Intel Makes Strong Ethernet Switch Play With Barefoot Networks Acquisition

Intel on Monday announced that it signed an agreement to acquire Barefoot Networks for an undisclosed amount. Barefoot is an Ethernet switch silicon provider and one of the frontrunners in the programmable networking paradigm. Intel is looking to spread Barefoot’s programmable networking paradigm to more customers and is also likely hoping to drive synergy with its own silicon photonics business.

Barefoot represents an emerging player in a market dominated by Broadcom and, to a lesser extent, by Mellanox. Through the acquisition, Intel gets access to Barefoot's Ethernet switch silicon and software capabilities via its Tofino series of switching silicon and P4 networking programming language, which is gaining popularity.

The Tofino 2 series of switch chips debuted late last year with a bandwidth up to 12.8 Tbps, fast enough for 64-port full-duplex 100GbE switches. Interestingly, as The Next Platform detailed, the Tofino 2 series consists of a chiplet design with a 7nm switch ASIC and transceiver chiplets on what is presumably a 16nm class process.

Navin Shenoy, executive vice president of Intel’s data center group, in a statement said Barefoot is "a great complement to our existing connectivity offerings."

"Barefoot Networks will add deep expertise in cloud network architectures, P4-programmable high-speed data paths, switch silicon development, P4 compilers, driver software, network telemetry and computational networking. Most important, this is one of the most talented and experienced teams in this domain in the industry," Shenoy said.

Although financial details of the deal were not announced, Barefoot has raised $155.4 million over several rounds. Intel expects the deal to close in Q3.

The Ethernet Market

This marks the second big acquisition in the networking space this year, as Nvidia acquired Mellanox for $6.9 billion in March, outbidding Intel in the process. While Broadcom is the leader in the switching space, Mellanox is the leader in Ethernet adapters.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Now Intel is adding a key component to its networking portfolio. Intel’s main product in this area is its Omni-Path fabric (a competitor to Mellanox’ Infiniband), the second version of which is scheduled to launch later this year and offer 200 Gbps. Intel also has a portfolio of optics and cables, ethernet controllers and network adapters.

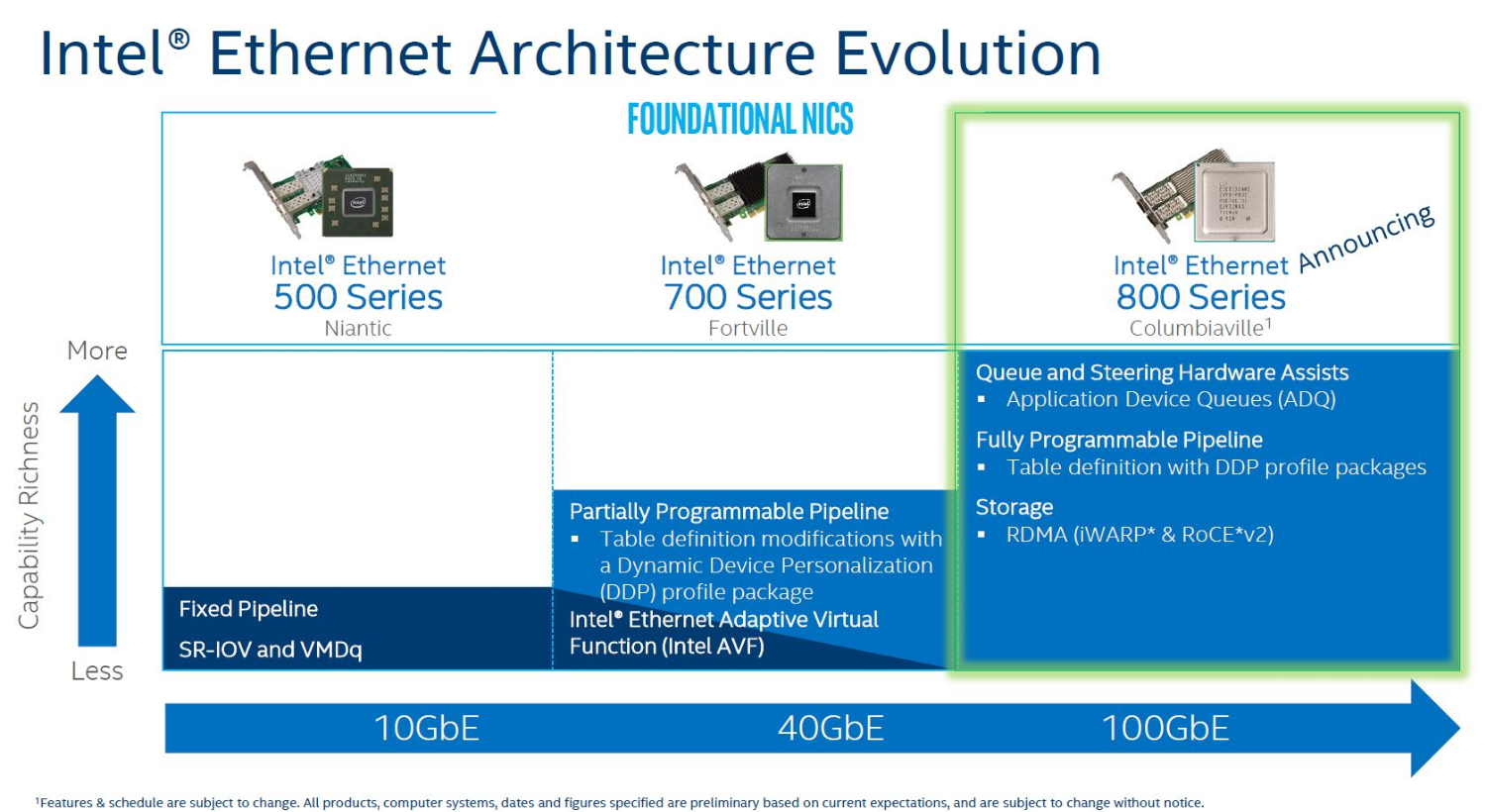

In terms of network adapters, earlier this year Intel announced its Columbiaville Ethernet 800 Series for Q4 availability with 100 Gbps Ethernet (up from the 40 Gbps of its 700 Series). However, 100 Gbps Ethernet has been in the market for a few years now and is also a generation behind Intel's own 200 Gbps Omni-Path. However, 10GbE is still the largest Ethernet market.

The Silicon Photonics Play

A deeper look at Intel’s networking portfolio reveals what might actually be the most important reason for the acquisition (this was not mentioned in Intel's announcement): the tight synergy between Intel’s silicon photonics offering and the switching silicon.

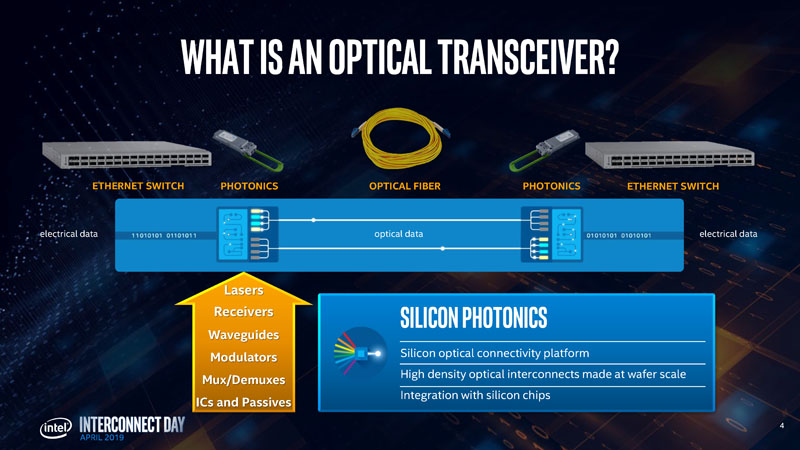

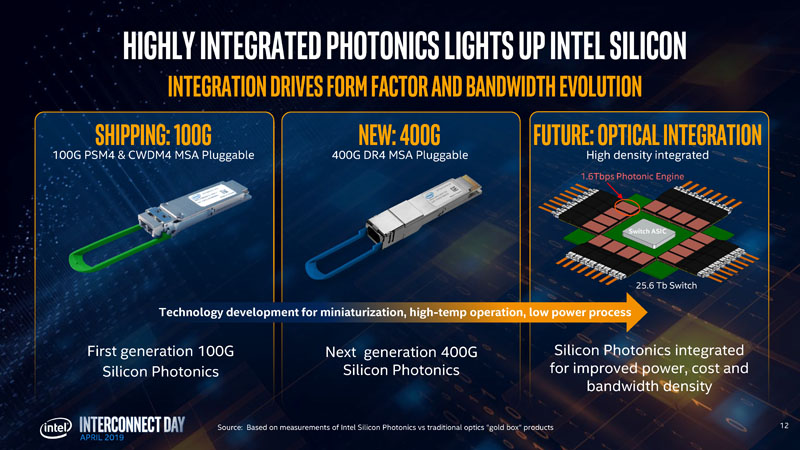

Currently, Intel’s silicon photonics (just like regular copper) manifests itself as a pluggable optics form factor. They are transceivers that are plugged into switches and fire laser pulses that are transported via optical fiber. The 400GbE generation will start to ramp by the end of this year in this same traditional form factor. However, the pluggable form factor is reaching its limitations in areas like power consumption.

Beyond that, Intel is looking to further integrate its silicon photonics by co-packaging it together with the switch ASIC, providing improved cost, power and bandwidth density. Facebook showed a similar proof-of-concept last year.

With switch silicon and silicon photonics inevitably moving towards a co-packaged solution, it was just a matter of time before Intel bought a switch silicon company and sought further integration.

Photo Credits: Intel

-

boe I think 100g is slow to get market share is the outrageous expense. I know a few video editing shops that would just like a 4 or 8 port 100g switch. Until you treat it as a common commodity like 1g ethernet, it won't make a big dent in the market.Reply -

bit_user Reply

The market for 100 Gigabit is currently cloud - not SOHO (Small Office/Home Office).boe said:I think 100g is slow to get market share is the outrageous expense. I know a few video editing shops that would just like a 4 or 8 port 100g switch. Until you treat it as a common commodity like 1g ethernet, it won't make a big dent in the market.