AMD Stock Price Surpasses Intel's for First Time in 15 Years

AMD versus Intel: Who will win next week?

If you've been investing in Intel stock over the last few years, you've undoubtedly witnessed pretty significant growth. But if you've been investing in AMD, then you're probably even more chuffed right now. That's because AMD's stock price has just surpassed that of Intel, marking the first time this has happened since 2006.

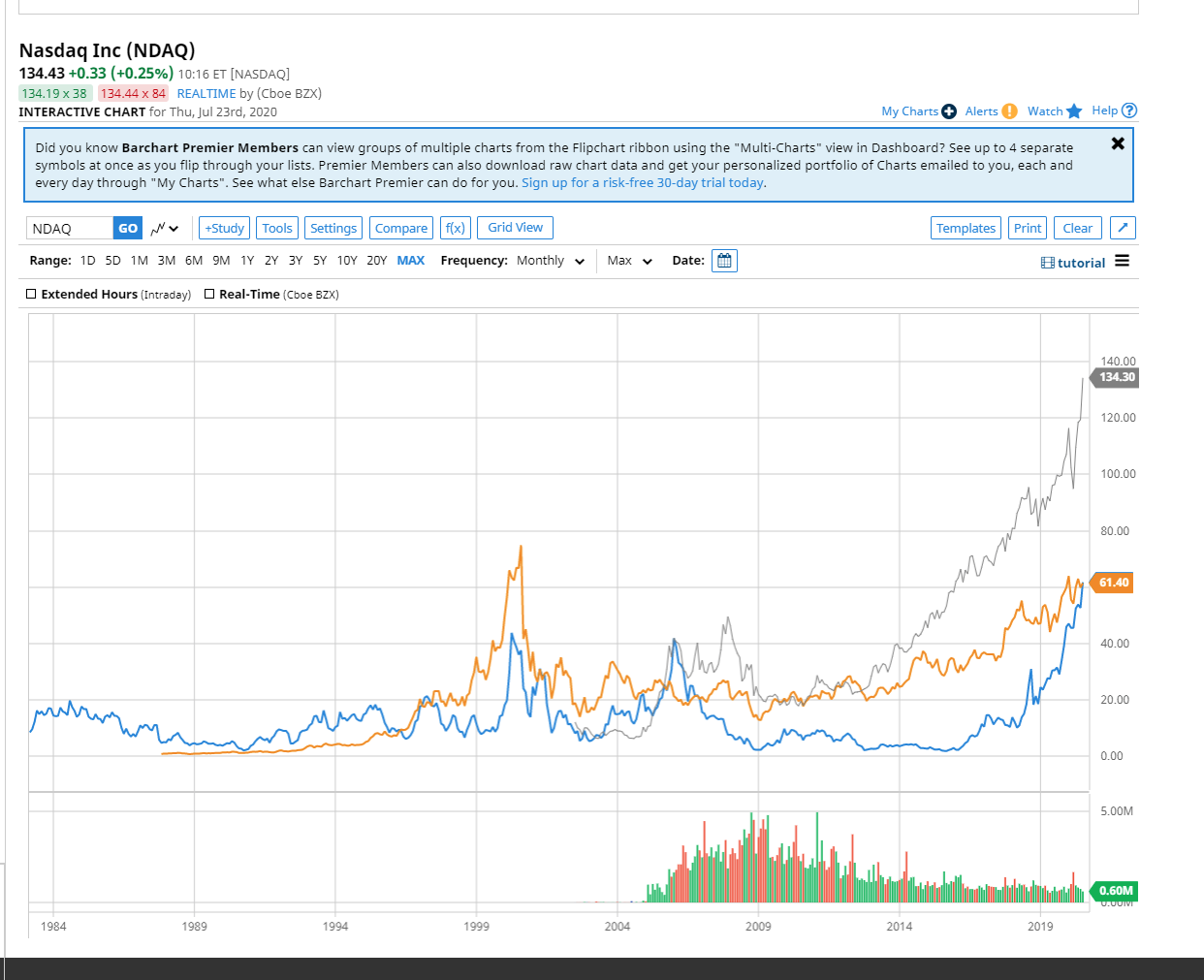

Currently priced at $61.79, AMD's stock price is just a hair more valuable than Intel's at $61.57 (7:45 am Pacific Time), though the two have been battling for the top spot over the last few hours. This comes after AMD broke its all-time stock price record at the start of this year.

Of course, it must be said that the stock price says nothing about the company's value. For that, you would need to multiply the stock price by the number of shares, and that's when things end up looking totally different.

AMD has a market cap of $72.43 billion USD, whereas Intel is far more valuable at $260.79 billion USD -- and that, again, doesn't say much about what the company is worth in actual assets.

What these figures do show is that there is quite a bit of optimism among investors right now, which isn't surprising given AMD's history. Ever since Lisa Su became the company's CEO, AMD has been growing tremendously. In fact, Su has been named one of the world's best CEOs.

One of AMD's primary driving forces right now is the Zen architecture at the heart of its Ryzen CPUs, which debuted in 2017 and has since been revised to Zen+ and Zen 2. The latter is currently dominating the market at the 7nm fabrication process, all while Intel is still trying to advance from 14nm with just a few products on the 10nm node.

It won't be long until AMD releases CPUs with its next revision of the Zen architecture, Zen 3. Two days ago, AMD confirmed that Zen 3 CPUs will launch this year. Next week, AMD will hold its earnings call, so we'll likely get an update from the company then.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Niels Broekhuijsen is a Contributing Writer for Tom's Hardware US. He reviews cases, water cooling and pc builds.

-

tennis2 Back in 2017-2018 I predicted this upward trend. Unfortunately, I wasn't in a financial position to put my money where my mouth was..... Deeply regret not getting into a 4x-5x gain.Reply -

King_V I did NOT predict it, but wondered if I should invest when Ryzen came out. But, I was gun-shy, so, here I am, in the same position you are.Reply -

A_jana I am not from finance background but what i understand about share market its all about influencing people .Reply

Here in this case its a obvious choice for investors why they gone invest in a back dated company who actually forgot to innovate.If this situation happed few more year then my prediction is that intel gone die from chip buisness like IBM. -

Deicidium369 Reply

LOL. With a 95x P/E ratio at AMD vs an 11x P/E at Intel - of course AMD will have a higher stock price - $7B/ year in revenues vs $75B in revenue is what matters. AMD is not larger than Intel - also doesn't mean that Intel is in trouble - they are about to introduce a full portfolio of new products, all of which will be market leaders. AMD's high PE is over exuberance from Wall Street - at some point AMD has to start to deliver to justify that sky high PE - if they don't they will be down to a $5-6/share stock commensurate with their anemic revenue.A_jana said:I am not from finance background but what i understand about share market its all about influencing people .

Here in this case its a obvious choice for investors why they gone invest in a back dated company who actually forgot to innovate.If this situation happed few more year then my prediction is that intel gone die from chip buisness like IBM.

Tesla has a larger market cap than Toyota - do you think that Tesla poses a threat to Toyota? -

cfbcfb "Of course, it must be said that the stock price says nothing about the company's value. For that, you would need to multiply the stock price by the number of shares, and that's when things end up looking totally different. "Reply

Making this article totally and completely irrelevant. Share price means absolutely nothing at all in a vacuum. If Intel were to do a reverse split, making its shares worth 2x as much, what would that mean? Nothing. Zero. Bupkis. -

Deicidium369 Reply

Multiplying the Share price x the outstanding shares is how you calculate Market Cap - which determines the company's value. The stock price is manipulated through P/E ratios - Price to Earnings. So the stock price is P/E x Revenue divided by outstanding shares- which in AMD's case as of Today (Thursday July 23 2020) is almost 105x. Intel is a little over 11x. So every dollar of revenue at AMD represents $105 of it's valuation/market cap. One dollar of revenue at Intel represents $11.00 of it's valuation/market cap. A little simplistic but accurate.cfbcfb said:"Of course, it must be said that the stock price says nothing about the company's value. For that, you would need to multiply the stock price by the number of shares, and that's when things end up looking totally different. "

Making this article totally and completely irrelevant. Share price means absolutely nothing at all in a vacuum. If Intel were to do a reverse split, making its shares worth 2x as much, what would that mean? Nothing. Zero. Bupkis.

Average P/E industry wide is 15-16X - Intel is below that, and AMD is 7x the average. Some would say that AMD's high PE is based on optimism that they will do great in the future - at some point - they have to deliver - and so far they have not. I don't care about mouth frothing fan boys, revenues are revenues. IF AMD was even at the market average, it would be less than $10 per share. Nvidia's high stock price is a function of their increase P/E as well - they haven't really started booking revenue for Ampere yet - and Intel's doesn't reflect that they are introducing a full portfolio of new products, including the meat and potatos of the data center - 2 socket servers (with the same 128 PCIe4 lanes, same 8ch DDR43200ECC memory as Epyc).

Stock market is largely a rigged game. Hardware stocks are even more rigged. Revenues are all that matters back in reality. -

JayNor what is in zen3? If it is such a big thing, why no presentation on zen3 at Hotchips 2020?Reply -

artk2219 Replytennis2 said:Back in 2017-2018 I predicted this upward trend. Unfortunately, I wasn't in a financial position to put my money where my mouth was..... Deeply regret not getting into a 4x-5x gain.King_V said:I did NOT predict it, but wondered if I should invest when Ryzen came out. But, I was gun-shy, so, here I am, in the same position you are.

I did buy into AMD back in 2016 when they were around $3, but I didn't put enough money in since i'm not exactly awash in it, and was even less so at that point in time. But I did put in roughly $250, and unfortunately had to sell 80 precent of it when it was at $13 dollars a share for some bills. The remaining 20% has been interesting to watch though, what was worth $50 dollars at that point in time, is now worth almost $1200, more than what I got for 80 percent of my shares back in 2017 :-/. -

timberland67 If you own Intel I would recommend selling today before the earnings. The stock is up in anticipation of good earnings, but I predict bad things. Here is the reasoning.Reply

Intel motherboards have been easy to obtain through the pandemic even with lower supply. AMD motherboards on the other hand have been selling out. Intel continues to use 14nm lithography whereas everyone else has moved to 7nm. The last generation of CPU's increased TDP and thermals to obtain faster speeds, but at the cost of efficiency. They have nothing in the pipeline to compete with AMD's Ryzen 3 CPU's that have just been released, and finally Apple is no longer using Intel chips in their products.

Verdict...The previous quarter and guidance should be bad. I think traders are expecting good news because of the influx of technology purchases during the pandemic, but I believe Intel has dropped the ball here and the stock price will suffer.