AMD to Buy Xilinx for $35 Billion

AMD pulls out its wallet

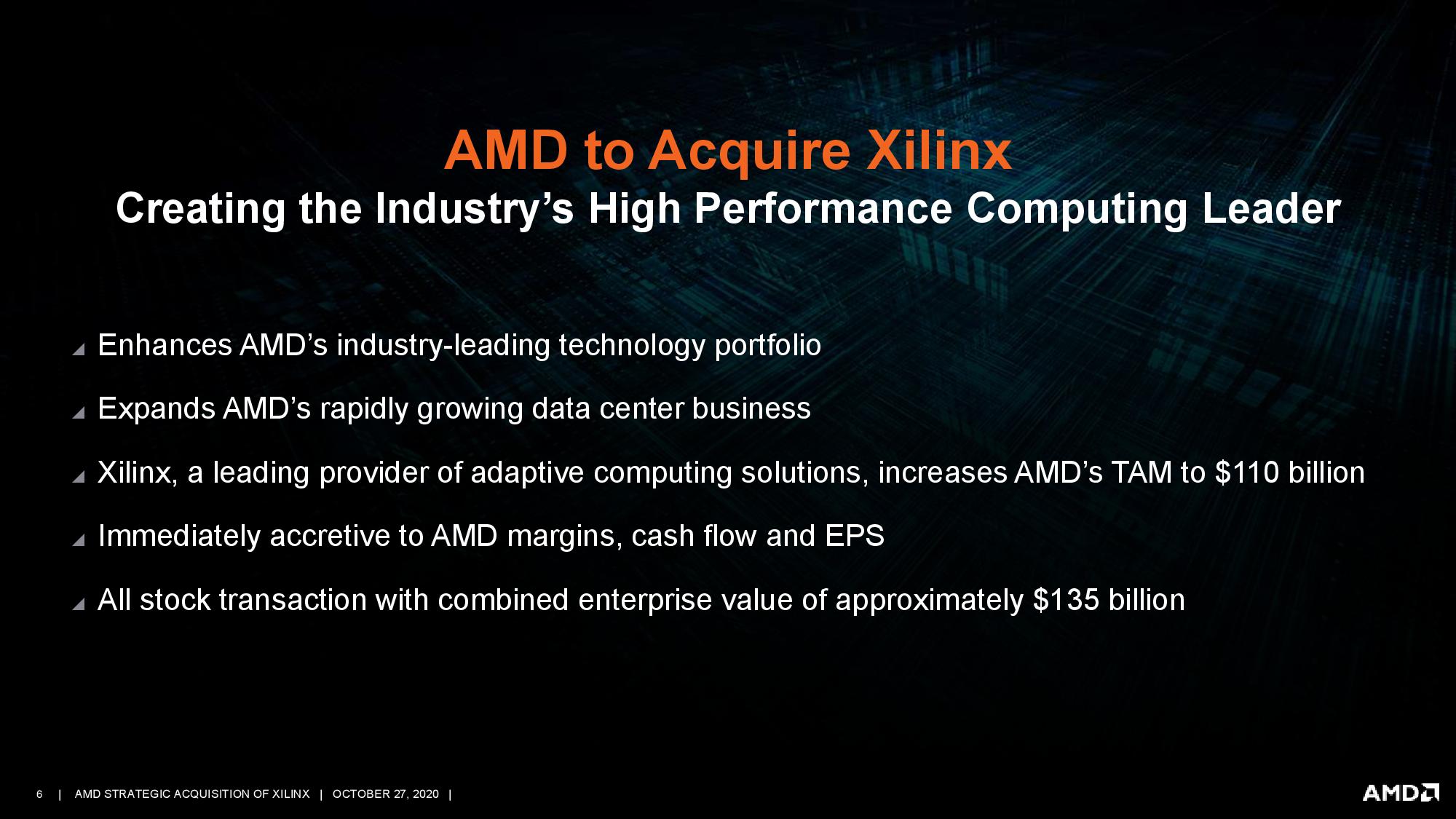

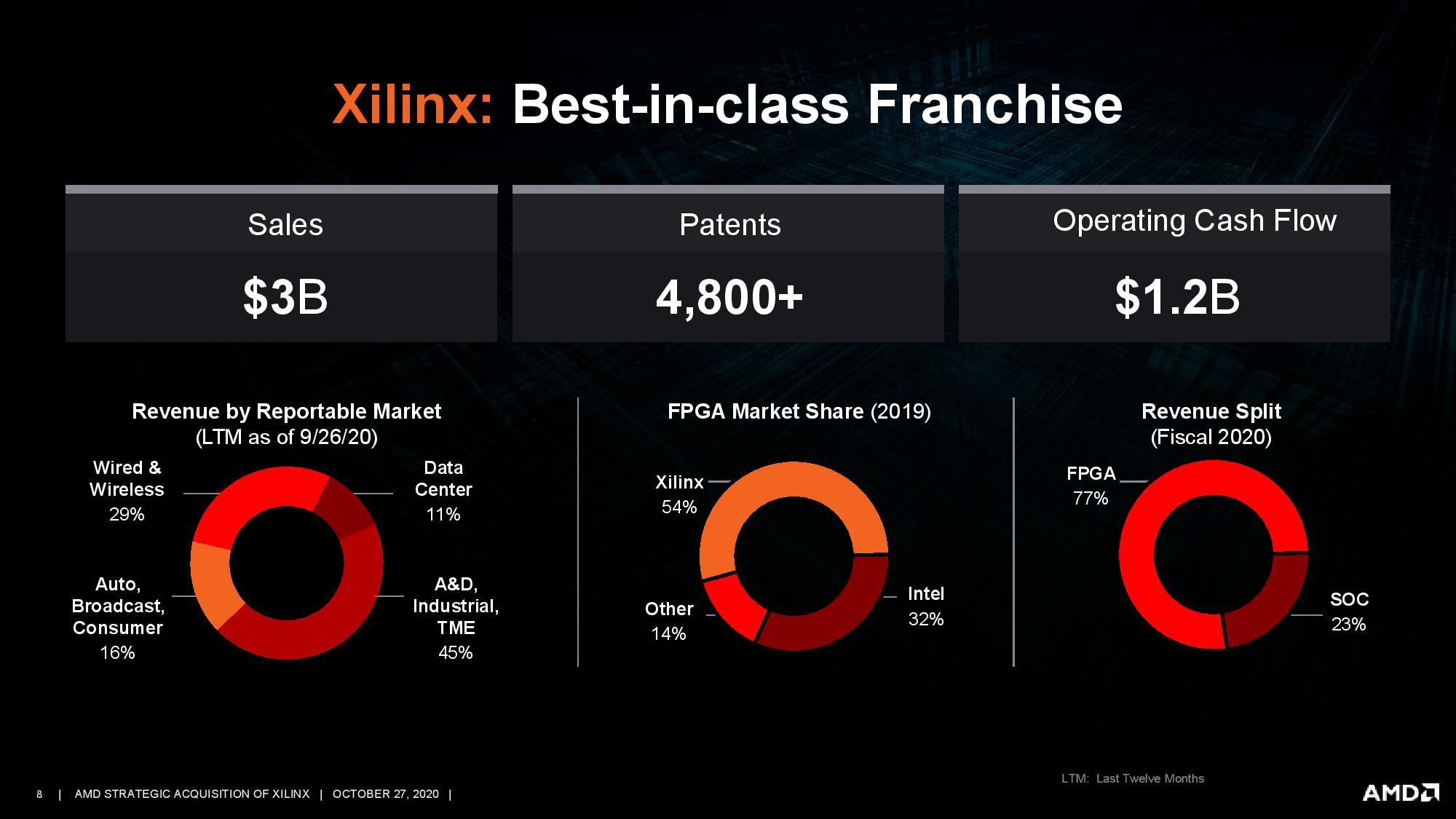

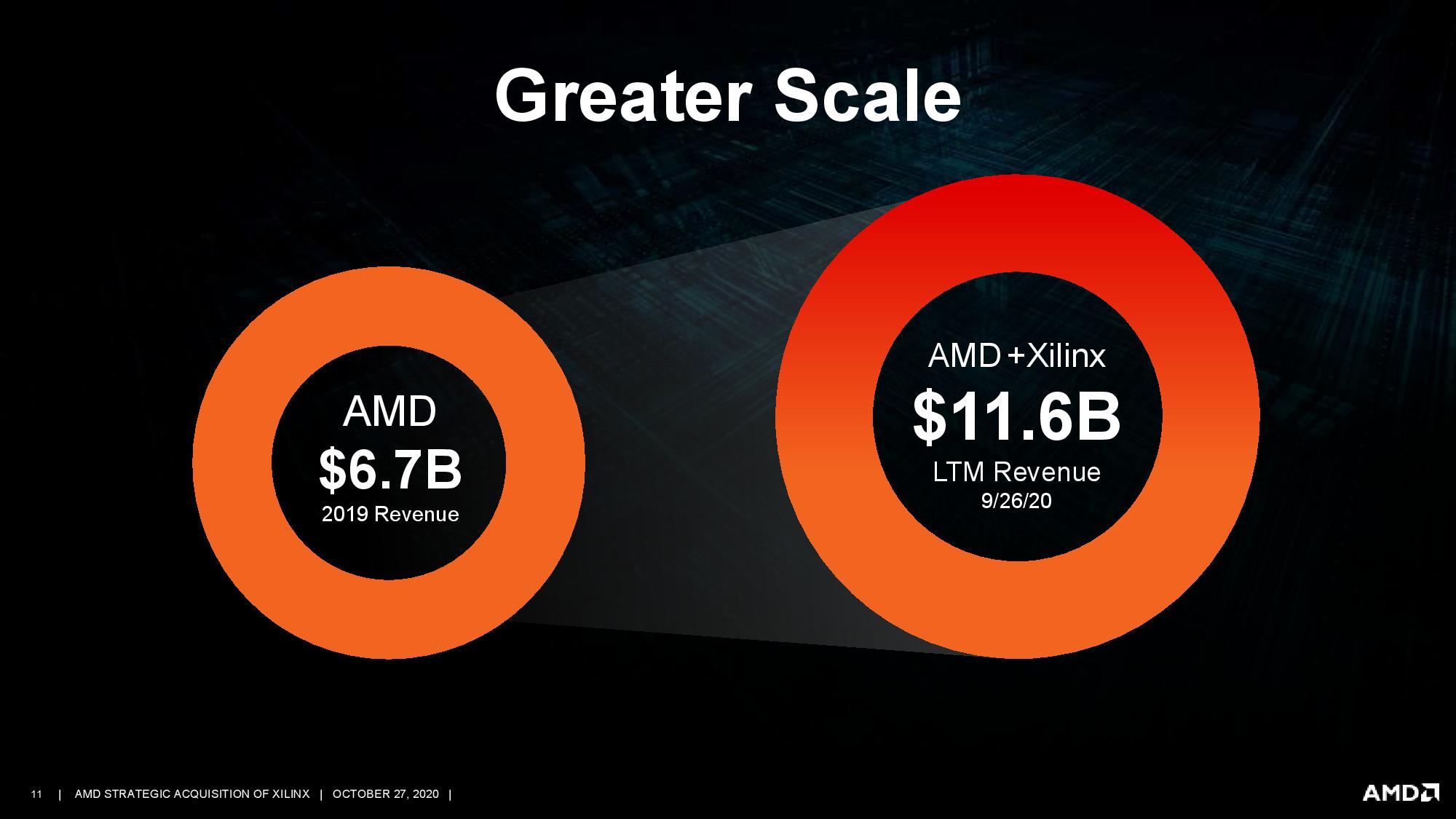

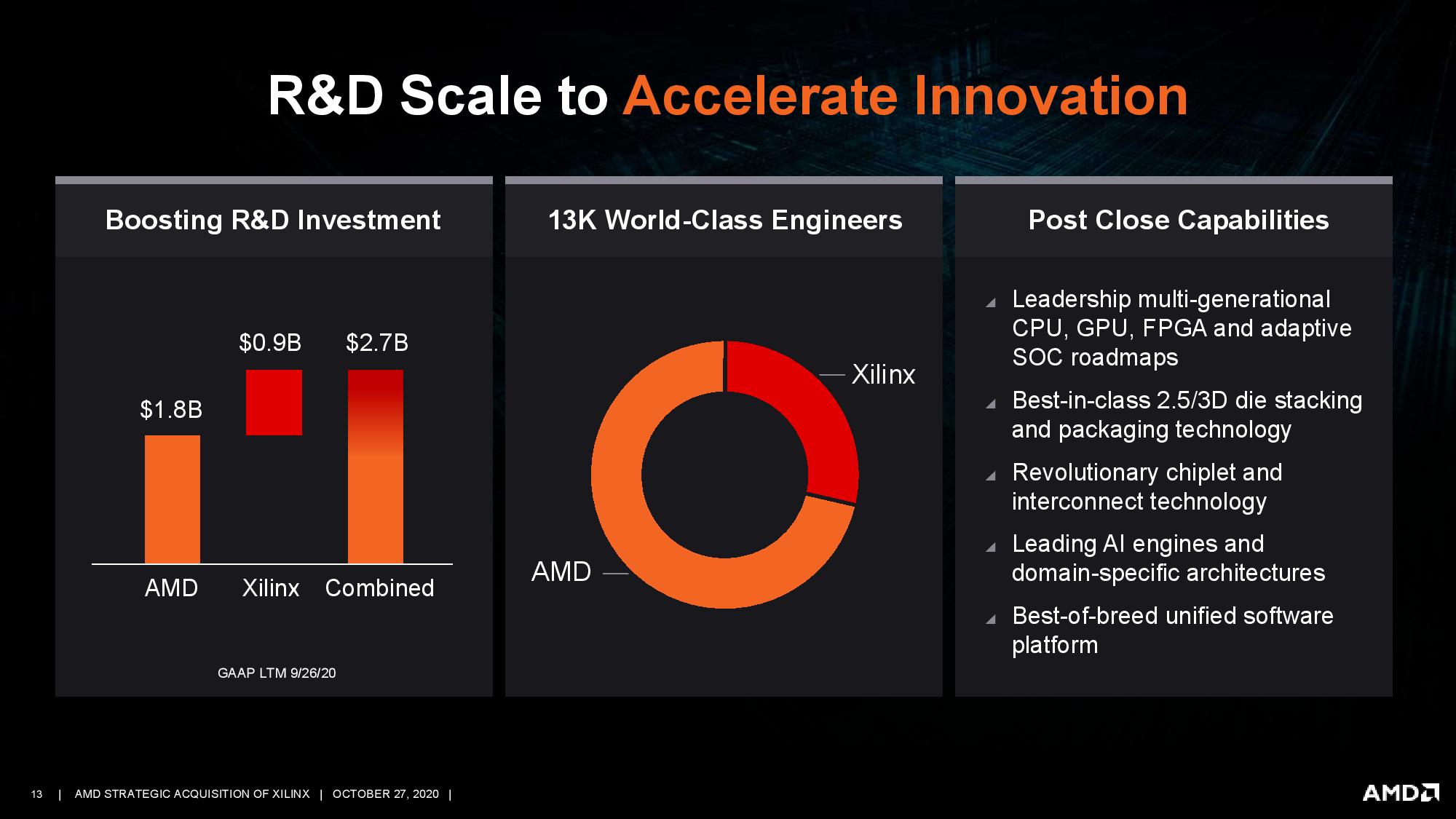

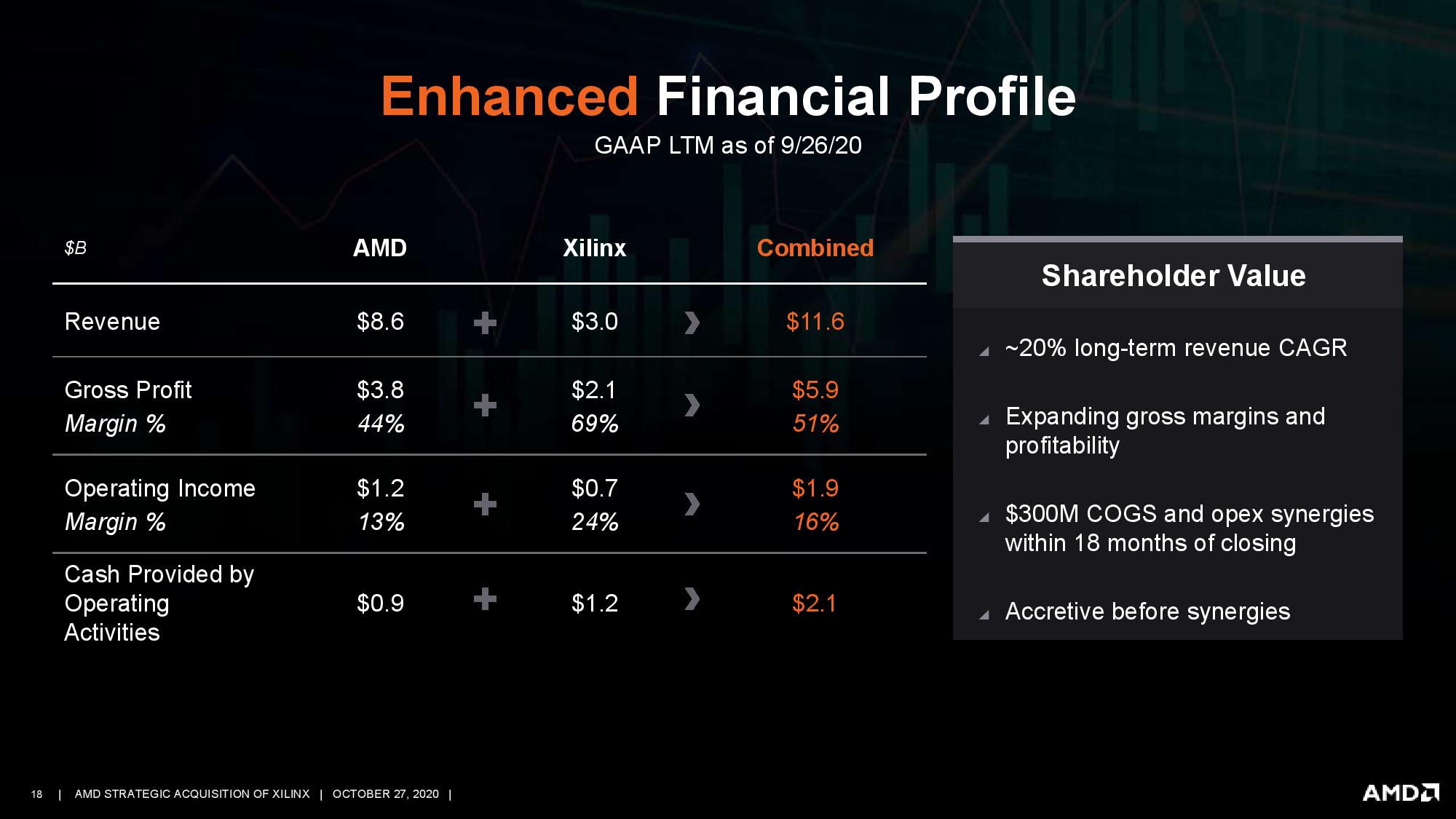

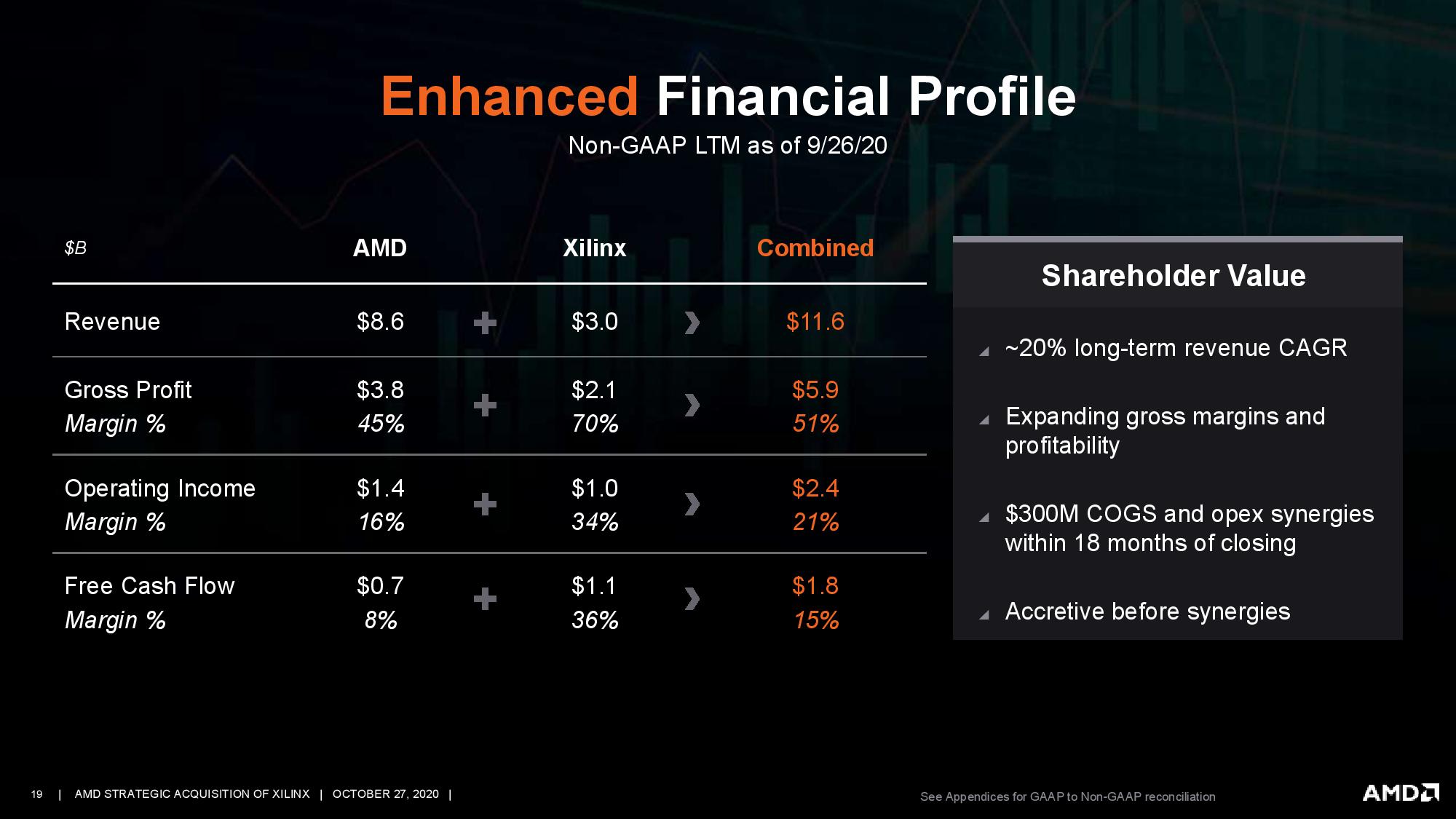

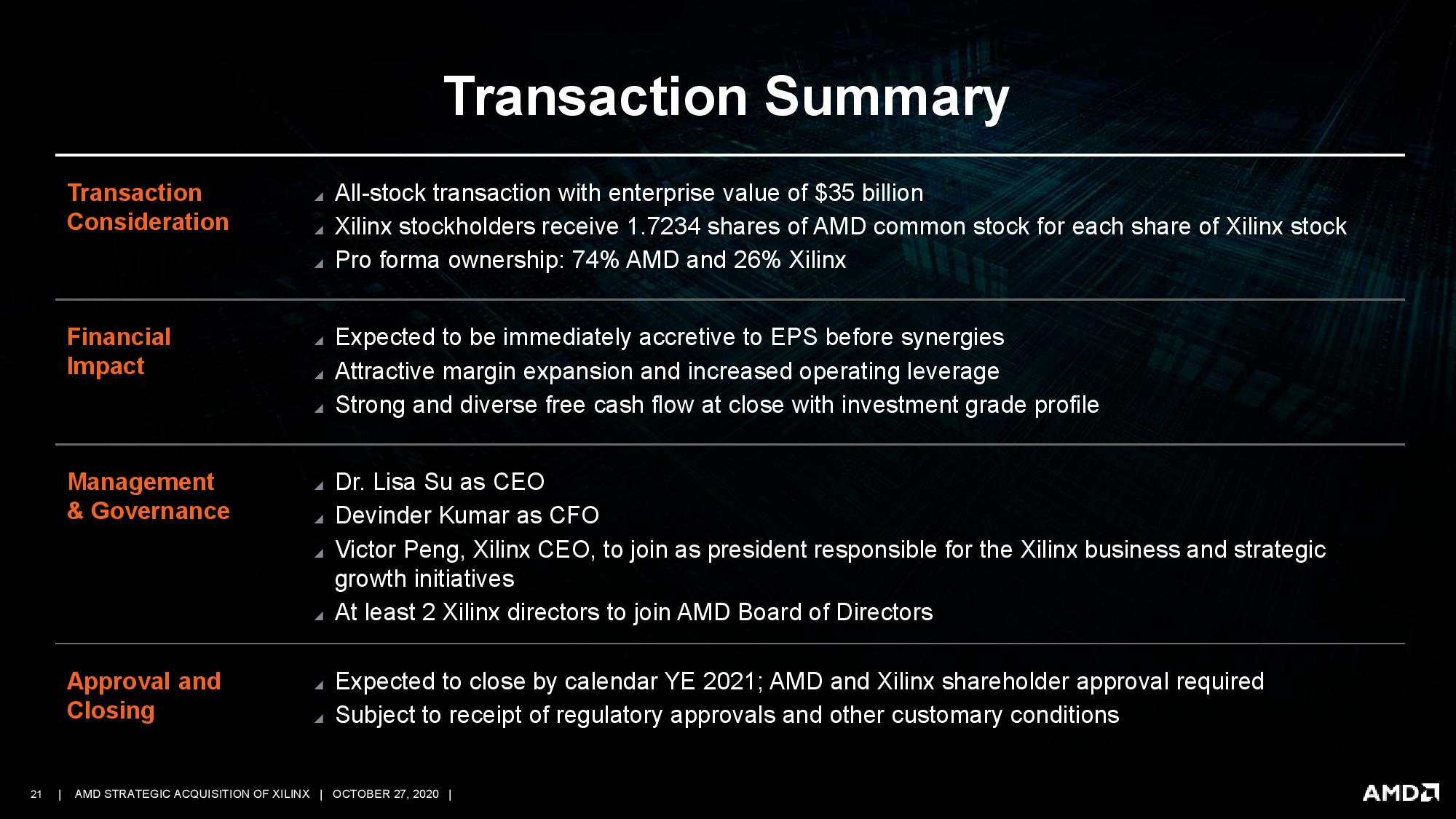

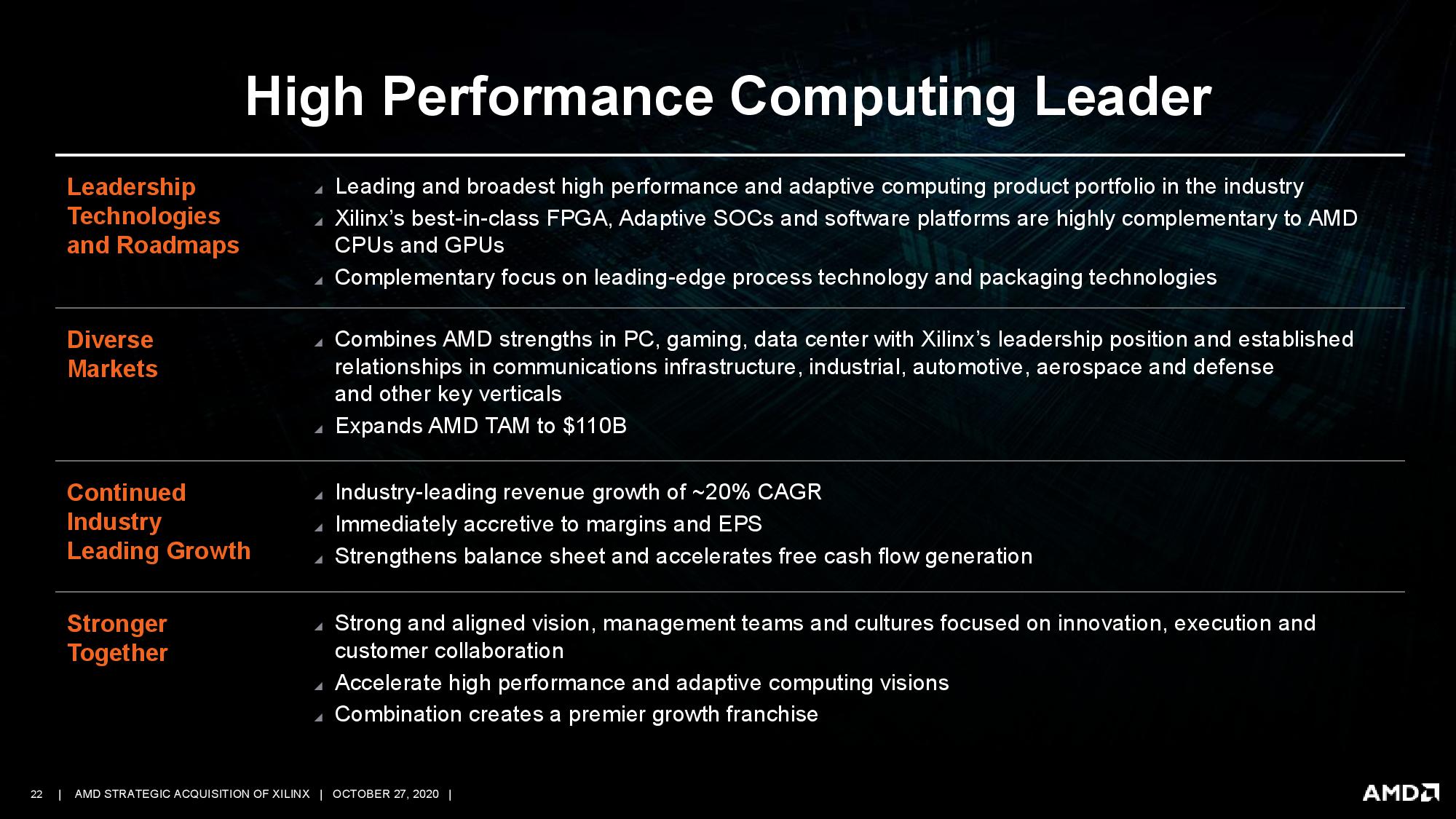

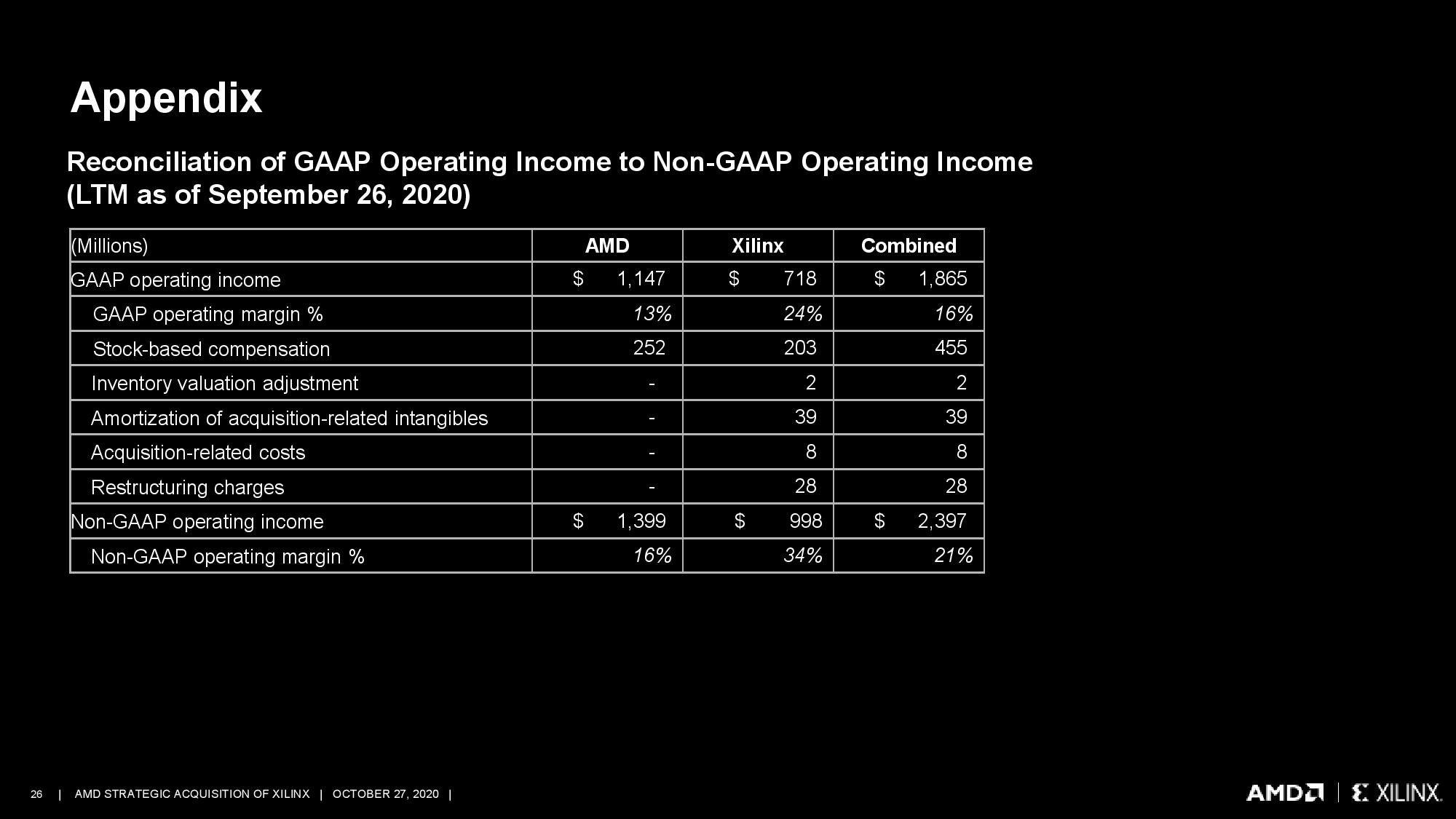

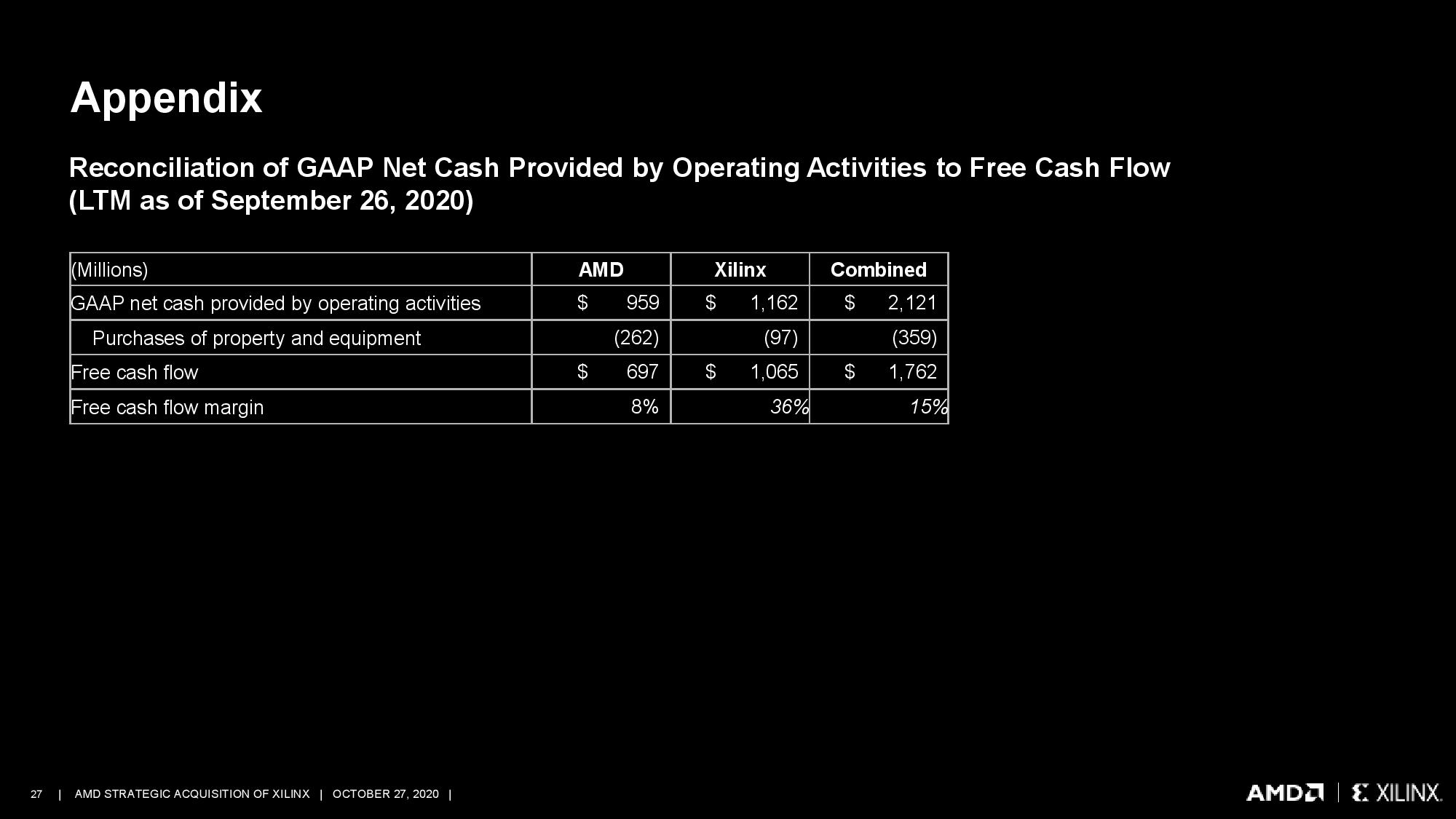

AMD announced today that it is purchasing FPGA-maker Xilinx for $35 billion in an all-stock transaction, confirming recent rumors that the two companies were in advanced talks. The deal pushes AMD's TAM up to $110 billion. Together, the companies will have a combined 13,000 engineers and over $2.7 billion in annual R&D investment.

The transaction, which capitalizes on AMD's stellar stock valuation, equates to $143-per-share based on the exchange ratio, and AMD stockholders will own approximately 74% of the combined company, while Xilinx stockholders will own 26%. The transaction will qualify as a tax-free reorganization and was unanimously approved by both AMD and Xilinx's boards.

AMD CEO Dr. Lisa Su will lead the company in a continued role as CEO, while Xilinx President and CEO Victor Peng will become President of the Xilinx business and strategic growth initiatives. At least two Xilinx directors will also join the AMD Board of Directors upon closing of the deal. The transaction will close by the end of 2021, and both companies will remain separate entities until the closing.

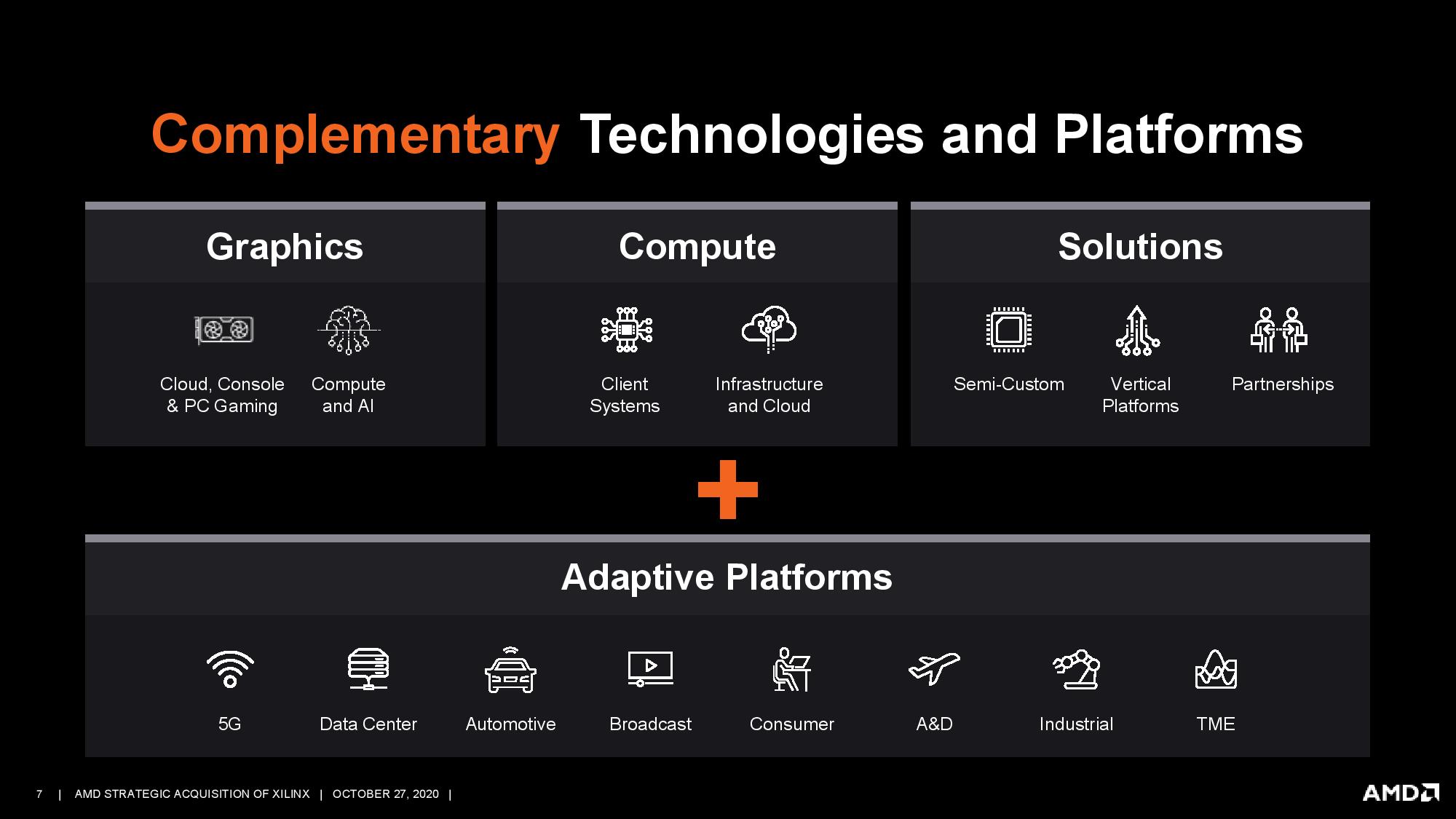

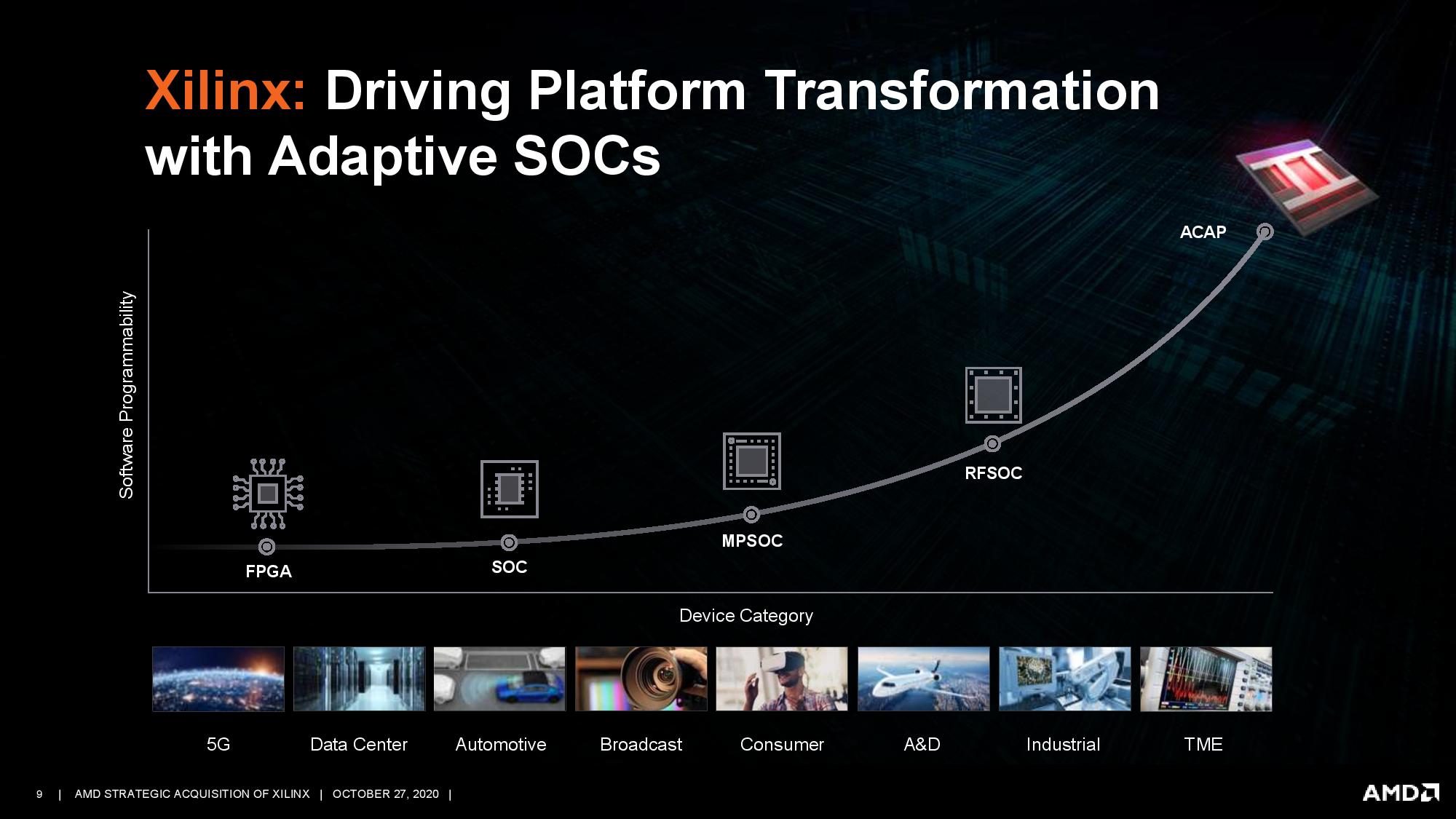

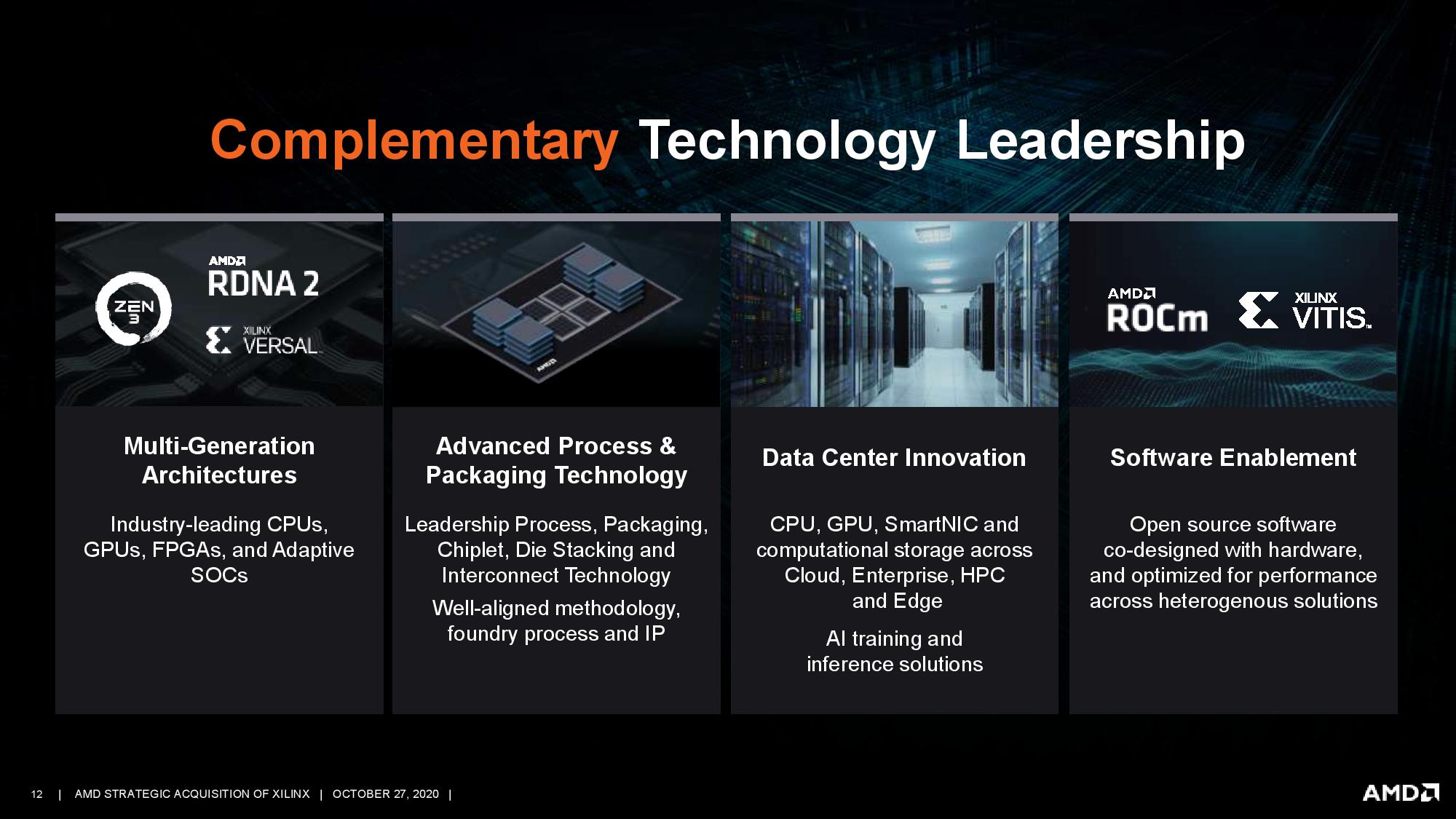

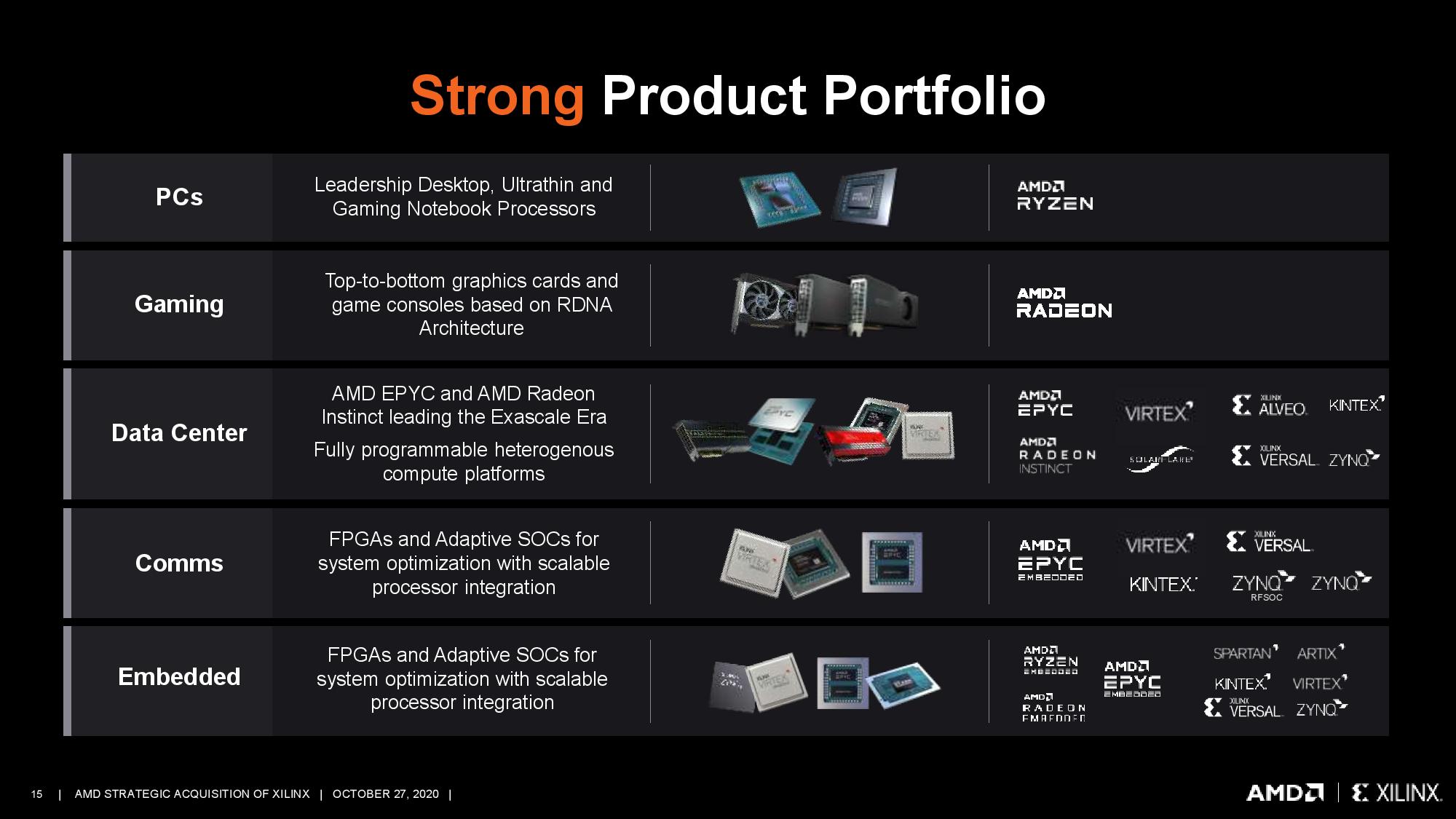

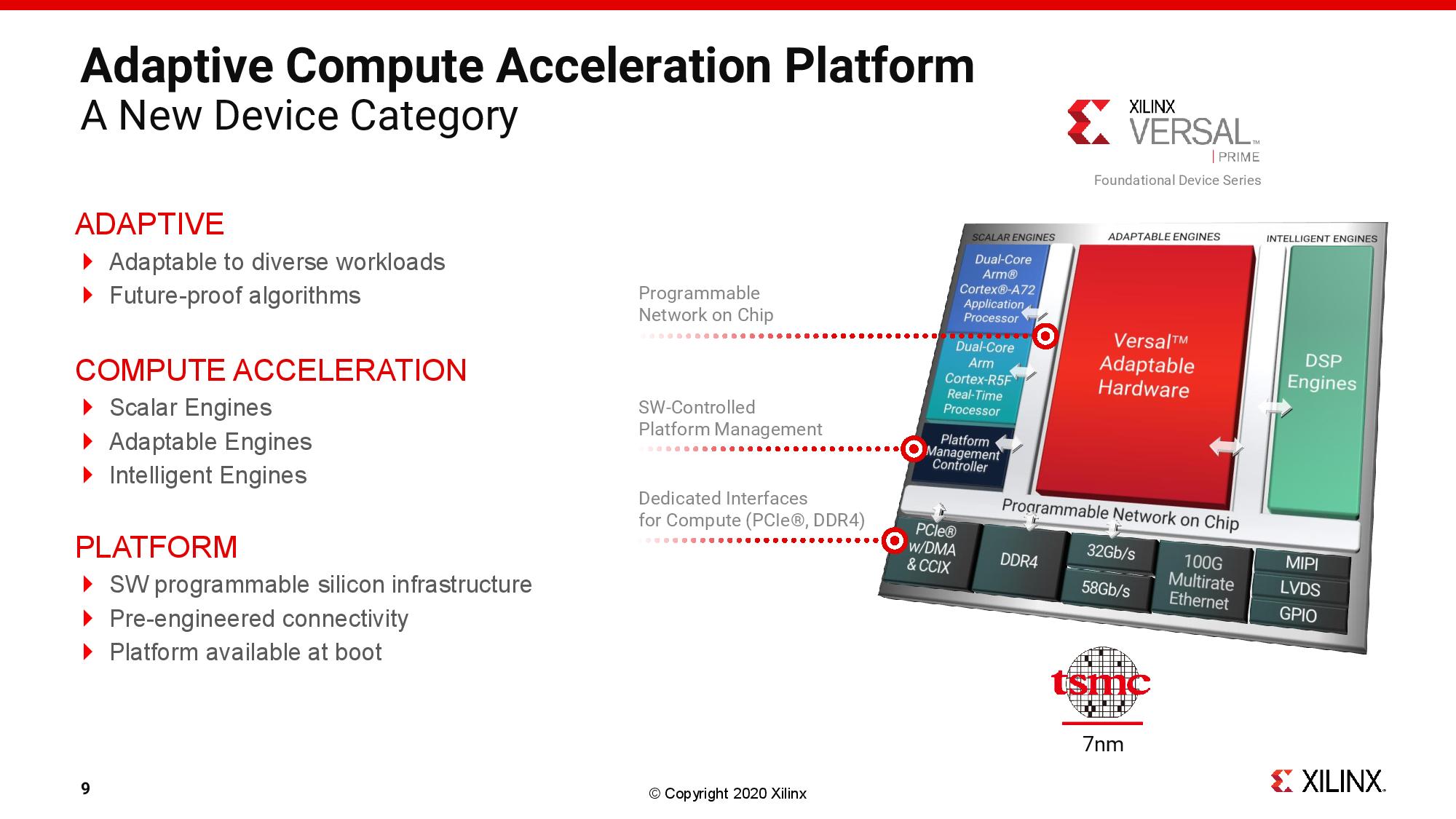

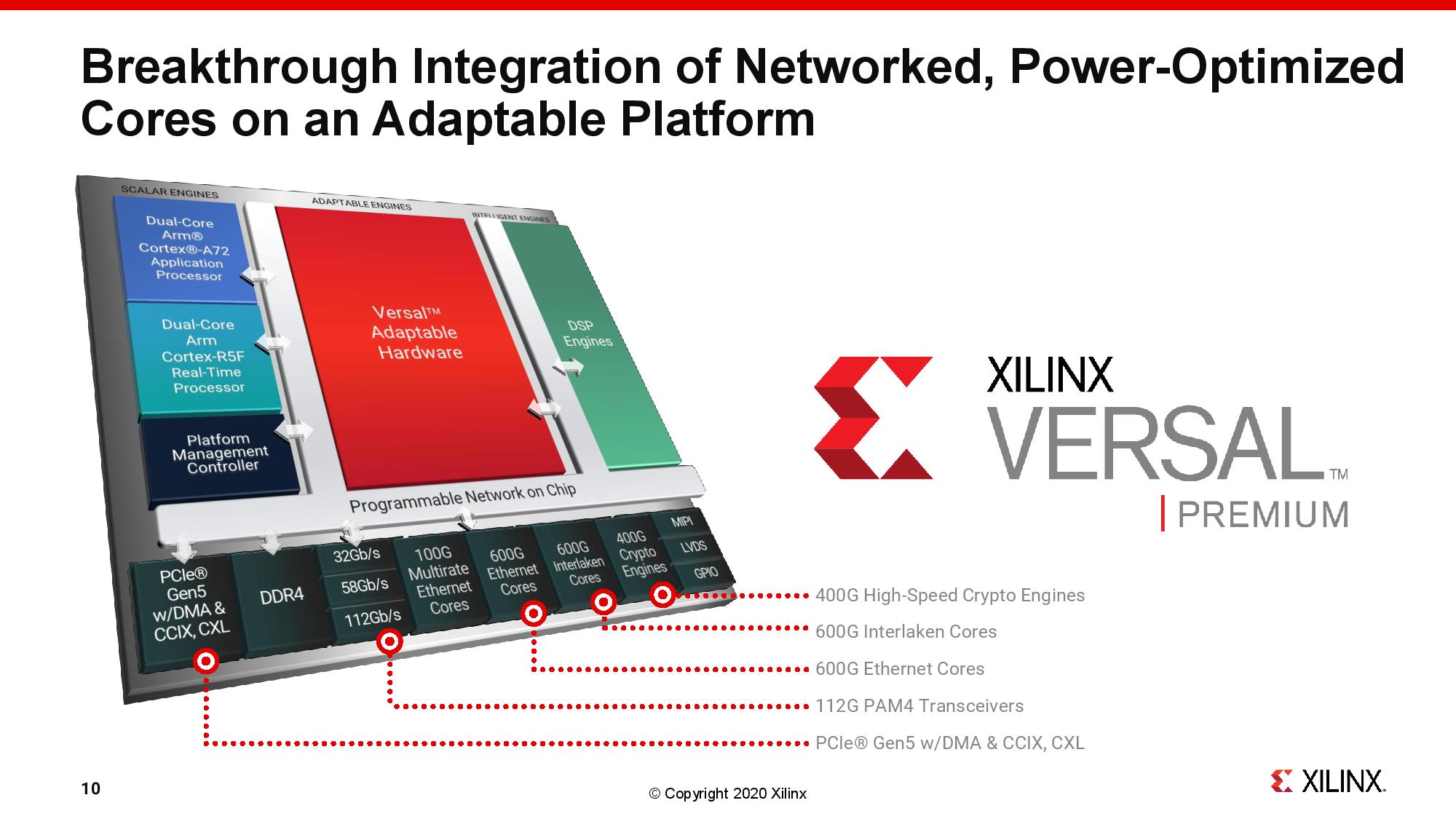

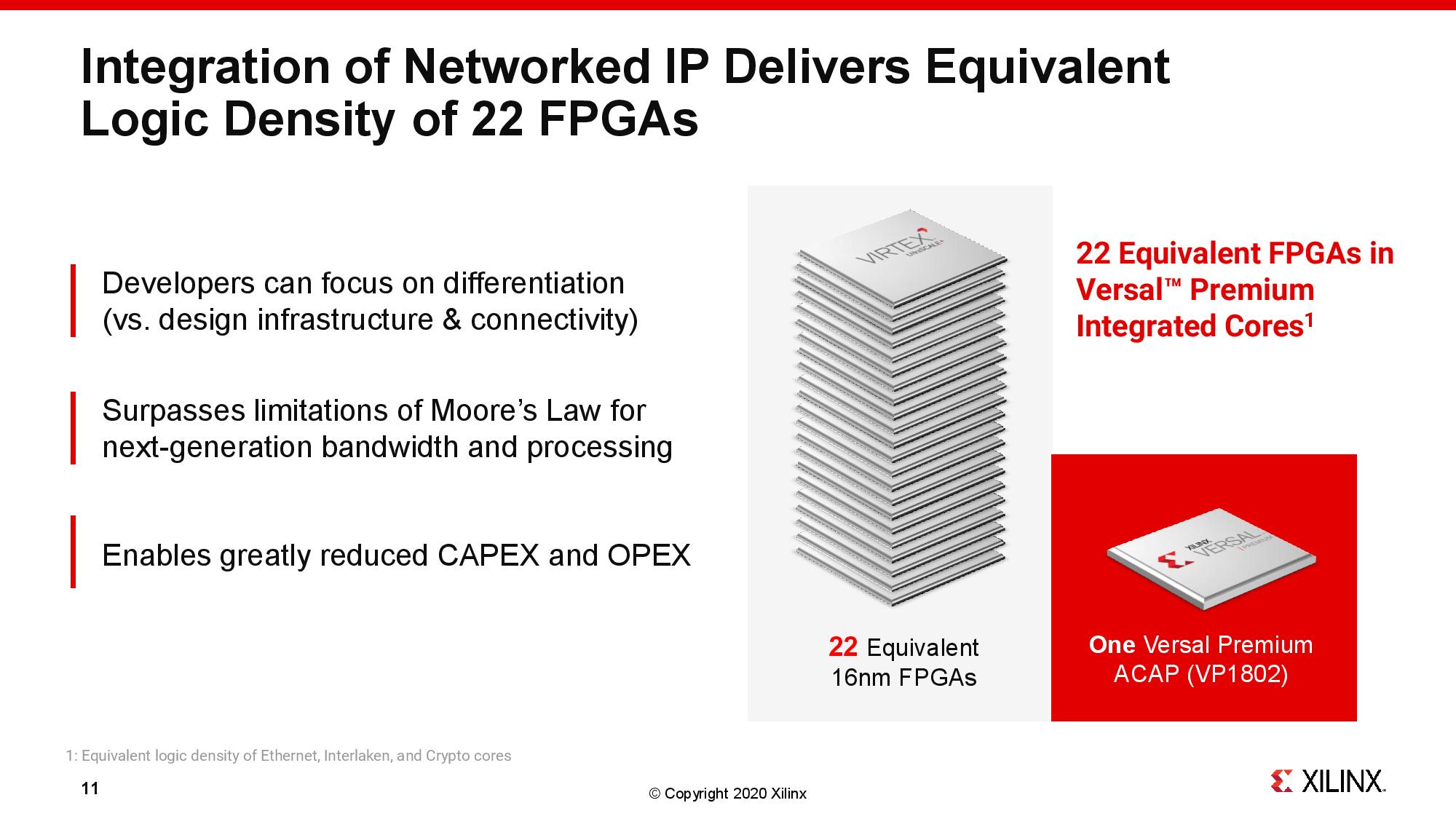

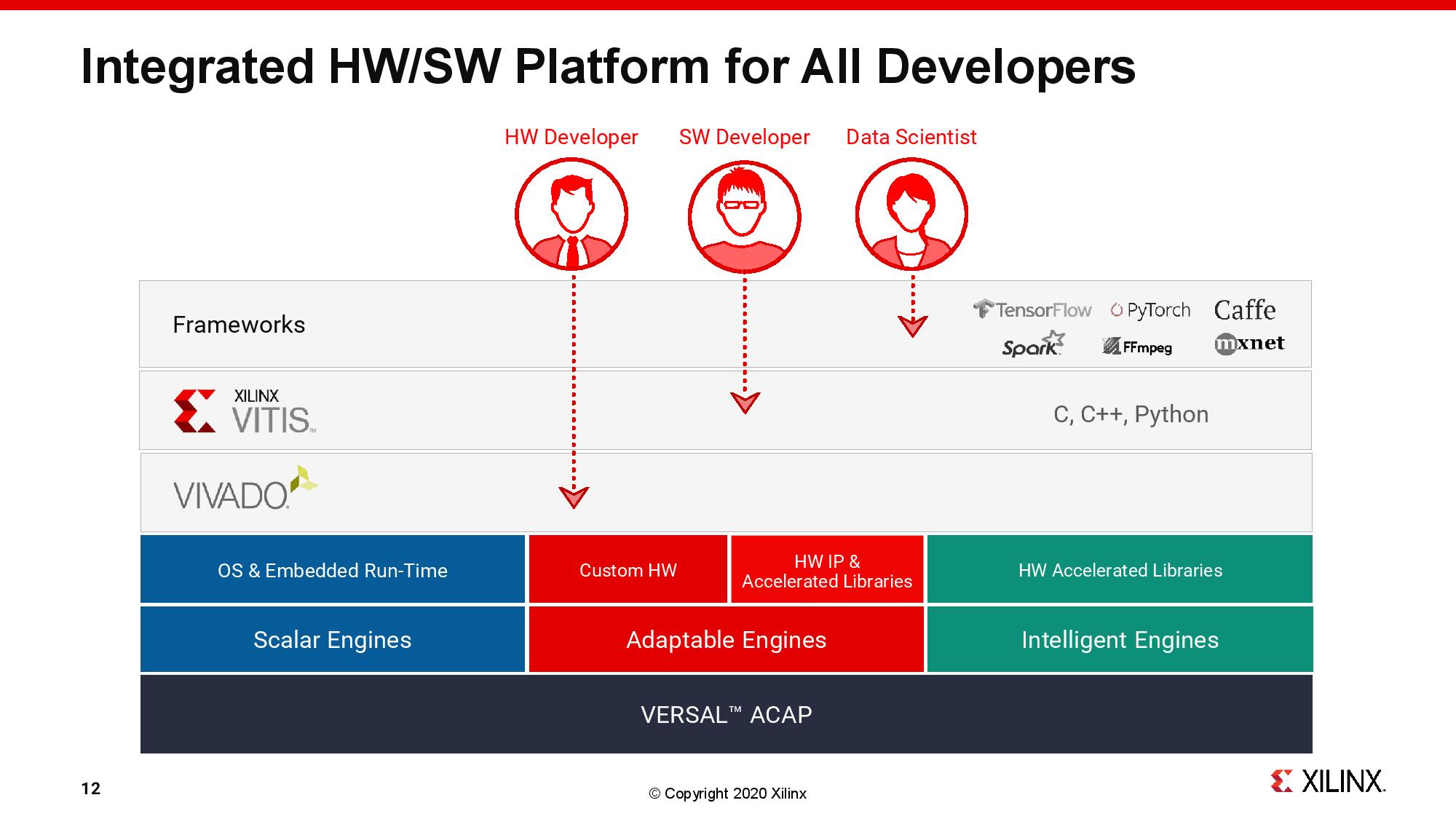

Xilinx is primarily known for its FPGA products, and the combined company will have products spanning CPUs, GPUs, FPGAs, Adaptive SOCs, and expansive software offerings. The two companies have a history of working in close collaboration on deep learning projects, such as the Xilinx deep learning solution on AMD EPYC processors (among many other pursuits).

“Our acquisition of Xilinx marks the next leg in our journey to establish AMD as the industry’s high performance computing leader and partner of choice for the largest and most important technology companies in the world,” AMD President and CEO Dr. Lisa Su said. “This is truly a compelling combination that will create significant value for all stakeholders, including AMD and Xilinx shareholders who will benefit from the future growth and upside potential of the combined company. The Xilinx team is one of the strongest in the industry and we are thrilled to welcome them to the AMD family. By combining our world-class engineering teams and deep domain expertise, we will create an industry leader with the vision, talent and scale to define the future of high performance computing.”

FPGAs (Field Programmable Gate Arrays) are semiconductor devices that can be rapidly reconfigured on the fly. They offer certain advantages over other types of devices, like CPUs and GPUs, in a wide variety of workloads.

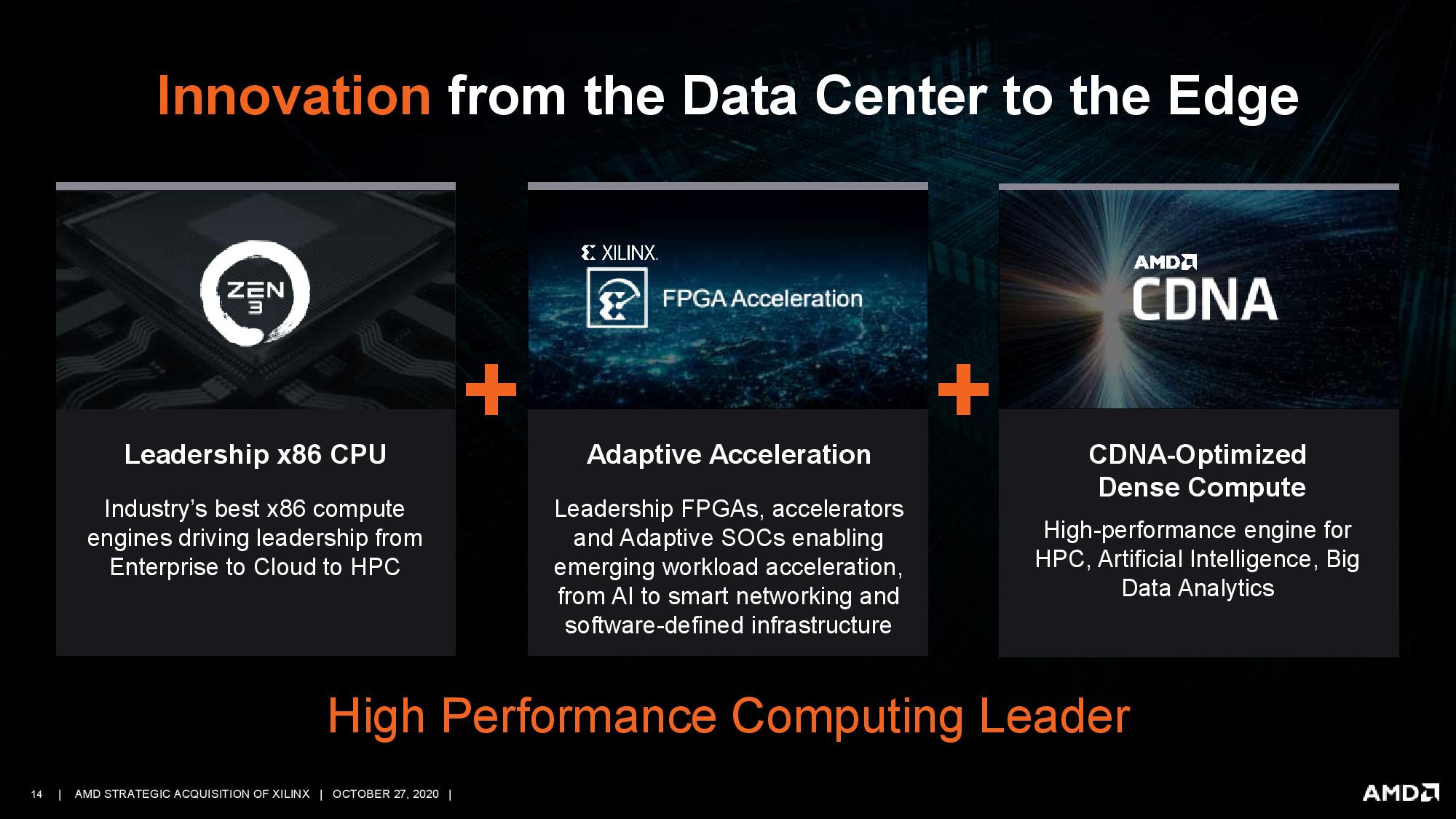

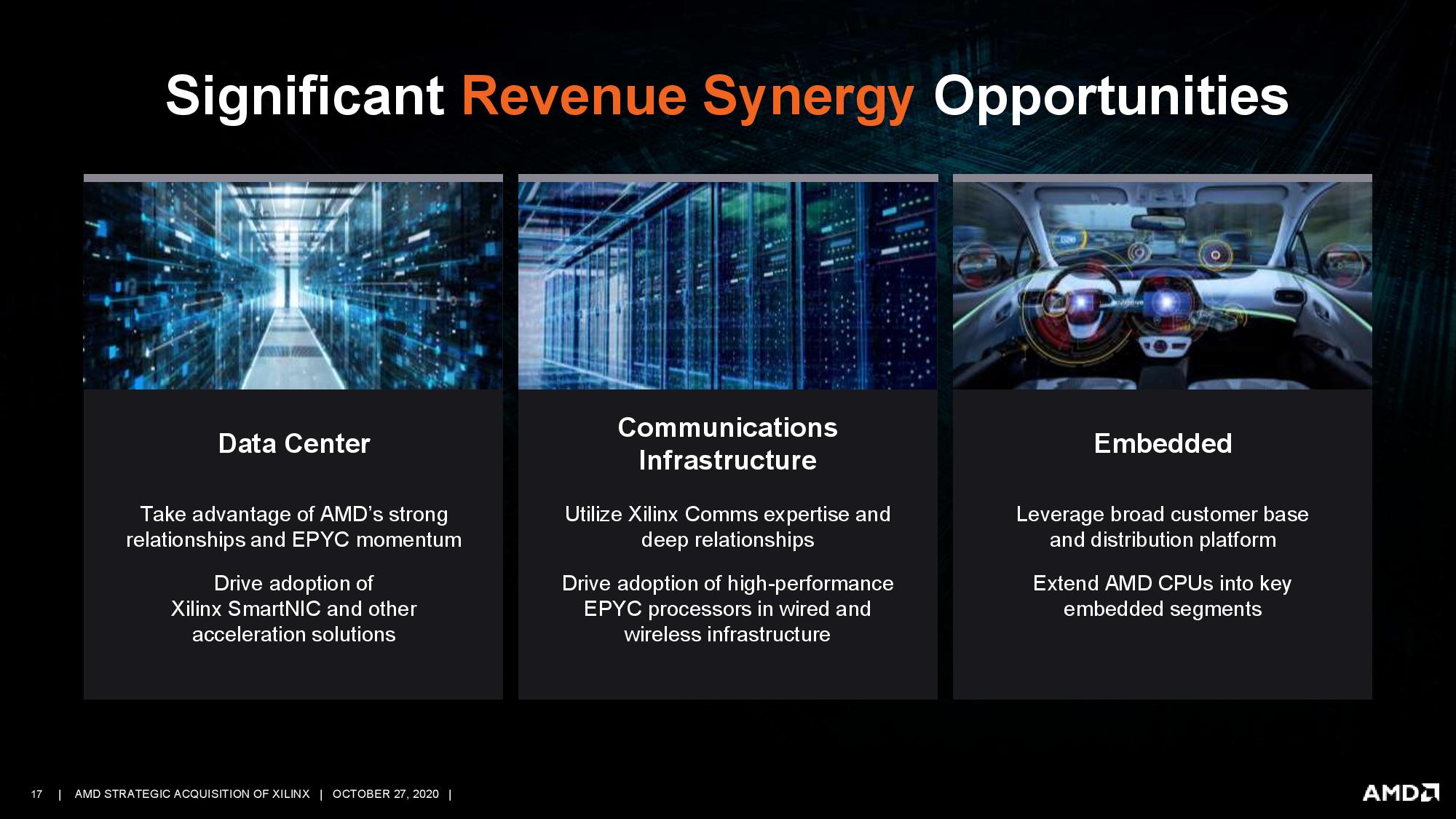

Bringing Xilinx's technology portfolio into AMD's war chest could enable tightly-integrated CPU+FPGA solutions that would fit well within AMD's current chiplet-inspired design methodologies. It's easy to envision future EPYC data center processors with integrated FPGA chiplets to boost AI workload performance.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

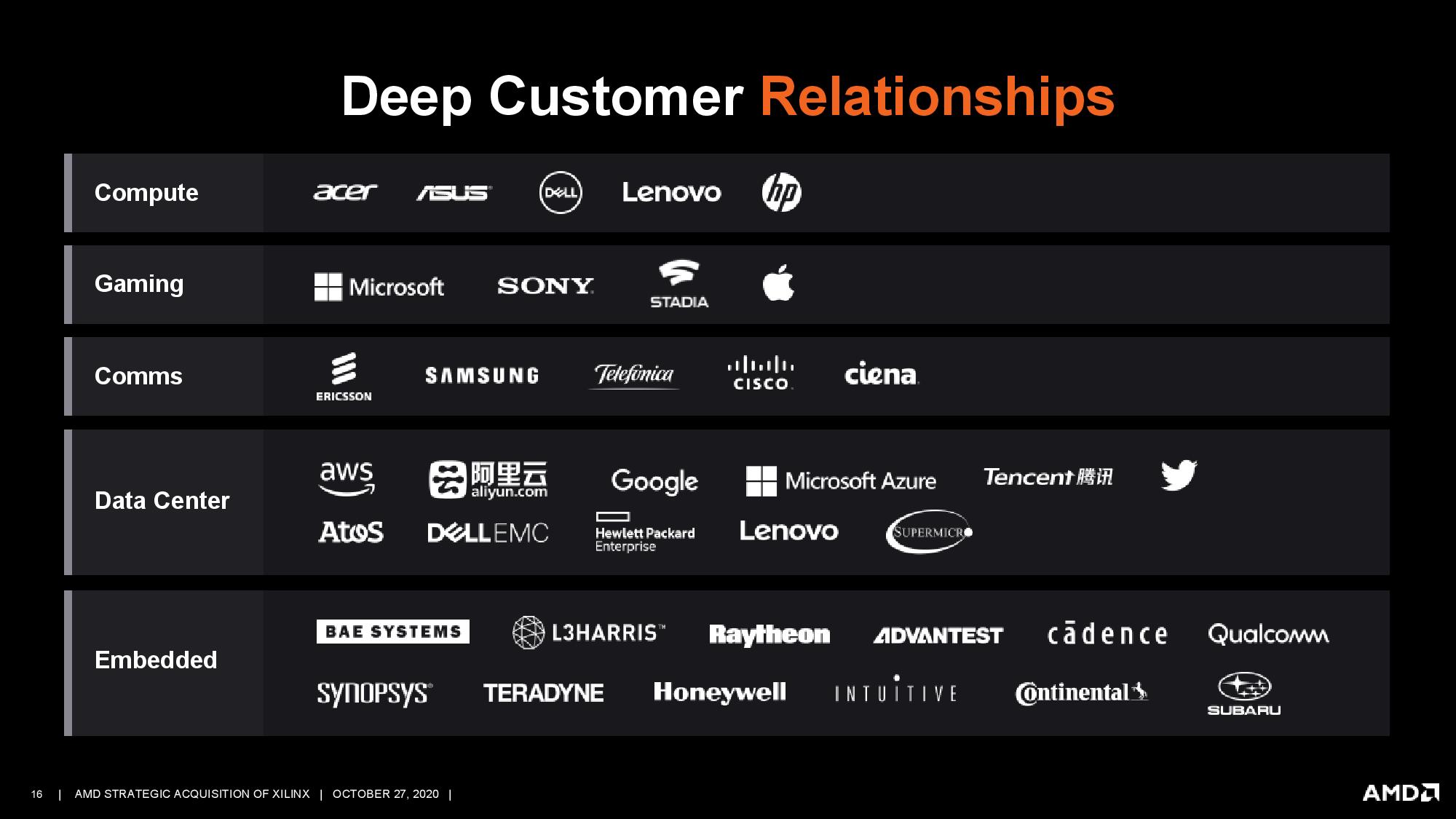

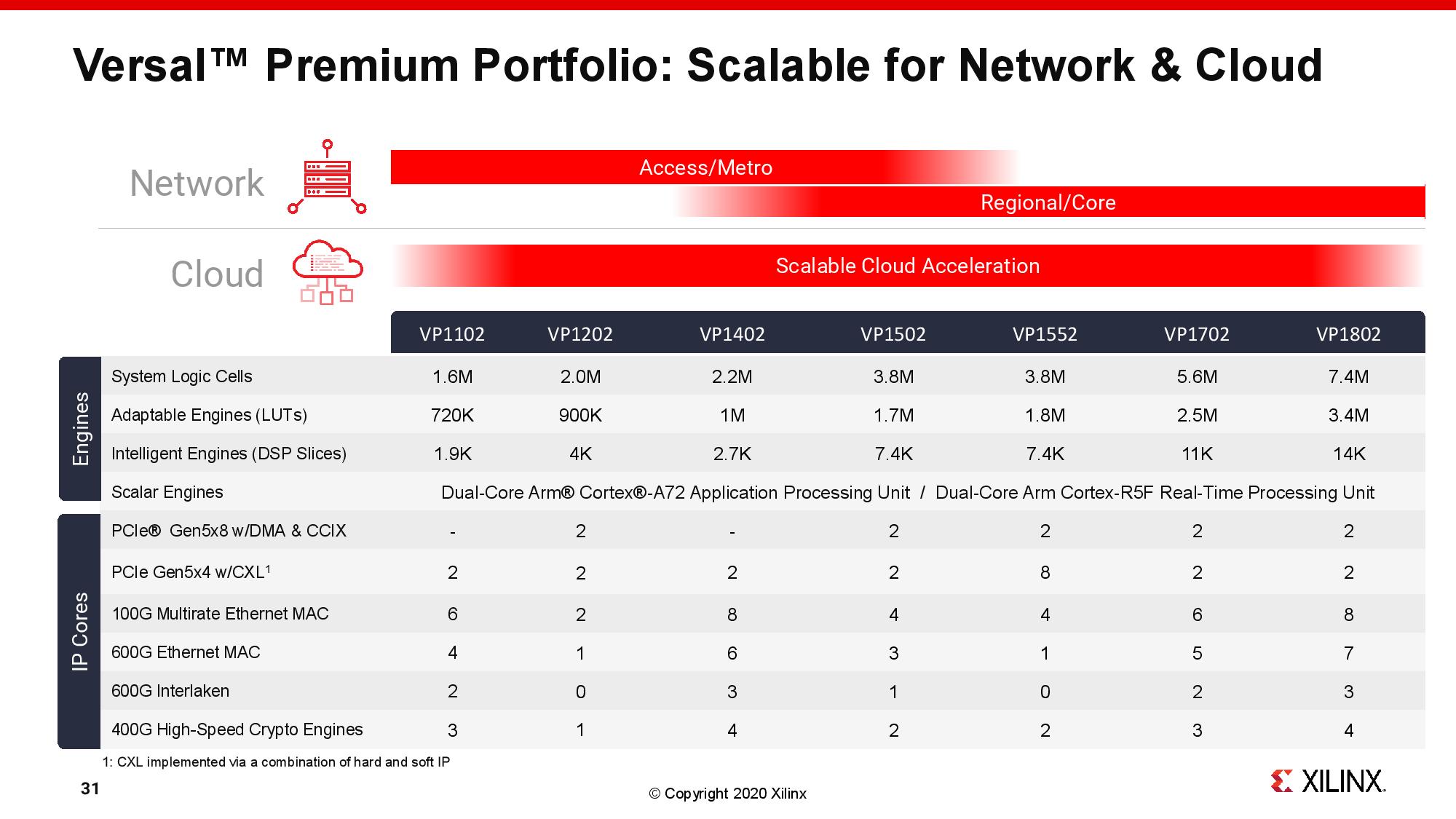

Xilinx's broad technology pallet includes leading-edge connectivity options that could also serve as a backbone for more expansive data center architectures. AMD would certainly have plenty of options with Xilinx under its roof; the FPGA maker currently engages in the automotive, aerospace and defense, data center, HPC, industrial, IoT, and communications markets. The firm also has deep experience in software development/enablement.

Notably, Intel purchased Xilinx's main rival, FPGA-maker Altera, for $16.7 billion in 2015, and has integrated the company into its Programmable Solutions Group (PSG). You can see the full roster of Intel's AgileX FPGAs that come as a result of the Xilinx acquisition here.

The AMD news comes in the wake of Nvidia's ongoing efforts to purchase ARM for $40 billion and marks yet another big deal during an ongoing wave of industry consolidation. Xilinx also has a solid portfolio of SmartNic/DPUs that would serve as a nice AMD parry to Nvidia's DPU thrust that comes as the fruits of its Mellanox acquisition.

“We are excited to join the AMD family. Our shared cultures of innovation, excellence and collaboration make this an ideal combination. Together, we will lead the new era of high performance and adaptive computing,” said Victor Peng, Xilinx President and CEO. “Our leading FPGAs, Adaptive SoCs, accelerator and SmartNIC solutions enable innovation from the cloud, to the edge and end devices. We empower our customers to deploy differentiated platforms to market faster, and with optimal efficiency and performance. Joining together with AMD will help accelerate growth in our data center business and enable us to pursue a broader customer base across more markets.”

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

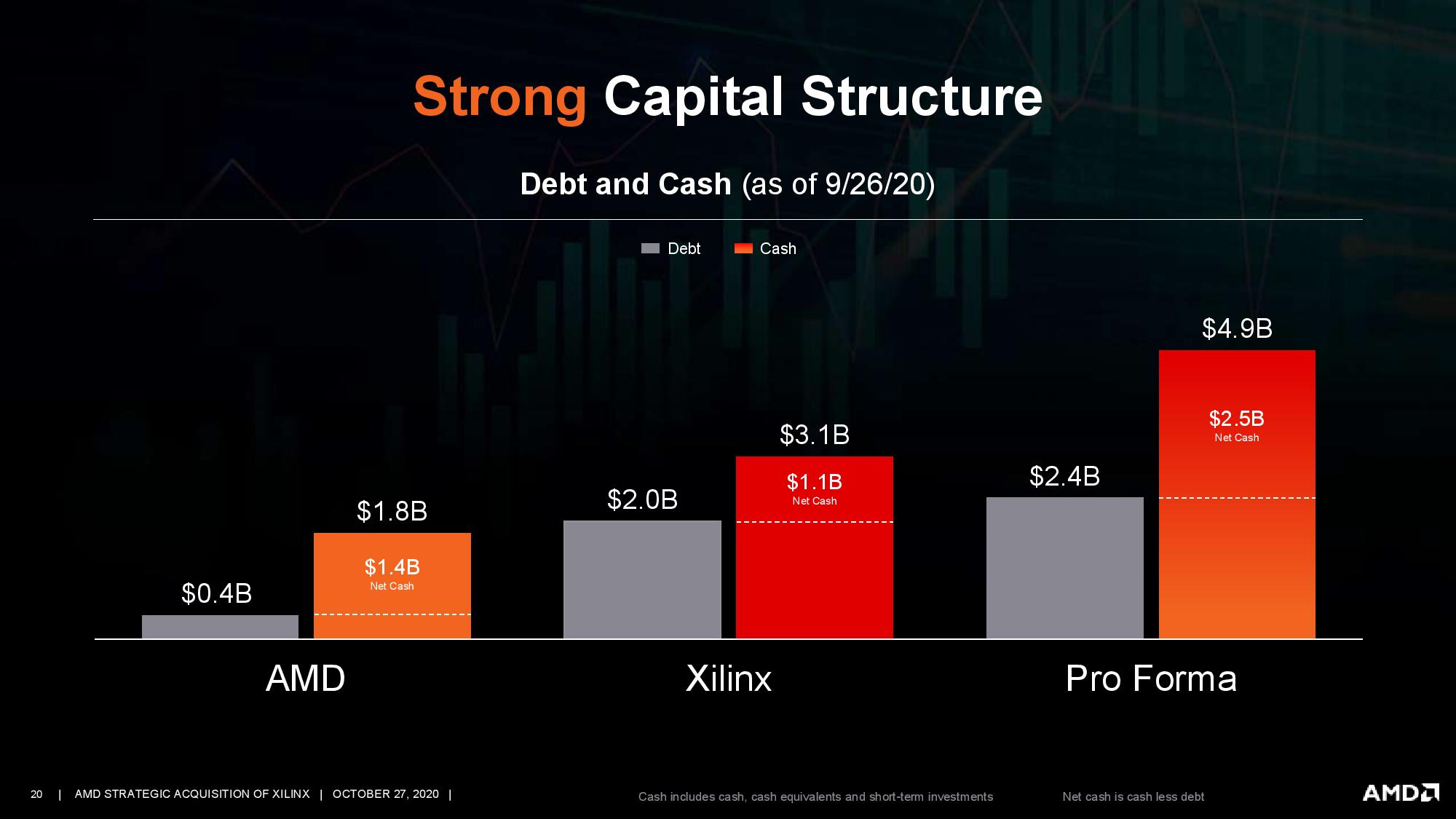

Soaptrail Glad to see Lisa is not adding Debt to AMD's books which would have caused Bulldozer 2.0.Reply -

hotaru.hino I'm not really happy with this because it feels like everything is becoming Intel, AMD, or NVIDIA owned at this rate.Reply -

domih Congratulations AMD.Reply

To sell solutions in the data center, selling the best CPUs is no longer enough. You need smart NICs to carry data over 100, 200, 400 GbE interconnect. You need plenty of AI/DL/ML co-processors for heavy load compute. You need to be able to offload tasks from the CPU to other components (e.g. GPU/Compute cards talking directly between each other without bothering the CPU).

Intel has good enough CPUs, good enough smart NICs and good enough AI/DL/ML hardware.

NVidia has excellent AI/DL/ML hardware (specialized GPUs), excellent smart NICs (they bought Mellanox) and hopes to acquire ARM for making their own CPUs.

AMD has the best CPUs (as of this writing) , good enough GPUs (and maybe excellent ones by tomorrow). Xilinx bring the FPGA and co-processor business and expertise to complete the set.

The Data Center wars for the next 5 to 10 years is going to be very interesting to follow. -

dalek1234 Can somebody explain to me where AMD is getting the 35 billion dollars worth of stock to buy Xilinx? Does AMD own its shared valued at least 35 billion, or is AMD going to issue brand new shared valued at 35 billion?Reply