EU Explores Massive Local Semiconductor Alliance and Fab

Can Infineon, NXP, STMicroelectronics ASML and others work together to better compete?

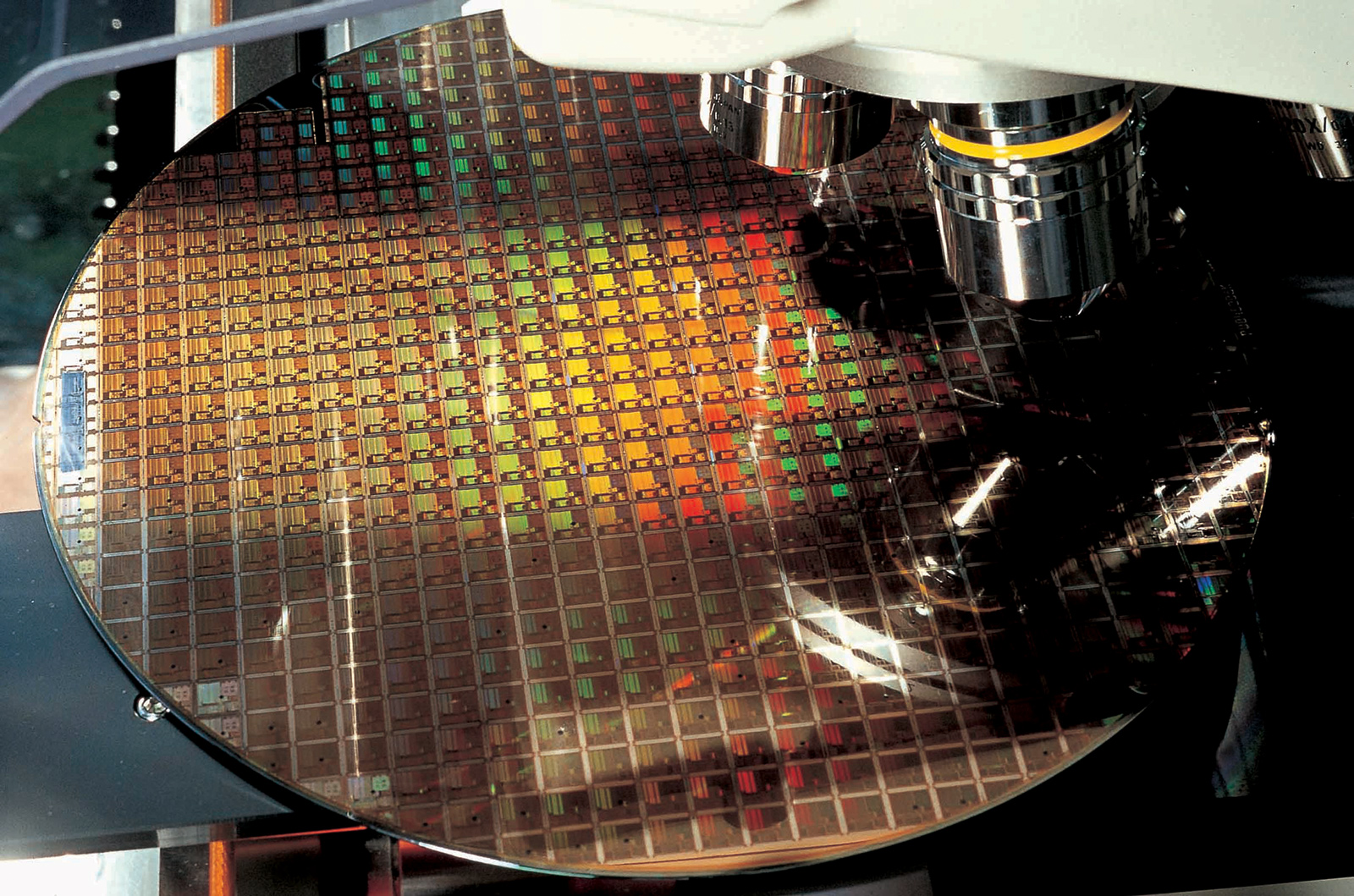

In a move that echoes the whole endeavor of the European Union in general, the conglomeration of nations is exploring the idea of a semiconductor alliance as an alternative (or a complement) to a leading-edge fab built by a multinational chip company, according to a Reuters report. The general idea here is if one company (or country) can’t afford a leading-edge semiconductor production facility, a number of companies can do it with assistance from 27 national governments.

Europe is home to semiconductor companies like Infineon, NXP, and STMicroelectronics, as well as lithography equipment giant ASML. The EU is considering building an alliance consisting of these companies in a bid to reduce Europe's dependence on foreign chipmakers. U.S.-based GlobalFoundries, which operates Europe's largest fab in Dresden, Germany, could also be a part of the alliance, according to the report that cites four sources.

EU politicians think that the project could be backed using a pan-European scheme called an Important Project of Common European Interest (IPCEI), which enables national governments to fund it under simpler state aid rules.

This also fits with the European Union's plan to increase the bloc's share in the global semiconductor market. The EU wants to produce 20% of the world's chips and processors (by value) by 2030, up from 10% today. There are several ways for the EU to catch up with Taiwan, South Korea, and the U.S. when it comes to leading-edge fabs and fabrication technologies.

One approach is to attract Intel, Samsung Foundry, and/or TSMC to Europe with various incentives. Intel has operated a leading-edge fab in Ireland for decades, so European politicians have to make sure it stays there going forward and perhaps to persuade the CPU giant to build another fab in another European country. An EU Commissioner is set to meet with Intel's CEO Pat Gelsinger on Friday. Meanwhile, TSMC is not particularly interested in building a fab in Europe as there are not many customers (i.e., chip designers) or consumers (i.e., high-volume factories like those operated by Foxconn) there. Furthermore, not everyone in Europe is happy with the idea of a foreign fab in the EU.

"Politicians like shiny things and sometimes tend to sacrifice long-term industrial policies for short-term announcements," a senior French official is reported to have said. "If we step on the toes of European players, then I am not sure our sovereignty will gain anything from it."

Another approach is to consolidate local chipmakers, fund development of both bleeding-edge and specialty fabrication processes, and then provide financial assistance to build advanced fabs in Europe. Modern process technologies cost billions of U.S. dollars, whereas a leading-edge fab costs tens of billions and requires regular upgrades. Semiconductor market analysts say that governments will need to spend at least $150 billion over the next five years to have a serious go at catching up with companies like Samsung or TSMC. So in many ways, pooling the resources (both financial and technological) of several resources makes sense. Still, this would be a huge, long-term undertaking, even for a large collection of nations.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"IC Insights believes that governments would need to spend at least $30 billion per year for a minimum of five years to have any reasonable chance of success," a report from IC Insights reads.

Consolidating European chip companies would make them more capable financially and pouring in EU's money would increase that financial prowess. But the problem is that there are not many chip designers in the EU that need leading-edge fabrication technologies and advanced fabs. In fact, Infineon, NXP, and STMicroelectronics do not need them and when they need to build something advanced, they outsource to GlobalFoundries, Samsung Foundry, TSMC, and other contract makers of chips.

No decisions have been made yet and all talks are preliminary. Thierry Breton, the European Commissioner for Internal Market (responsible for industrial development) and Margrethe Vestager, EVP of the European Commission for A Europe Fit for the Digital Age, will present the bloc's updated semiconductor industry strategy on May 5.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError Consolidation of smaller chip manufacturers is the most logical thing to do since modern fabs aren't economically viable at wafer throughput below 50k WSPM, too many wafers for many smaller companies' needs. If they could partner with Samsung or Intel to share technology, that would reduce their costs and also enable them to act as surge facilities for whichever chip maker mentors them. It could be made into an "everyone wins" scenario if everyone can hold their greedy hands back for a minute.Reply -

hannibal It also would spread chip manufacturing to wider area and thus makes the environment as a whole more Secure. If there are problems in one area in the world, it would not be the end of the world, because other manufacturers in different areas would not be affected similarly.Reply -

Co BIY One thing that I think is not clear is if the cutting edge processes will remain the most profitable processes. It is entirely possible that mature processes like TSMC's 7nm and Intel's 14nm could be the sweet spot for effectiveness and profitability while more advanced processes are limited to specific markets with extreme requirements.Reply -

InvalidError Reply

I doubt it: smaller processes are necessary to bring down the cost of more complex chips and make those more complex chips feasible in the first place. Rocket Lake is a huge piece of power-hungry silicon that barely manages to compete with AMD/TSMC up to 8-cores. Intel is on its last leg as far as 14nm is concerned at the bleeding edge and even its 10nm Tiger Lake isn't doing too good against AMD's 5000G series in the mobile space. Intel cannot afford to screw up its 7nm.Co BIY said:It is entirely possible that mature processes like TSMC's 7nm and Intel's 14nm could be the sweet spot for effectiveness and profitability while more advanced processes are limited to specific markets with extreme requirements.

Sure, those new fabs will take a while longer to turn a profit but they will get there as long as they can be kept busy churning out chips at 80-90% capacity and offering foundry services is a great way to make that happen, not everything needs bleeding-edge process tech. Among other things, 10-22nm should have a very long life ahead churning out passive and active silicon interposers for 2.5D/FOVEROS style packaging.