Consumers Largely Willing To Pay Higher Prices For Blu-ray

Pricewatch - Over the past month we have been reporting on the pricing trend of Blu-ray Dusc players. As HD DVD faded away, prices of BD devices began to slowly creep up, to where they have now largely rested at around $400.

This week we decided to take a look at how changes in price have changed the demand of the products, and found that while consumers have been stepping up to buy players for around $350, many appear to be deterred from spending much more than that.

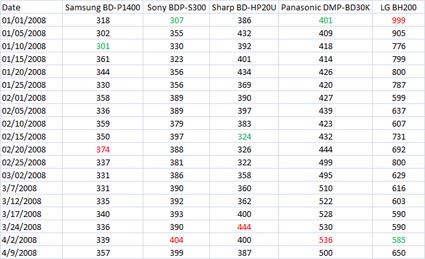

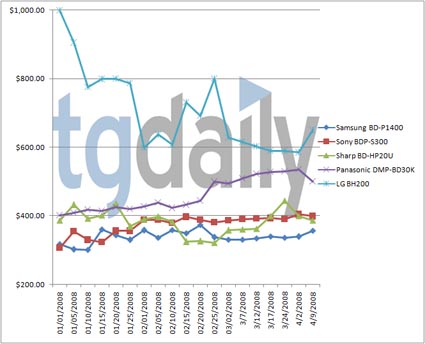

This chart shows the average prices of four major Blu-ray players as well as the top-selling Blu-ray/HD DVD combo player since the beginning of this year, according to e-tailer data from Pricegrabber.

It is clear that in every instance, players are more expensive now than they were when HD DVD was still a contender in the high-def disc market. After all, price leadership was the only thing HD DVD had going for it at the time, and Blu-ray manufacturers and some retailers were aggressively trying to nullify that point by bringing down BD prices.

Sony's BDP-S300, Sharp's BD-HP20U and Panasonic's DMP-BD30K are all at or around new price highs for 2008. For a while, LG's BH200 combo player was dropping in price, but over the past week it has climbed back up.

The overall increase in Blu-ray prices is something we've been watching for a while now, and one question we had was whether this would be a burden on the chosen HD format or if it would cause the early Blu-ray victory to crumble.

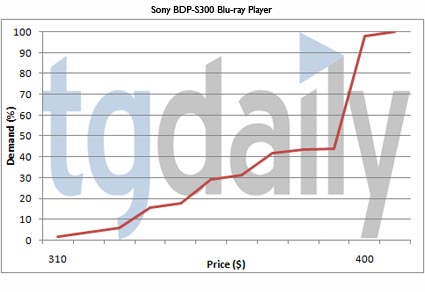

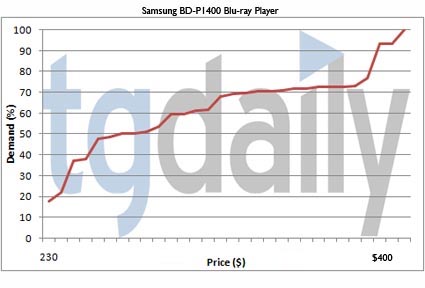

We decided to look at total sales of the two top-selling standalone Blu-ray players, the Sony BDP-S300 and the Samsung BD-P1400, and look at how many units have been sold at various price levels.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

This chart shows data for the Sony BDP-S300 player. The line represents a cumulative amount of the number of players demanded through different price points. For example, at the low end of the scale, purchases of the S300 when it was priced at around $310 make up around 2% of all sales of the device.

The total quantity demanded increases cumulatively as the price increases on the x-axis. Each tick mark represents an increase of $10, so sales of the S300 when it was priced at between $310 and $330 accounted for around 7% of all sales. Between $310 and $360 accounted for around 30% of all sales.

What is visible from this graph is that the area between $390 and $400 accounted for a big chunk of the sales, nearly 40%. This is also likely due to the fact that this was the most common price range for the player, but clearly people were still buying it.

After $400, there is very little activity. It bounced up above that price point a few times and clearly was unable to sell many units at that restrictive price level.

The Samsung BD-P1400 tells a somewhat different story. Because its price has fluctuated more, people have jumped on the opportunity to buy it at much more varied price ranges. Unlike Sony's S300, the P1400 has had moments of very low price points, reaching down to around $230. This means that consumers have had more opportunities to purchase the P1400 at sub-$350 levels than is the case for the S300.

Also of note is that consumers seemed fairly tepid about the P1400 when it was priced between $350 and $370. However, quantity demanded was somewhat higher when it was right under $400.

This trend of increased demand at the $400 mark likely represents consumers who bought Blu-ray players after the format war was declared over. In other words, the demise of HD DVD did in fact cause an increase in Blu-ray player sales, acoording to the data available from Pricegrabber.com, in spite of the fact that these players were priced higher than they had been in months.

This is a clearer picture of the price ranges at which these two players were sold. 38% of BD-P1400 sales were made when the player was selling for under $300, for example. In both cases, though, the majority of players were sold when the price was between $350 and $400.

However, these figures are unusual and are indicative of the fact that this is still a market mainly driven by early adopters, those who are more price inelastic when it comes to emerging technology. This would explain why player prices are increasing with little recourse to unit sales.

Of course, Blu-ray needs to migrate into the mass consumer market, and for that to happen, we need to see prices come down...way down.

Mark Raby is a freelance writer for Tom's Hardware, covering a wide range of topics, from video game reviews to detailed analyses of computer processors.