If it's Friday, AMD and Intel dual-core prices must be falling

Sunnyvale (CA) - They did this last Friday, too: Prices for AMD dual-core processors are taking another pre-weekend dip, according to the latest data from PriceGrabber, with the Athlon 64 X2 5000+ falling the furthest since Monday: down $47 (13.1%) to $313. The trouble for AMD is, Intel prices are continuing to fall at the high end.

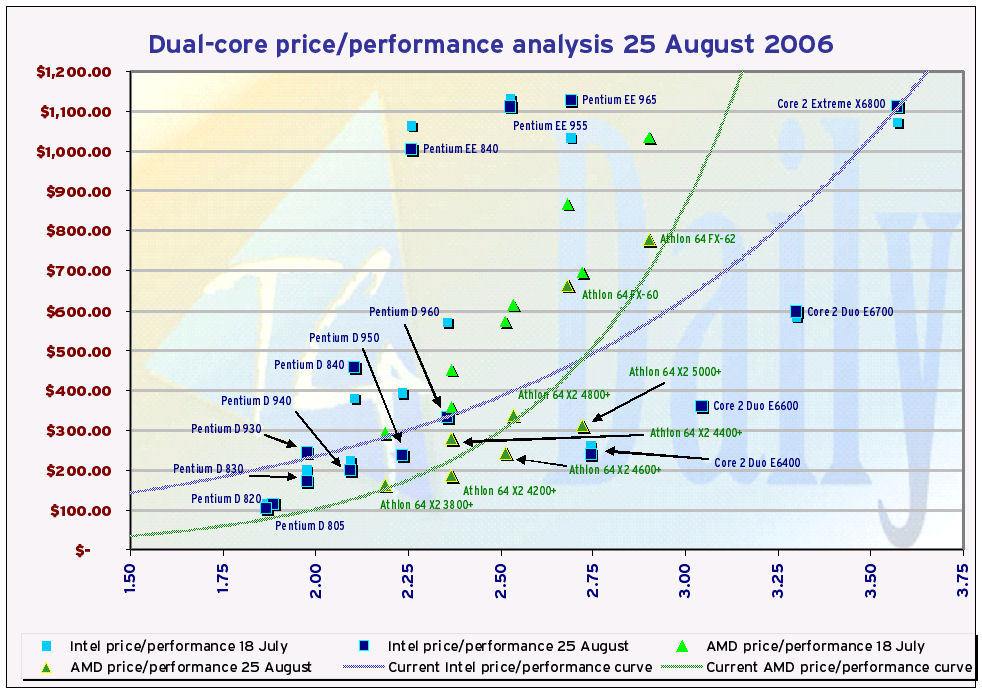

In our latest CPU price/performance chart, Intel Core 2 Extreme prices have fallen $71 since Monday, down 6.0% to an average of $1,111. Core 2 Duo prices are following nicely, with the E6400 price down 3.6% over Monday to $238, and the E6300 price down 4.9% to an all-time low of $194. Click the miniature below to see the complete, full-size chart.

Meanwhile, the older Intel architectures are seeing prices scattering all over the map, like bugs fleeing a hailstorm. While Pentium D 930 prices dropped a terrific 14.4% over Monday to $172, Pentium D 830 prices rose an astonishing $60, up 32.8% to $243. You'd think that as inventories of older chips started to dwindle, prices would decline across the board.

As long as the Pentium EE chips remain officially on sale from Intel, they weigh the Intel price/performance curve somewhat on the high side. Without a new performance leader to enable AMD's FX-62 and FX-60 prices to decline more rapidly, they too artificially weight the AMD price/performance curve to the high side, balancing the "EE effect" from Intel. But while the EE prices remain stable, FX prices are continuing to drop: FX-60's average street price, for instance, is down 5.6% over Monday to $663, according to PriceGrabber, and FX-62's street price dropped $32 over Monday, down 3.9% to $779. PriceGrabber data is based on prices that participating vendors report that consumers actually paid for chips, and these prices can be lower than the prices vendors offer to their customers.

On our estimated CPU price/performance scale, the Athlon 64 X2 5000+ extends its lead as AMD's best price/performer overall, with a plot point that falls nearest to the bottom right corner of the chart. At an average street price of $313, a hypothetical Intel processor with a performance index score of 2.72 would sell for $478.84, assuming all Intel processors were averaged out along the curve.

But as many of you have written to remind us, they're not. Intel's Core 2 Duo E6400 is a real-world competitor to the 5000+, with a higher performance index score of 2.74 and an average price of $238 - a whole $75 less. Meanwhile the Core 2 Duo E6600 could conceivably be Intel's best price performer this week overall, even on the premium side. With an index score of 3.04 and a price of $361, a hypothetical AMD processor with the same index score would sell for $524.62. While Intel's nearest real-world competitor to AMD's 5000+ breaks the curve on the value side, AMD's nearest real-world competitor to the E6600 breaks the curve on the premium side: the FX-62, scored lower at 2.90 and selling for $779. That price is coming down, but maybe not fast enough.

Speaking of e-mail, we've received a number of letters this week asking us why we include "legacy" processors along with the newest performers, for both AMD and Intel. To respond, our CPU price/performance charts include those processors that are currently being sold in quantity by the original manufacturer, even if only to clear out remaining inventory. Now, we could have two pairs of performance curves, one pair for the previous generation, and one for the current one. The trouble is, this is not how marketing executives think. When they determine price points for both old and new processors, they're projecting exponential curves very similar to what you see in our chart.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Now, market forces being what they are, they tend to change the scattering of the price points, especially as vendors hold sales or promotions. This is why the real-world prices end up not following an easy curve exactly, and why we have to reconstruct a curve based on the assessed sales data. But neither the manufacturers nor the market itself have two separate strategies for "legacy" and current-generation products. The same forces impact both segments simultaneously; what's more, one has an impact on the other. If we were to divide these segments and treat them individually, we would be less able to draw conclusions about the market as a whole behaves.