10% surge in Taiwanese currency vs US dollar could hurt PC and components pricing

We are witnessing the most powerful Taiwan Dollar appreciation in over 30 years.

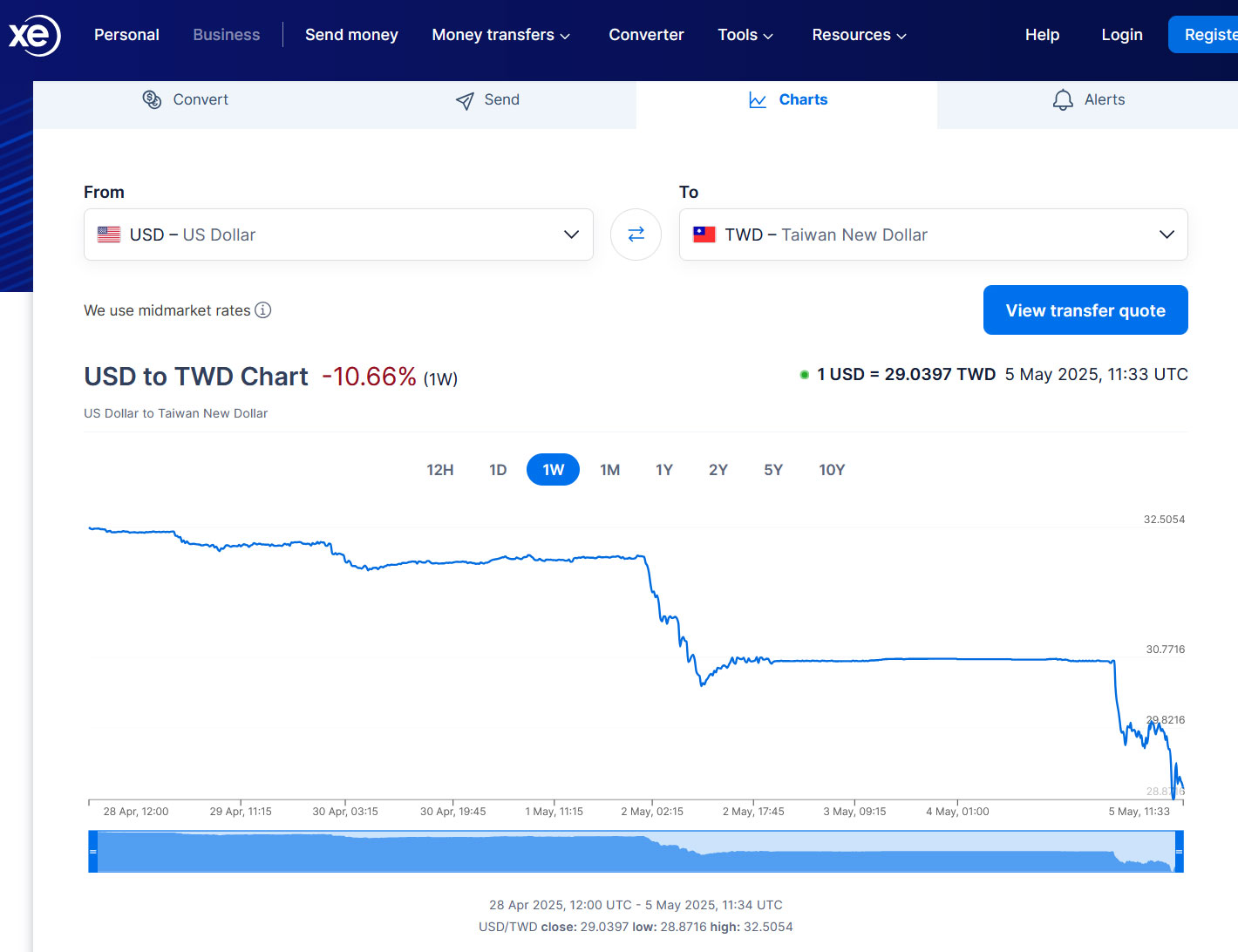

The strengthening of various East Asian currencies vs the U.S. Dollar (USD) has been one of the talking points in financial markets over the holiday weekend. The case of the Taiwan Dollar (TWD) is particularly alarming, as the currency of the 'silicon island' has appreciated over 10% vs the USD in the space of just a few days. This is the strongest Taiwan dollar appreciation in over 30 years, according to DigiTimes.

Crucially, when a trading partner's currency gets stronger, it typically becomes more expensive to buy their goods. Taiwan's chips and manufacturing play a big part in the most coveted PCs and components. So, are we looking at even more upwards pressure on electronics heading to U.S. retail?

DigiTimes shared statements and reports from some of Taiwan's major electronics players like Acer, Asus, Pegatron, Wistron, Foxxconn. It noted that most of these companies hold broad currency portfolios to lessen impacts / shocks when there is turbulence in exchange rates. However, if we are seeing the biggest currency valuation moves in over three decades, it is difficult to be prepared enough. One might hope this 10% dive in USD valuation is a temporary blip on the radar, or else there will be significant pressure on profit margins witnessed.

The source publication, and others, indicate that semiconductor companies have larger profit margins, to afford some flexibility on their part. For example, Focus Taiwan says that ASE Technology Holding Co., the world's largest IC packaging and testing services provider, expects a 1.5 percentage point impact on its gross margin "whenever the Taiwan dollar rises NT$1 against the greenback." It says TSMC and UMC would be hurt similarly by this valuation shift.

Taiwan's Central Bank attempts to steady the ship

In a rare move, Taiwan's Central Bank held a press conference today, issuing a seven-point statement to the market (machine translation). In summary, the Central Bank believes that the TWD has surged due to speculation about recent trade discussions between Taiwanese and American officials. People seem to be expecting that the U.S. will ask Taiwan to manipulate its currency to make American imports cheaper. However, the governor of the bank denies there is any such influence.

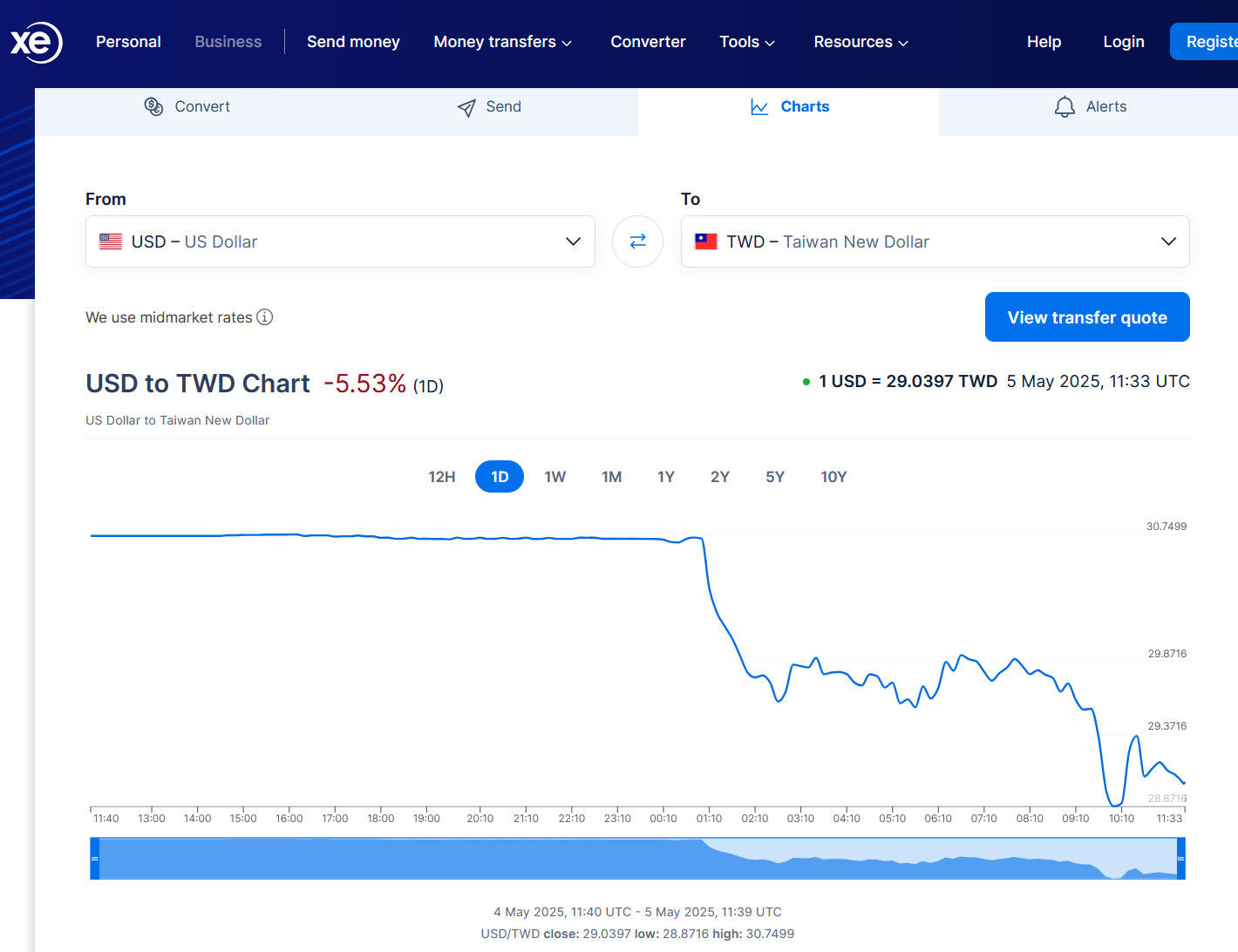

Taiwan's Central Bank confirmed the country's economy remains strong. However, global financial markets are in a volatile era. Last but not least, individuals and organizations with an eye on currencies should be wary of speculators seeking to move valuations, helped by "overly exaggerated or untrue market analysis, generating irrational expectations." Looking at live data, the Central Bank's statement seems to have stemmed TWD's appreciation vs USD, for now.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

-Fran- Ah, yes. Nothing says "free market" as loudly as "currency manipulation". All in all, it's a tricky situation for Taiwan, as they don't want to keep holding the bag if they can't export what they're producing, since there's no way they can internally consume all of it.Reply

I wonder what effect this will have in the rest of the world, since the Euro and GBP are somewhat fine compared to the USD.

Regards. -

baboma It's not so much that the TWD gain against the USD, but that the USD has fallen against other currencies.Reply

https://www.xe.com/currencycharts/?from=USD&view=1M&to=TWD (Taiwan)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=EUR (EU)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=JPY (Japan)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=HKD (Hong Kong)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=GBP (UK)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=CAD (Canada)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=INR (India)

https://www.xe.com/currencycharts/?from=USD&view=1M&to=CNY (China)

(RMB doesn't really count, as exchange rate is set by China's PBOC)

The USD has been eroding for a while, as foreign investors get more wary of the US debt. But the hemorrhaging really got going a week after the so-called Liberation Day, when foreign govts start dumping US T-bonds. People aren't in love with us anymore.

Peeps here are used to seeing prices staying the same while the tech gets better. They're in for a rude shock. XBox is just the canary in the coal mine. We'll all soon be intimately acquainted with the word 'inflation.'

Let an economist explain it,

https://nytimes.com/2025/05/05/opinion/weak-us-dollar.html (nonsubs disable Javascript)

Another econ dude in convo form,

https://nytimes.com/2025/05/02/opinion/ezra-klein-podcast-kenneth-rogoff.html

Edit: Adding Indian Rupee to the mix, as Apple et al will soon move production to there. -

baboma >Nothing says "free market" as loudly as "currency manipulation".Reply

It's not currency manipulation. Some currencies are managed more strictly than others. Here's a list of abovementioned currencies:

TWD (Taiwan Dollar) -- Managed float -- Determined mainly by market forces since 1979, but the Central Bank of Taiwan may intervene to prevent excessive volatility.

RMB (Chinese Yuan/Renminbi) -- Managed float -- The People’s Bank of China sets a daily midpoint and allows trading within a narrow band, intervening as needed to stabilize the rate. References a basket of currencies, not just the USD.

EUR (Euro) -- Free float -- Value is determined entirely by supply and demand in the market, with minimal intervention by the European Central Bank.

JPY (Japanese Yen) -- Free float -- Determined by market forces, with occasional intervention by the Bank of Japan to address excessive volatility.

HKD (Hong Kong Dollar) -- Pegged -- Pegged to the US dollar within a tight range via a currency board system; the Hong Kong Monetary Authority intervenes to maintain the peg.

GBP (British Pound) -- Free float -- Determined by market forces, with the Bank of England rarely intervening.

CAD (Canadian Dollar) -- Free float -- Value set by market supply and demand, with rare intervention by the Bank of Canada.

INR (Indian Rupee) -- Managed float -- Primarily market-driven, but the Reserve Bank of India intervenes to curb excessive volatility.

USD (US Dollar) -- Free float. -

_Shatta_AD_ If tech companies are forced to raise prices across the board internationally. No one will buy their products especially if competitors from other countries can sell cheaper and close the tech gap a bit. Like who will buy an Xbox internationally when Sony’s PS5 /6 is already selling so well and remains cheaper elsewhere except for in the US. This is a one-two punch for US consumers and US based companies. Microsoft will survive due to sheer size and current profit margins but smaller companies will tank within a month and start-ups will evaporate, joblessness and layoffs incoming. R&D will lose momentum in a negative feedback loop with reducing profitability. This is worse than most people realize at the moment especially with their false sense of security.Reply -

UWguy When the effects of the tariffs kick in 4-6 months from now we are going to see an economic recession the likes of which most of us have never experienced. For a lot of folks computer components will take a back seat to basic necessities.Reply -

Moonstick2 Reply

In fairness, this is an actual surge in TWD. Compared to Mon 28th Apr (a week ago), one USD/GBP/EUR buys about 92% of the amount of TWD it could before.baboma said:It's not so much that the TWD gain against the USD, but that the USD has fallen against other currencies.

USD 32.43 -> 30.09 92.8%

GBP 43.57 -> 40.06 91.9%

EUR 36.99 -> 34.10 92.2%

It's often said that when the US sneezes the rest of the world catches a cold. I guess if it takes a shotgun to its feet the rest of the world bleeds out too. -

ianpac1969 No need to wait 4-6 months. The effects of tariffs will be obvious by June/July when pretty much everything will rise in price. Currently, we are in a false calm before the storm due to increased stocks purchased before the tariff deadlineReply -

Moonstick2 Replybaboma said:It's not so much that the TWD gain against the USD, but that the USD has fallen against other currencies.

Moonstick2 said:In fairness, this is an actual surge in TWD.

Maybe so, but the point is that this is an actual surge in TWD that will affect all countries, which your first post glossed over, at best.baboma said:Yeah, but it's mostly market speculation...

USD/EUR is unchanged over the past week but your first post implied that the 10% fall referenced in the headline is just the USD falling against everything else too.