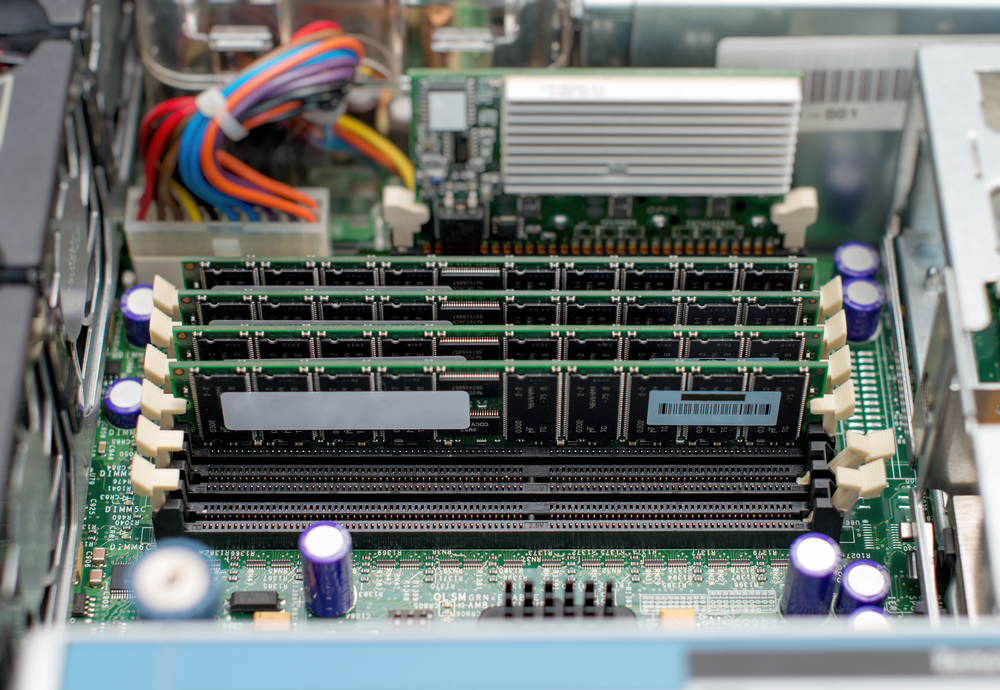

DRAM Prices Expected to Decline as Much as 30 Percent This Quarter

DRAMeXchange, a division of market research firm Trendforce, announced today that it expects contract prices for server DRAM to decrease by 30 percent compared to Q1 2019 prices. DRAMeXchange previously predicted that server DRAM prices would fall over 20 percent in Q1 but is now making its prediction even more dramatic.

High DRAM Supply, Low Demand

TrendForce's analysts believe that the same issues of oversupply and lower-than-expected demand that affected suppliers in Q1 2019 will affect the market in Q2, as prices fall 15 percent compared to Q2 2018.

They also predict that the consumer PC market will continue to see DRAM price declines of 20 percent in Q1 and 15 percent in Q2.

The oversupply of DRAM modules and the consequent price decline are expected to continue in the second half of this year. However, the gap between supply and demand should narrow as manufacturers in late 2018 started taking steps to reduce their supply in 2019.

A DRAM Price Trend Reversal

Over the past two years, DRAM prices climbed steadily until peaking in the first half of 2018. The peak and the following decline coincided with the Chinese government's start of investigating memory chip suppliers over price fixing. By fall 2018, prices were falling.

Data center owners seem to have slowed down their RAM purchases lately, as they are also anticipating further declines in server DRAM prices.

DRAMeXchange said that the DRAM price declines may slow down by the end of the year, when DRAM module makers will have started to resolve their oversupply issues. However, by the end of the year we may be looking at PC DRAM prices that are 50 percent lower compared to a year before, and server DRAM prices may see an even more drastic drop.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.