AMD Posts Strong Results on Robust EPYC Sales As Consumer CPU Sales Disappoint

AMD posts record $23.6 billion full year 2022 revenue.

AMD published its financial results for the fourth quarter and full year of 2022. Due to strong demand for AMD's data center EPYC processors, the company posted an all-time record revenue for the full year. Meanwhile, sales of consumer CPUs and GPUs declined significantly in the fourth quarter, which clearly limited the company's growth in Q4.

Record Year, Not-So-Record Quarter

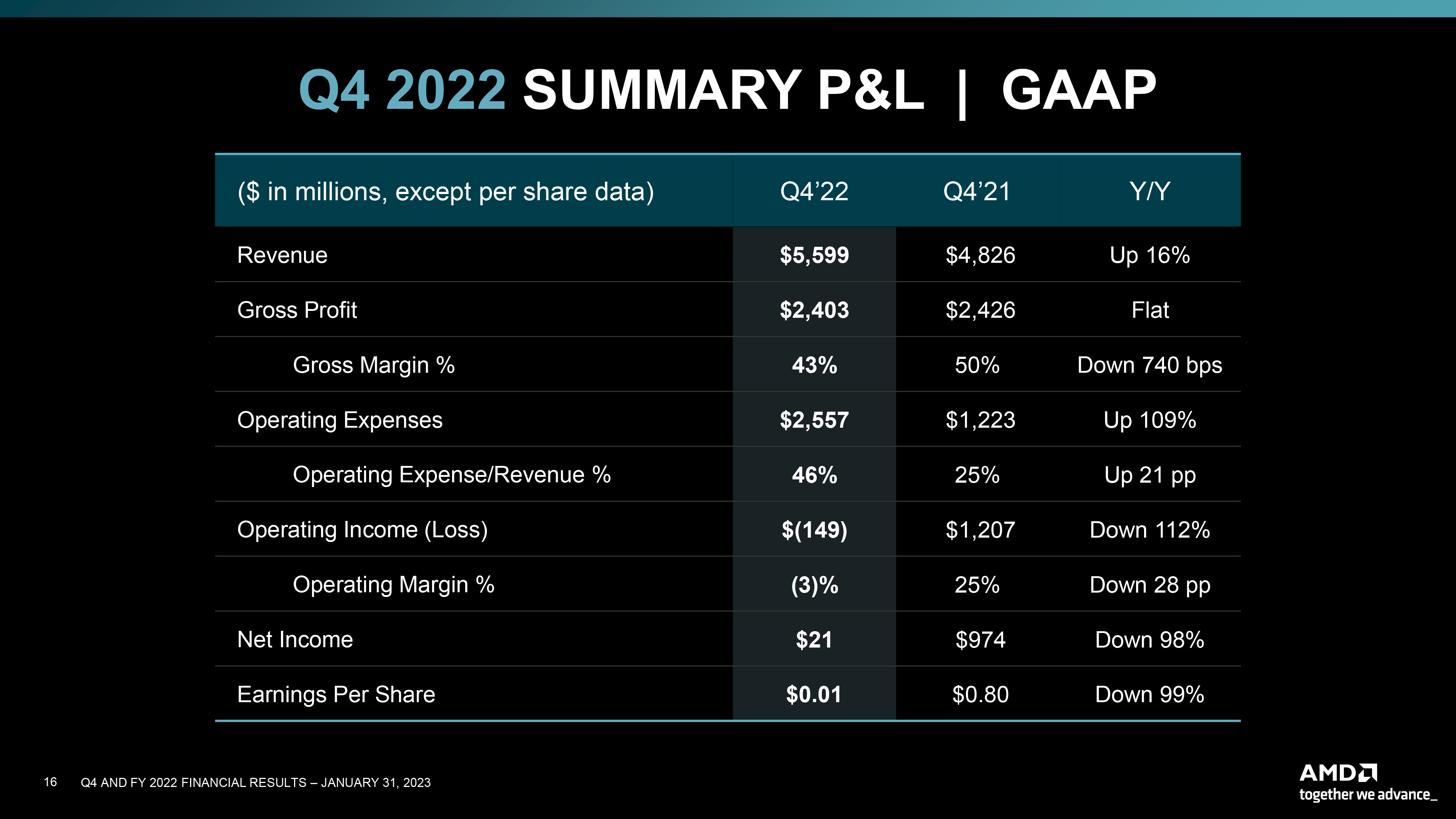

AMD's Q4 2022 revenue totaled $5.6 billion, up 16% year-over-year and flat with Q4 2022. Meanwhile, the company's net income collapsed to $21 million, 98% lower than in the same period a year ago. As for gross margin, it dropped to 43% from 50% in Q4 2021.

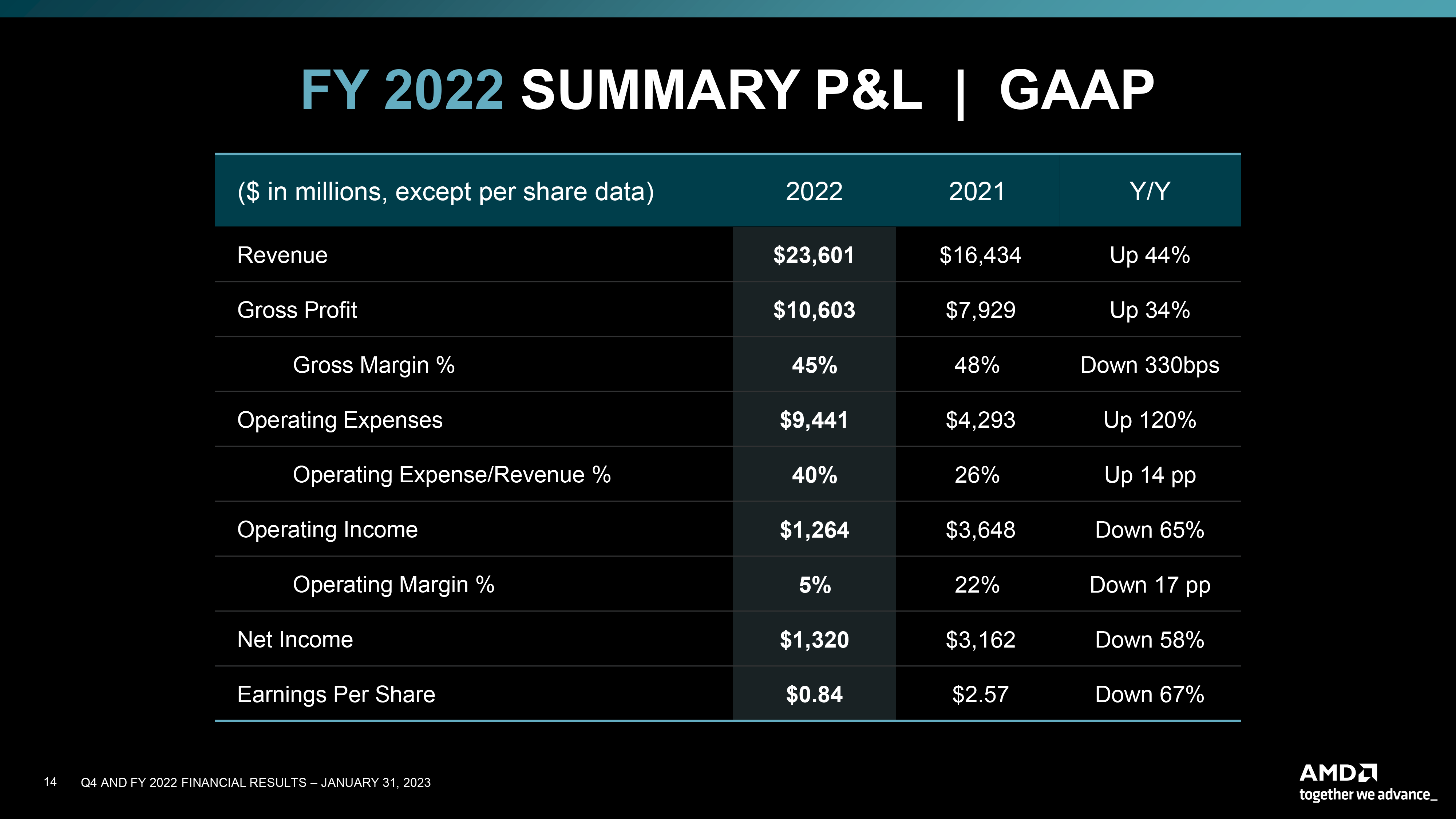

As for the full year 2022, AMD earned $23.601 billion, up a whopping 44% from $16.434 billion in 2021. This was the highest yearly result that AMD has ever posted, yet it could have been higher if demand for consumer processors and graphics cards had been stronger in the third and fourth quarters.

"2022 was a strong year for AMD as we delivered best-in-class growth and record revenue despite the weak PC environment in the second half of the year," said AMD Chair and CEO Dr. Lisa Su. "We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model. Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio."

Because of softening PC market, the year 2022 was somewhat of a mixed bag for AMD since demand for its products met expectations in the first half, but demand for consumer PC hardware dropped sharply in the second half, affecting the full-year results.

Data Center Hardware on the Rise, Consumer Hardware Sales Craters

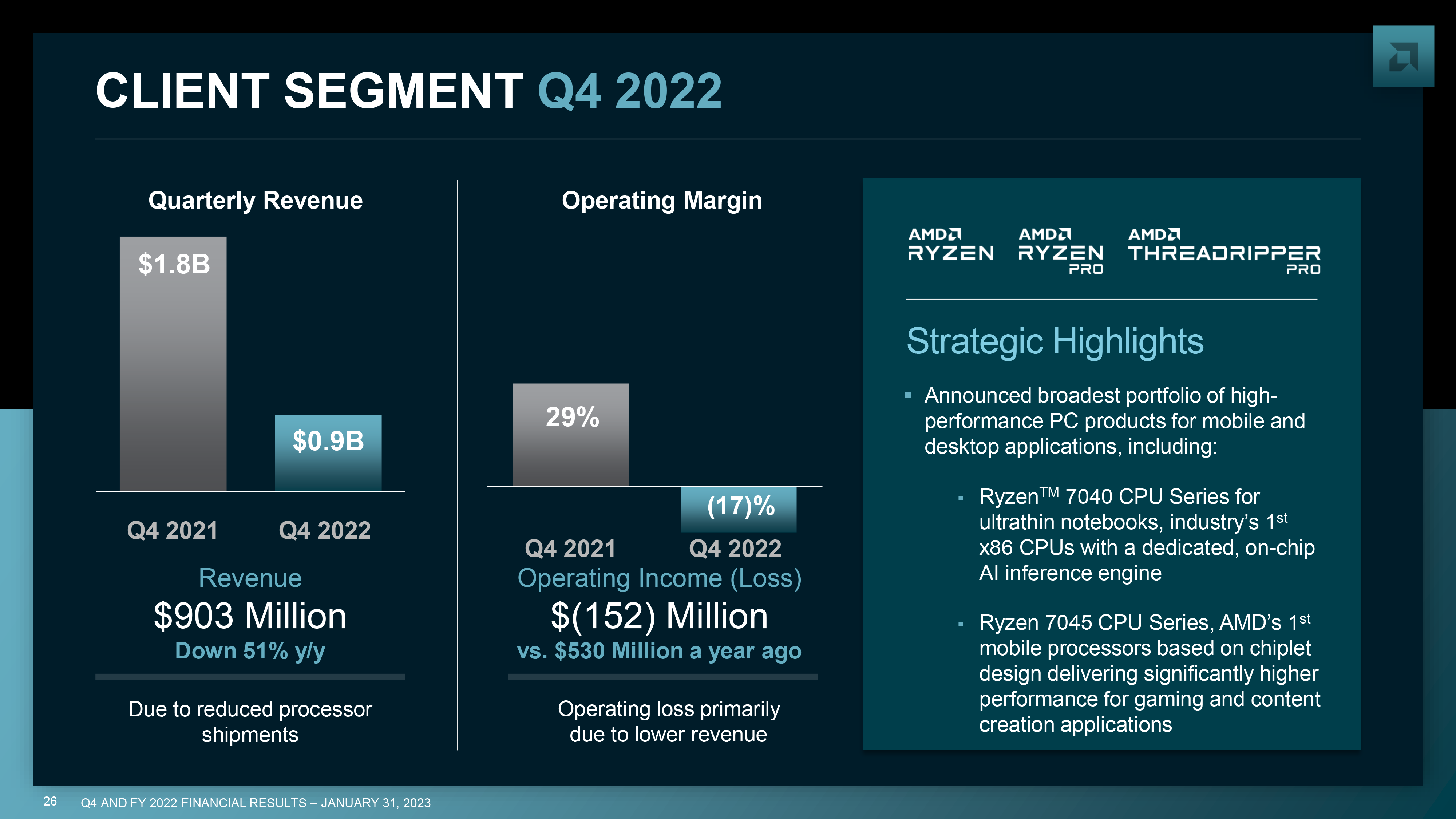

Consumer CPUs and chipsets used to be AMD's bread and butter some five or six years ago, but that is no longer true. In Q4, the revenue of AMD's Client Computing Business dropped to $0.903 billion, or 51% year-over-year. The business unit lost $152 million, whereas in the same quarter a year before, it posted a $530 million profit.

Perhaps the most alarming detail about AMD's consumer CPU business is that in a quarter when the company introduced its brand-new Ryzen 7000-series processors, the average selling prices of its CPUs were flat year-over-year, suggesting tepid sales of the latest parts.

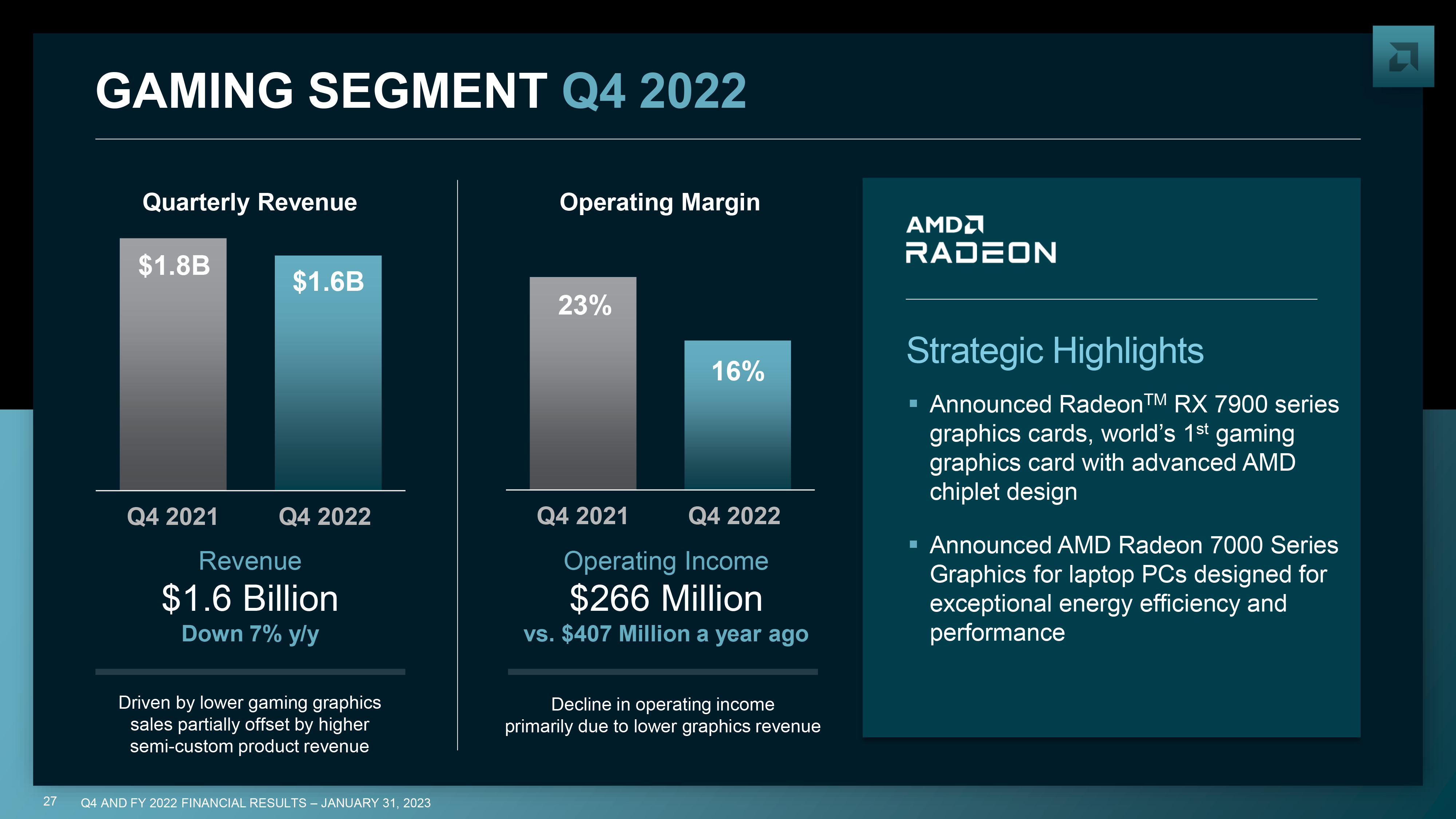

When it comes to AMD's Gaming Business, there was a mixed bag again. On the one hand, the unit earned $1.6 billion in revenue (down 7% year-over-year) and $266 million in profits (down from $407 million in Q4 2021). But on the other hand, this strong result was achieved primarily because AMD managed to sell loads of system-on-chips for consoles, whereas the sales of its graphics processors for discrete desktop PC GPUs were down year-over-year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

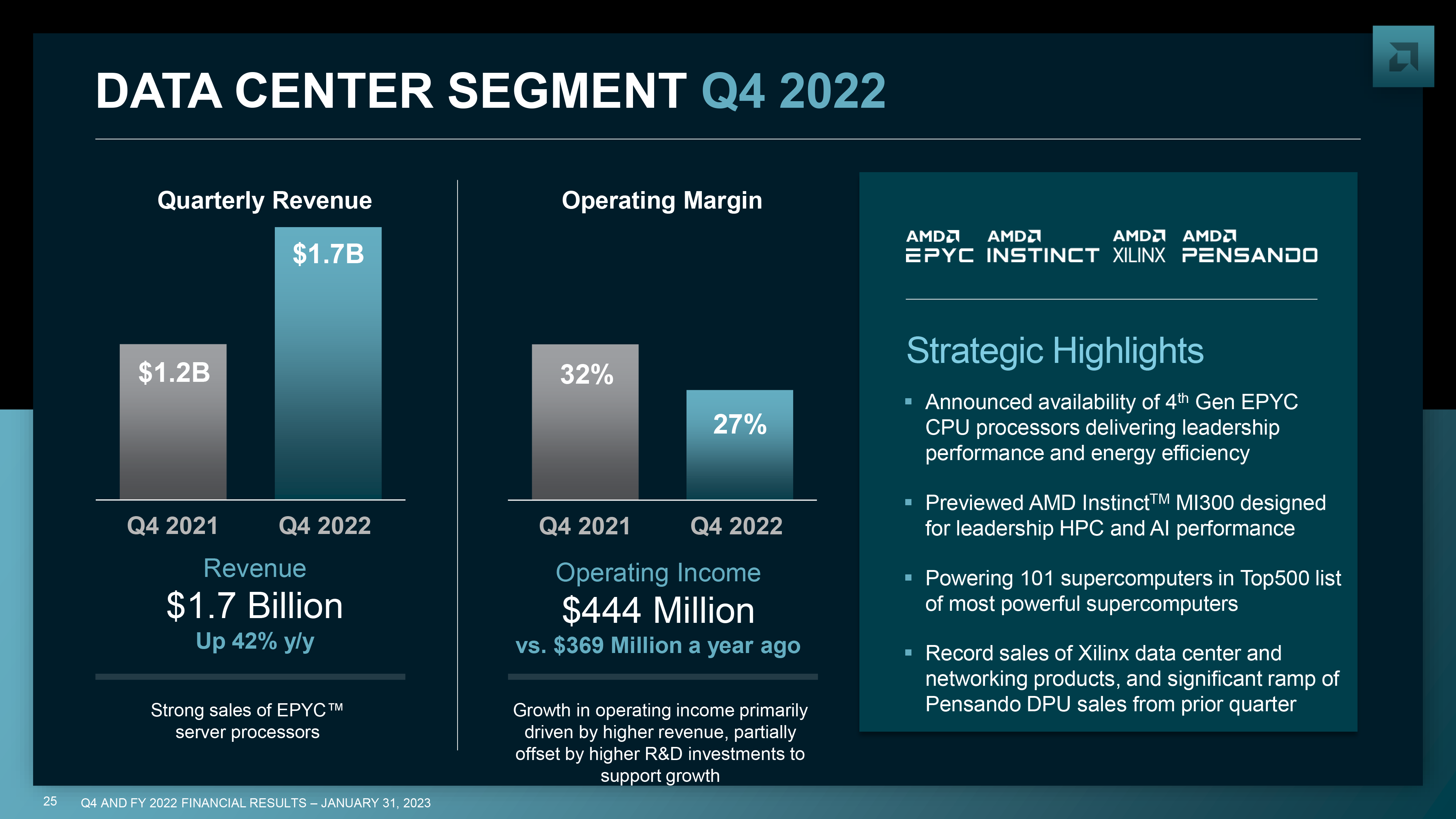

Having earned $1.7 billion in revenue, an increase of 42% year-over-year, AMD's Datacenter Business was the main source of income for the company in Q4 2022, outstripping the Gaming and Embedded businesses. Despite lower margins (27% in Q4 2022 vs 32% in Q2 2022), the group's operating income totaled $444 million, up from $369 million in the same period a year before.

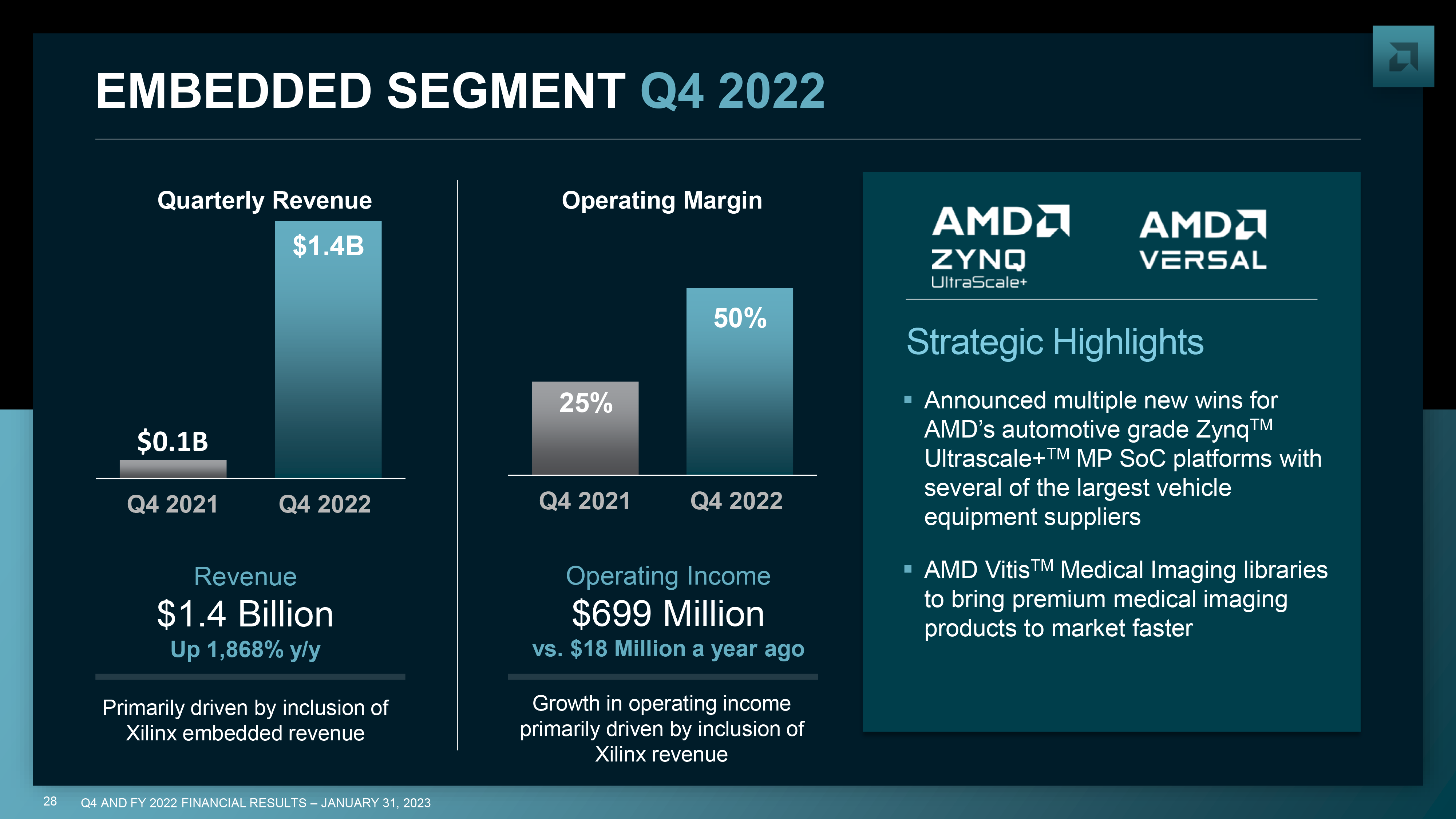

As for AMD's Embedded Business — which mostly sells products designed by Xilinx and some chips designed by AMD — posted earnings of $1.4 billion and earned $699 million in profits, marking another bright spot in AMD's financial report.

Cautious Outlook for Q1, Lack of Outlook for Whole 2023

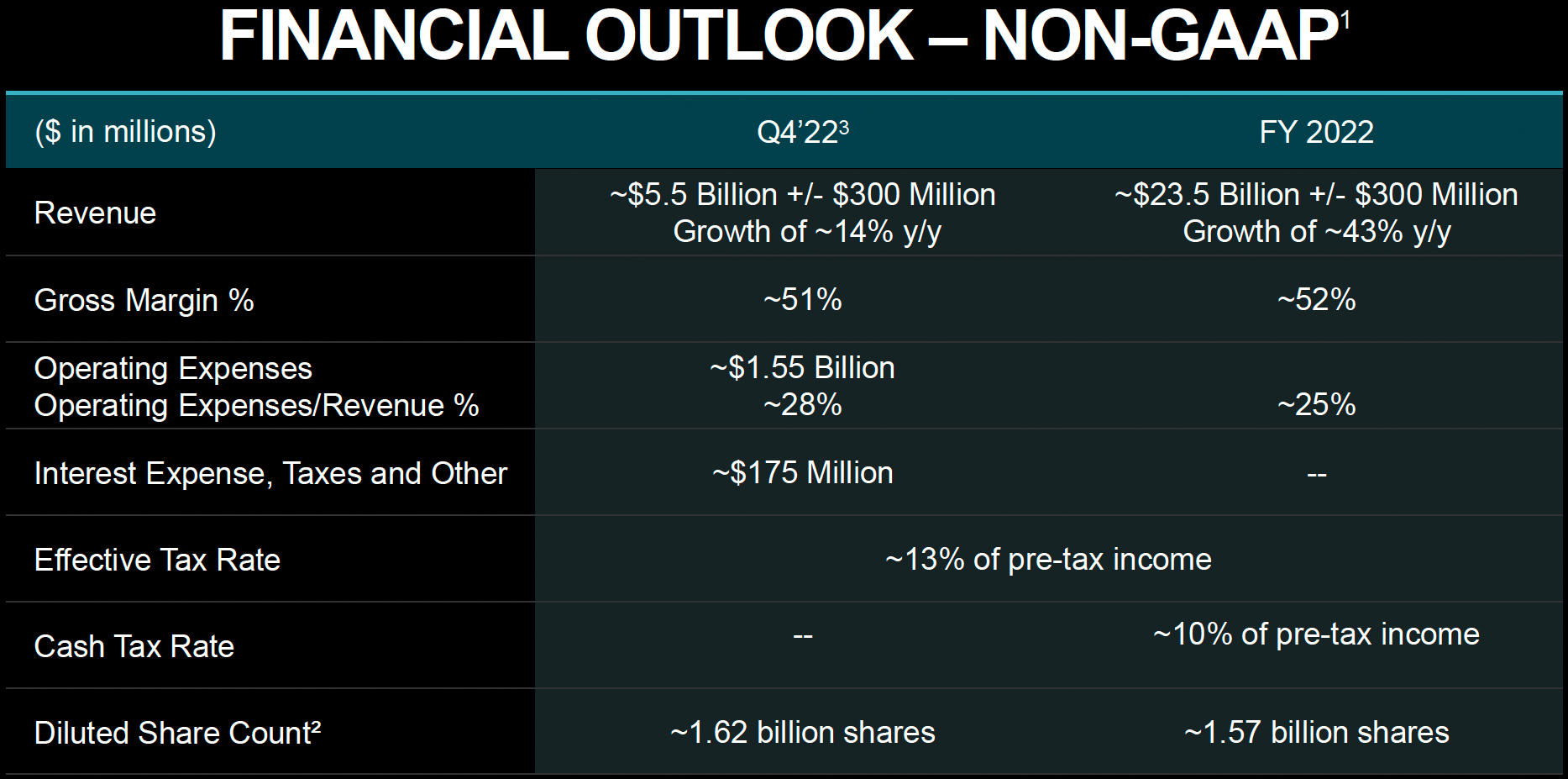

AMD expects its first-quarter revenue to be approximately $5.3 billion (±$300 million), a decline of about 10% YoY mainly because of lower consumer CPU and gaming GPU and SoCs sales. The company expects shipments of its data center solutions, such as EPYC CPUs and Pensando DPUs, FPGAs, and embedded products to continue increasing.

Meanwhile, just like some other high-tech companies, AMD didn't provide an outlook for the whole year due to a lack of proper visibility for the second half of 2023.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JamesJones44 Datacenter actually wan't that good. The revenue was good, but the gross margins missed expectations. Where AMD is really winning is with the Xilinx acquisition. The "embedded" segment (largely automotive and aerospace) killed it on all metrics. The embedded segment was more than 50% of their total profit while only being about 25% of their total revenue.Reply -

SSGBryan Expectations were a bit unrealistic. Everybody upgraded their systems during the pandemic, so for the most part, they don't actually need a new computer. People don't replace their pc systems every generation. If they do, it is normally around 5 years with a GPU upgrade inbetween.Reply

In my case, I went from a Ryzen 7 2700 to a Ryzen 5700x, nearly doubled performance. $199 and I didn't even need to replace the CPU cooler.

The upgrade wasn't a "have to have" - it was a nice to have, and it will extend my current system for at least 2 more years, if not more. -

kal326 Most everyone that hadn’t already upgraded was waiting out new chips and gpus. GPUs hit almost mid December for purchase. Chips and new boards hit earlier, but still weren’t compelling purchases either. Especially with 3D cache chips yet to be released. Also through in a looming likely recession and not surprised to see soft consumer demand.Reply -

hotaru251 i expect intel/nvidia/amd to all feel "lower than expected" for consumer market.Reply

Everyone recently upgraded during pandemic...and most ppl don't upgrade for many yrs. -

TechieTwo The economic recession in the U.S. and EU started at least 6 months ago. With 40 year record high inflation in the U.S., $5/gal. gas and $8 for a dozen eggs consumers simply have less discretionary income. With tens of thousands of tech job layoffs being announced almost daily by Microsoft, Apple, car makers, Intel and more it's inevitable that there will be significantly lower consumption because most unemployed workers don't make unnecessary purchases when they don't know when they will have a job again or how severe and long the economic recession will be. There is a snowball effect in all industries so expect a lot more lost jobs and drops in corporate revenue.Reply -

Amdlova The problem is windows 11, another problem is the really bad expecting for a great hardware every year. The pc master race is another pain. And the worst is the graphics price.... how to pay 1700 dollars for something will be obsolete next year? For an amd cpu you can get a Chinese board, 18 cores and 64 gb of ddr4. I got a Chinese 2696v3 cpu for 72 dollar without oc can match a 3700x with oc can match a 3900x 1/4 price and the heat? With a cheap air cooler is about 50 degree celcius on full load. MAN and have TONS OF CPU.Reply -

zecoeco AMD is probably the only tech company that didn't do a "mass layoff" and that is due to the positive financial reports.Reply

Xilinx acquisition was a really smart move by AMD. The chips business is not only for Desktops/Laptops/Data Center

The embedded market is very important and probably the only segment that will only continue growing for the machinery needs of different use and embedded systems. -

watzupken Investors expectation is generally unrealistic because they will only expect things to improve if not maintain. So the assumption is that companies will always make more or maintain profits. In reality, we know its not the case. In fact, the industry growth and high margins over the last few years are fueled by exceptional events that will come to an end. What we are looking at now is the same trend we saw pre-pandemic, I.e. a decline in demand for PC. So if we ate comparing the norm results vs exceptional results, then of course we should expect corrections.Reply -

Kamen Rider Blade Reply

Sadly, Investors are always blinded by greed and unrealistic beliefs about what can really happen in the market.watzupken said:Investors expectation is generally unrealistic because they will only expect things to improve if not maintain. So the assumption is that companies will always make more or maintain profits. In reality, we know its not the case. In fact, the industry growth and high margins over the last few years are fueled by exceptional events that will come to an end. What we are looking at now is the same trend we saw pre-pandemic, I.e. a decline in demand for PC. So if we ate comparing the norm results vs exceptional results, then of course we should expect corrections.

Their fantasy land ideas of endless profits & growth is what causes issues and needs to be massively corrected on a Global Scale.

They need a MASSIVE Attitude/Expectation adjustment.