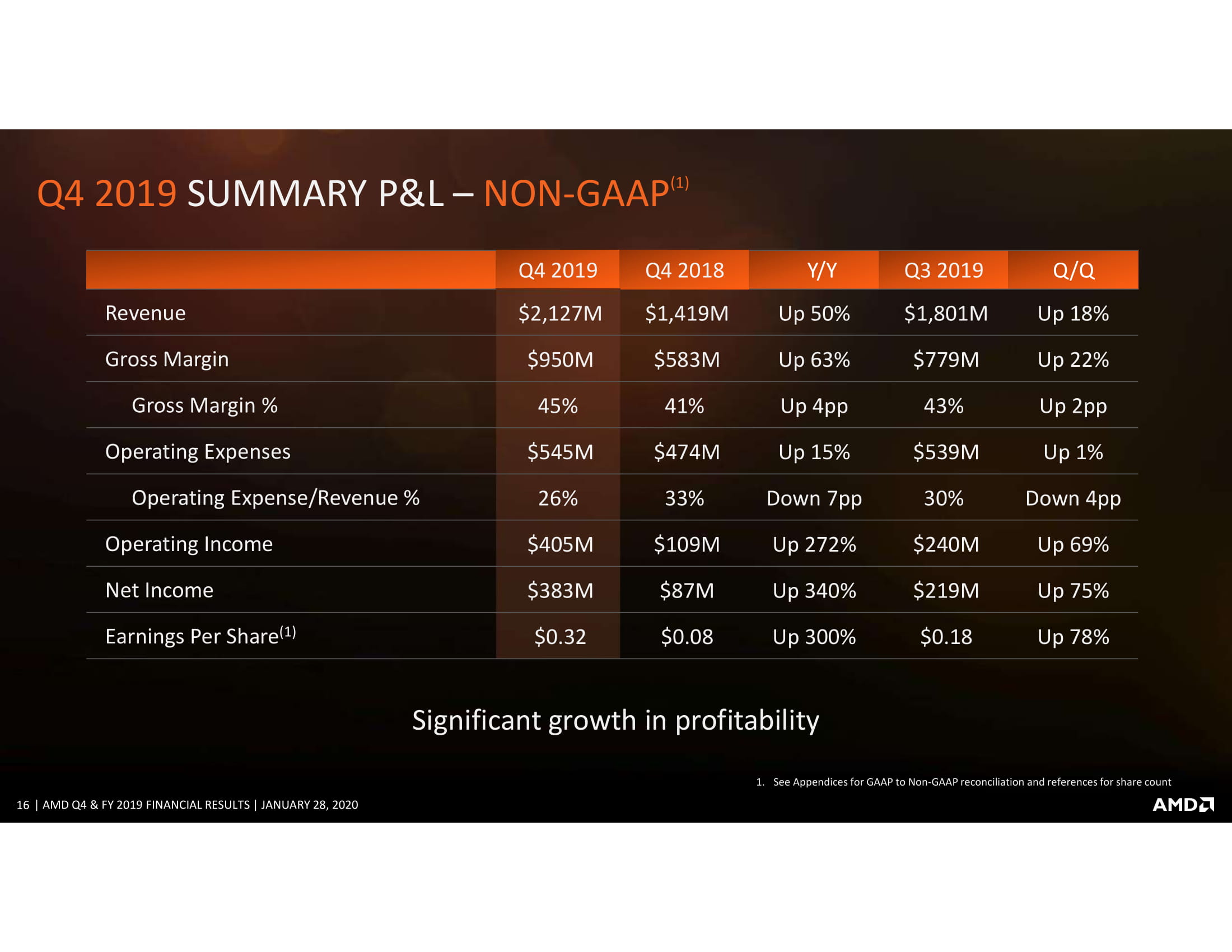

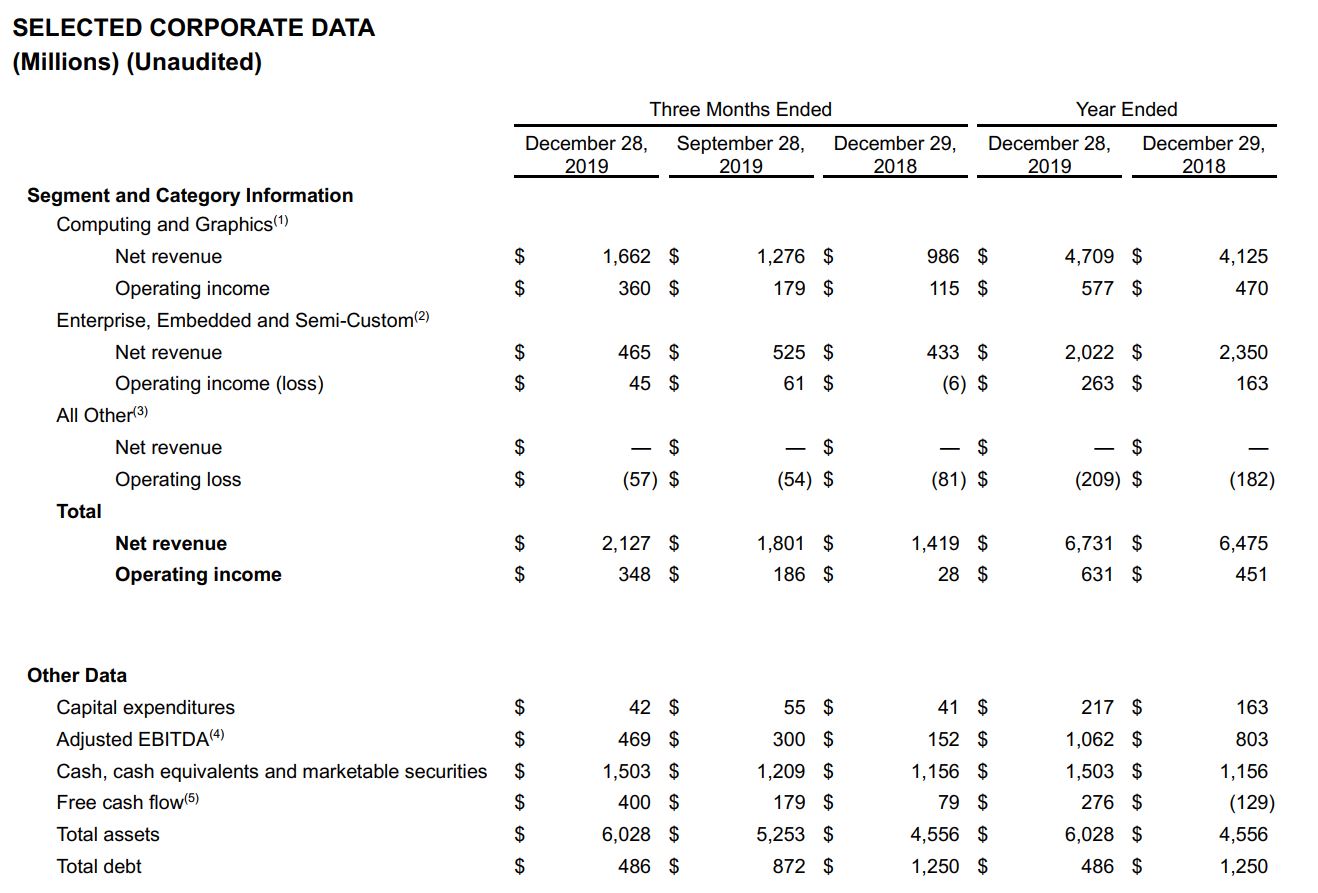

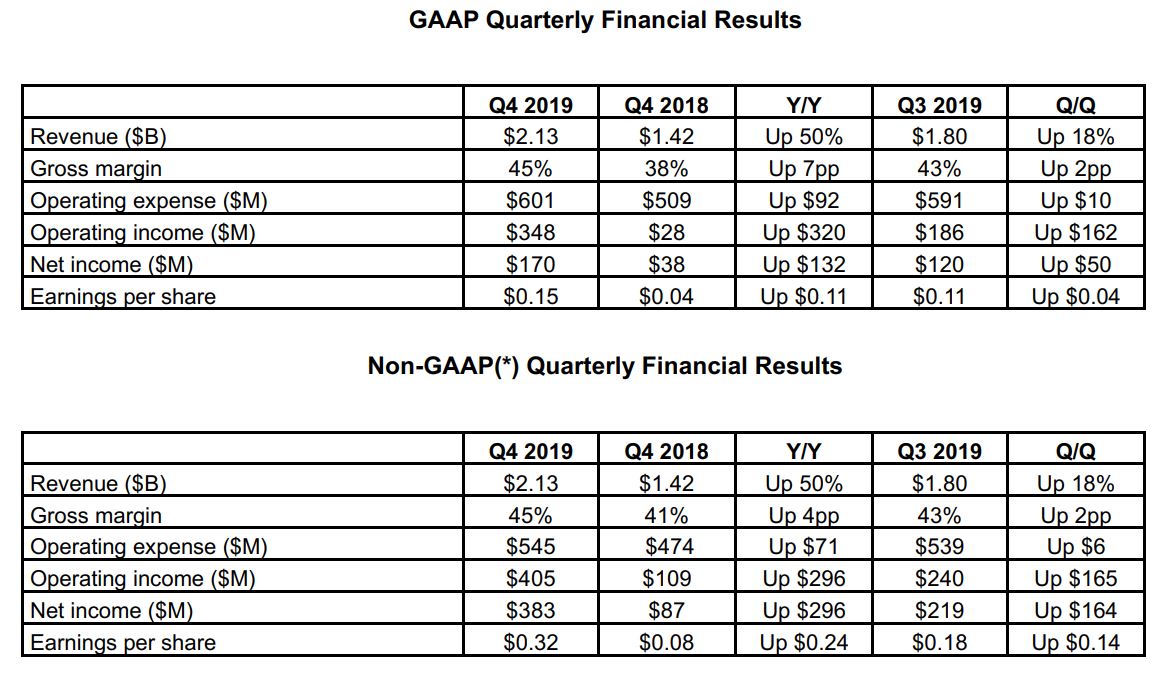

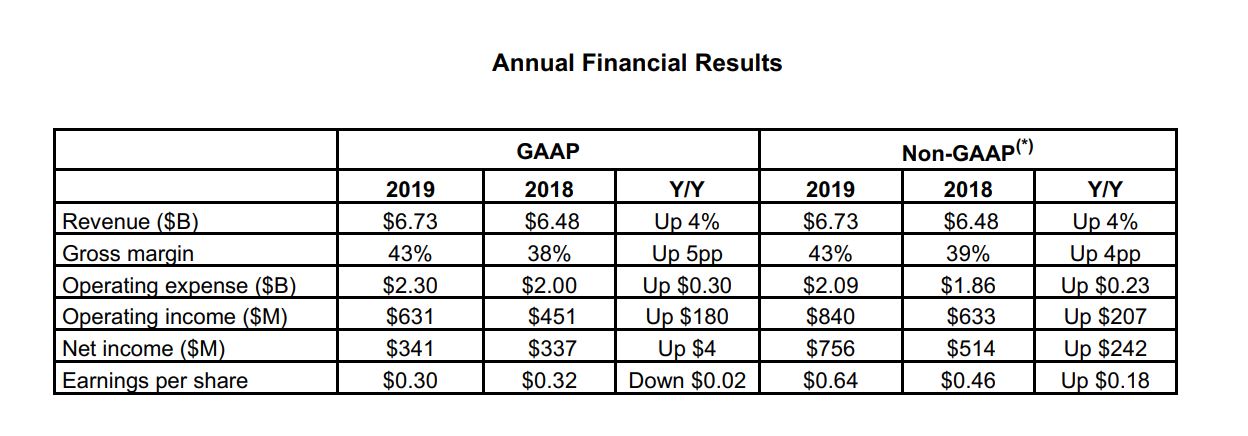

AMD announced its fourth-quarter 2019 and full-year earnings results today, with top-line numbers including record quarterly revenue of $2.13 billion, a 50% gain over the prior quarter. AMD also notched a record $6.73 billion in revenue in 2019, a 4% increase over the prior year.

AMD CEO Lisa Su announced during the earnings call that the company will introduce its next-gen RDNA architecture in 2020, saying, "In 2019 we launched our new architecture in GPUs, it’s the RDNA architecture, and that was the Navi-based products. You should expect those will be refreshed in 2020 and we'll have our next-generation RDNA architecture that will be part of our 2020 lineup."

There has been some confusion over Su's use of the term "refresh," which we've covered here. In short, we shouldn't expect to see a refreshed lineup of Navi cards based on the tech community's typical definition of a refresh. Instead, we will see new cards based on the next-gen RDNA architecture.

Su didn't share any details about the new graphics cards but said the company would announce more details at its Investor Day on March 5, 2020. Su also said we could expect new data center GPUs in the second half of 2020, too.

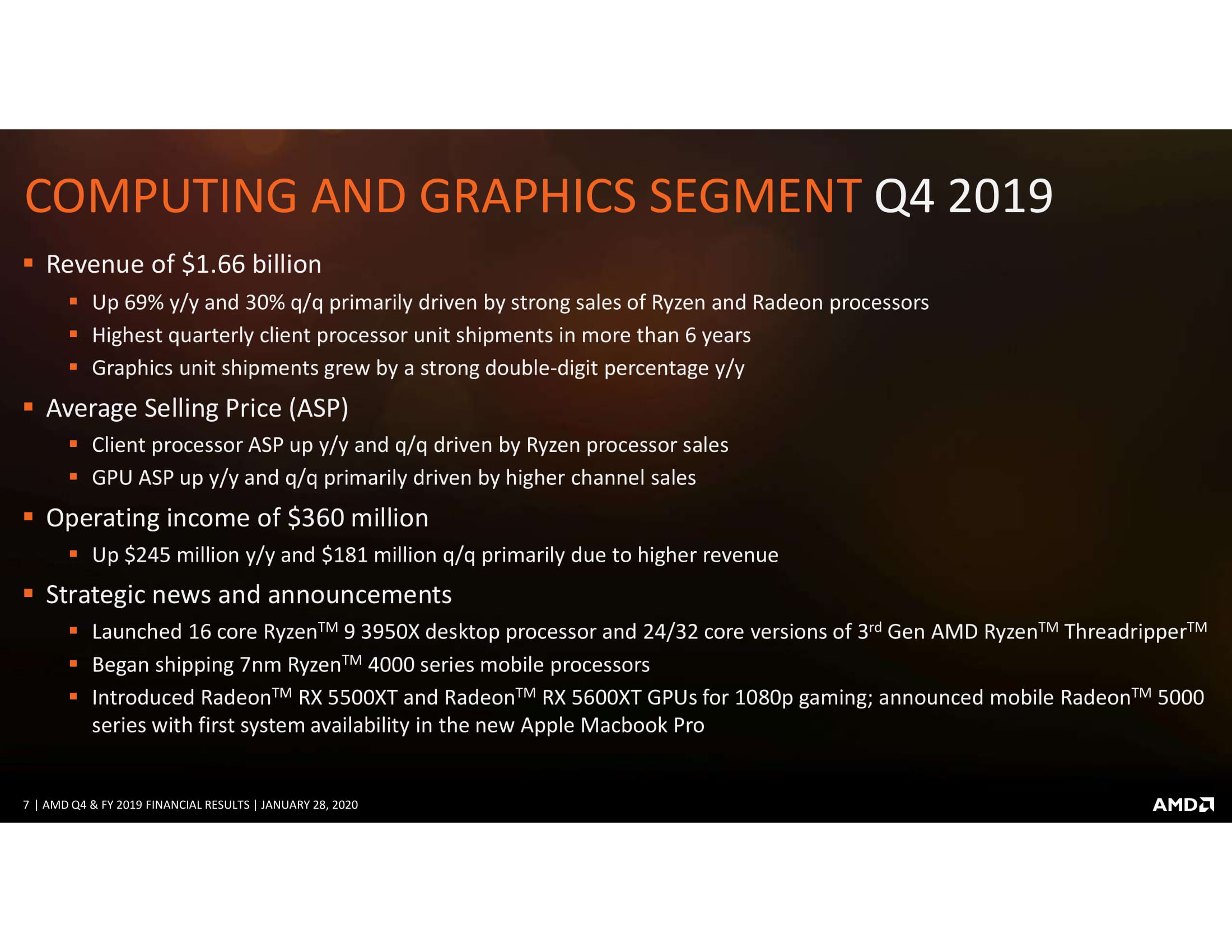

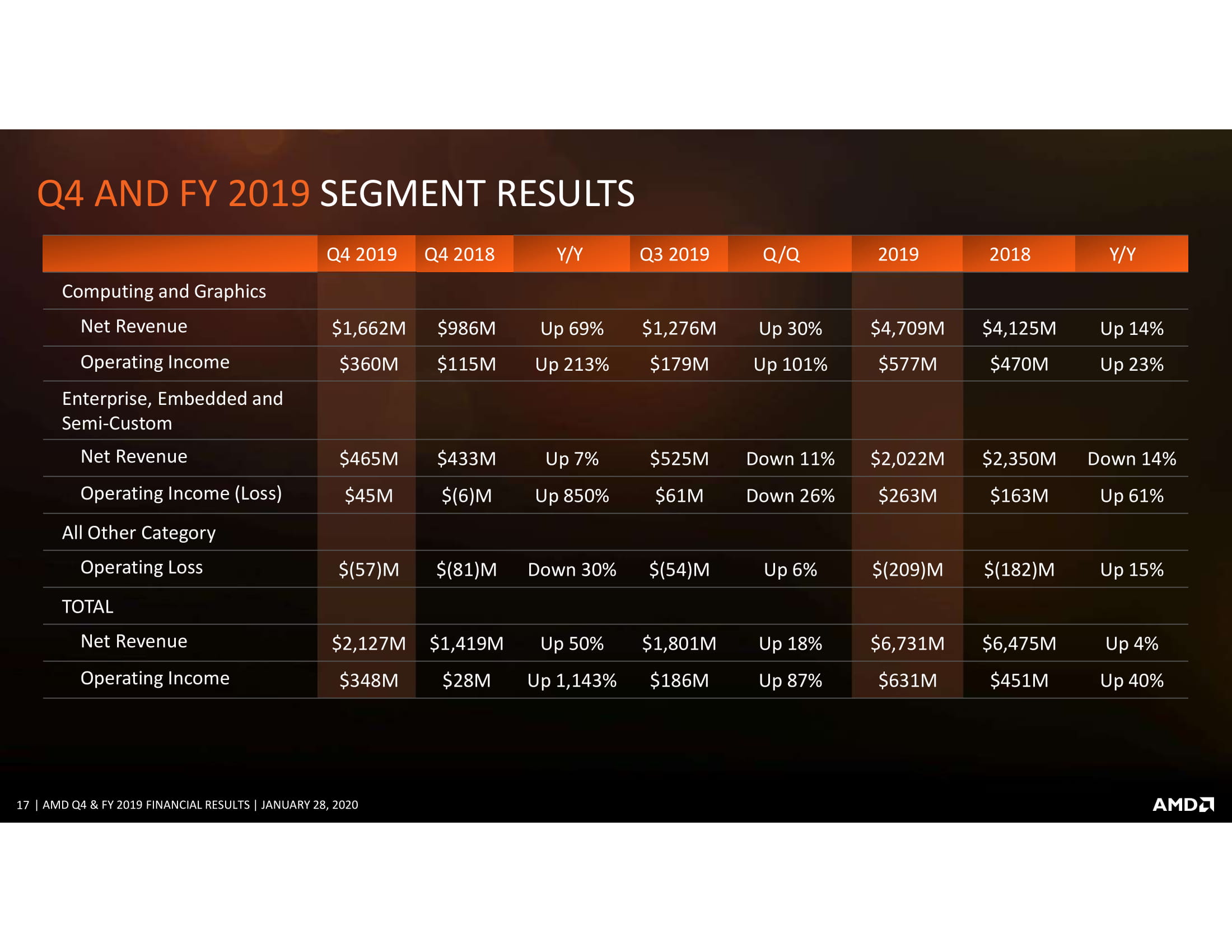

On the Computing and Graphics side of the business, which encompasses both Ryzen and Radeon products, AMD's revenue grew 69% on the year to $4.7 billion, and 30% over the prior quarter to $1.66 billion. Comparatively, Intel generated $10 billion in revenue for its consumer CPUs last quarter.

7nm products and Ryzen Mobile processors drove AMD's sales, and AMD CEO Lisa Su stated that the company had the highest processor sales in six years. Graphics unit shipments also grew by "double-digit" percentage year-over-year (YoY), driven by Radeon RX 5000 sales.

AMD's quick move to TSMCs 7nm process has given the company its first process lead over Intel in its history. AMD's 7nm chips now comprise 50% of its overall revenue, and Su noted that its 7nm volume would continue to grow throughout 2020. That doesn't come without challenges, but AMD has largely moved beyond the initial shortages. AMD is working diligently to ensure continued supply, with Su noting that even though "it's fair to say that wafer supply is tight," AMD's current supply visibility supports its projected sales during 2020.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Su also noted that AMD expects "resistance" from its competitors this year, including on the pricing front. Su said AMD is gaining market share in the consumer processor market, mirroring Intel's claims during its own recent earnings call. We expect the coming market share reports will suss out the actual winners.

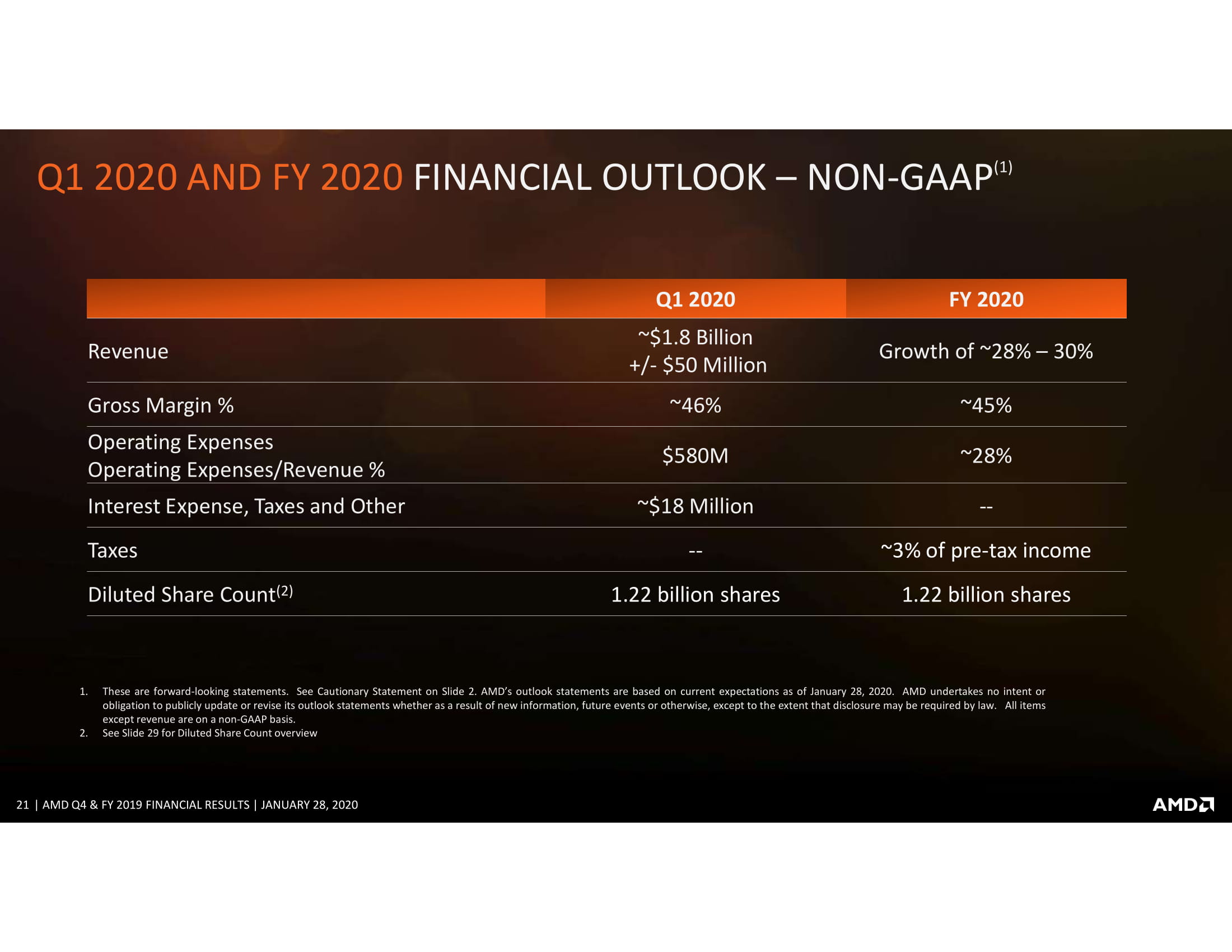

However, AMD's stock slumped 4% in after hours trading (at the time of writing) due to a softer-than-expected Q1 outlook of $1.8 billion (up 42% YoY), along with somewhat soft performance in the Enterprise, Embedded and Semi-Custom (EESC) business that produces both EPYC processors and chips for consoles.

Citing weak console sales partially offset by increased EPYC sales, the EESC group generated $465 million for the quarter (down 11% quarter-over-quarter), which was well below the consensus estimate of $604 million. The group generated $2 billion during 2019, down 14%. Comparatively, Intel's data center group generated $7.2 billion during the fourth quarter alone.

AMD says that console sales have softened faster than expected as Microsoft and Sony gear up for holiday launches of new hardware, with AMD's semi-custom business down more than the expected "high 30's [%]" in the second half of 2019.

AMD has doubled the number of EPYC platforms to 100 systems during the fourth quarter, which is important to gain share in the lucrative OEM market, but on the surface, it appears that AMD's EPYC Rome processors aren't gaining quite the expected rapid traction.

Su said the company remains on track to reach a double-digit unit share in the data center by mid-2020 and that server revenue grew by "double-digit" percentages on the back of increased EPYC Rome demand and higher average selling prices.

Notably, AMD shook up its server business unit this month with the hire of ex-Intel'er Dan McNamara, who will take over for the departing CVP and GM of AMD's Data Center Solutions, Scott Aylor.

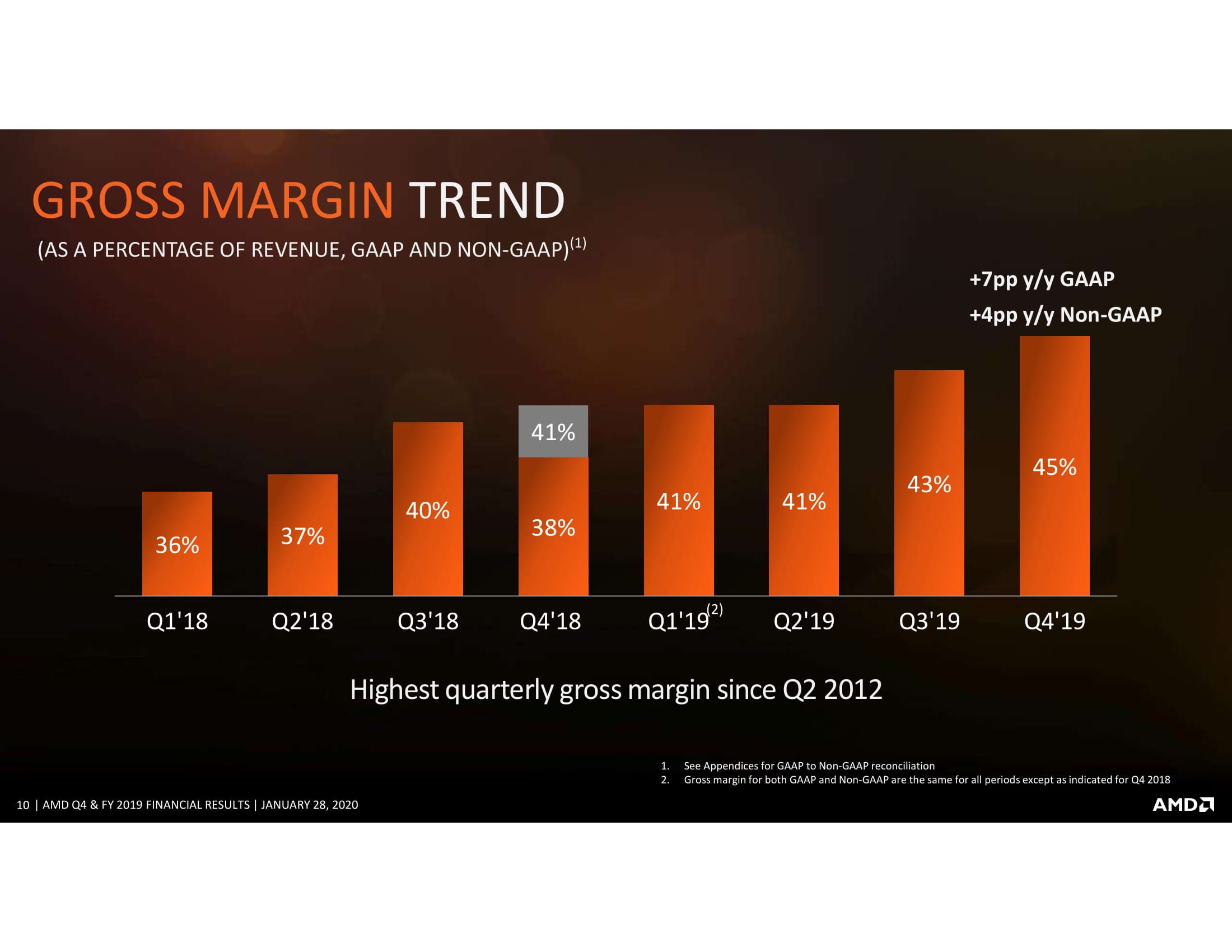

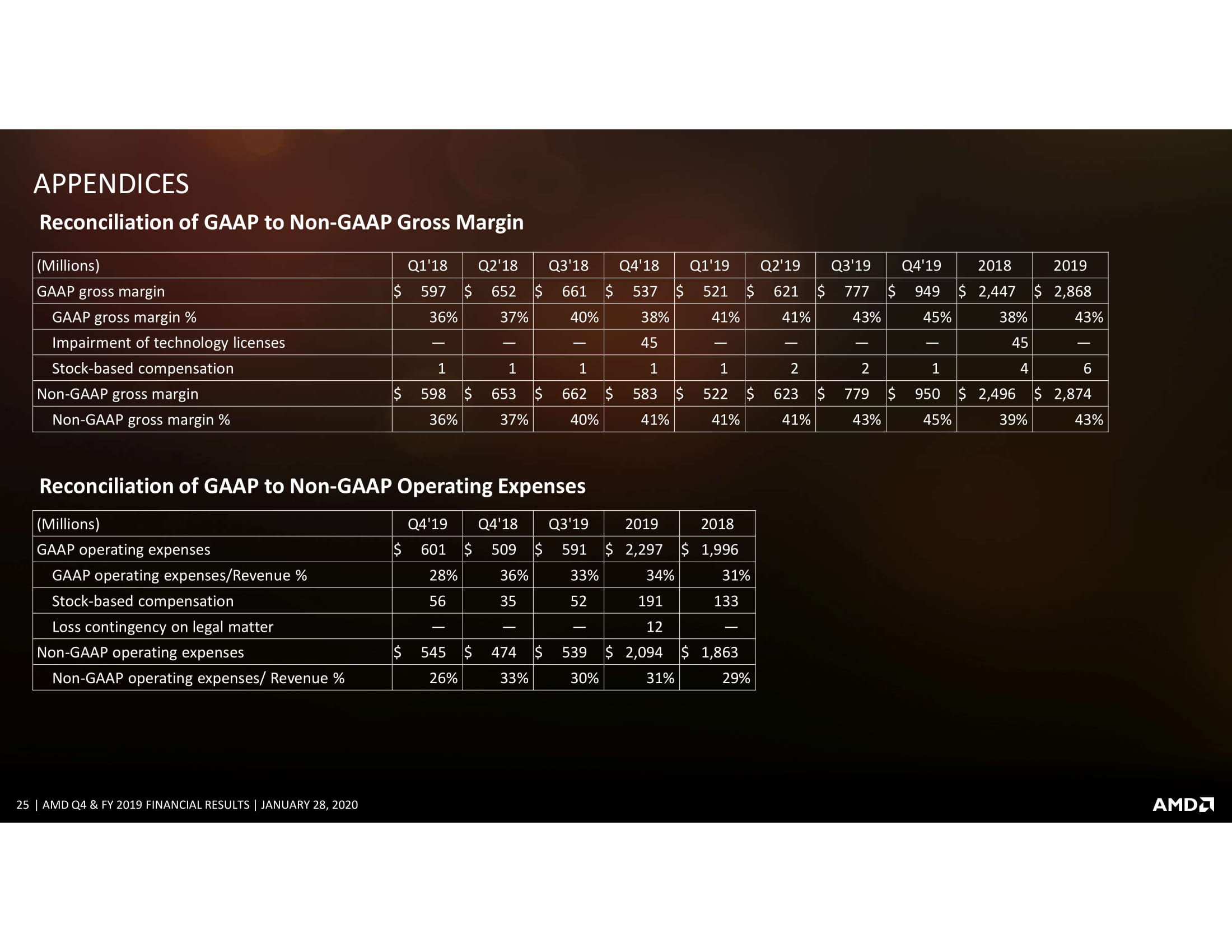

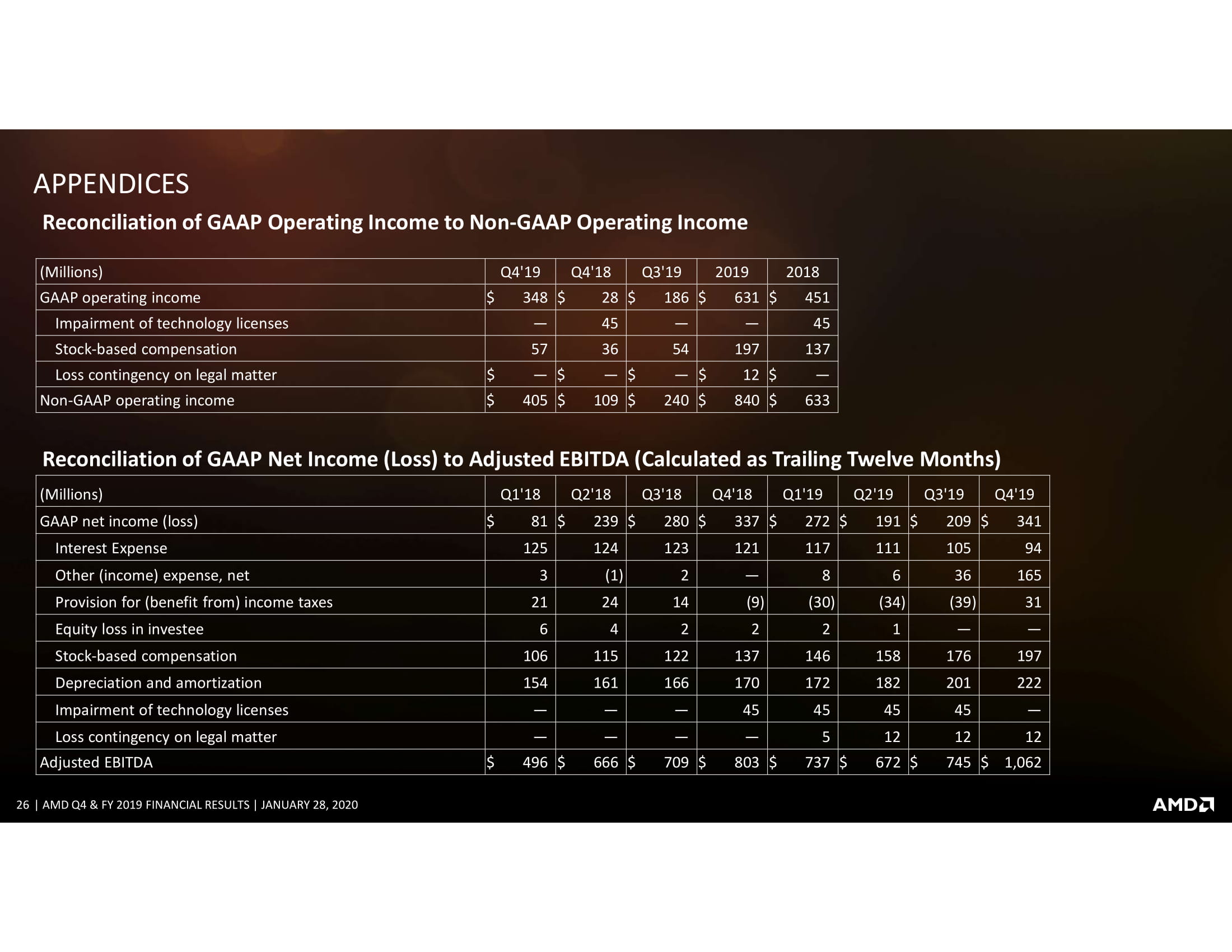

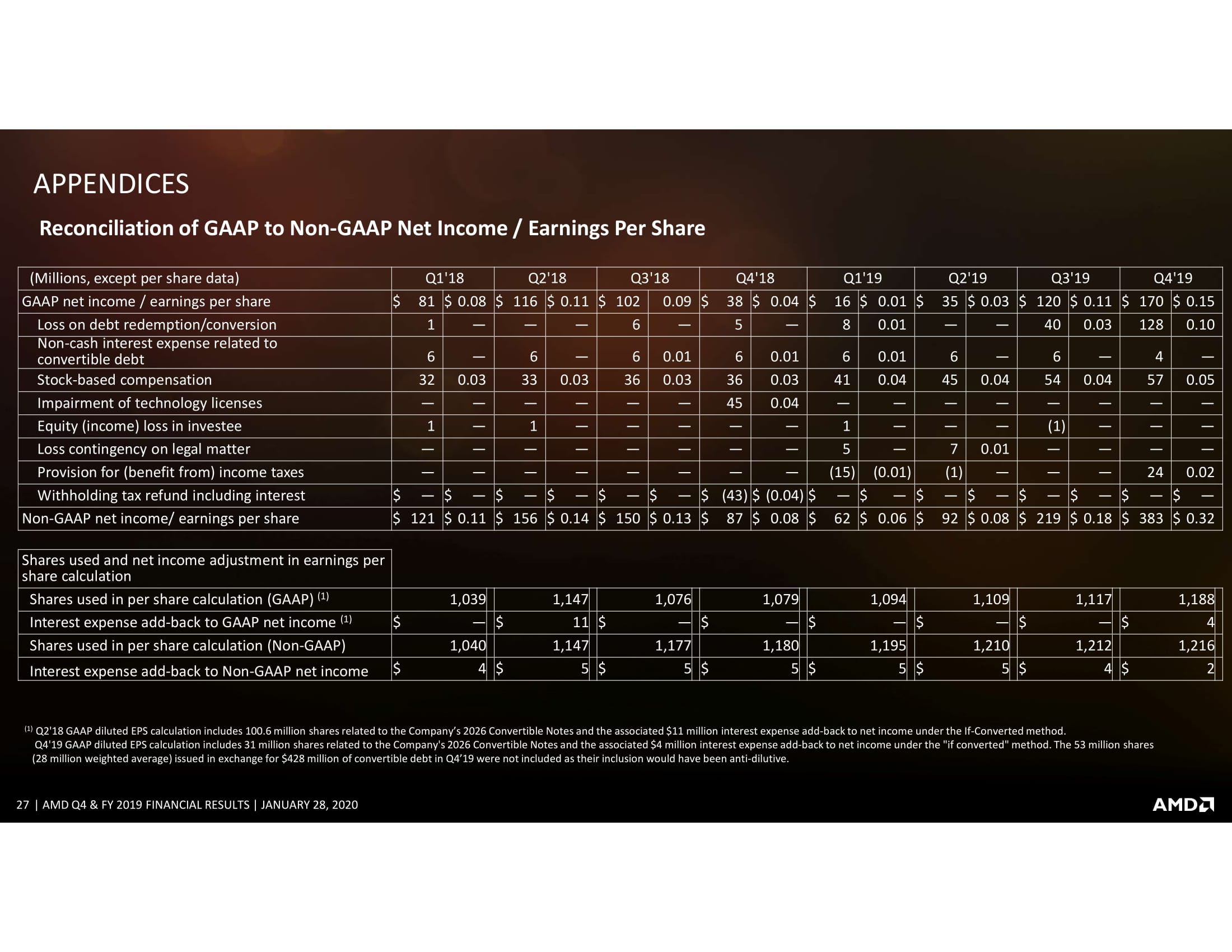

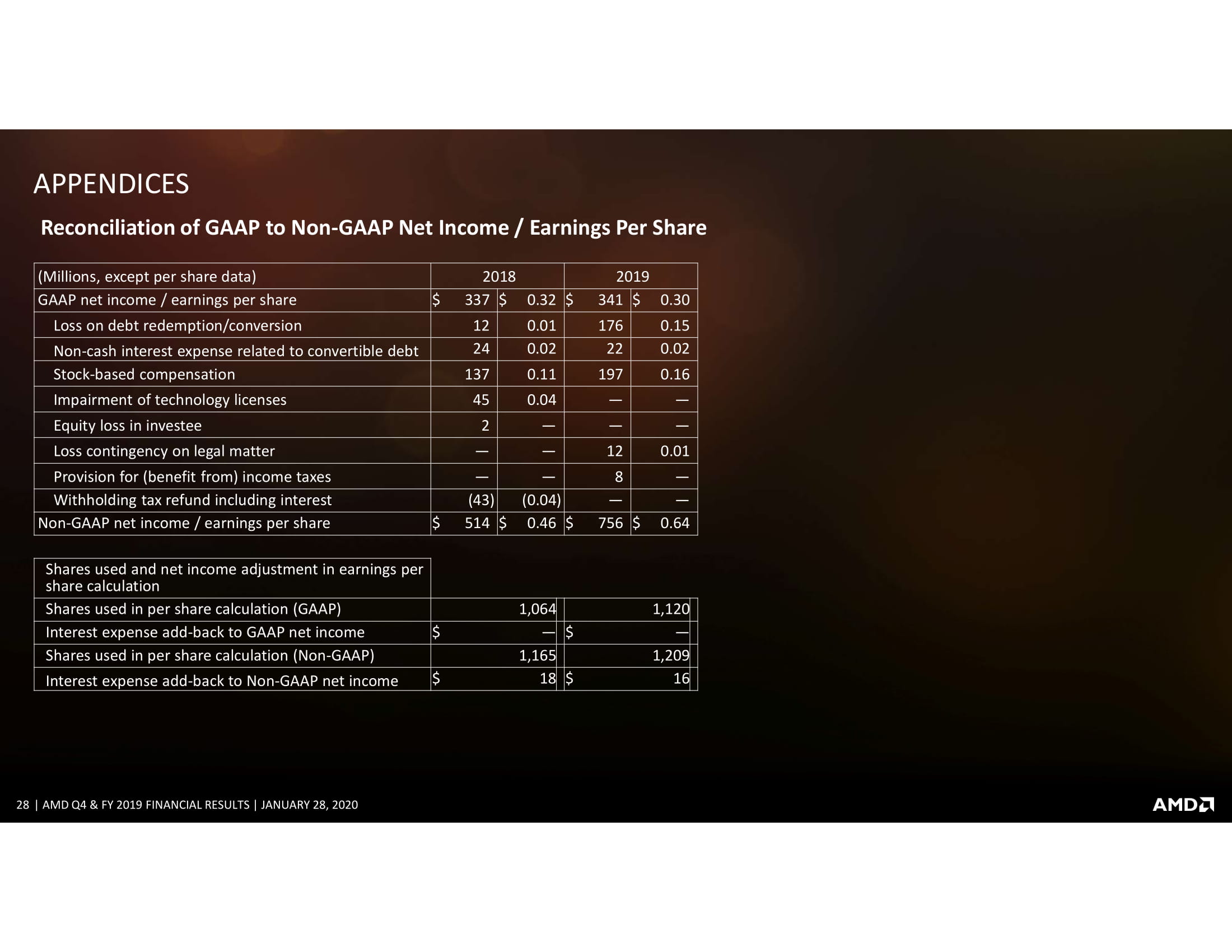

AMD also made solid progress on the margin front as it enhances its profitability. Gross margins increased from 38% in 2018 to 43% in 2019, including a record 45% margin for the fourth quarter. AMD generated $170 million in profits during the quarter, a sharp increase over $45 million a year ago, and a total of $341 million during 2019.

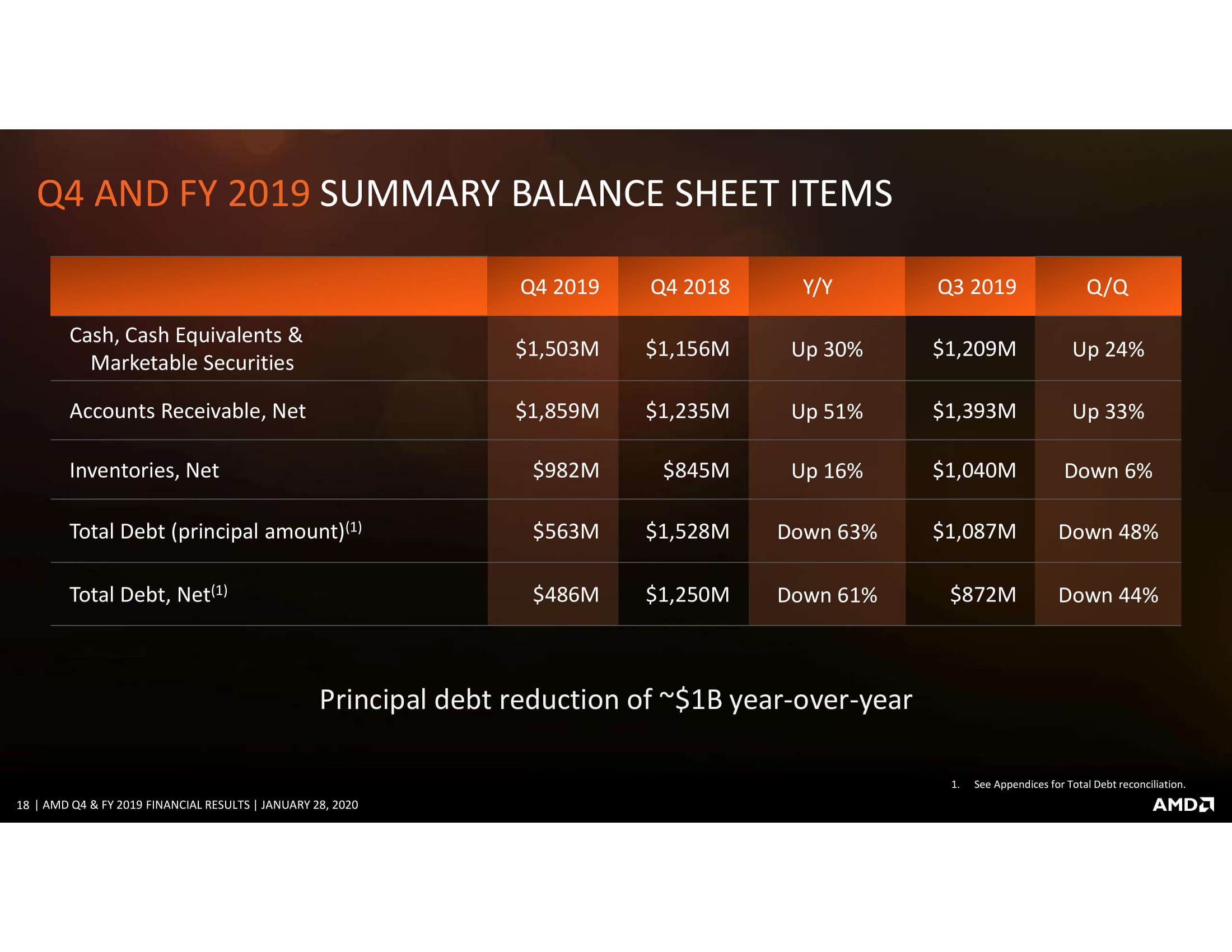

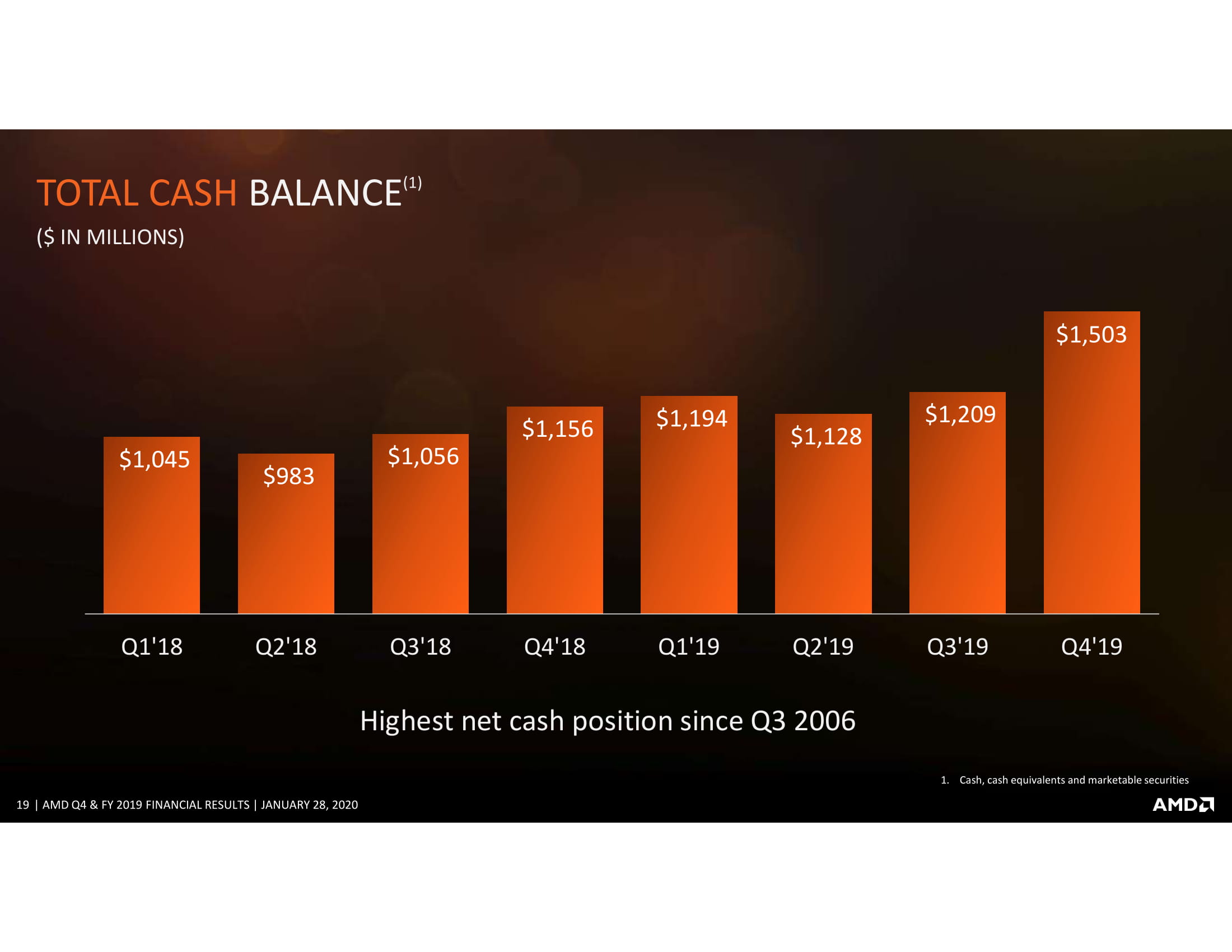

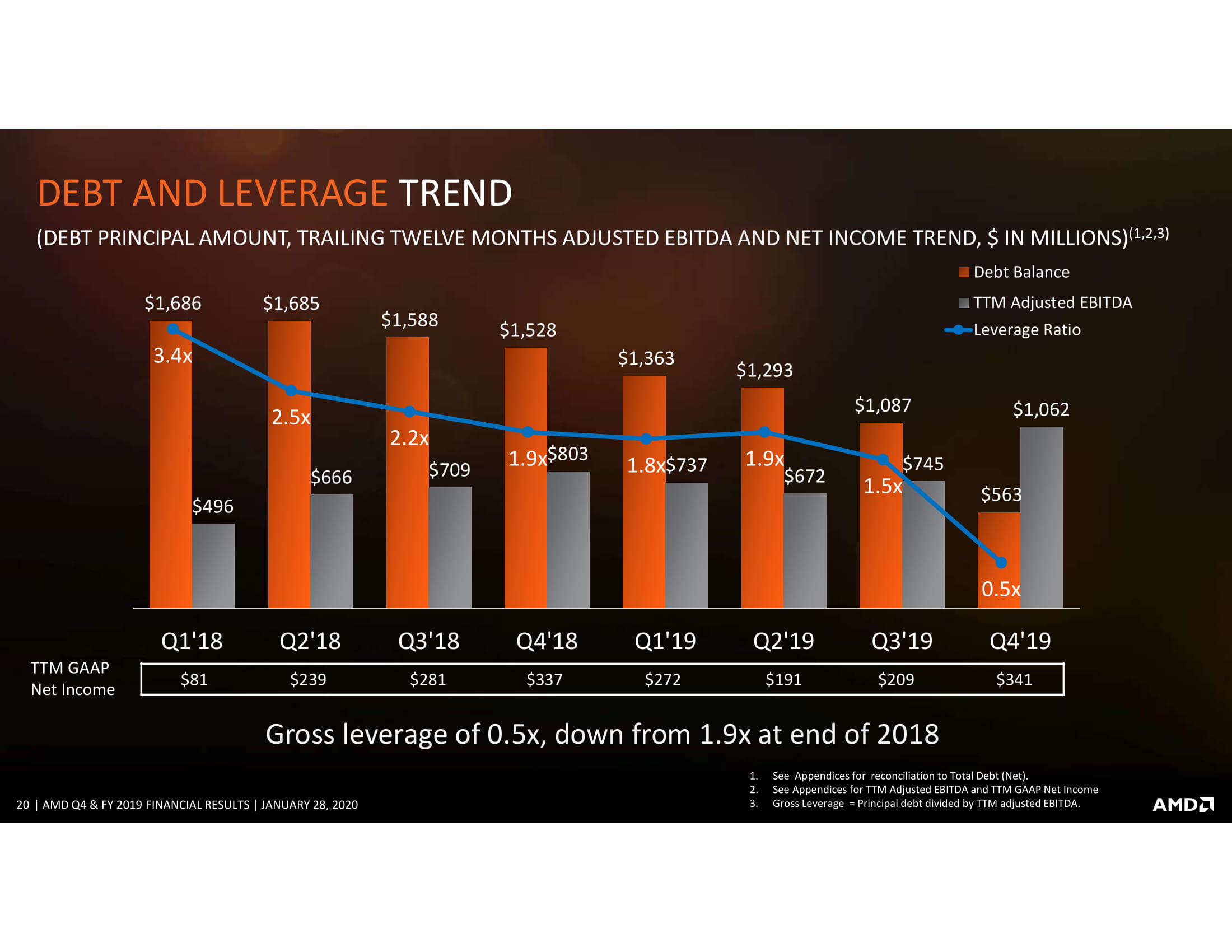

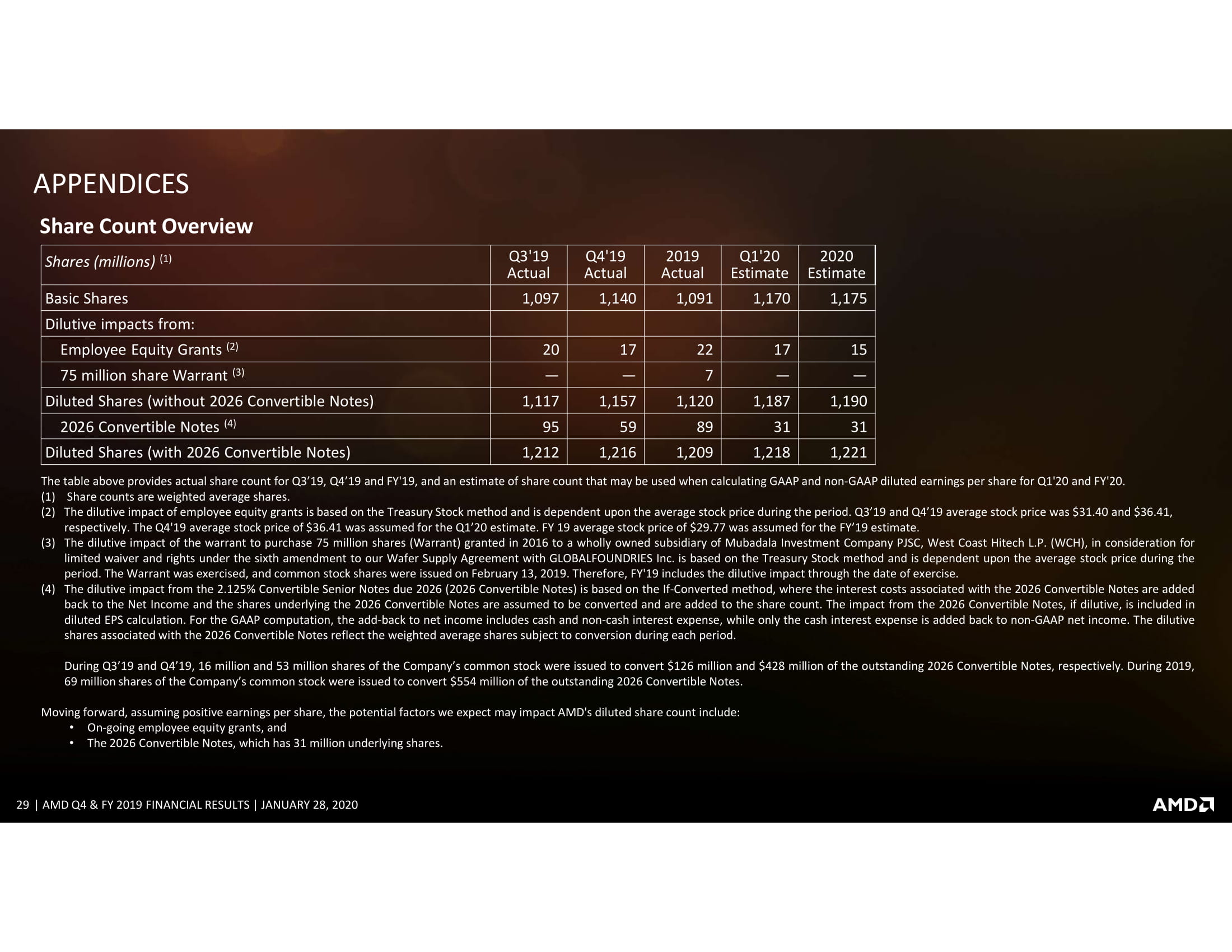

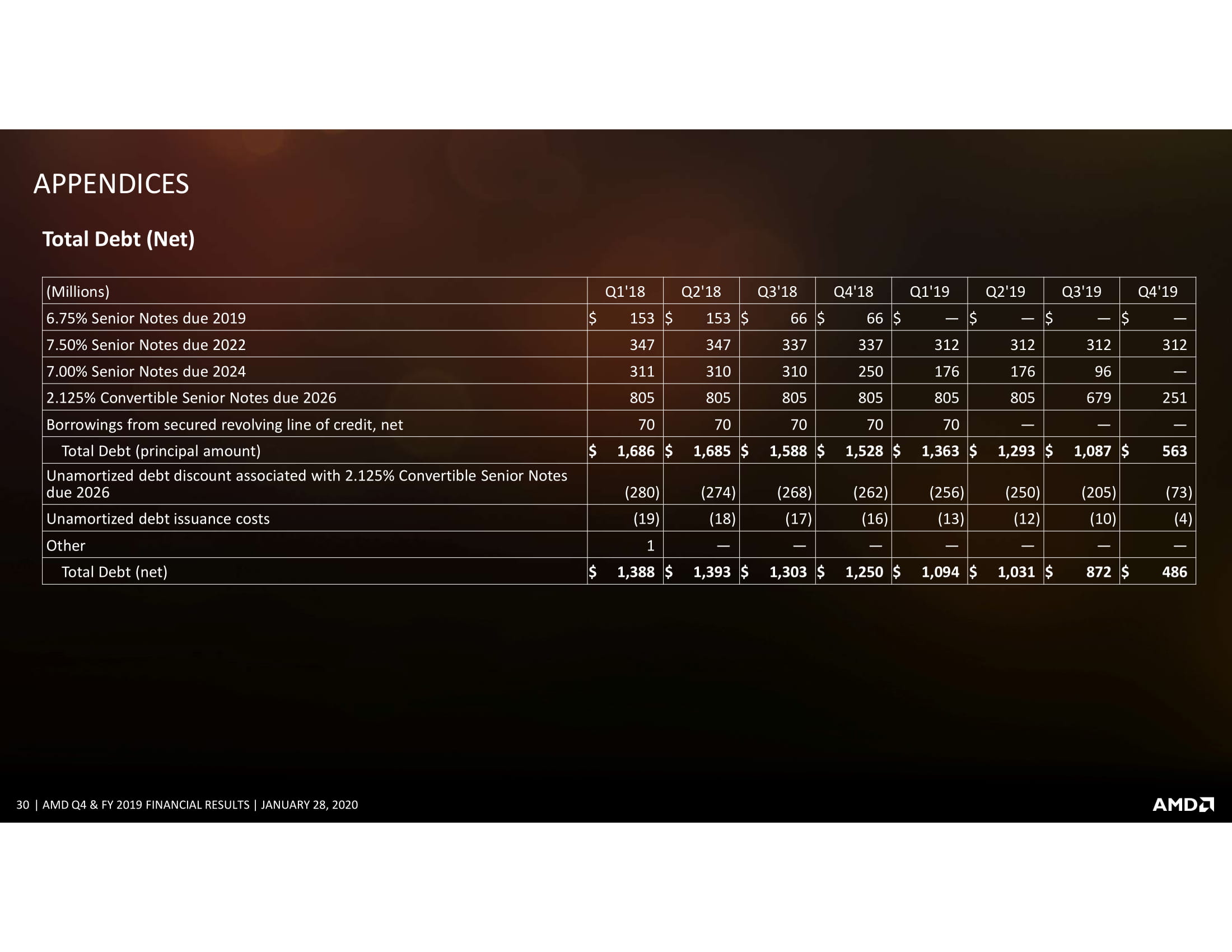

AMD also reduced its debt by 50% during 2019 and has $1.5 billion in net cash on hand, the highest since 2016. That's a massive change from its $4.5 billion in debt ten years ago.

For 2020, AMD projects a 45% gross margin and a 30% increase in revenue. AMD said that, removing its semi-custom products from the mix, its other businesses grew over 20% during 2019 (including EPYC), and the company expects the same trend for 2020.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

escksu Looks very good. Debt gone down almost 2/3 compared to a year ago!! Things are looking very good for AMD right now.Reply

But its not yet time for celebrations. We all seen how a single bad product (Bulldozer) can destroy all the hard work. So AMD must maintain the momentum. -

bit_user Reply

I think the more likely reversal of fortunes will come on the back of Intel's 7 nm EUV process and then as China stops buying outside tech and the cloud shifts towards RISC V. That could all happen over the course of the next 3-5 years.escksu said:But its not yet time for celebrations. We all seen how a single bad product (Bulldozer) can destroy all the hard work. So AMD must maintain the momentum.

Of course, AMD could certainly jump on the RISC V bandwagon, as well, but they won't have quite the advantages they enjoy in the x86 world.

I also wonder if AMD will ever give up on AI, since they've always been a day late and a dollar short. -

calken Also, RISC V would allow NVidia to enter the CPU market.Reply

Wouldn't surprise me if they already had working silicon. After a quick google:

https://www.linkedin.com/jobs/view/senior-risc-v-cpu-architecture-engineer-at-nvidia-1411541499/?trk=jobs_job_title -

calken Replyescksu said:Looks very good. Debt gone down almost 2/3 compared to a year ago!!

The stability of the company is gradually improving. No high risk strategies, wise use of resources and some excellent products in their stack. -

jimmysmitty Replyescksu said:Looks very good. Debt gone down almost 2/3 compared to a year ago!! Things are looking very good for AMD right now.

But its not yet time for celebrations. We all seen how a single bad product (Bulldozer) can destroy all the hard work. So AMD must maintain the momentum.

It wasn't just one bad product. K10 (Phenom) had a bad launch with a product that didn't meet performance expectations, clock speeds and the TLB bug which affected servers more than consumers and at the time servers was where AMD made its money. It also didn't help that Intel was swinging hard with better performing and value products like Core 2. They also overpaid for ATI and at the time had only a single FAB to produce products which hurt their ability to keep supply channels full.

Phenom II corrected a lot of issues with Phenom but it still was not competitive with Intels offerings.

Bulldozer was just the massive kick to AMD while they were down.

bit_user said:I think the more likely reversal of fortunes will come on the back of Intel's 7 nm EUV process and then as China stops buying outside tech and the cloud shifts towards RISC V. That could all happen over the course of the next 3-5 years.

Of course, AMD could certainly jump on the RISC V bandwagon, as well, but they won't have quite the advantages they enjoy in the x86 world.

I also wonder if AMD will ever give up on AI, since they've always been a day late and a dollar short.

I would think they wouldn't give up on AI and likely embrace it as its a pretty big emerging market. Even Intel has been pushing it and their 10th gen is supposed to have built in acceleration for AI. -

bit_user Reply

They make embedded SoC's with ARM cores, currently, and are using RISC V as low-level controllers, in their GPUs. So, if they're not just continuing work on the controllers, then maybe they're trying to replace the ARM cores with it.calken said:Also, RISC V would allow NVidia to enter the CPU market.

Wouldn't surprise me if they already had working silicon. After a quick google:

https://www.linkedin.com/jobs/view/senior-risc-v-cpu-architecture-engineer-at-nvidia-1411541499/?trk=jobs_job_title

I doubt Nvidia will try to enter the fairly cut-throat CPU market. Be careful about what conclusions you draw from "a quick google". -

bit_user Reply

It's a tempting market, which is why everyone is going after it. AMD just lacks the focus, and has been building products that seemed to compete with Nvidia's previous generation, for a few years now. Yet, we might already be moving beyond the era where GPUs can really compete on AI.jimmysmitty said:I would think they wouldn't give up on AI and likely embrace it as its a pretty big emerging market. Even Intel has been pushing it and their 10th gen is supposed to have built in acceleration for AI.

Intel is going after AI with more than just GPUs. They have bought at least 3 companies that make purpose-built AI accelerators, in the past 4 years, not counting Mobileye. -

calken Replybit_user said:Be careful about what conclusions you draw from "a quick google".

I never drew any conclusions, I merely provided a single data point and expressed that NVidia's attitude to markets in the semiconductor space wouldn't cause me any shock. -

jimmysmitty Replybit_user said:It's a tempting market, which is why everyone is going after it. AMD just lacks the focus, and has been building products that seemed to compete with Nvidia's previous generation, for a few years now. Yet, we might already be moving beyond the era where GPUs can really compete on AI.

Intel is going after AI with more than just GPUs. They have bought at least 3 companies that make purpose-built AI accelerators, in the past 4 years, not counting Mobileye.

I am sure FPGAs will do to GPUs what ASICs did to GPUs for bitcoin mining, make them useless.

I do agree AMD doesn't have the focus but also don't have the funds to put into it. Even with their sudden reemergence to a profitable company they still make very little in comparison to Intel. Nvidia is not a massive profit monster like Intel but they have one focus, GPUs, unlike AMD that is attacking on two fronts.

In all honesty it might help AMD to split off or sell RTG and just focus only on CPUs and HPC markets and let RTG compete with Nvidia and soon Intel. -

bit_user Reply

I'm not. If a GPU is a good fit for what you want to do, then a FPGA can actually be worse. This is evident by recent top-end FPGAs not even reaching the performance of Nvidia Turing GPUs, much less the power-efficiency, on certain AI tasks.jimmysmitty said:I am sure FPGAs will do to GPUs what ASICs did to GPUs for bitcoin mining, make them useless.

This makes no sense. Without GPUs, how would they get console design wins? How would they compete in the thin, light, and low-cost laptop markets (i.e. where you don't normally have a dGPU)? How would they compete in the SFF desktop market, which is also dominated by iGPUs?jimmysmitty said:In all honesty it might help AMD to split off or sell RTG and just focus only on CPUs and HPC markets and let RTG compete with Nvidia and soon Intel.

If you look at Google's Stadia platform, it seems clear they're using both EPYC CPUs and VEGA GPUs. If AMD didn't have both to offer as a bundle, maybe they wouldn't have won the contract. GPU-compute is instrumental, in HPC, and therefore AMD's GPUs were probably an indispensable part of their bid for the upcoming DoE supercomputer (I forget what it's called).

Finally, if you step back and look at how Intel is rushing into the GPU market, it makes even less sense for AMD to step back from it.

All I said was they should quit burning die area and valuable Engineering & QA time on putting AI in their GPUs. They were always second-tier, not least because their software support always lagged. Now, they look set to shift into 3rd tier, as an AI provider.