Intel Qualifying 10nm Ice Lake CPUs, Expects First Full-Year Revenue Decrease In Three Years

Intel reported its first quarter 2019 results today and gave yet another update on the progress of its 10nm production. Intel CEO Bob Swan stated the company is on track with its 10nm production, saying its 10nm products are moving through the fab at twice the rate, and the company forecasts higher 10nm production in 2019 than previously planned.

“As I shared earlier, our confidence in 10nm is also improving. In addition to the manufacturing velocity improvement I described earlier, we expect to qualify our first volume 10nm product, Ice Lake, this quarter and are increasing our 10nm volume goals for the year,” said Swan.

Swan also reported that the company has begun qualifying its 10nm Ice Lake processors, which is a critical first step towards volume production, and maintains the company's previous projections that systems with those chips will hit retail shelves in volume in time for the holidays. “On the process technology front, our teams executed well in Q1, and our velocity is increasing. We remain on track to have volume client systems on shelves for the holiday selling season. And over the past four months, the organization drove a nearly 2X improvement in the rate at which 10nm products move through our factories,” Swan said.

Swan also noted that the company's Ice Lake server chips would come "earlier versus later" in 2020.

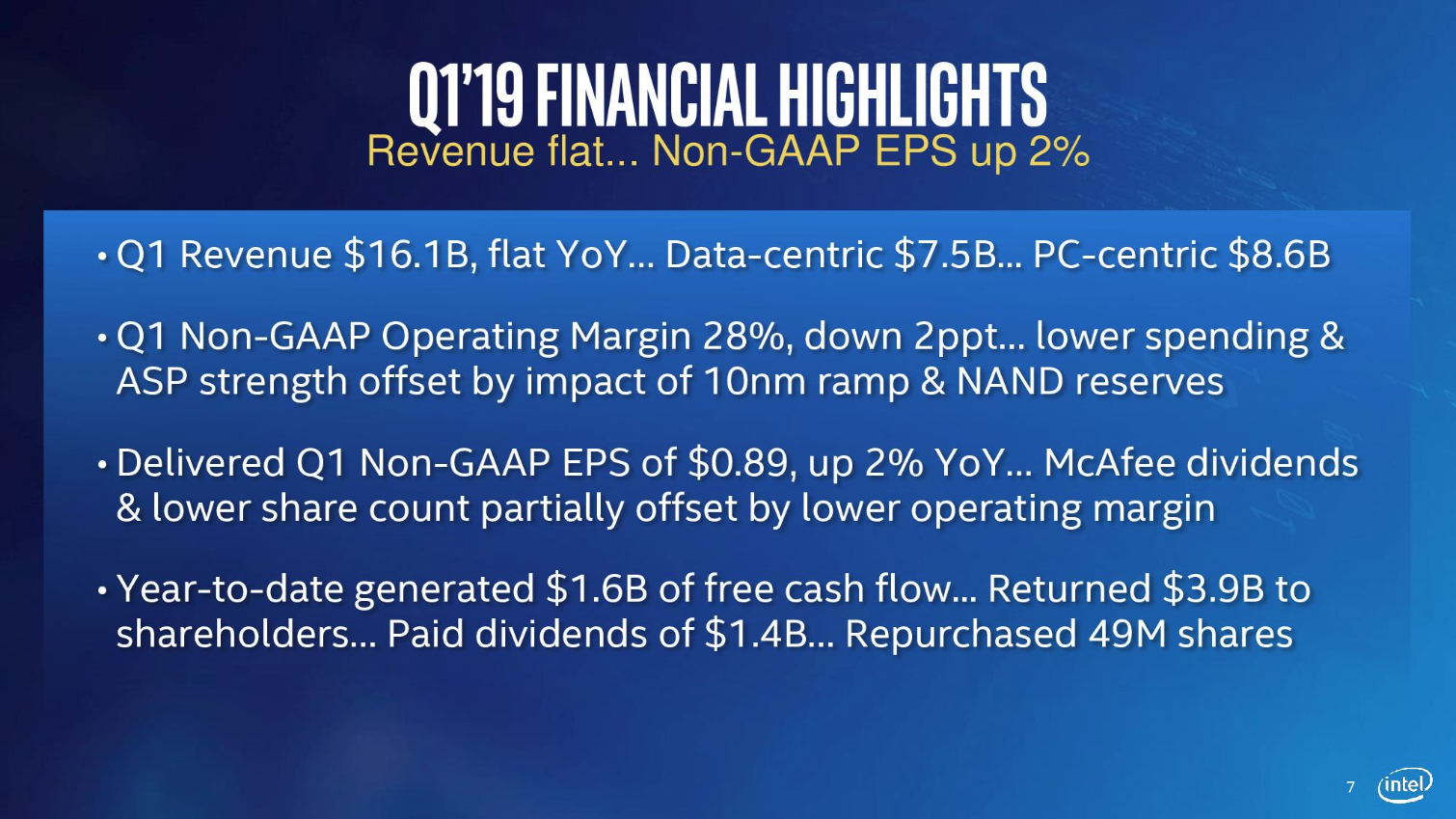

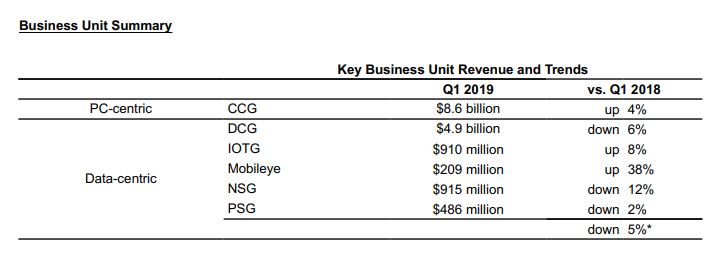

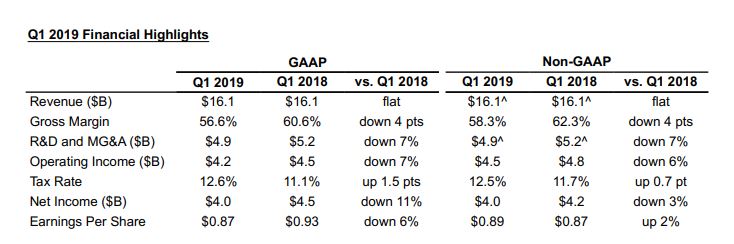

These positive notes came against a backdrop of decreasing demand in China, among other factors, as the company also expects to notch its first full-year revenue decrease in three years. While revenue at $16.1B was in line with expectations from three months ago, as a result of a softening market after a record-breaking 2018, Intel has revised its full-year revenue outlook downward by $2.5 billion, to $69.0B, representing a 3% decline compared to the $70.8B the company reported for 2018.

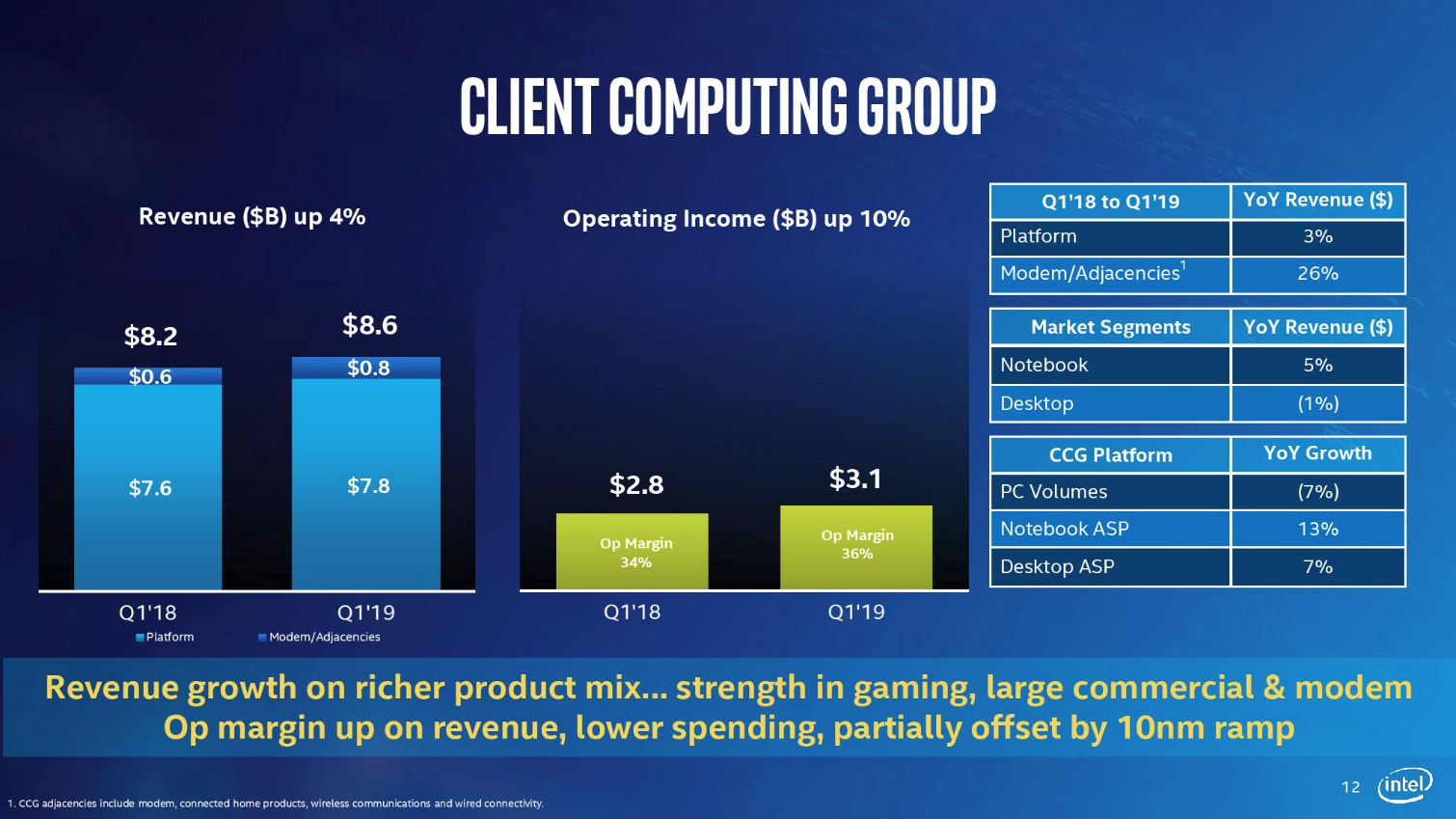

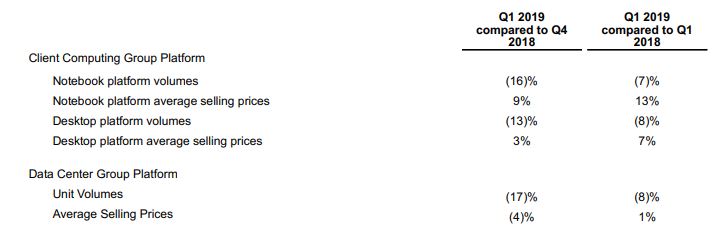

Intel's desktop volumes dropped 13% Quarter-over-Quarter (QoQ) and 8% Year-over-Year (YoY), but ASPs also improved. Meanwhile, notebook platform volumes dropped dramatically at 16% QoQ and 7% YoY, once again partially offset by a 9% and 13% gains in average selling price (ASP), respectively.

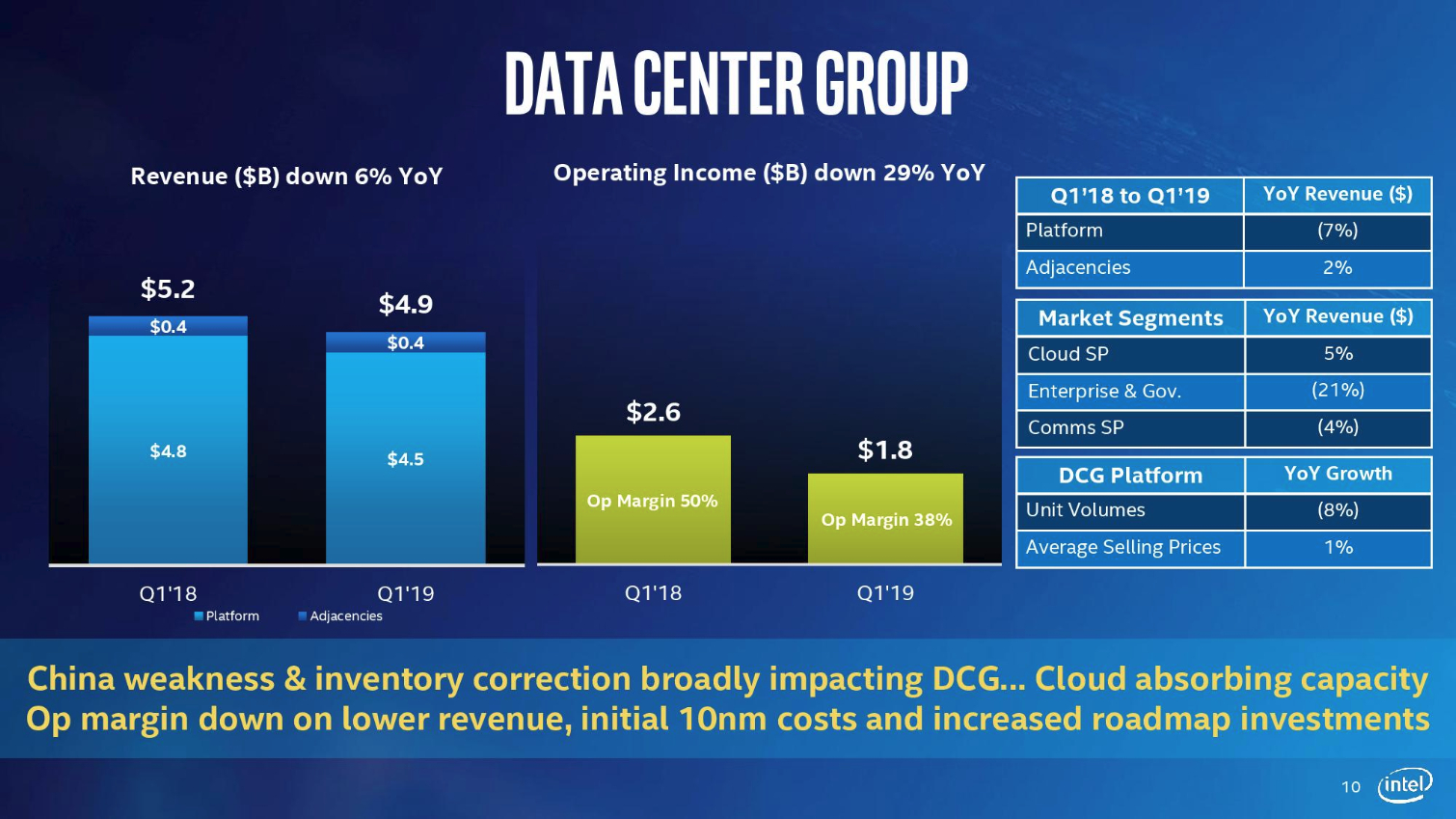

The data center group (DCG) also weathered a 17% QoQ and 8% YoY decline, with ASPs declining 4% on the quarter and improving 1% year over year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

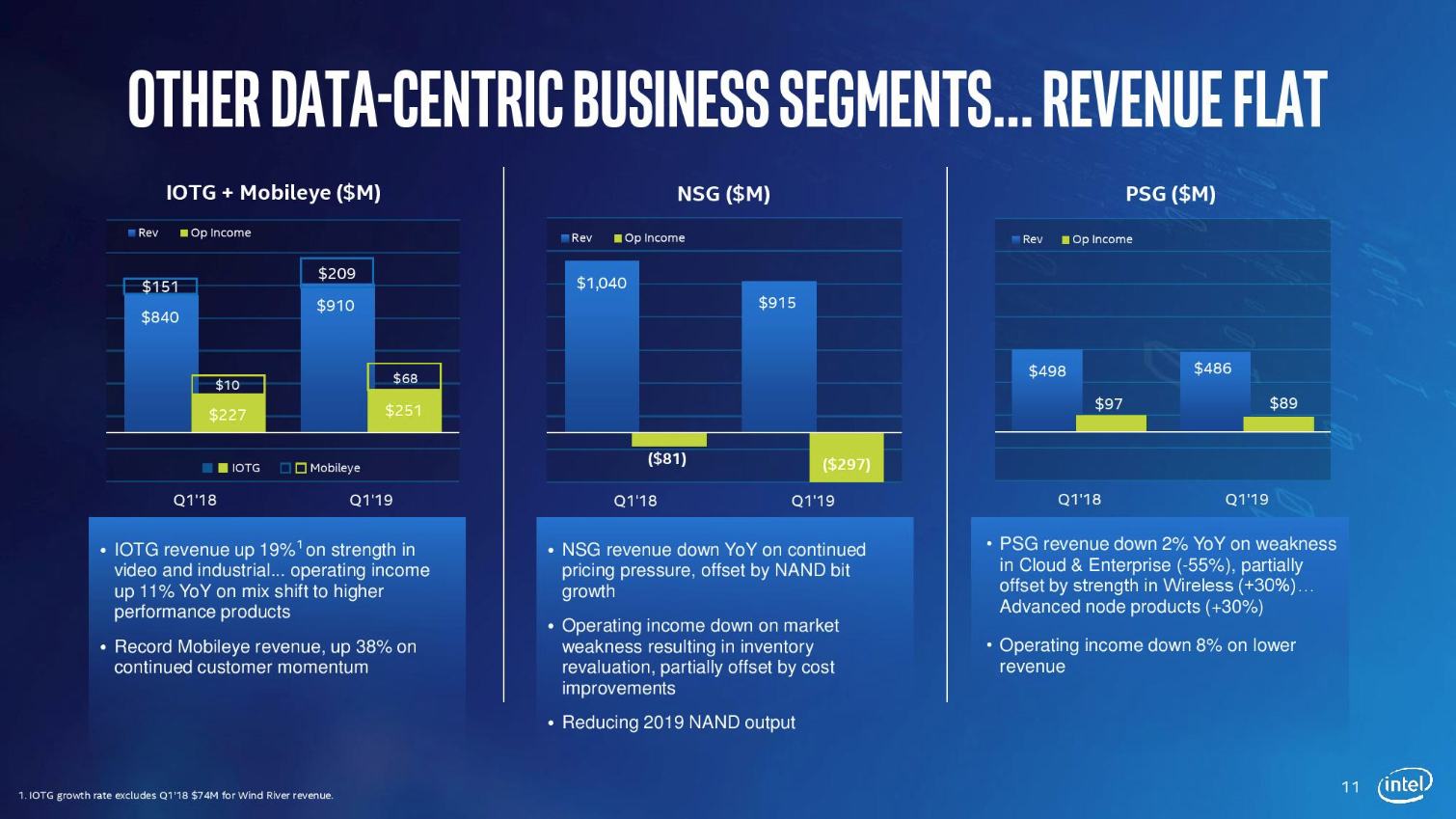

One year ago, Intel reported earnings well ahead of everyone's expectations, with its data-centric businesses collectively growing 25%. This kicked off a series of great earnings results for the company, with especially the cloud segment growing at up to 50%, resulting in total revenue that was 13% higher than the $62.8 billion of 2017, at $70.8 billion. This higher than expected growth resulted in reports of demand outpacing supply, resulting in shortages. The main victim of this was the Internet of Things business, which had been growing at double digits for years, which now saw a decline of 7% year-on-year, as the company prioritized the production of Core and Xeon processors above Atom and Pentium/Celeron.

Even amidst those shortages, last quarter saw the first signs of worsening market conditions, as revenue came in $500 million below the company's expectations nonetheless. At the time, Intel cited significantly weaker modem demand (as a result of weaker phone demand), cloud customers absorbing the capacity that they had put in place in huge volume during the first nine months of 2018, weakness and slowdown in China, and a weakening NAND environment with falling SSD prices.

In that sense, the results and outlook presented today are just a continuation of the factors that started playing out last quarter, with tough year-on-year comparisons given the intense growth last year. Revenue came in at $16.1B, the same as last year. However, gross margin declined by 4.0 points to 56.6%, at the lower end of what Intel calls its historical range of 55%-65%, although the company is usually above 60%. Net income was $4.0B, down 11% from last year.

Intel revised its 2019 outlook to reflect a "mid single-digit" decline this year, with the non-volatile storage group (NSG), the memory making side of the company, experiencing a high-single digit loss this year. Meanwhile, Intel projects its PC-centric business will decline in the low single-digits.