China Establishes $41 Billion Fund to Boost Fab Tool Makers

China pours in massive sums into domestic makers of wafer fab equipment.

China is gearing up to establish yet another investment fund to finance the development of its domestic semiconductor industry, according to Reuters. The new fund will have $40 billion to invest in companies developing and producing wafer fab equipment. It will be one of the most substantial efforts by the China Integrated Circuit Industry Investment Fund, also known as the Big Fund.

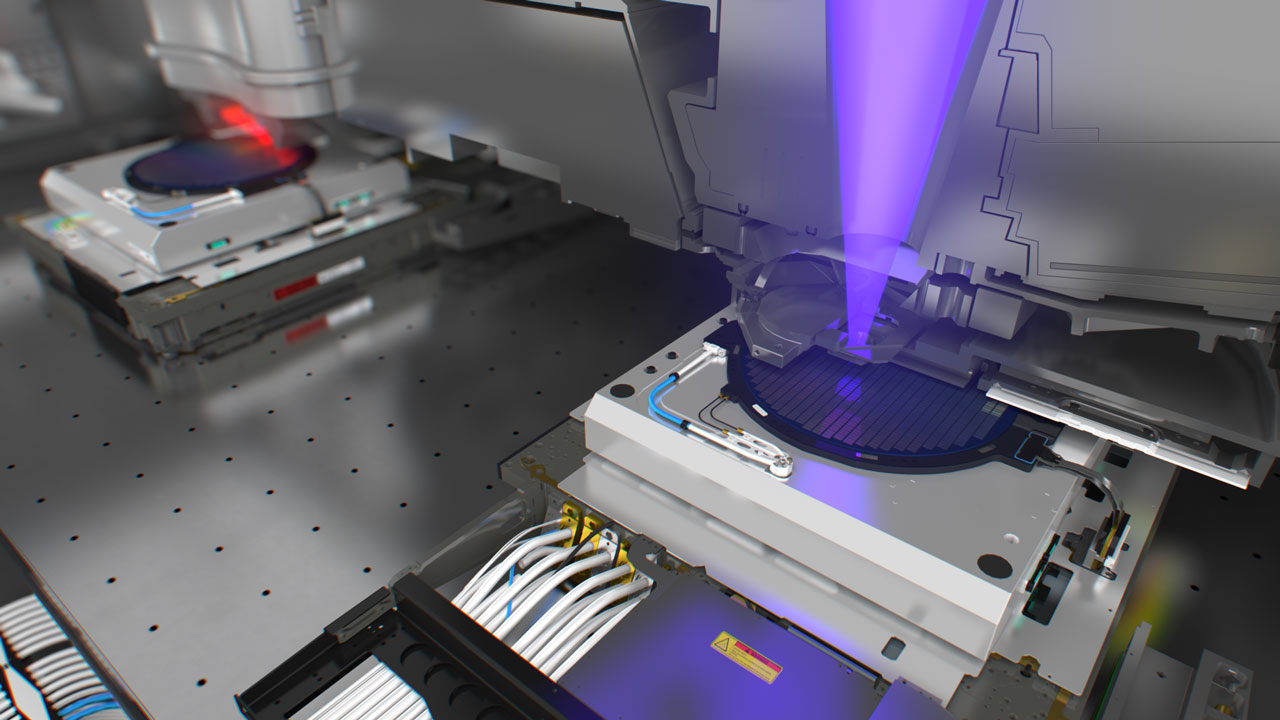

The report claims that the new fund could be China's most important because it focuses on the country's fundamental abilities to build tools for making chips. In recent years, Chinese chipmakers have lost access to more or less sophisticated wafer fab equipment from American, Dutch, and Japanese companies, which significantly limits the development of China's semiconductor champions, such as SMIC and YMTC.

While China's SMIC and YMTC have competitive logic and 3D NAND manufacturing technologies, they need tools produced in the U.S., Netherlands, and Japan to use them. Without access to equipment from ASML, Applied Materials, and Tokyo Electron, these companies will not be able to develop further, so China is ready to help local makers of fab tools.

Previously, in 2014 and 2019, China had launched similar investment funds but on a smaller scale, garnering funds amounting to 138.7 billion yuan and 200 billion yuan, respectively. The upcoming fund dwarfs these amounts, targeting an ambitious 300 billion yuan ($41 billion), emphasizing its utmost importance.

On the funding front, China's finance ministry has committed to infusing a substantial portion of the fund, with a contribution of 60 billion yuan, according to Reuters. However, details about other potential contributors remain under wraps. Entities such as China Development Bank Capital, China National Tobacco Corporation, and China Telecom have historically backed the Big Fund's initiatives.

Regarding management and oversight for the new fund, the Big Fund contemplates engaging at least two institutional entities. Despite being under investigation since 2021, SINO-IC Capital is projected to remain a pivotal player in managing the fund. Additionally, discussions with China Aerospace Investment, a state-owned enterprise's investment arm, have been initiated for potential managerial roles.

The geopolitical landscape significantly influences China's intensified efforts in the semiconductor domain. President Xi Jinping has continually emphasized the critical importance of the nation becoming self-reliant in the semiconductor sector. This urgency has been magnified with the U.S., alongside allies like Japan and the Netherlands, imposing stringent restrictions on China's access to advanced chipmaking resources, citing security and defense concerns.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Despite hefty investments from the Big Fund in the past, China's position in the global semiconductor arena, especially regarding advanced logic chips, remains elusive.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

-Fran- Because of the way Chinese IP works, I think they may be able to catch up in a shorter amount of time than the US (and allies) think they will... This is leaving outside all tinfoil hat stuff about espionage.Reply

Interesting and somewhat terrifying times ahead; Cold War 3.0.

This being said, and trying to take on the "upside"... I wonder what China will come up with by cracking the problems from another angle.

Regards. -

everettfsargent Maybe TH should stop pushing hate? Because every article you post on such matters immediately goes there now, whether TH likes it or not. Everyone that now see's these types of stories immediately starts pushing their own or others buttons, both explicitly and implicitly.Reply

Stop, just stop. -

bit_user Reply

And what way is that, given that you're clear about not suggesting espionage?-Fran- said:Because of the way Chinese IP works, I think they may be able to catch up in a shorter amount of time than the US (and allies) think they will...

You think they will? If they wanted to catch up as fast as possible, I think they'd just seek to replicate the tried and true techniques already proven to work. Trying to find different avenues to get there sounds like a way to waste a lot of time and money.-Fran- said:This being said, and trying to take on the "upside"... I wonder what China will come up with by cracking the problems from another angle.

Besides, even though there are relatively few players, it's not as if we don't already still have competition in the sector. -

bit_user Reply

I disagree. While I have my own issues with aspects of some of these articles, if there's conflict happening in the world, then we should expect no less than for the media to cover it. Since the semiconductor industry is very relevant to other areas Tom's covers, it's appropriate that they cover the disputes and races in this sector.everettfsargent said:Maybe TH should stop pushing hate? Because every article you post on such matters immediately goes there now, whether TH likes it or not.

If you want to take a principled stand against this coverage, vote with your clicks: simply don't read these articles or comment on them. -

everettfsargent Reply

Manufactured conflicts? So just don't raise objections, be quiet? 'merica has been trying to do that at least since its founding, somehow that abjectly has not worked to date. 🤨bit_user said:I disagree. While I have my own issues with aspects of some of these articles, if there's conflict happening in the world, then we should expect no less than for the media to cover it. Since the semiconductor industry is very relevant to other areas Tom's covers, it's appropriate that they cover the disputes and races in this sector.

If you want to take a principled stand against this coverage, vote with your clicks: simply don't read these articles or comment on them. -

bit_user Reply

If you're saying the media (like Toms) is creating these conflicts where none exist in reality, I think you're wrong on the facts.everettfsargent said:Manufactured conflicts? So just don't raise objections, be quiet?

If you're saying the conflict is created by the parties involved, I'd there's nothing so unusual about that. Furthermore, that wouldn't make the subject cease to be relevant to our interests and therefore newsworthy.