Gartner Predicts a 9.5% PC Industry Decline for 2022

It has a darker outlook than IDC suggested recently.

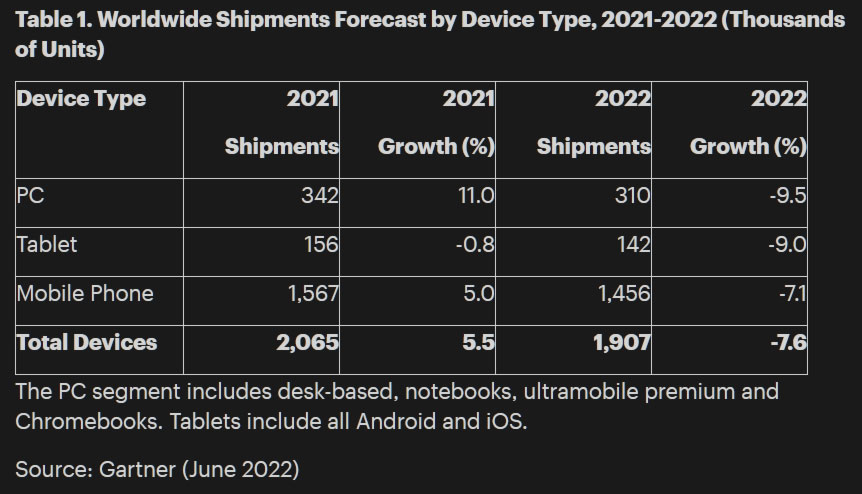

Market research and analysis outfit Gartner has published a gloomy set of predictions about the fate of the PC industry in 2022. It headlines the report by highlighting an expected 9.5% decline in PC shipments globally by the end of the year. Like the downbeat predictions published by IDC three weeks ago, Gartner cites inflation, war and supply chain disruptions for the PC industry's misfortunes.

Gartner provides some insight by breaking out PC shipment predictions by market segment, and geography. For example, Ranjit Atwal, a senior director analyst at Gartner, said that "Consumer PC demand is on pace to decline 13.1% in 2022 and will plummet much faster than business PC demand, which is expected to decline 7.2% year over year."

In the report, we also find that the Europe, the Middle East and Africa region (EMEA) will see a record dip in consumer PC demand though 2022. The EMEA, with its proximity to Russia and Ukraine, has seen consumer confidence hit particularly hard, and we also see this reflected in local currency valuations – which makes largely imported products like PCs more expensive.

With the broad macroeconomic brush strokes behind the projected 9.5% decline in PC shipments for 2022, one might expect similar impacts on the tablet and smartphone markets. This is indeed the case, but smartphones seem like they will fare a little better with a projected worldwide shipment decline of around the 7% mark. Smartphones would have done even better through, if it were not for the China Covid lockdowns strangling demand for refreshed 5G devices in the country, reckons Gartner.

What About Next Year?

The Gartner report is overall somewhat more gloomy than IDC's analysis from early in the month. What we found particularly positive from IDC was its prediction that 2023 will see a return to PC industry growth. It went on to explain that certain new technologies becoming more mainstream and affordable would drive upgrades. Specific upgrade drivers mentioned included; higher resolution monitors, with faster refresh rates and wider gamut technologies like micro LED, QDs, and OLED. Sadly, Gartner didn't comment on 2023 in its blog post today.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

InvalidError ReplyLike the downbeat predictions published by IDC three weeks ago, Gartner cites inflation, war and supply chain disruptions for the PC industry's misfortunes.

Missing the likely two biggest elephants in this room:

1- the pre-covid 6-8%/year PC decline that had already been going on for several years

2- the humongous number of people and companies that had out-of-cycle upgrades in 2020-2021 due to covid

I'm actually surprised they are only projecting a 9.5% decline. Since sales were up 15% in 2021, a return to pre-covid normal should have seen sales crash by as much as 20%. People and companies who were due to upgrade during the component shortage but couldn't must be propping up post-covid sales by ~10%. -

PBme ReplyInvalidError said:Missing the likely two biggest elephants in this room:

1- the pre-covid 6-8%/year PC decline that had already been going on for several years

2- the humongous number of people and companies that had out-of-cycle upgrades in 2020-2021 due to covid

I'm actually surprised they are only projecting a 9.5% decline. Since sales were up 15% in 2021, a return to pre-covid normal should have seen sales crash by as much as 20%. People and companies who were due to upgrade during the component shortage but couldn't must be propping up post-covid sales by ~10%.

100% I'd be very surprised if the YOY drop isn't closer to 15+% and I can't imagine the supply chain is a significant factor in this as we'd see prices spiking if it were (as we saw in GPU market). The massive tech buying caused be all the information worker working from home artificially pulled a huge number of future purchases forward, and likely even created a number of purchases that wouldn't have been made at all. -

Co BIY ReplyInvalidError said:People and companies who were due to upgrade during the component shortage but couldn't must be propping up post-covid sales by ~10%.

I think this is the case. Although I think some of the remote work migration is going to be permanent and will push baseline demand a little higher.

I look forward to buying in the "dip" with improved availability and some competitive pressure. -

InvalidError Reply

I wouldn't be so sure about the WFH crowd propping up sales on an on-going basis: most of the stuff that can be done from home is low-compute, low-security stuff that won't need particularly regular upgrades. A large amount of those WFH sales must have been to people who either didn't own a PC/laptop previously or simply discovered that they were grossly overdue for a refresh when they tried to use whatever they had for more than whatever personal use they had for their PC/laptop.Co BIY said:I think this is the case. Although I think some of the remote work migration is going to be permanent and will push baseline demand a little higher.