Chia Coin's Initially High Prices Could Cause a Storage Shortage

The price is dropping but still looks far too enticing.

After about a month of preparation, following the initial mainnet launch, cryptocurrency Chia Coin (XCH) has officially started trading — which means it's possibly preparing to suck up all of the best SSDs like Ethereum (see how to mine Ethereum) has been gobbling up the best graphics cards. Early Chia calculators suggested an estimated starting price of $20 per XCH. That was way off, but with the initial fervor and hype subsiding, we're ready to look at where things stand and where they might stabilize.

To recap, Chia is a novel approach to cryptocurrencies, ditching the Proof of Work hashing used by most coins (i.e., Bitcoin, Ethereum, Litecoin, Dogecoin, and others) and instead opting for a new Proof of Time and Space algorithm. Using storage capacity helps reduce the potential power footprint, obviously at the cost of storage. And let's be clear: The amount of storage space (aka netspace) already used by the Chia network is astonishing. It passed 1 EiB (Exbibyte, or 2^60 bytes) of storage on April 28, and just a few days later it's approaching the 2 EiB mark. Where will it stop? That's the $21 billion dollar question.

All of that space goes to storing plots of Chia, which are basically massive 101.4GiB Bingo cards. Each online plot has an equal chance, based on the total netspace, of 'winning' the block solution. This occurs at a rate of approximately 32 blocks per 10 minutes, with 2 XCH as the reward per block. Right now, assuming every Chia plot was stored on a 10TB HDD (which obviously isn't accurate, but roll with it for a moment), that would require about 200,000 HDDs worth of Chia farms.

Assuming 5W per HDD, since they're just sitting idle for the most part, that's potentially 1 MW of power use. That might sound like a lot, and it is — about 8.8 GWh per year — but it pales in comparison to the amount of power going into Bitcoin and Ethereum. Ethereum, as an example, currently uses an estimated 41.3 TWh per year of power because it relies primarily on the best mining GPUs, while Bitcoin uses 109.7 TWh per year. That's around 4,700 and 12,500 times more power than Chia at present, respectively. Of course, Ethereum and Bitcoin are also far more valuable than Chia at current exchange rates, and Chia has a long way to go to prove itself a viable cryptocoin.

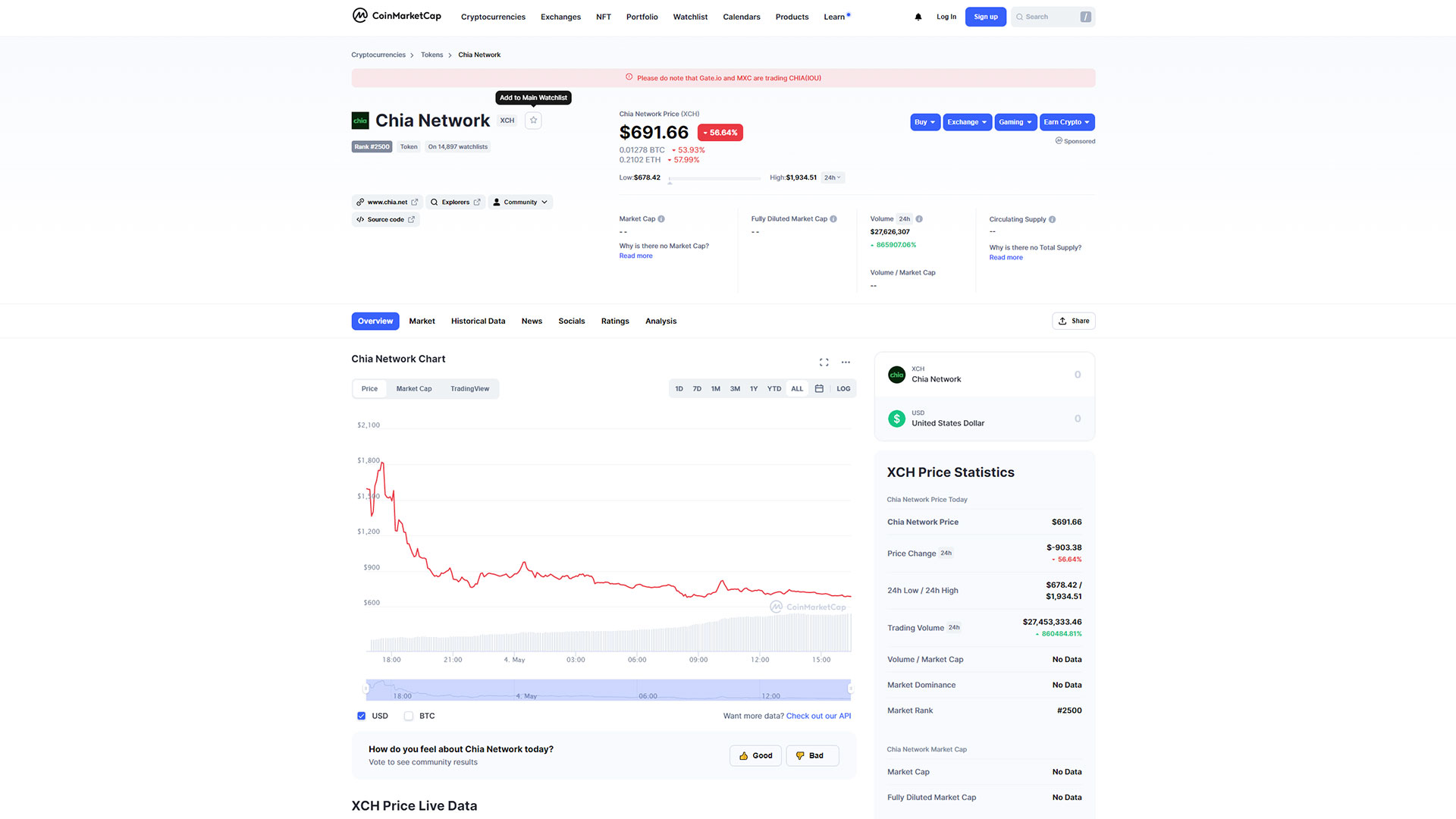

Back to the launch, though. Only a few cryptocurrency exchanges have picked up XCH trading so far, and none of them are what we would call major exchanges. Considering how many things have gone wrong in the past (like the Turkish exchange where the founder appears to have walked off with $2 billion in Bitcoins), discretion is definitely the best approach. Initially, according to Coinmarketcap, Gate.io accounted for around 65% of transactions, MXC.com was around 34.5%, and Bibox made up the remaining 0.5%. Since then, MSC and Gate.io swapped places, with MXC now sitting at 64% of all transactions.

By way of reference, Gate.io only accounts for around 0.21% of all Bitcoin transactions, and MXC doesn't even show up on Coinmarketcap's list of the top 500 BTC exchange pairs. So, we're talking about small-time trading right now, on riskier platforms, with a total trading volume of around $27 million in the first day. That might sound like a lot, but it's only a fraction of Bitcoin's $60 billion or so in daily trade volume.

Chia started at an initial trading price of nearly $1,600 per XCH, peaked in early trading to peak at around $1,800, and has been on a steady downward slope since then. At present, the price seems to mostly have flattened out (at least temporarily) at around $700. It could certainly end up going a lot lower, however, so we wouldn't recommend betting the farm on Chia, but even at $100 per XCH a lot of miners/crypto-farmers are likely to jump on the bandwagon.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As with many cryptocoins, Chia is searching for equilibrium right now. 10TB of storage dedicated to Chia plots would be enough for a farm of 100 plots and should in theory account for 0.0005% of the netspace. That would mean about 0.046 XCH per day of potential farming, except you're flying solo (proper Chia pools don't exist yet), so it would take on average 43 days to farm a block — and that's assuming netspace doesn't continue to increase, which it will. But if you could bring in a steady stream of 0.04 XCH per day, even if we lowball things with a value of $100, that's $4-$5 per day, from a 10TB HDD that only costs about $250. Scale that up to ten drives and you'd be looking at $45 per day, albeit with returns trending downward over time.

GPU miners have paid a lot more than that for similar returns, and the power and complexity of running lots of GPUs (or ASICs) ends up being far higher than running a Chia farm. In fact, the recommended approach to Chia farming is to get the plots set up using a high-end PC, and then connect all the storage to a Raspberry Pi afterwards for low-power farming. You could run around 50 10TB HDDs for the same amount of power as a single RTX 3080 mining Ethereum.

It's important to note that it takes a decent amount of time to get a Chia farm up and running. If you have a server with a 64-core EPYC processor, 256GB of RAM, and at least 16TB of fast SSD storage, you could potentially create up to 64 plots at a time, at a rate of around six (give or take) hours per group of plots. That's enough to create 256 plots per day, filling over 2.5 10TB HDDs with data. For a more typical PC, with an 8-core CPU (e.g, Ryzen 7 5800X or Core i9-11900K), 32GB of RAM, and an enterprise SSD with at least 2.4TB of storage, doing eight concurrent plots should be feasible. The higher clocks on consumer CPUs probably mean you could do a group of plots in four hours, which means 48 plots per day occupying about half of a 10TB HDD. That's still a relatively fast ramp to a bunch of drives running a Chia farm, though.

In either case, the potential returns even with a price of $100 per XCH amount to hundreds of dollars per month. Obviously, that's way too high of a return rate, so things will continue to change. Keep in mind that where a GPU can cost $15-$20 in power per month (depending on the price of electricity), a hard drive running 24/7 will only cost $0.35. So what's a reasonable rate of return for filling up a hard drive or SSD and letting it sit, farming Chia? If we target $20 per month for a $250 10TB HDD, then either Chia's netspace needs to balloon to around 60EiB, or the price needs to drop to around $16 per XCH — or more likely some combination of more netspace and lower prices.

In the meantime, don't be surprised if prices on storage shoots up. It was already starting to happen, but like the GPU and other component shortages, it might be set to get a lot worse.

Jarred Walton is a senior editor at Tom's Hardware focusing on everything GPU. He has been working as a tech journalist since 2004, writing for AnandTech, Maximum PC, and PC Gamer. From the first S3 Virge '3D decelerators' to today's GPUs, Jarred keeps up with all the latest graphics trends and is the one to ask about game performance.

-

jasonelmore whats with all the Chia coin shilling. You guys act like it's the first crypto to offer a proof of storage blockchain. Filecoin offers the same technology, is not based in China, and has mature tokenomics. You can't even buy Chia coin.Reply -

caseym54 The 16TB and 14TB drives are really hard to find already.Reply

What a fracking waste of energy and storage. What's next? Basing money on baby's teeth? -

lvt Replycaseym54 said:What's next? Basing money on baby's teeth?

Could be DDR2/3/4 RAM Farming.

The more RAM you have, the more crypto money you earn. -

JarredWaltonGPU Reply

Nope, it's not at all the same: https://docs.filecoin.io/mine/hardware-requirements/jasonelmore said:whats with all the Chia coin shilling. You guys act like it's the first crypto to offer a proof of storage blockchain. Filecoin offers the same technology, is not based in China, and has mature tokenomics. You can't even buy Chia coin.

While Filecoin has been around a while, and it's Proof of SpaceTime may be similar to (or even the same as — it's not really important) Chia's Proof of Time and Space, the way farming works on Chia is decidedly different. That's why miners/farmers in China have been buying up storage during the past month or two.

As for why we report on it, this has the potential to impact computer enthusiasts and hobbyists, just like GPU mining has impacted us. Some will be interested in trying to earn a buck via farming Chia, others will just want to know why storage prices are going up. Either way, it's relatively big news right now in the storage sector. -

watzupken It is still worth because prices of hard drives are still fairly low, even though they have gone up considerably with this Chia mining. I am not surprise as this gets more popular, prolong shortage due to extremely high demand will see the drive prices trend upwards. At some stage it will hit a tipping point.Reply -

JarredWaltonGPU Reply

The biggest roadblock right now, IMO, is that there's no proper pooled mining -- everyone is basically flying solo. So the big mining groups can scale up way faster than individual miners (farmers), and if you want to have a reasonable chance of solving a block and getting paid, like say once per two weeks, you'd need at least 36TB of storage filled with plots. At an ambitious ramp in plots, a single PC might be able to add 24 plots per day, so it will take 15 days just to create the plots.watzupken said:It is still worth because prices of hard drives are still fairly low, even though they have gone up considerably with this Chia mining. I am not surprise as this gets more popular, prolong shortage due to extremely high demand will see the drive prices trend upwards. At some stage it will hit a tipping point.

15 days ago, the netspace for Chia was only around 400 PiB. So in 15 days the netspace has increased five-fold. I don't think it's going to be up to 30 EiB in the next 15 days, but at the current rate of scaling, it could easily be at 10–15 EiB. Which means 36 TiB of plots will then take more like 60–90 days on average to solve a block.

It's like the early days of many cryptocoins, where there's a ton of hype and a rush to grab as much of the hashing / farming / staking / whatever power as possible in the shortest time possible. And we still can't really say whether Chia will stick around long-term. -

cryoburner Reply

It wouldn't surprise me if they had piles of review-sample drives grinding away at mining them.jasonelmore said:whats with all the Chia coin shilling.

...and Chia has a long way to go to prove itself a viable cryptocoin.

I would think a "viable" coin would be one that sees widespread use as an actual currency, not just a useless collectible to trade in for real money to speculative investors before the market for it inevitably collapses. Like other cryptocurrencies, this is just another scam designed to make the creators and early adopters money by essentially stealing from those who will eventually be left holding onto what is essentially a worthless product.