AMD Rejoins the Fortune 500

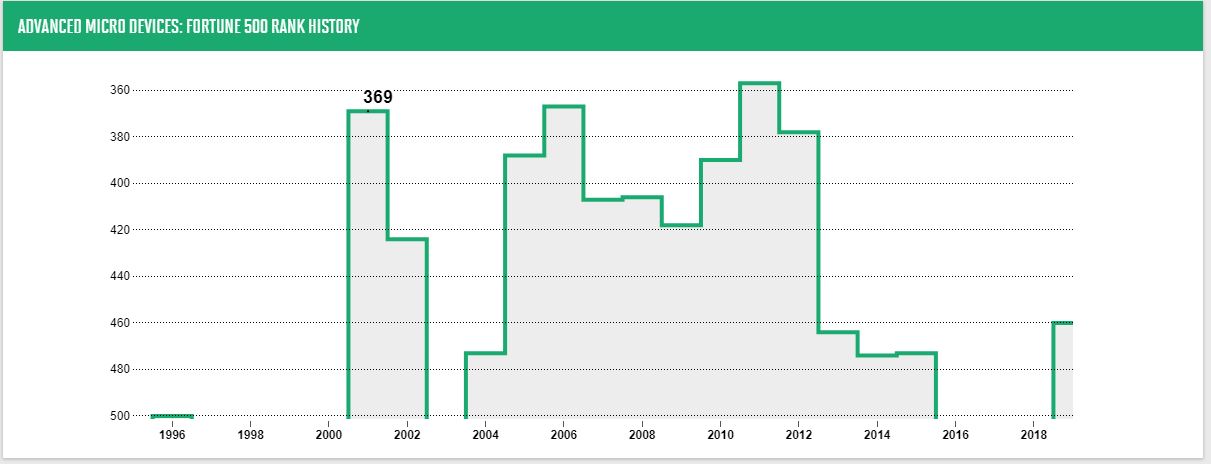

AMD has been on the Fortune 500 for a total of 26 of its 50 years, but it dropped off the list back in 2015. As enthusiasts know, the Zen microarchitecture that powers AMD's Ryzen chips has revitalized the company, bringing it back from the brink of bankruptcy and now helping propel the company back onto the Fortune 500 list at #460.

AMD's jump back to the Fortune 500 (which is based on gross revenue) adds to its other recent accomplishments, like joining the Nasdaq-100 last year and being named the top-performing stock on the S&P in 2018.

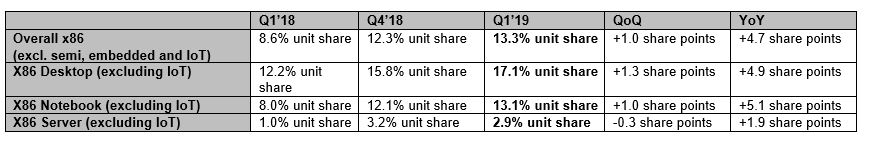

AMD continues to make steady headway in nearly all segments of its business, with its recent sound financial performance bolstered by news that the company continues to chew away market share from Intel in the desktop PC and laptop markets. This sixth straight quarter of growth was marred by a slight downturn in server share that amounted to a 0.3% quarter-over-quarter decline that AMD attributes to general 'lumpiness' in sales after a strong Q4.

| Row 0 - Cell 0 | 3Q16 | 4Q16 | 1Q17 | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | 3Q18 | 4Q18 | 1Q19 |

| AMD Desktop Unit Share | 9.1% | 9.9% | 11.4% | 11.1% | 10.9% | 12.0% | 12.2% | 12.3% | 13% | 15.8% | 17.1% |

| Quarter over Quarter (QoQ) (Percentage Points) | Row 2 - Cell 1 | +0.8 | +1.5 | -0.3 | -0.2 | +1.1 | +0.2 | +0.1 | +0.7 | +2.8 | +1.3 |

It's also possible that the slowing of first-gen EPYC uptake stems from customer anticipation for the next-gen 7nm EPYC Rome parts, which will deliver market-leading core counts and perhaps power advantages. AMD is already making impressive headway into the high-margin HPC market with its EPYC Rome processors, and it also has announced it will power the world's fastest supercomputer with its next-next-gen CPUs (presumably Milan) and its 7nm Radeon Instinct graphics cards.

These advances are likely just paving the way for more to come as the company, which just celebrated its 50th anniversary, is on the cusp of releasing its new Ryzen 3000 processors based on the 7nm process. These new chips will give the company its first process lead over Intel in its history.

Overall AMD seems to be firing on all cylinders on the CPU side of the house, but its soon-to-be-released 7nm Navi GPUs will need to be more competitive than its current lineup to help the company regain its footing against Nvidia in the gaming market.

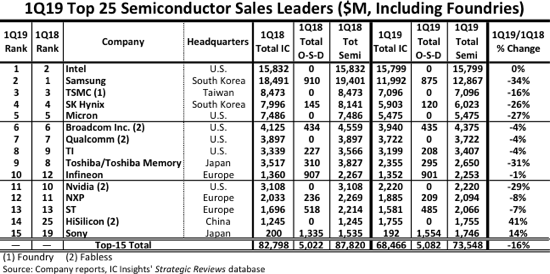

But there's no doubt that AMD is competing well against the heavyweights of the industry. Intel recently retook the lead from Samsung in the semiconductor market (based on revenue), as outlined in the IC Insights chart above.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As you can see, several fabless companies (companies that don't actually produce their own chips), like Nvidia and Qualcomm, are on the list, but the chart is most interesting based on the fabless company that isn't listed: AMD.

Considering the massive disparity in AMD's revenue, which pulled in $6.48 billion in 2018, compared to Intel and Nvidia, which raked in $70.8 billion and $9.71 billion, respectively, the company's ability to field competitive architectures on a comparatively shoestring budget is impressive.

Overall, it's hard to overstate the impact AMD's Zen architecture has had on the company, but now the future is Zen 2 and the 7nm process, both of which we expect to learn much more about during next week's Computex trade show. We're sure Intel isn't sitting idle either, so we should expect big announcements from both companies at the show.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.