AMD's Ryzen and EPYC Sales Punish Intel, Posts Record Revenue in Q3 Earnings

AMD's cash register dings...a lot.

AMD's earnings today kicked off with big news – the company agreed to purchase Xilinx for a whopping $35 billion in an all-stock transaction. Still, that big news shouldn't overshadow the company's stellar performance during its third quarter as the company posted record revenue. While Intel struggles with an unexpected shift to lower-end products for its desktop PC chip sales, punishing its bottom line and margins, AMD continues to chew away market share and notched record client processor revenue and unit shipments. That certainly throws Intel's relatively poor quarter in desktop processor sales into stark relief.

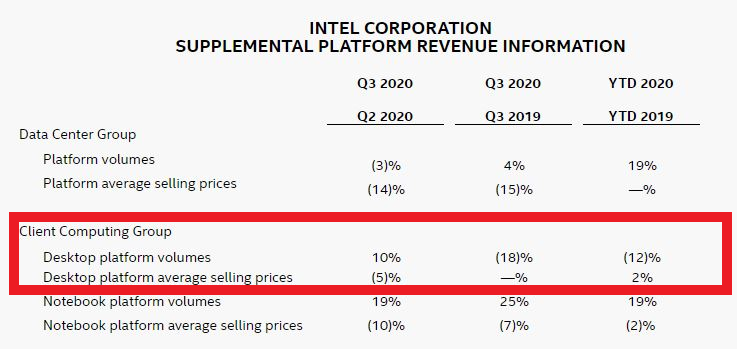

Intel is struggling with lower processor average selling prices (ASPs) as it engages in a price war with AMD, and that's exacerbated by an unexpected shift in its product mix to low-end lower-margin processors. Meanwhile, AMD's processor ASPs continue to climb and the company posted record quarterly consumer processor revenue, signaling that Intel's sudden shift to selling more low-end chips comes at the expense of AMD's high-performance Ryzen models snapping up more of Intel's potential sales.

For now, Intel blames its flagging desktop PC sales, which dropped 18% YoY last quarter and are down 12% for the year, on a mixture of factors, like the pandemic and the shift to the work-from-home environment. The cratering PC processor sales led Intel to post a 17% decline in revenue from client chips. However, those factors don't seem to be impeding AMD's progress as it chugs along in the consumer PC market. In terms of whether or not AMD is impacting its sales, Intel's official line is that the company isn't seeing any more competition than it expected. Still, Intel hasn't defined just how much competition it expected, so that's a bit of a hollow statement.

AMD is also on the cusp of launching its Ryzen 5000 processors next month, which the company says brings an amazing 19% improvement in IPC and takes the lead in gaming performance, so we should see AMD's gains accelerate in the near future. Intel's response will come in the form of Rocket Lake, but we won't see those chips until the latter portion of Q1 2021, meaning AMD should own the holiday season for client processor sales.

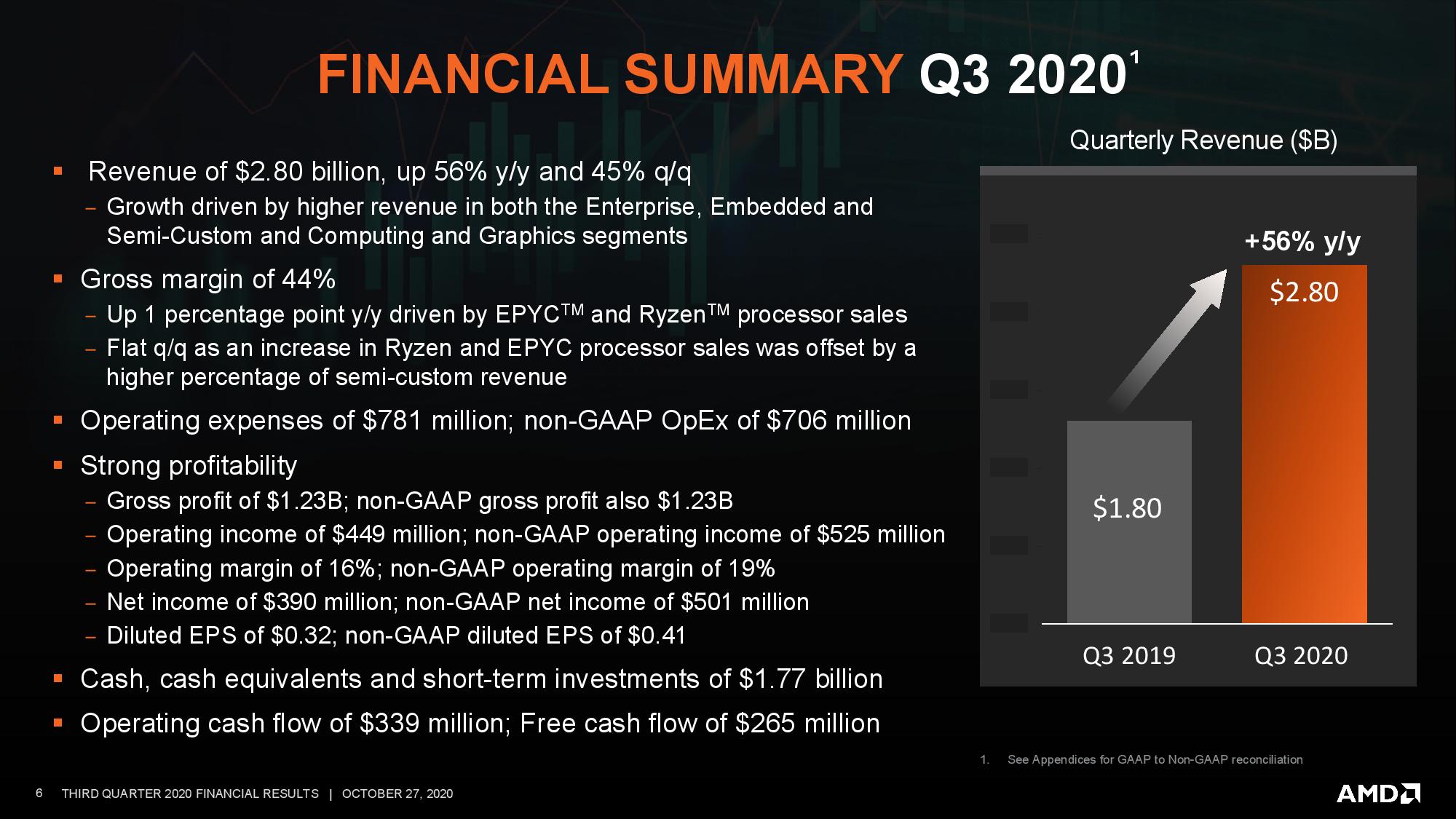

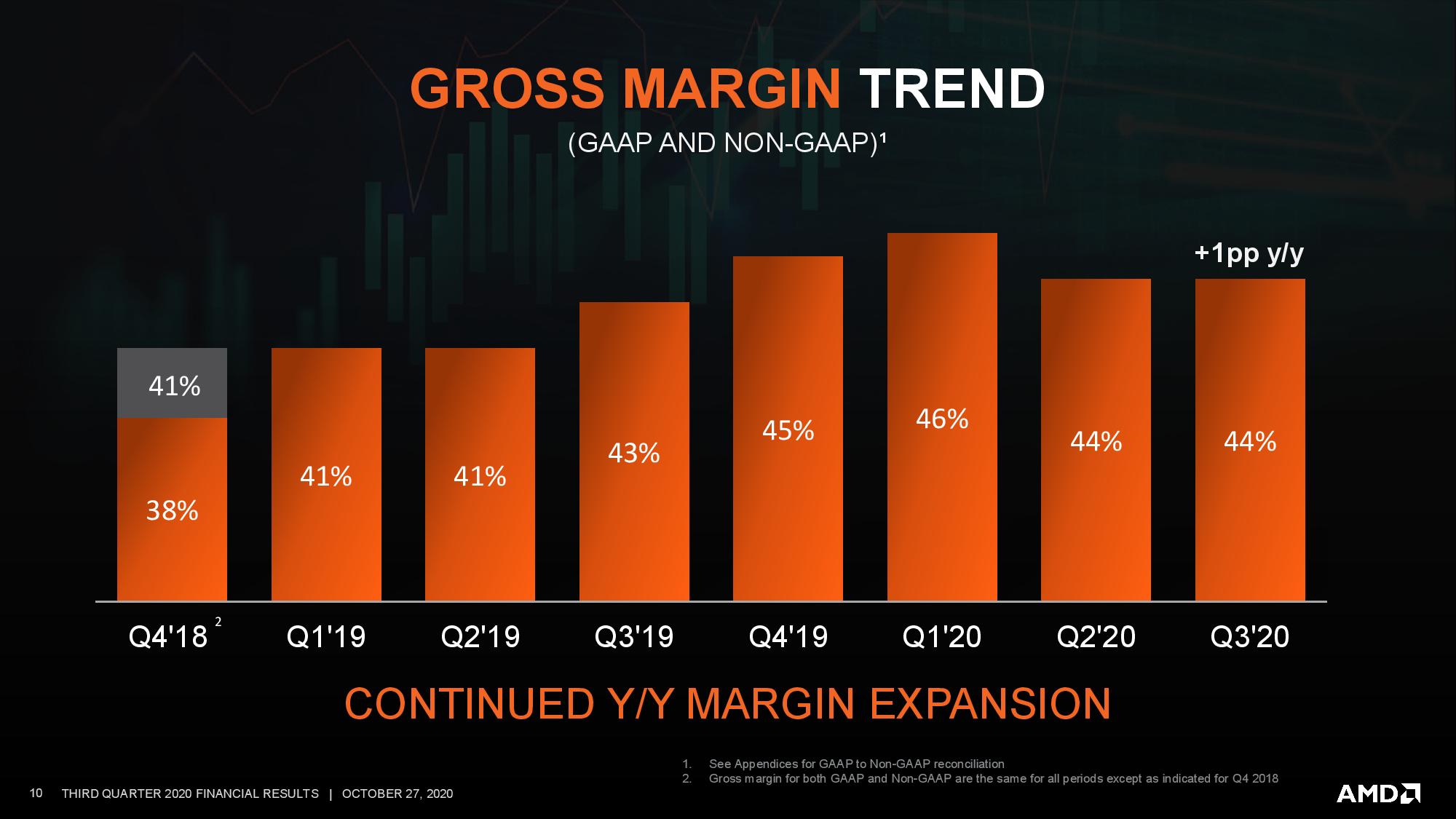

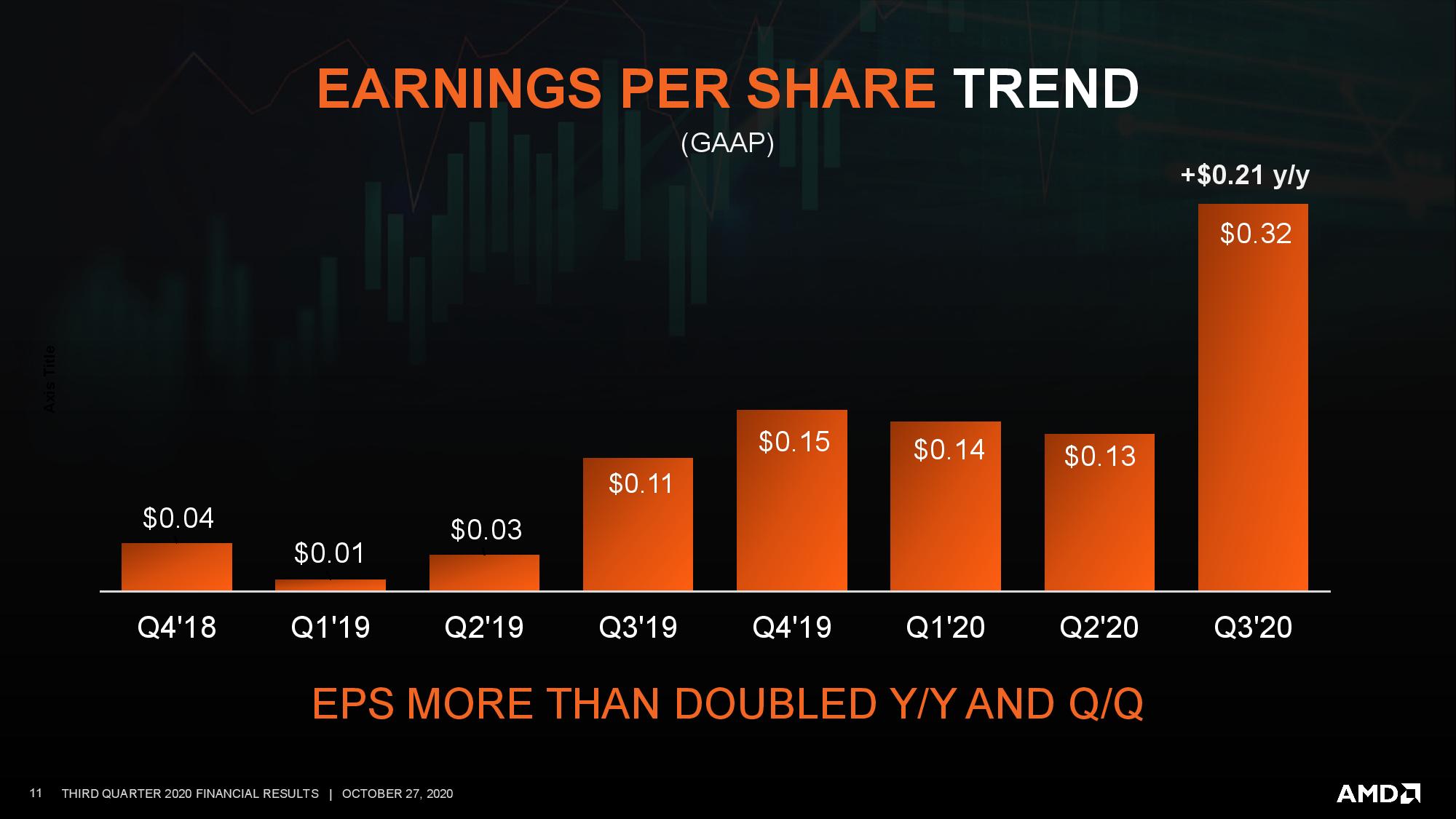

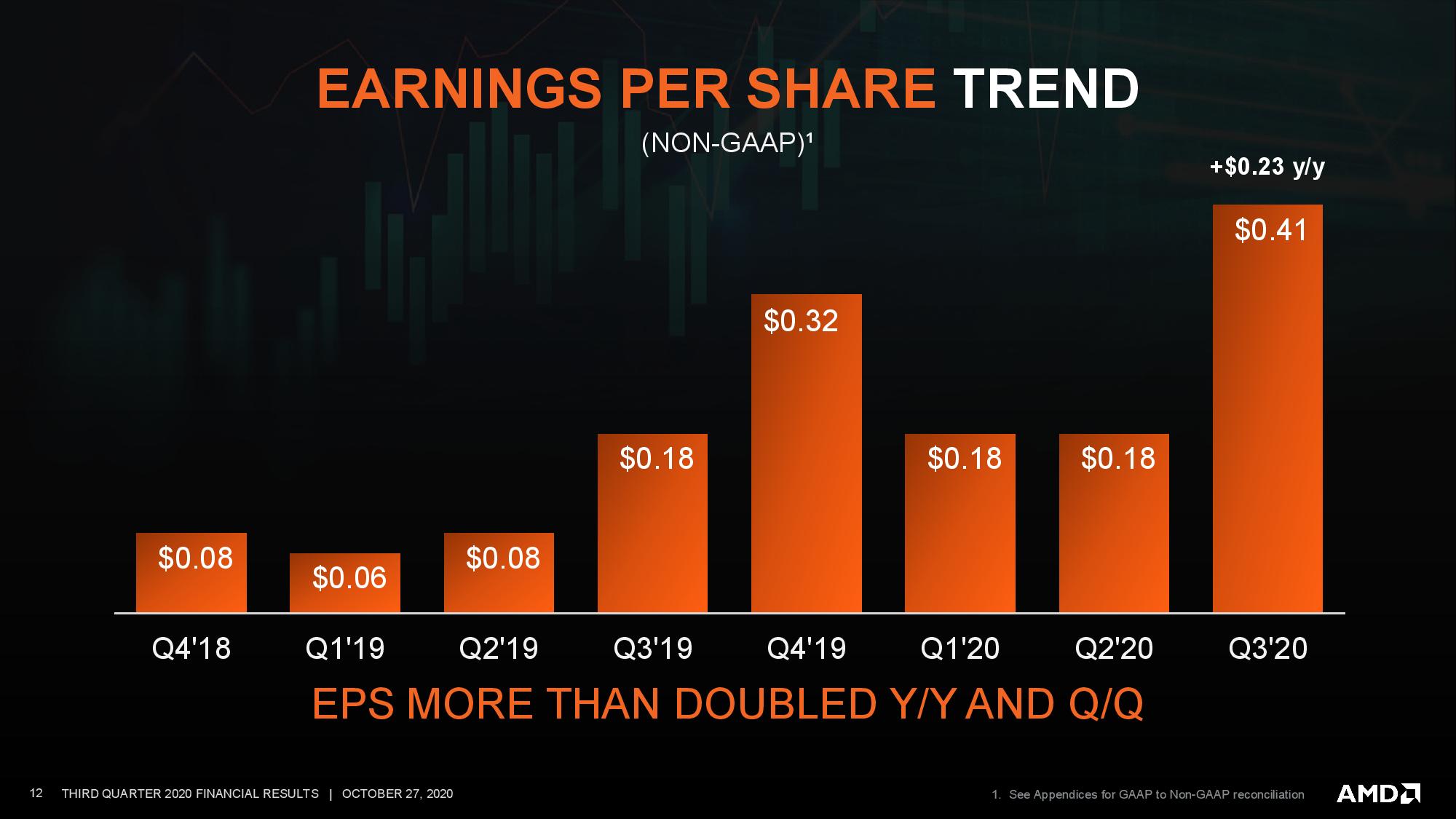

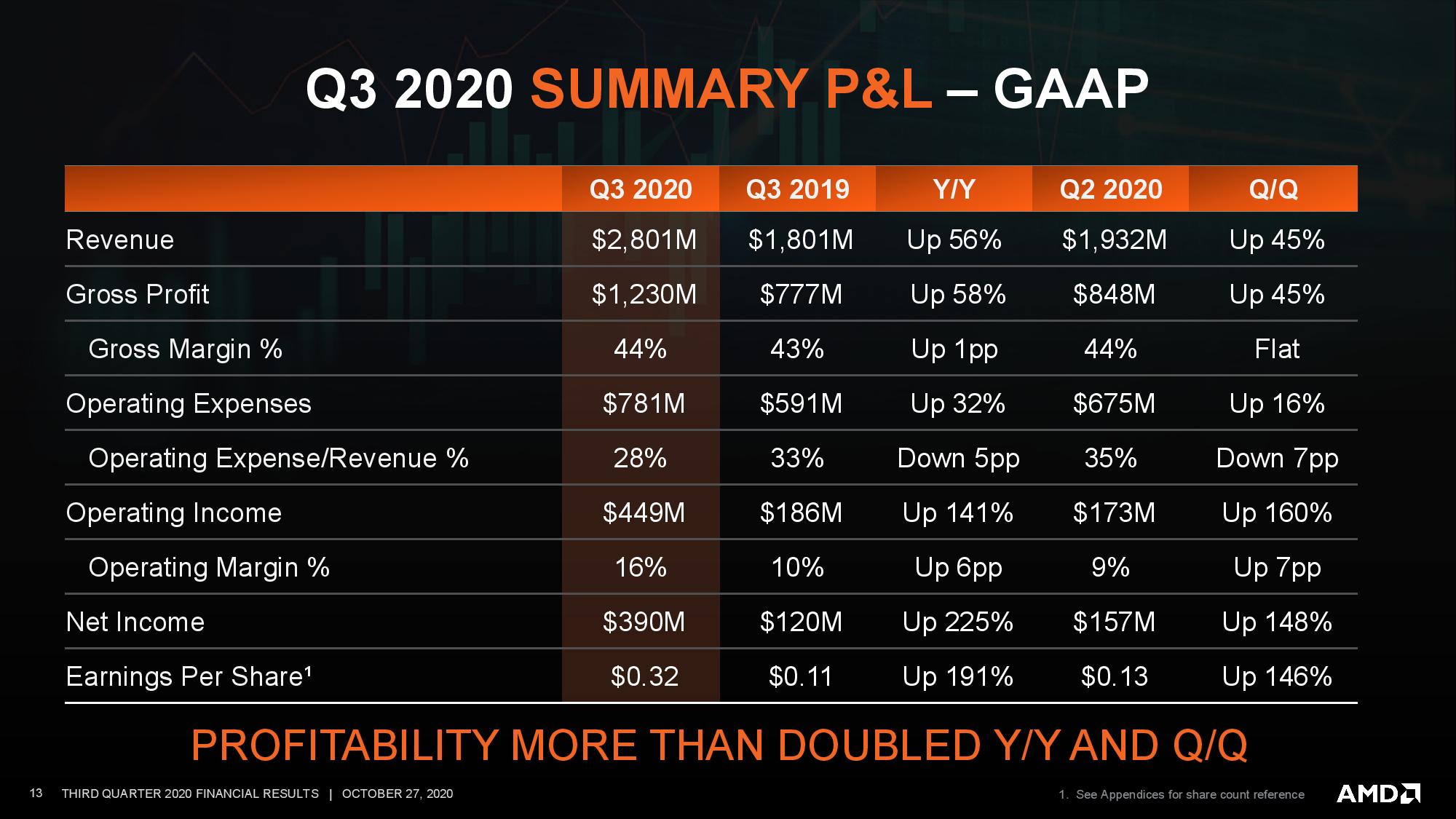

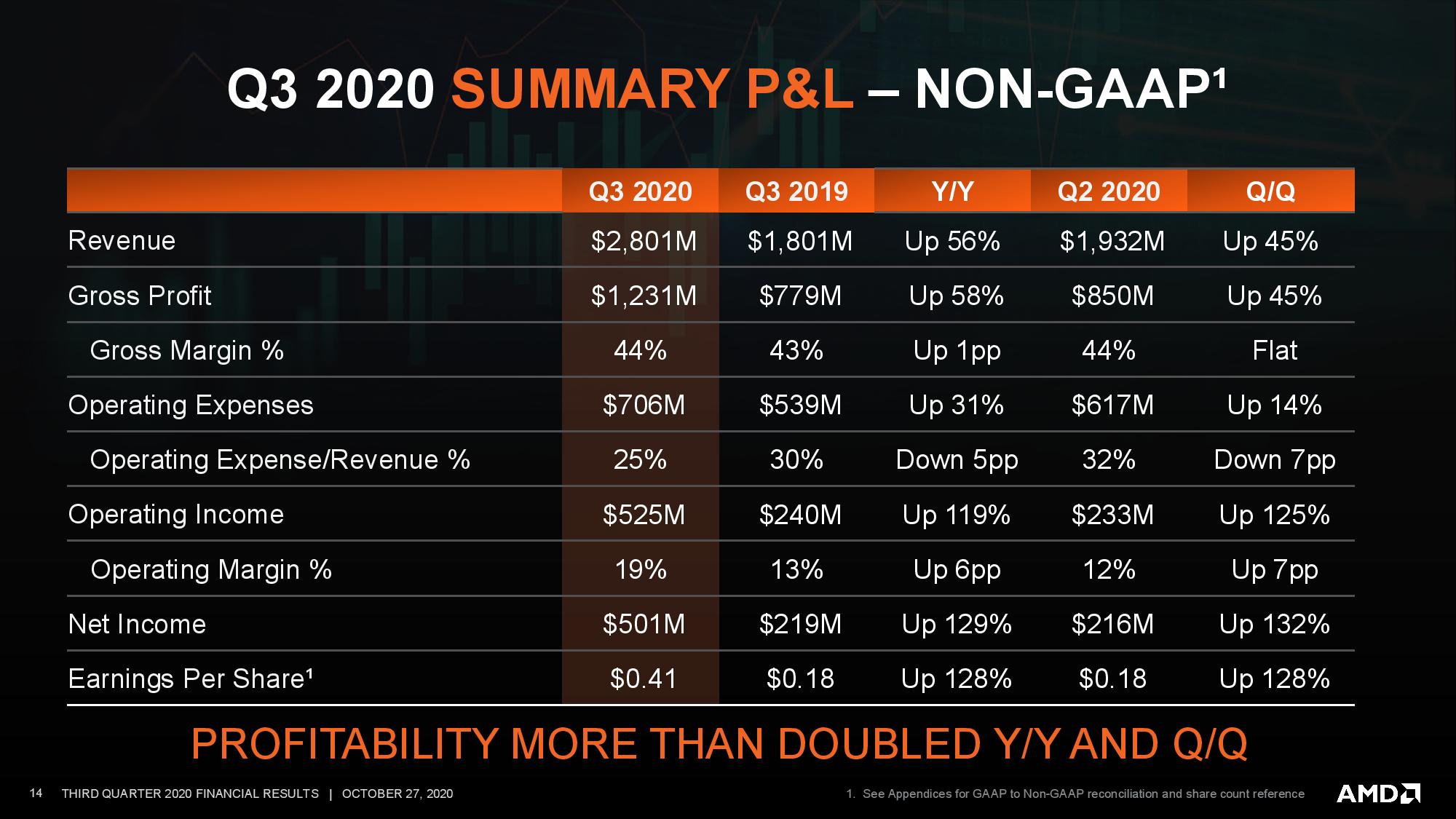

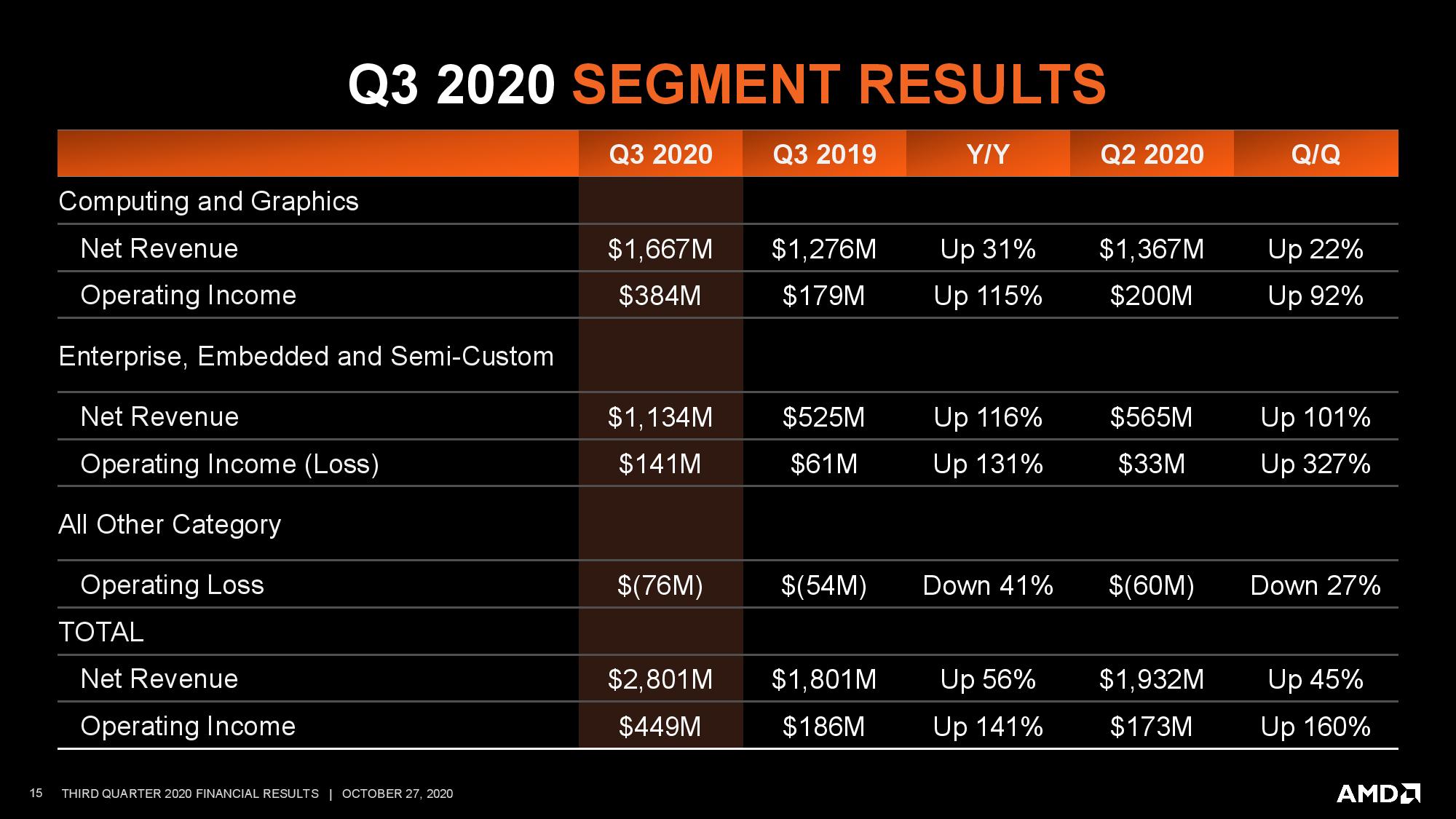

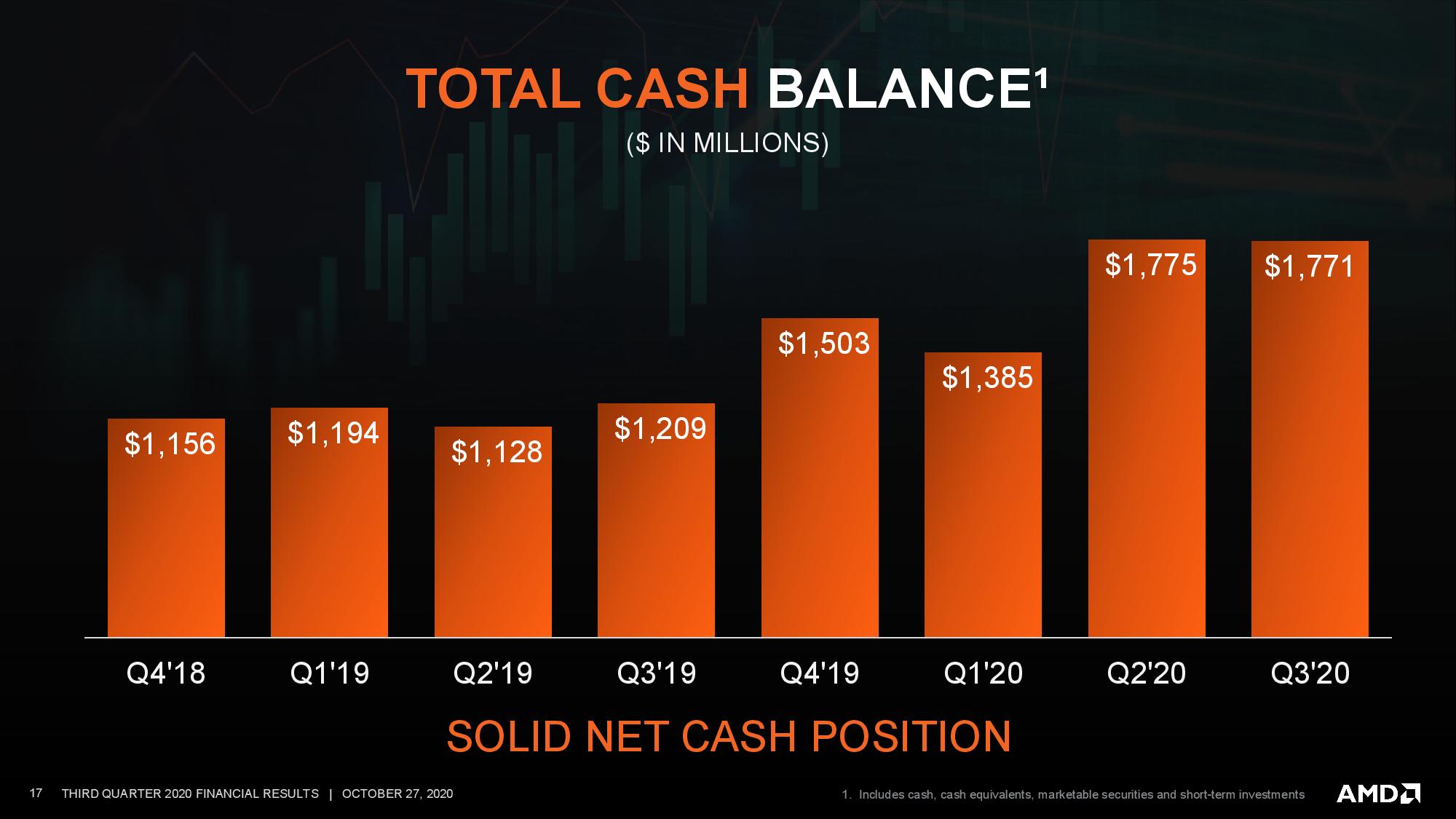

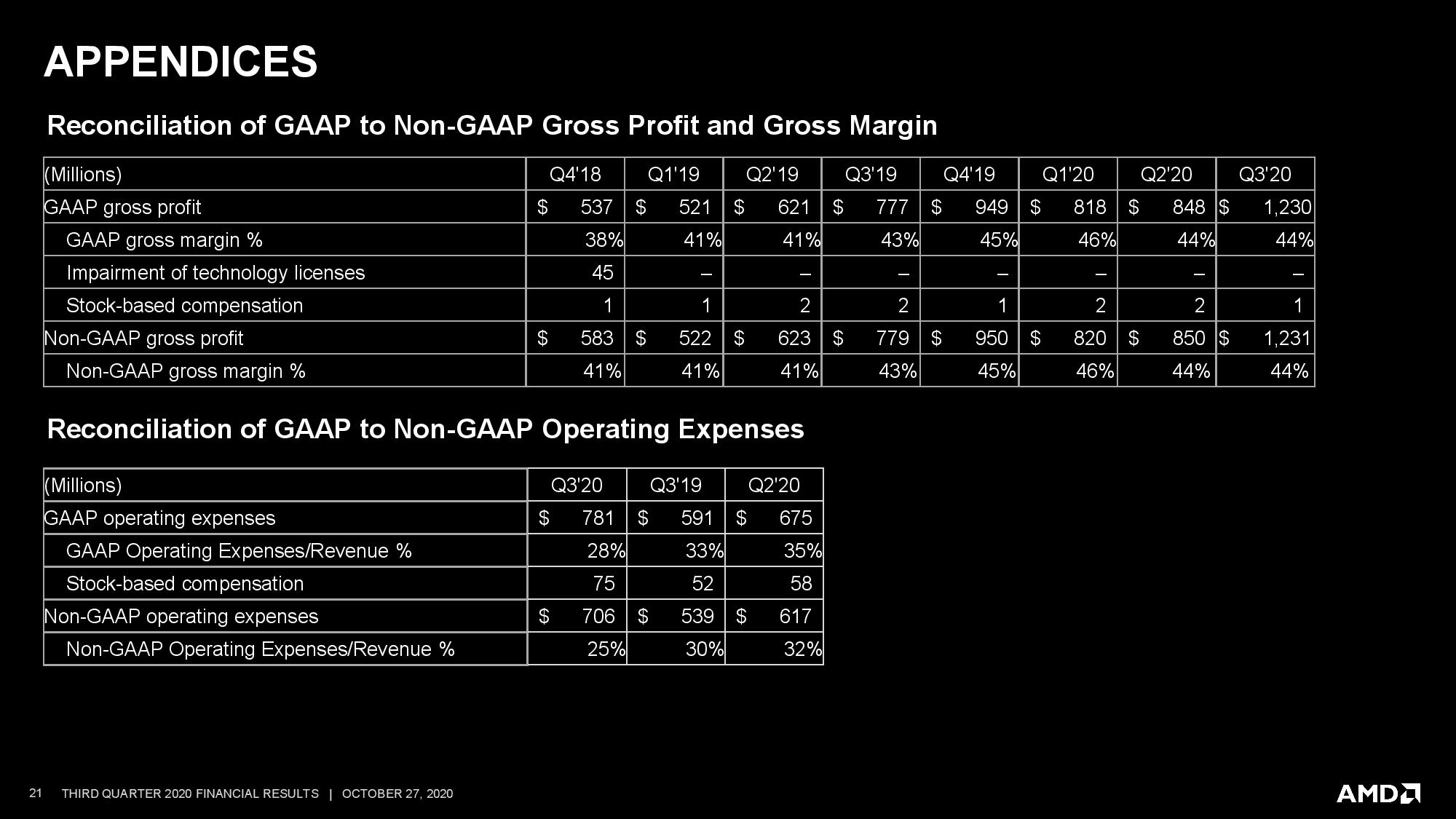

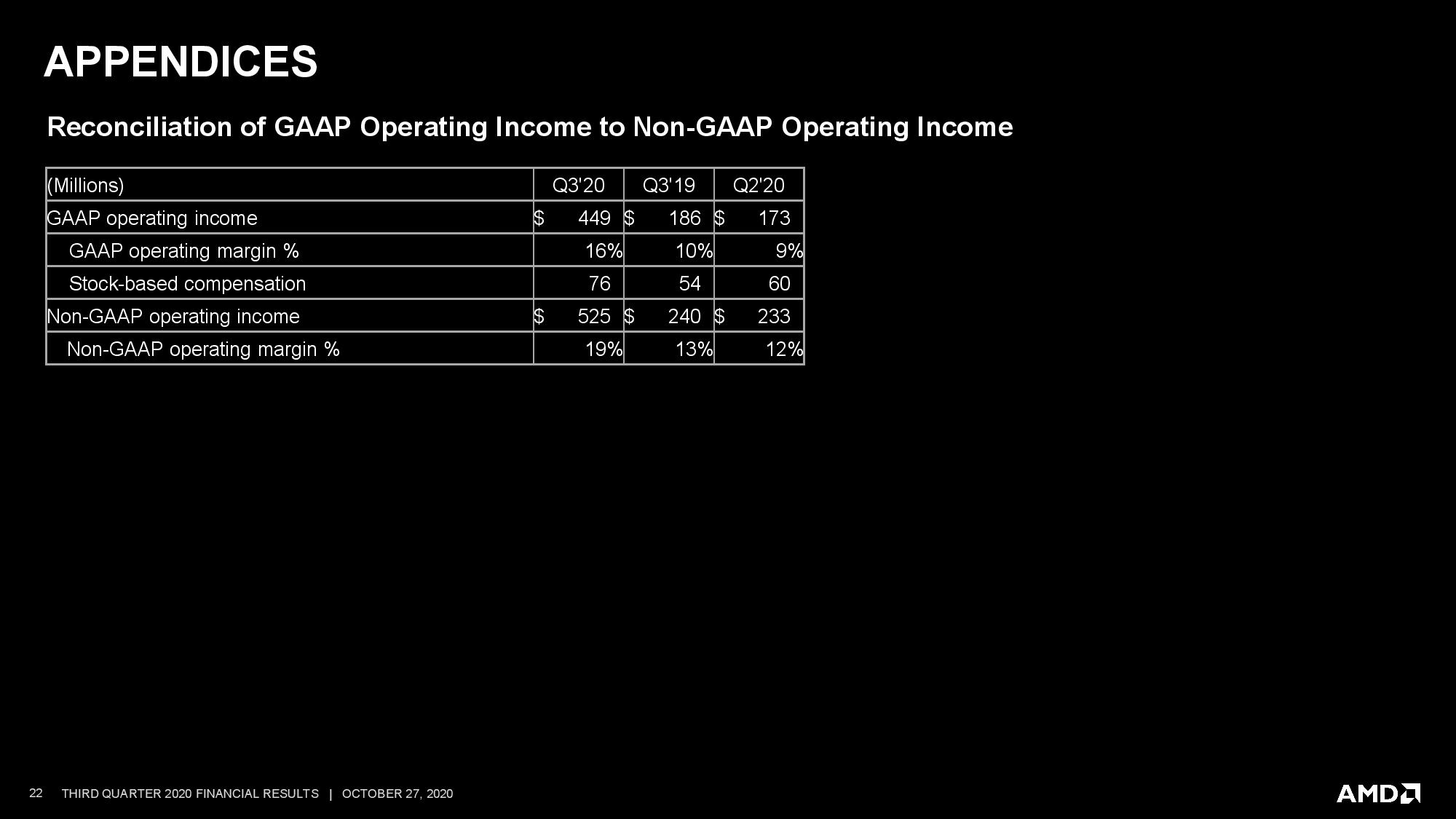

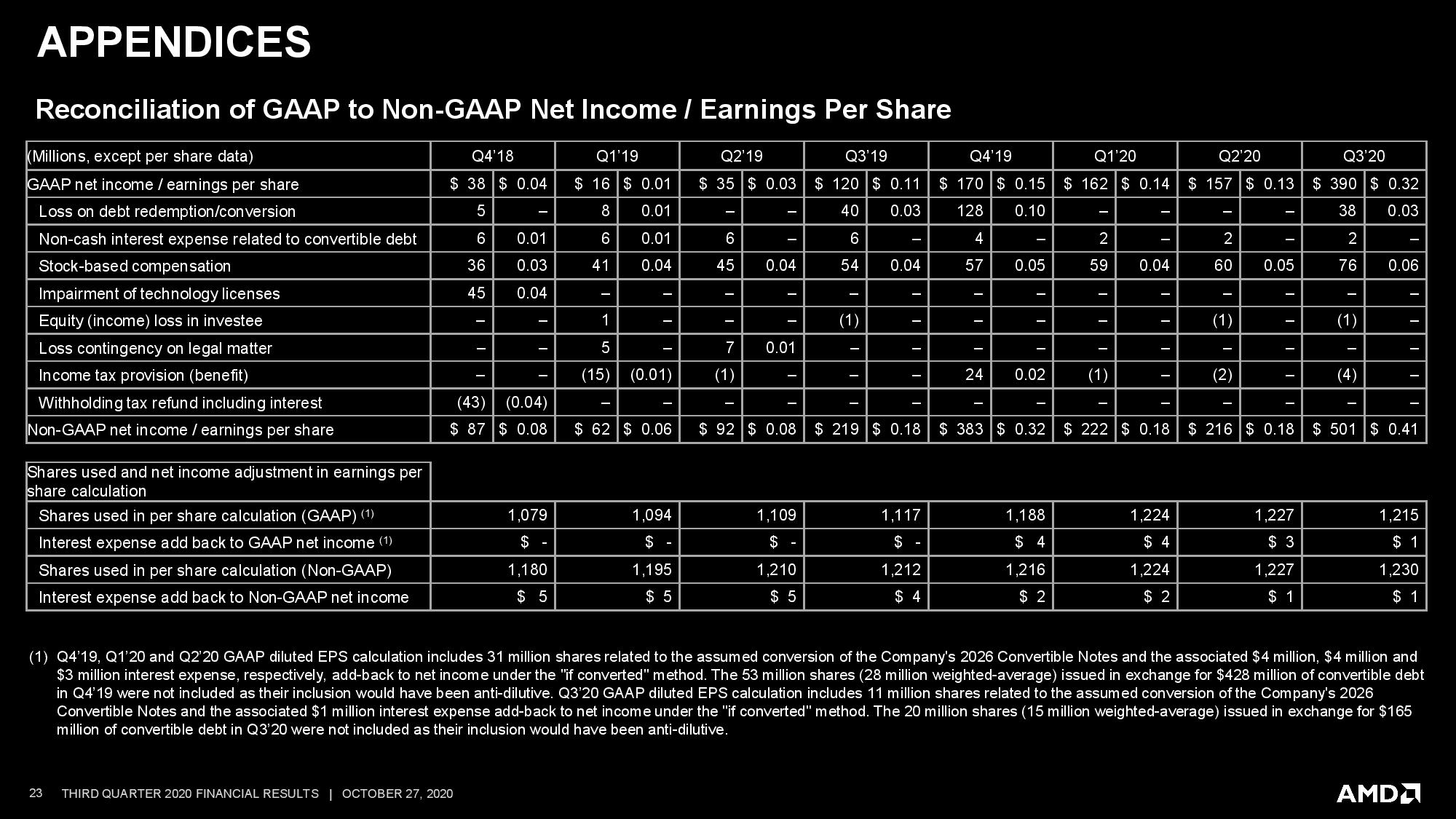

Overall, AMD is firing on nearly all cylinders, with company revenue skyrocketing to $2.8 billion, an increase of 56% year-over-year (YoY), and 45% quarter-over-quarter (QoQ). The stellar results stem from strong Ryzen and EPYC processor sales. AMD is also doing well at maintaining (and even slightly improving) its profitability: The company reported a gross margin of 44%, a 1% YoY increase. That yielded a gross profit of $1.23 billion during the quarter.

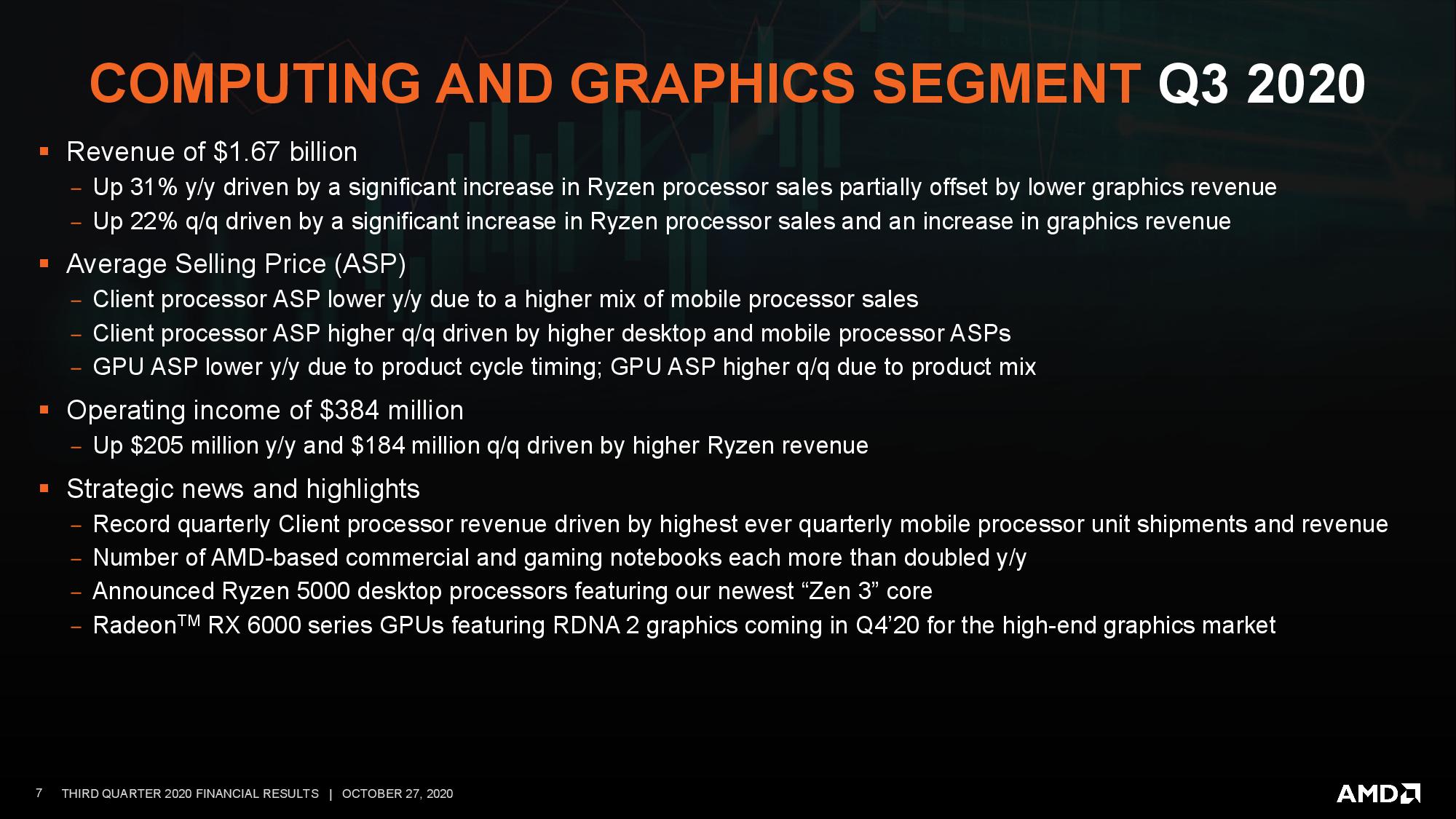

AMD raked in $1.67 billion in the client computing and graphics segment, which covers both consumer CPUs and GPUs (an increase of 31% YoY and 22% QoQ). Strong Ryzen sales drove those gains, but slow graphics sales dragged on revenue. That isn't surprising in the wake of Nvidia's Ampere launch, though AMD expects that to change with the release of its RDNA2 Big Navi graphics cards that it will announce later this week.

Meanwhile, AMD has pulled the covers off its Zen 3-based Ryzen 5000 processors, and sales begin November 5, so its already-stellar desktop PC sales should accelerate further. On that note, AMD reported that both it's desktop PC and notebook processor ASPs increased, OEM sell-through in notebooks doubled YoY, and the number of notebooks designs also doubled. Meanwhile, Intel's notebook ASPs plunged last quarter, which it chalks up to having greater availability of its lower-end chips as it looks to recover market share in the low-end. Still, AMD's Ryzen 4000 notebook processors continue to churn out big design wins, so Intel is likely facing pricing pressure on its Tiger Lake chips, too. Tiger Lake also comes with Intel's 10nm SuperFin process, which costs more to produce than Intel's 14nm, impacting margins.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD CEO Lisa Su said the company believes it gained more share in the client segment for the 12th straight quarter. Operating income of $384 for the client segment was up $205 million YoY and $184 million QoQ, indicating AMD is executing well on the client side of the house.

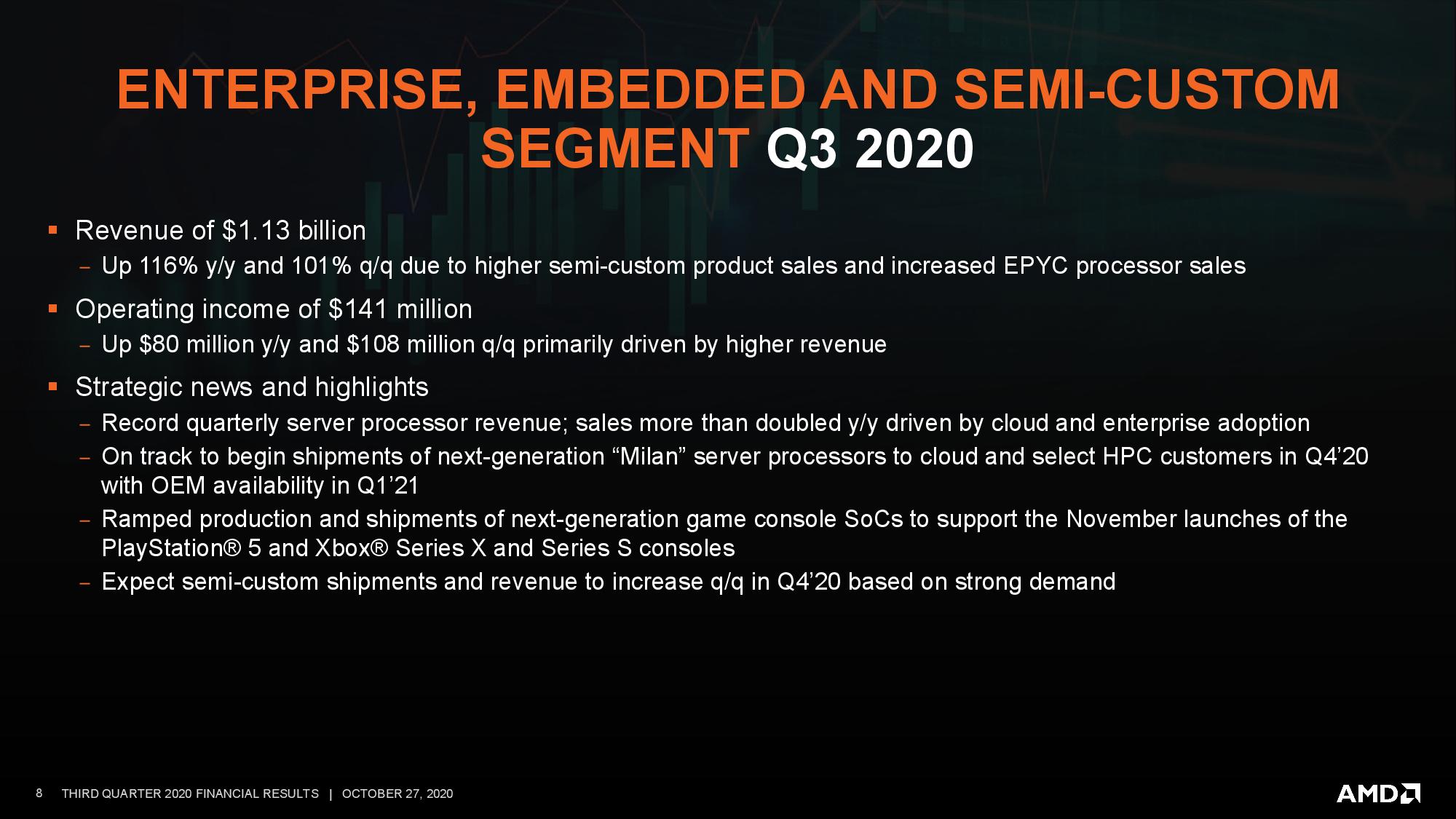

Moving on to the enterprise, embedded, and semi-custom segment, which produces server CPUs and chips for game consoles, AMD posted revenue of $1.13 billion *(up 116% YoY and 101% QoQ). That comes on the back of increased EPYC server processor sales, with revenue more than doubling YoY driven by cloud and enterprise adoption. In response, Intel has already had to cut pricing for Xeon chips, which has also hurt Intel's margins last quarter.

That growth comes before the release of AMD's next-gen EPYC Milan chips, which come with the powerful Zen 3 architecture, which begin shipping en masse to OEMs in Q1 2021. In the interim, AMD plans to begin shipping Milan chips to cloud and select HPC customers in 4Q 2020. AMD also has chips for the Playstation 5 and Xbox Series X in production, and sales ramps of those consoles over the holidays should further lift this segment through the tail end of the year.

AMD has suffered sporadic shortages of some of its client chips this year, which is largely thought to be a byproduct of limited production capacity at TSMC. Su said that supply has improved, helping the company bolster sales in the quarter, and the company doesn't see any significant supply shortages in the near future.

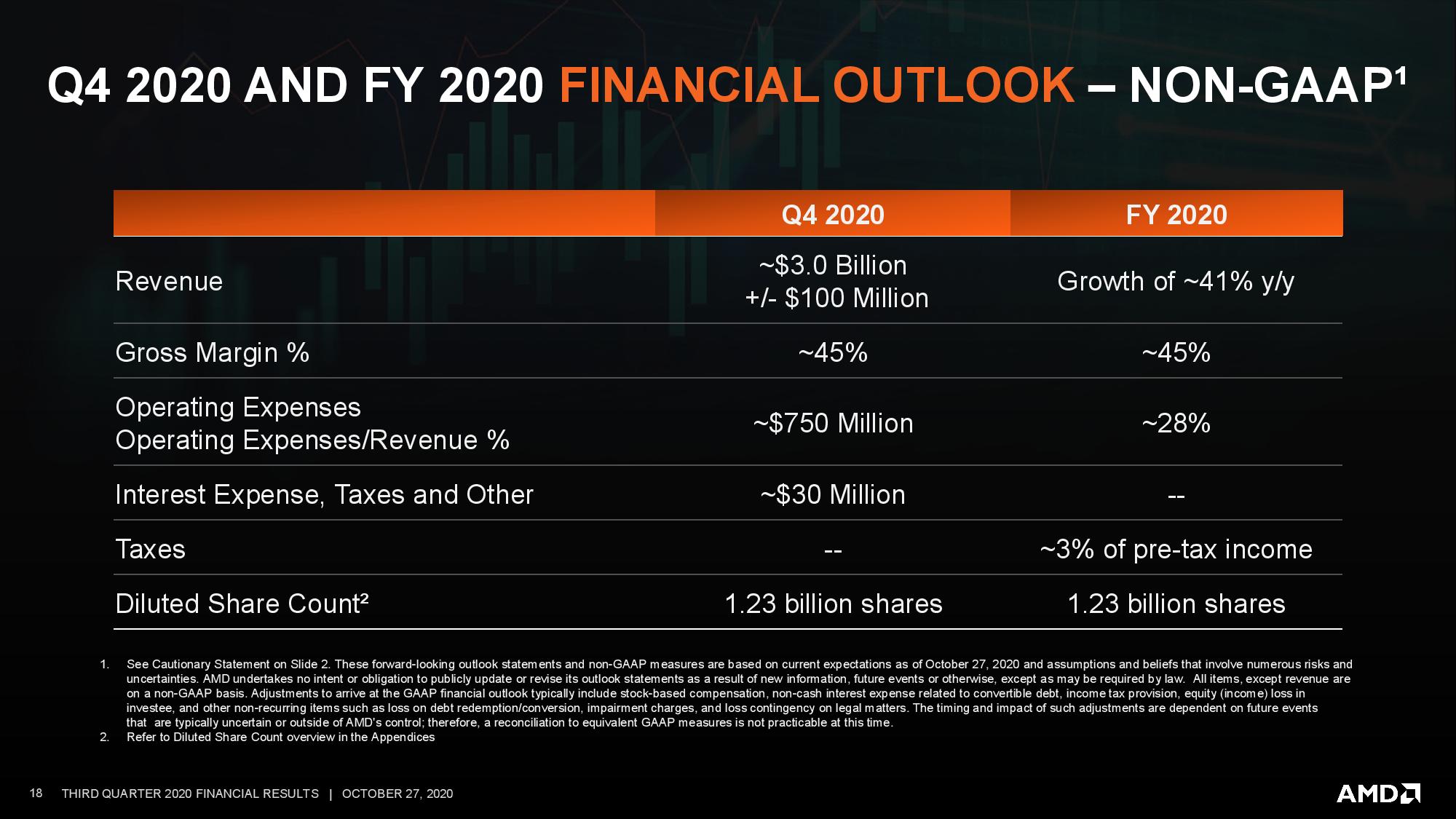

Things look good for the remainder of the year, too. AMD guides for $3 billion in revenue for the fourth quarter, a 41% YoY increase. As one would expect, AMD says those gains will come at the hands of increased Ryzen 5000 and EPYC Milan server CPU sales. AMD expects revenue to increase by 41% YoY and gross margins to weigh in at 45% for the full year, setting the stage for yet more growth in 2021.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

NewJohnny "Intel's official line is that the company isn't seeing any more competition than it expected. "Reply

Translation: "We expected to be beaten senseless." -

artk2219 ReplyNewJohnny said:"Intel's official line is that the company isn't seeing any more competition than it expected. "

Translation: "We expected to be beaten senseless."

Atleast they were realistic about it versus being "surprised" honestly they pulled an Intel and sat on their hands while they were on top and were reaping the profits. Now that theres competition, that stagnation is catching up with them. They'll be fine in the long run because i mean, they are Intel, but a lesson in humility and honestly a reorg is definitely needed. Meanwhile AMD is having their Sandy Bridge moment, Intel will take a bit to catch up, and people that bought into Ryzen 3 will probably have a chip that theyll hang onto for the next 5 to 7 years. That is unless these 19% uplifts are now the new normal, in which case, awesome, totally a welcome change. -

TerryLaze Reply

AMD made 390 million net income in this quarter compared to 4.3 billion that intel made.digitalgriffin said:Wasn't somebody on here just yesterday saying "AMD doesn't make any money"

In other words AMD's best quarter of recent years is 10% of one of intel's lowest quarters in recent years.

It's great that AMD is starting to make more money but calling intel making 4.3 billions "punish" is a huge stretch. -

digitalgriffin ReplyTerryLaze said:AMD made 390 million net income in this quarter compared to 4.3 billion that intel made.

In other words AMD's best quarter of recent years is 10% of one of intel's lowest quarters in recent years.

It's great that AMD is starting to make more money but calling intel making 4.3 billions "punish" is a huge stretch.

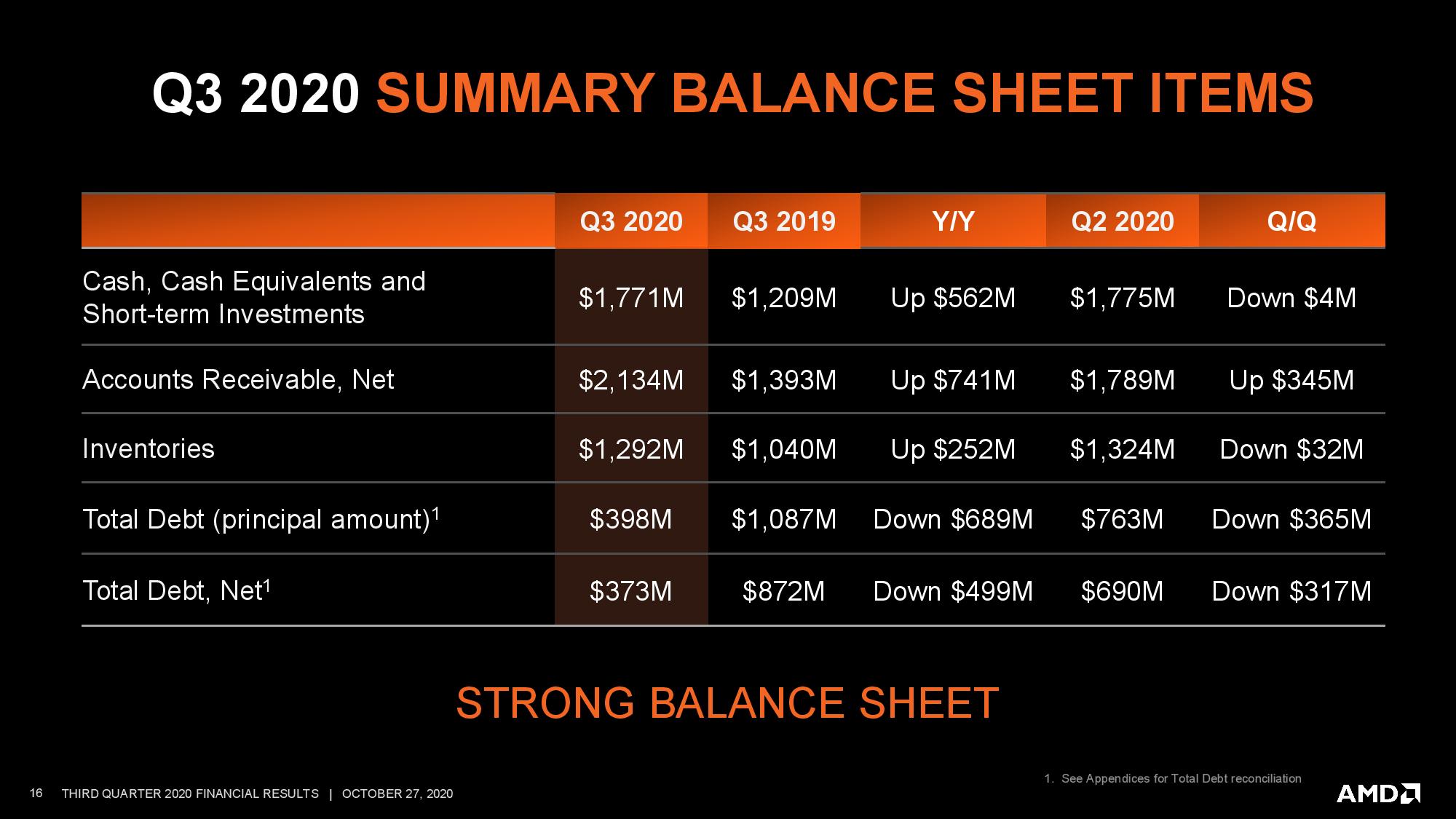

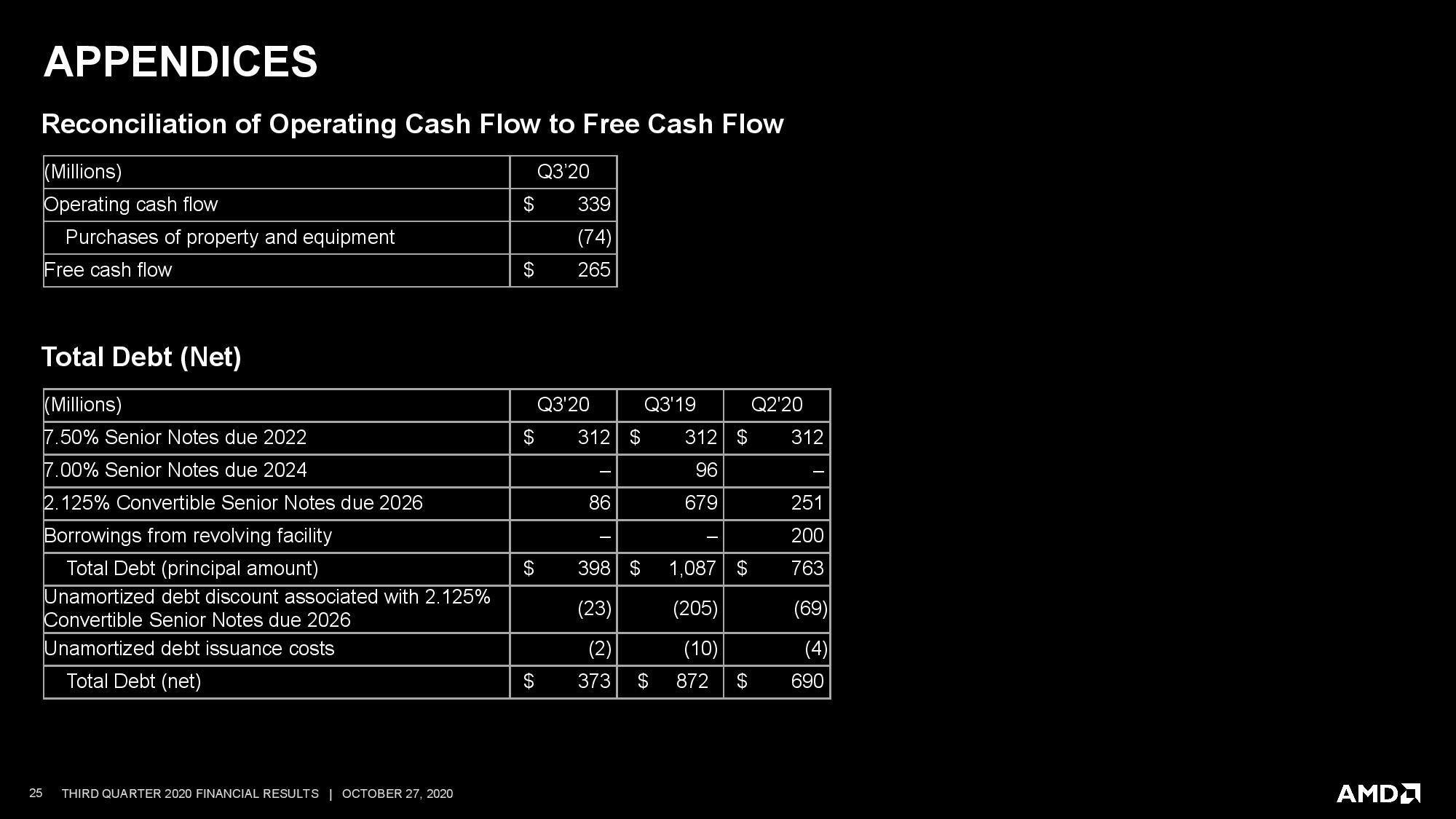

I will agree here. But the YoY growth and Ryzen 5000 is going to start dealing punishing blows in next quarters. AMD has pretty much eliminated their debt.

As Intel doesn't have anything to meet AMD with over the next 2 years, and net losses on the horizon, They will be close to parity by 2022. At least according to my numbers. Intel will have to start shedding more businesses for one time GAAP gains to hold up.

The limit is if the 5nm and 7nm foundry supply and if it can keep up. -

TerryLaze Reply

Considering that TSMCs whole revenue, and they are booked out solidly according to popular believe, is roughly half that of intel and AMD only gets a (small? )part of that, I highly doubt that it will be punishing blows.digitalgriffin said:I will agree here. But the YoY growth and Ryzen 5000 is going to start dealing punishing blows in next quarters. AMD has pretty much eliminated their debt.

TSMC makes half the rev/net income of intel and that will likely not change.

AMD is very likely to keep growing but that will not affect intel.

https://www.macrotrends.net/stocks/charts/TSM/taiwan-semiconductor-manufacturing/revenuehttps://www.macrotrends.net/stocks/charts/INTC/intel/revenue -

digitalgriffin ReplyTerryLaze said:Considering that TSMCs whole revenue, and they are booked out solidly according to popular believe, is roughly half that of intel and AMD only gets a (small? )part of that, I highly doubt that it will be punishing blows.

TSMC makes half the rev/net income of intel and that will likely not change.

AMD is very likely to keep growing but that will not affect intel.

https://www.macrotrends.net/stocks/charts/TSM/taiwan-semiconductor-manufacturing/revenuehttps://www.macrotrends.net/stocks/charts/INTC/intel/revenue

Anytime you lose double digit market revenue %, and your rival gains double digit revenue %, that's punishing.

Intel are on track to lose double digit revenue and AMD gain double digit revenue. You can't tell me that's not punishing. Over time that quickly eats your profitability. And Intel is fat around the gut with operating cost. -

Johnpombrio Terrific numbers from AMD and a hearty congratulations. That said, the next two quarters are benefitting greatly from the imminent launch of the two new consoles. Once the big rush is over, AMD will quickly go back to the pennies per console profits. Good money and helps increase revenue but does not help AMD break the 45% gross margin ceiling it seems to be bumping up against.Reply -

JayNor Replydigitalgriffin said:As Intel doesn't have anything to meet AMD with over the next 2 years

According to CC, Intel already sampling Alder Lake-S. They are already shipping the DG1 Xe GPU, and SG1 is in production, Xe-HPG and Xe-HP in the lab. Sapphire Rapids Server is sampling. Ice Lake Server in qualifications and ramping in volume in q1. Tiger Lake-H and Rocket Lake-S in q1.

Optane, avx512, dlboost, Thunderbolt 4, Wifi6 integrated features are yet to be developed by AMD. Intel also includes PCIE4 and lpddr5 support on Tiger Lake, which AMD has not matched on their laptop chips yet.

On Alder Lake, Intel brings in two new cores ... Gracemont and Golden Cove. The Gracemont matches AMD's avx2 simd in a low power and very compact Atom chip. -

waltc3 Replydigitalgriffin said:Anytime you lose double digit market revenue %, and your rival gains double digit revenue %, that's punishing.

Intel are on track to lose double digit revenue and AMD gain double digit revenue. You can't tell me that's not punishing. Over time that quickly eats your profitability. And Intel is fat around the gut with operating cost.

Good post! Absolutely. Intel is getting clobbered on the desktop and the desktop ASPs--all down considerably. It makes no sense at all to think the pandemic slowed down Intel even while AMD's pandemic business shot through the roof. No sense at all. Even looking at Intel's notebook share, that's dropping as well along with laptop CPU ASPs. And AMD is only now getting warmed up! Hasn't hit its stride yet, by any means. AMD income is set to at the very least double with buying Xilinx--a fantastic deal all around for both companies, imo. Depending on the products the combined companies produce--their combined incomes may triple what they were doing separately--or even quadruple it, as opposed to merely adding what each company is doing now together, etc.

People are weird when it comes to Intel--they talk about the money Intel is making when they should be looking at all the dough AMD is raking in--that's all money a part of which at least (if not all) would belong to Intel--except for AMD. AMD is getting it; Intel isn't. People get bullheaded about Intel--I don't understand it, either. In the final analysis, whether it's Intel or it's AMD, he who makes the best products wins. He who makes the best products long term wins long term. The world will, most assuredly, beat a path to your door if you offer a better mousetrap. I don't know of a time in the history of either company when that wasn't true. Intel was able to leverage market dominance at the turn of the century to be able to actually pay companies like Dell specific and large sums simply not to sell AMD. I've seen figures wherein Intel's direct subsidies paid to Dell actually kept Dell solvent for a couple of quarters in those days! Thankfully, none of that applies today!

AMD has no intention of slowing down product development--so Intel isn't going to get a couple of years of AMD remaining stagnant in order to catch up and pass AMD, as happened after the Athlon and the A64/Opteron. That's not in the cards. It might even be that Intel will decide to get out of the high-performance CPU business, sell off some FABs, and concentrate on some different aspects of the chip and PCB business than what the company has traditionally involved itself with. The Intel execs have commented about that very thing several times, already, in just the last year--ever since they have so clearly dropped behind AMD technically and publicly. That's likely just an apology, though, to their stockholders--for getting thrashed so publicly for the last year. Mind share directly correlates to market share, and AMD is all over Intel in the category. Really, Zen 2 as of just 16 months ago was the first time that AMD had moved out indisputably ahead of Intel in multi-core performance ( Zen1/+ were nice products, no question), but Zen 2 was where the AMD jewels really began to shine, imo. Multi-core performance, of course, is the new paradigm through which CPU performance will be. and shall be judged from now on. Now comes Zen 3 in a few days, and AMD is jumping even further ahead. Zen 4, Papermaster says, is already in design! AMD at present is a production and execution dynamo that Intel cannot match--ergo, AMD's stock shot up and away from Intel's, for the first time (and surely not the last...;))

The really, really big difference between AMD and Intel, as I see it,--a huge difference, is that as a company, AMD, since its inception, has always of necessity been a highly competitive company. The company is honed to a razor's edge to compete--it's a lean, mean, engineering machine, as I see it. For AMD the "compete or die" metric has always been a fact of life. OTOH, Intel has never in its existence had to compete with another company or else...or else face a quick annihilation if it couldn't come out on top in a reasonable amount of time. Intel simply doesn't really know how to exist in an environment in which neck-in-neck competition is the daily norm. The two companies could not be more different in that regard. I expect it may well be that Intel will compete with AMD for several years into the future before it will best AMD again in the x86 CPU performance arena. Then again, there may be nothing so rosy as that in store for Intel as time goes on. Much is happening right now right before our eyes in the CPU technology industry.

--Well, look at this! Sorry I got wound up here...;) I've only gone about three paragraphs more than I intended!