Ethereum Hits 18-Month Low as Worries About Inflation and the Merge Grow (Updated)

One ETH is worth $1,239 at the time of writing.

Update 6/13/2022 05:35 PT:

The valuation of Ethereum has continued to drop over the weekend. When we wrote about the 15-month lows being hit, we would never have predicted a drop to 18-month lows by Monday. At the time of writing 1ETH is worth just $1,239. This represents a near 15% drop in value over the last 24 hours. We've updated the original story to reflect the updated news.

Updated Story

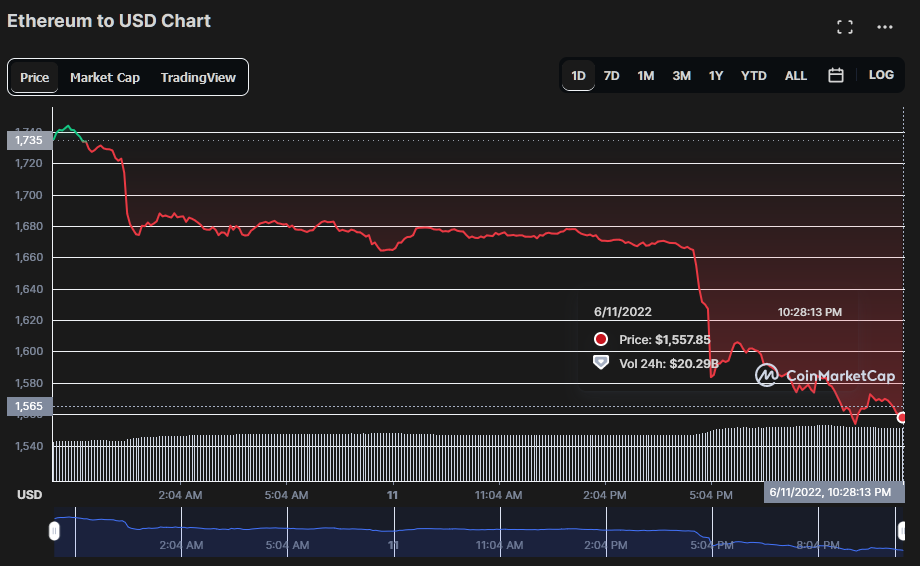

Cryptocurrencies aren't faring well as we hit the second weekend in June. Ethereum has been hit particularly hard in recent hours. Not only has the broader cryptocurrency market seen a sell-off in the wake of the current US inflation report, but Ethereum developers are also indicating that the difficulty bomb will be delayed again. This is leading some to worry that the merge will also be delayed. Ethereum (ETH) carries a valuation of $1,239 at the time of writing, down about 15% on the day and sitting at its lowest ebb for the last 18 months.

So, the cryptocurrency market as a whole is currently feeling some ill effects from Friday's consumer inflation report published by the US Labor Department. WSJ surveyed economists who had expected the consumer price index (CPI) to rise 8.3% in May, but the government said it increased 8.6% to a 40-year high. As a result, US stocks fell sharply, and crypto behaved as we have become accustomed, by following tech stocks down the pan – but exaggeratedly.

With inflation so high, moneyed individuals tend to move away from the risks of the stock market, and this movement amplifies more speculative investments. Many view cryptocurrencies as highly speculative.

The misery of ETH holders has been compounded by reports suggesting the difficulty bomb has been kicked further down the road. On Friday, developers decided to disable the difficulty bomb from earlier in the month, and will deploy it again at a later date. According to the Bloomberg report, developers found some bugs with software for the merge on one of the oldest testnets of the network and thus decided to push back the bomb. When the difficulty bomb does drop, it should help clear out ETH mining operations as the network finally begins transition from transition of ETH from Proof of Work (PoW) to Proof of Stake (PoS).

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

With the now regular push-backs, uncertainties emerged, raising doubt about things playing out in the way the Ethereum execs and devs have outlined. Ethereum co-founder Vitalik Buterin stated the merge could happen this August if the devs didn't uncover any significant issues. Though Buterin also mentioned that the merge could be pushed back to September or October. Tim Beiko, who coordinates Ethereum developers, is worried about developer burnout from moving too fast. Beiko estimated that there was a 1 to 10% chance the merge won't happen at all this year in an interview with Bloomberg.

PC DIYers have a love/hate relationship with ETH and GPU-based crypto mining. On the one hand, it lets those with powerful graphics cards profit from otherwise idle computer time, perhaps helping to pay PC hardware bills. On the other hand, colossal GPU mining operations sprung up, stripping consumer outlets of GPUs and encouraging price gouging and scalpers. 2022 may see the end of this era.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

InvalidError Burnout from moving too fast on something that has been delayed by a few years already? Or burned out from push-back from miners and hardware manufacturers who don't want their money cows to go udders-up?Reply -

atomicWAR I mine a little on the side when my rig's gpu isn't under heavy use (ie watching shows, web browseing, MAME, etc), since my GPU is watercooled I tend to not worry as much about it as much. Plus my RTX 2080 Ti (and my CPU platform) are in need of an upgrade this winter anyways. Hardware is expensive and you want to get the most out of it. My cpu platform is proof of that. Point being I am hardly surprised though miners are pushing back after investing in said hardware. But everyone knows this is coming, stop investing in hardware. I don't consider myself to have much skin in the game but for those who, I still get it. However, I think we should move to more a environmentally friendly model all the same. Force PoW to renewable energy only, tricky to prove I get that but not impossible. I'd say more about how but some ideas (and I do have some) are worth keeping to yourself until you can act on them!Reply -

spongiemaster Reply

Seems more likely, the fear is with the developers. With crypto values already nose diving, the developers are probably concerned that moving to POS in this market could well crater the value of ethereum and make it an also ran. They need a stronger market to implement this so there is room for it to drop and recover without collapsing totally.InvalidError said:Burnout from moving too fast on something that has been delayed by a few years already? Or burned out from push-back from miners and hardware manufacturers who don't want their money cows to go udders-up? -

InvalidError Reply

If they think the crypto market is hurting now, wait until the EU and possibly other countries pass PoW crypto bans for energy and environment conservation purposes.spongiemaster said:They need a stronger market to implement this so there is room for it to drop and recover without collapsing totally. -

spongiemaster Reply

There are way bigger concerns with the economy in general which is pulling all the markets down including crypto, than legislation in the EU.InvalidError said:If they think the crypto market is hurting now, wait until the EU and possibly other countries pass PoW crypto bans for energy and environment conservation purposes. -

InvalidError Reply

Few concerns can affect PoW crypto worse than all-out bans in major markets regardless of whatever else is happening and much of the pressure to ban PoW crypto is the global energy crisis partly but not entirely caused by Putin's war on Ukraine.spongiemaster said:There are way bigger concerns with the economy in general which is pulling all the markets down including crypto, than legislation in the EU. -

nitrium All cryptos are going to go to their inherent value of zero. No government with a functioning economy will tolerate a second currency existing alongside their fiat. It's trivial to ban exchanges (as was shown in China) at which point you can no longer spend your cryptos on goods and services at which point there is no longer any point in owning them.Reply

Further, major hedge funds are invested in them now which is why the entire crypto market has been largely following the broader markets (i.e. the stock market) for the last few years (hedge funds rotate in and out of risky assets like stocks and cryptos and out and in to bonds and cash).

Add to that that I gather~90% of all Bitcoins are owned by just 100 individuals, and you have a recipe for complete failure since a handful of people can easily manipulate the market (and all cryptos follow the fate of BTC for some reason). -

InvalidError Reply

All crypto follows BTC because BTC is kind of like the USD of crypto: the reference and reserve currency that defines a huge chunk of the global market regardless of the local currency.nitrium said:(and all cryptos follow the fate of BTC for some reason) -

Anubis01212 And this is what's wrong with crypto, even people from Tom's hardware do not comprehend what devs said. The merge is not delayed! The difficulty bomb is. Eth grow faster than anticipated and we might merge on a new block but the time lines didn't change. Thx for contributing to the problem! This miss information is so dumb.Reply

Watch it yourself and don't listen to this fud.

ethereum/comments/v9be3mView: https://www.reddit.com/r/ethereum/comments/v9be3m/sound_on_the_difficulty_bomb_all_core_devs_june

Shame on you Tom's hardware.