Intel Posts Another Record Quarter, 14nm Shortage To Worsen In Q4

Intel posted the best quarter in its 50-year history even as it grapples with an ongoing shortage of 14nm manufacturing capacity that has led to rising prices and shortages on some low-end processors.

Intel's interim CEO Bob Swan also said during the company's earnings call that the shortage had been limited in scope during the third quarter, which is surprising given the existing challenges, but the company expects the shortage to become more severe during the tail end of the year. That means we could see more widespread shortages and higher pricing during the holiday season. The company also reiterated that its 10nm process is on track for release by the 2019 holiday season.

Intel currently has an open CEO position after the departure of Brian Krzanich. Intel's interim CEO Bob Swan helmed the call. Intel's Dr. Murthy Renduchintala, a clear front-runner for the position, was also present. Navin Shenoy, the other clear candidate that has been on prior earnings calls, did not attend this call due to the birth of his child. Intel did not announce a new CEO during the briefing.

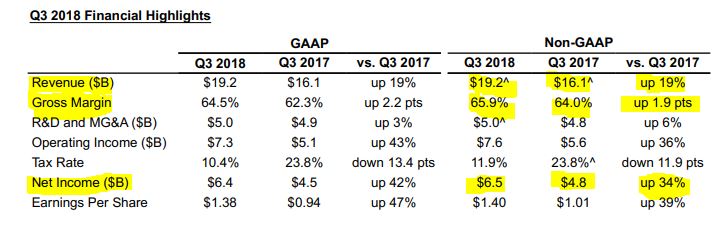

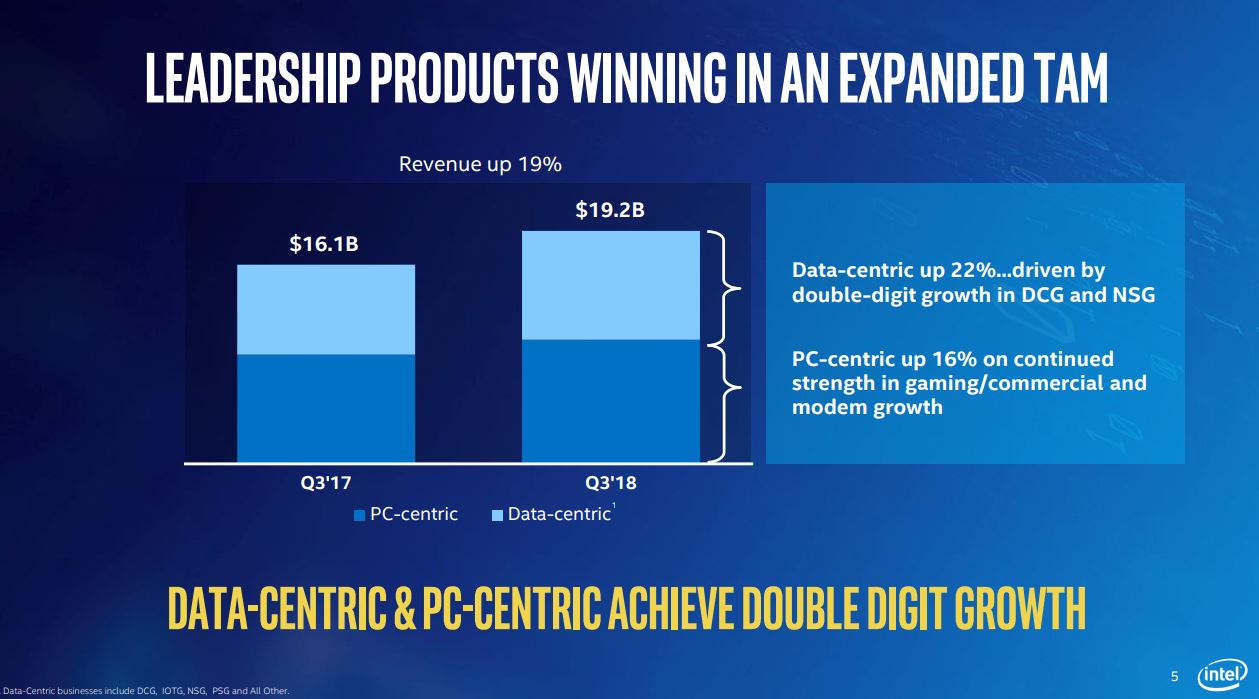

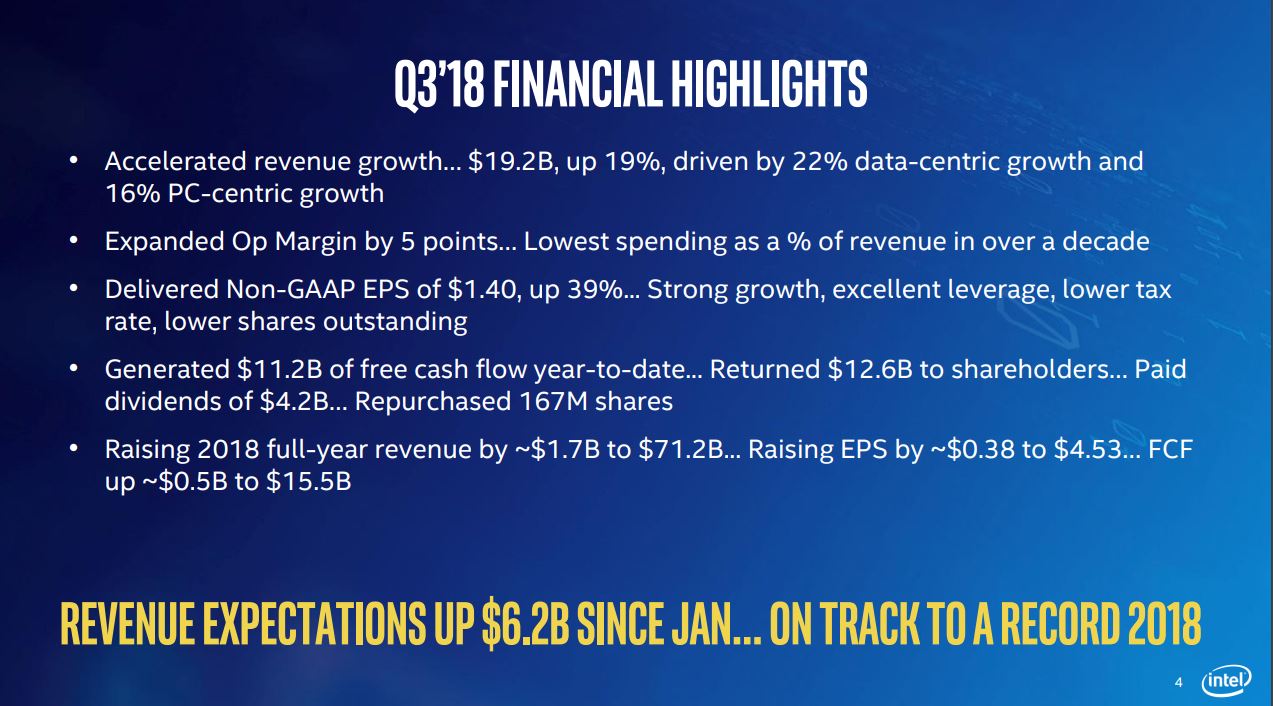

In either case, Intel is selling all the silicon it can spin out of its fabs. That led to a record $19.2B in revenue, a 19% year-over-year improvement, and an improved forecast of $71.2 billion for full-year revenue, a $6.2B increase compared to the forecast at the beginning of the year. Intel also posted a stellar 65.9% gross margin figure for Q318.

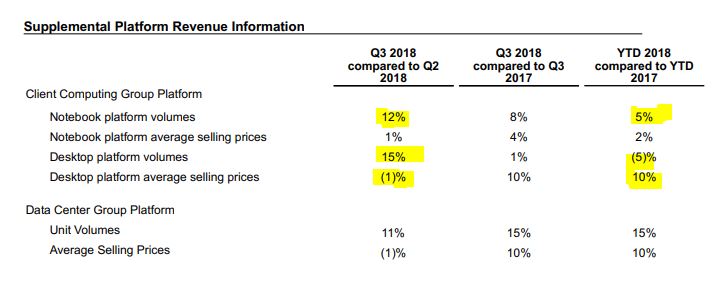

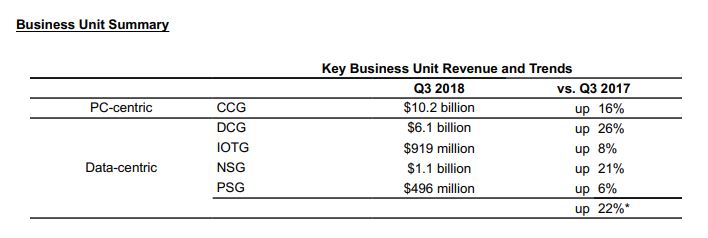

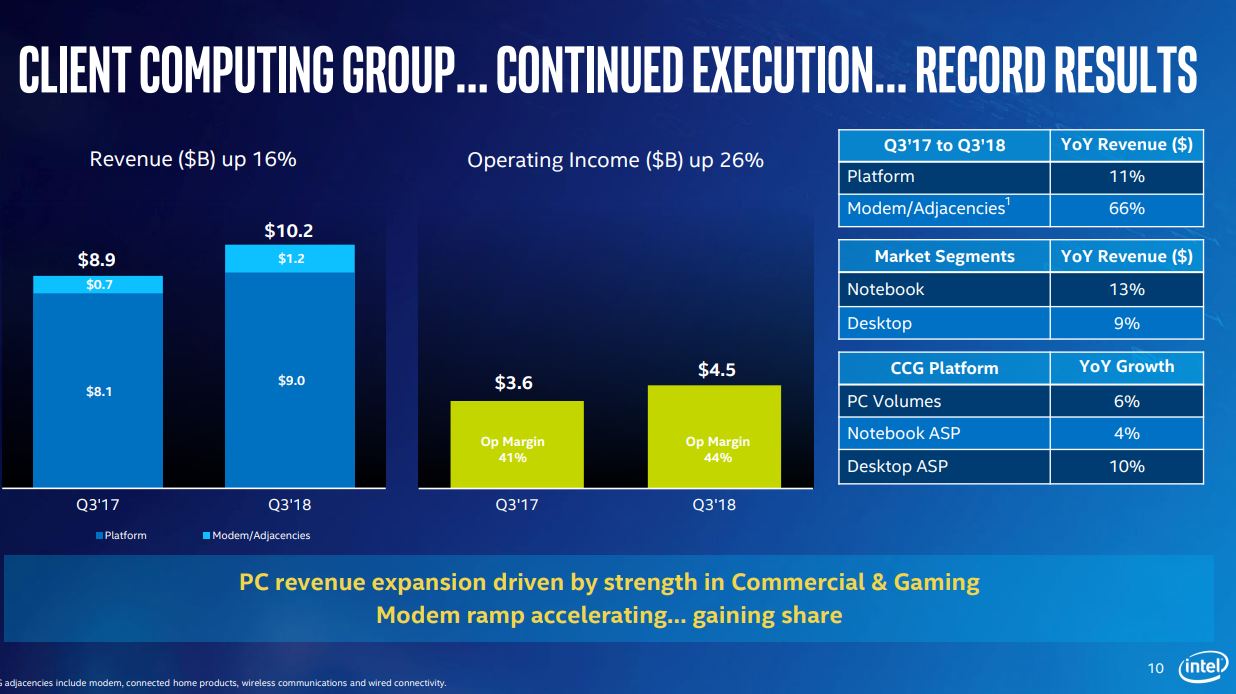

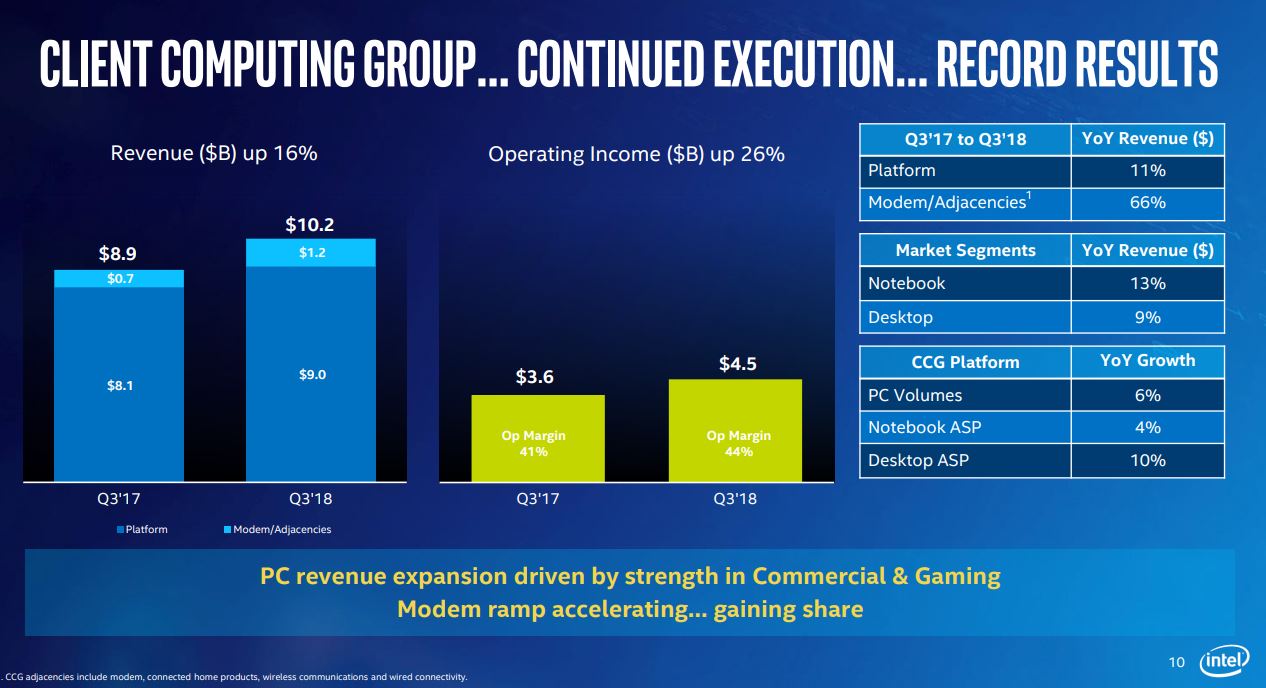

Intel is firing on all cylinders: every one of its business units posted record revenue. The Client Computing Group (CCG), the arm that produces desktop processors, experienced a particularly impressive uptick, especially considering the recent debut of AMD's second-gen Ryzen processors. That group posted a 16% year-over-year increase in revenue to $10.2B, setting yet another record.

That explosive growth comes against the backdrop of the first growth in the PC market it seven years, but the market only expanded by one to two percent. That makes the 16% growth even more impressive. We usually expect this type of uptick after a wave of new processors come to market, but Intel's 9th Gen processors, which it released last week, aren't included in the figures.

14nm Production Constraints

Intel is enjoying unusually strong demand that it claims has catalyzed the worsening shortages of 14nm processors, but the worst of the shortage is yet to come. Swan underlined the forthcoming challenges, stating (via Seeking Alpha),

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

I would say in Q3, largely a function of customer collaboration in our fabs, I don't think we were too terribly constrained on the PC side, to be honest with you. I think as we're going into Q4 is where I think the constraints are impacting us a little bit more.

The increased demand caught the company off guard:

[...]we were caught off guard a little bit this year by explosive growth well ahead of what our expectations were back in the beginning of the year, and that growth came from all different segments of the business. It put us in the unfortunate situation of constraining some of the demand signals that we were seeing from the market and our customer base.

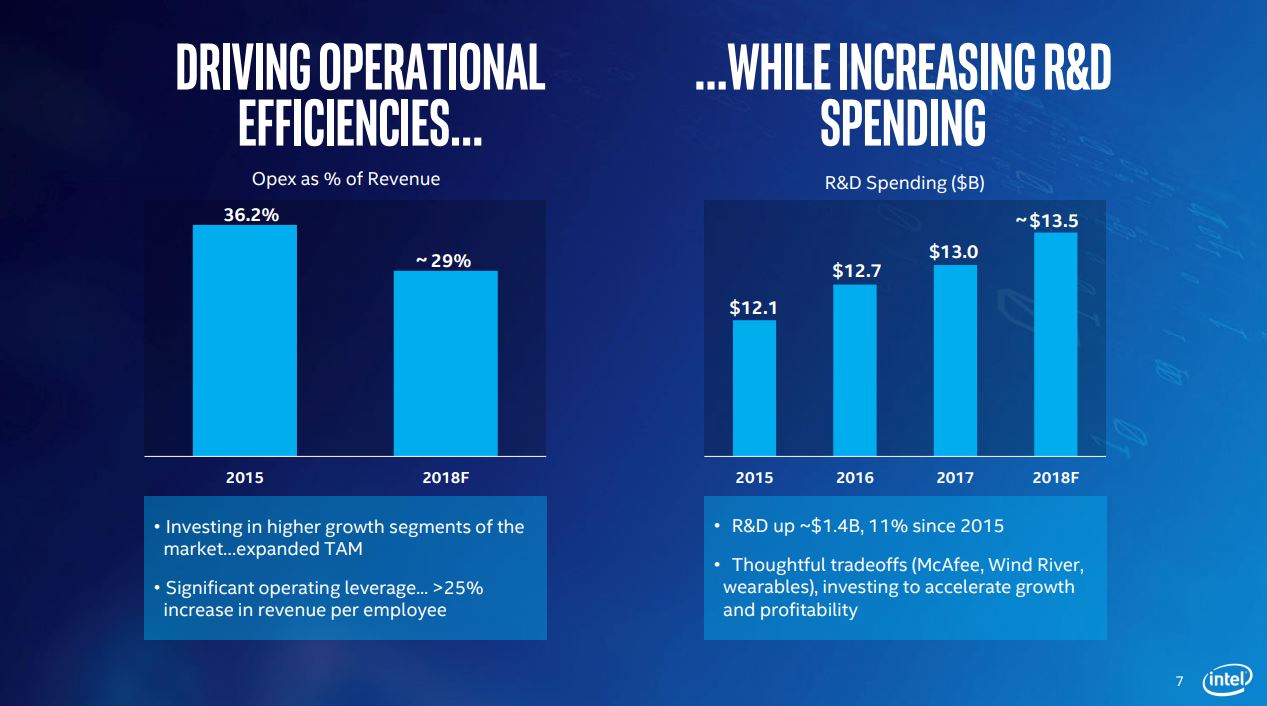

Intel's answer? Intel has boosted its CapEx to a record $15.5B this year, a $1.5B increase than expected at the beginning of the year. Intel also says that it has begun to migrate 10nm equipment over to the 14nm production lines to boost production. That's a wise move, as some industry analysts contend that roughly 95% of fab tooling is interchangeable between the 14nm and 10nm nodes.

Renduchintala stated the company is on track for 10nm deployment in 2019, citing improving yields on-par with the company's learning curve with the 14nm process, saying "[...]I feel more confident about that at this call than I did on the call a quarter ago." The company did not set an expected delivery date for the 7nm process but assured analysts the node is under development.

Data Center

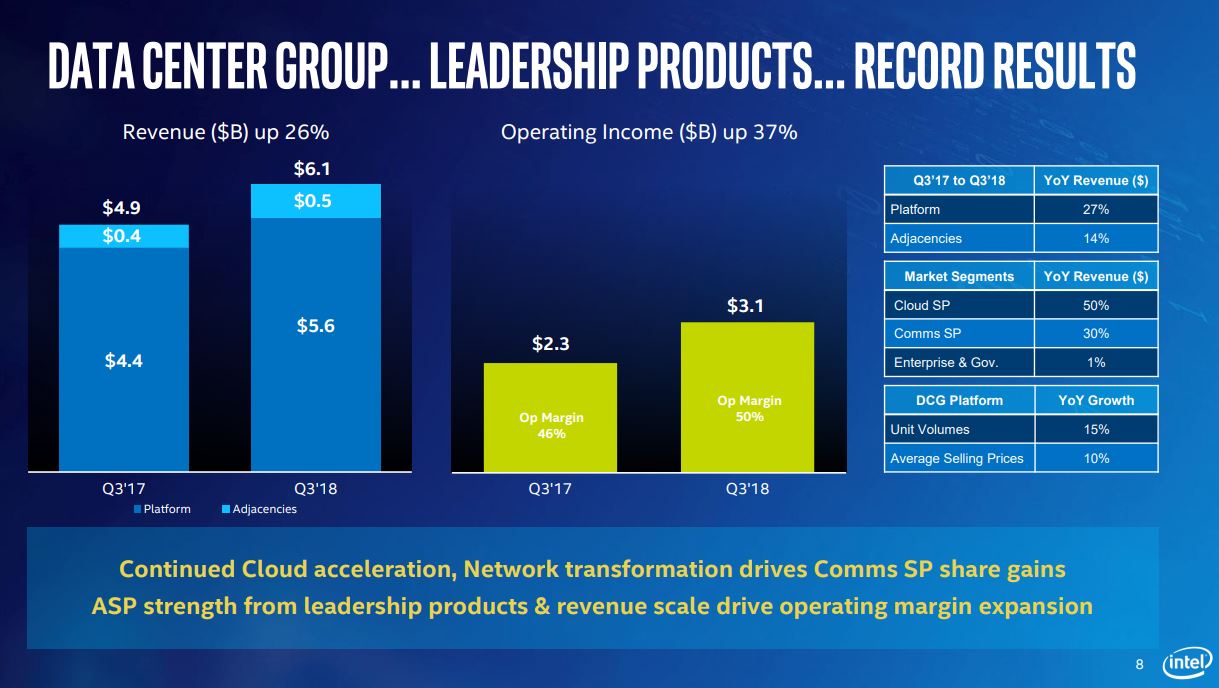

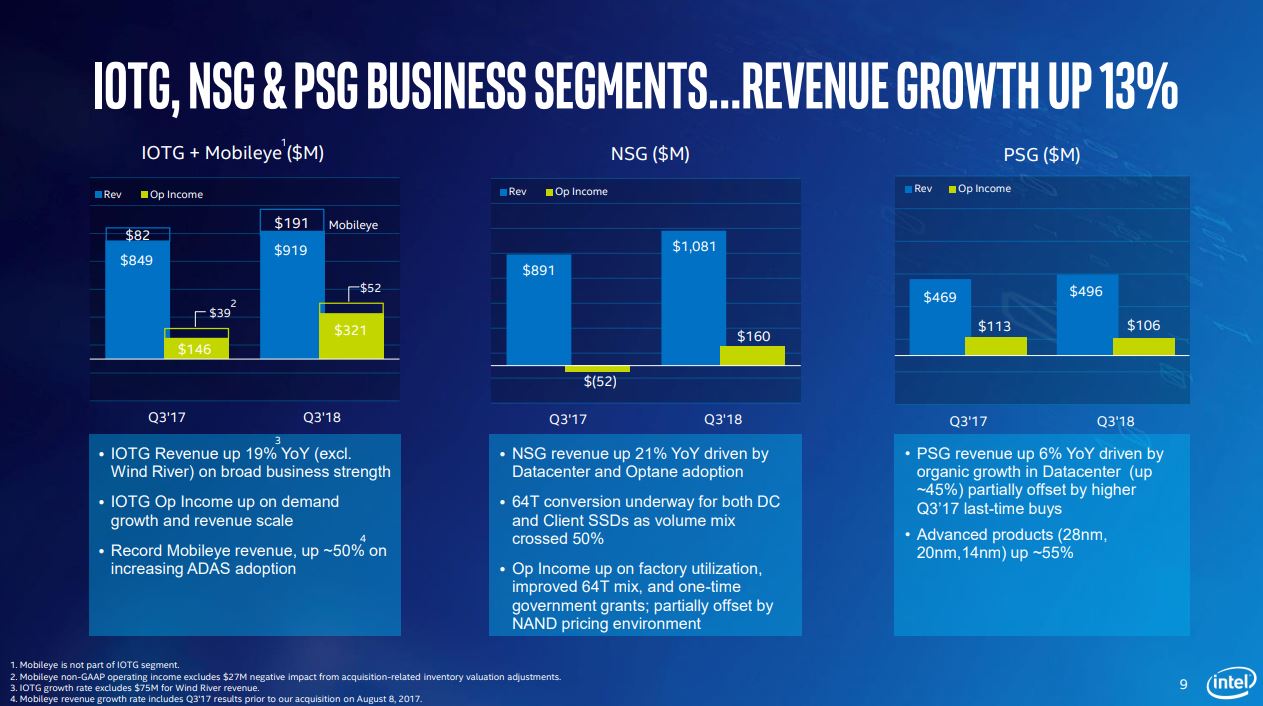

Intel's DCG (Data Center Group) posted impressive growth of $6.1B on the quarter, a 26% improvement sequentially. That helps brush off some of the lingering concerns that led to a stock price slump earlier this year. It also implies that AMD's EPYC isn't having a profound impact, though the second-gen EPYC 7nm chips, which debut later this year, may have more of an impact. Intel is also preparing for its Cascade Lake refresh.

Optane Updates

Micron made waves last week when it announced that it planned to buy out Intel's stake in their joint IMFT (Intel Micron Flash Technologies) venture. Micron will exercise the option on January 1, 2019, then close the deal within the year. This could have a profound impact on Intel, which has integrated the speedy new memory into its client and enterprise storage, and now processor (via Optane DIMMs), product stacks.

Swan said that Intel's contract with Micron guarantees it access to ample supply until 2020, thus providing the company enough time to bring up its own production lines. Intel also owns the IP for Optane, making this is the logical long-term solution.

Intel's storage-fabbing NSG (Non-Volatile Solutions Group) business unit also turned a profit for the first time this year, but margins aren't as impressive as Intel reaps on the logic side of its business.

Intel is also preparing its "world-class supply chain" for the impact of heightened trade tensions and tariffs with China. Swan conceded that China is both a big customer and an integral part of the company's supply chain, but indicated the company is adjusting its supply chain to circumvent the challenges.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Tanyac From an investor point of view this is probably good news.Reply

From a consumer point of view these people should be lined up and shot.

The blatant exploitation of consumers is appalling. If it weren't for the fact that AMD motherboards weren't so damned expensive I'd jump ship. No negligible performance margins are worth this rubbish.

And we've also got to deal with a predictable and correctable shortages - alogn with RAM, Flash, (and in our case graphics cards), whose prices are still on the rise....

This seems a concerted effort by manufacturers to kill the computing industry completely. -

octavecode I'm betting Intel will have a record drop in revenue next year....Their products are just not appealing any more.Reply -

adi6293 This is quite sad tbh, how can we expect AMD to complete when they make 1.5 billion a quarter next to Intels 19.....and there is also nVidia who also makes more money that AMD....Reply -

tikal AMD offers great value. Still, there are too many ignoramuses out there that rather overpay for INTEL CPU.Reply -

fredfinks Reply21433173 said:This is quite sad tbh, how can we expect AMD to complete when they make 1.5 billion a quarter next to Intels 19.....and there is also nVidia who also makes more money that AMD....

AMD was nearly dead a few years ago. Different ballpark.

Competition is good but based on what i saw while working at major retailer, regarding quantity of RMAs, led me to build a particular disdain for that brand.

21433272 said:AMD offers great value. Still, there are too many ignoramuses out there that rather overpay for INTEL CPU.

Get the product that suits your needs. If on par, id pay extra for intel. no hesitation. ive seen what the return box is full of and its not coloured blue.

Like early SSD days, you had your supertalents and OCZs but there was one that you could trust.

Theyre doing better than Cyrix so credit where credits due. -

Co BIY Reply21432959 said:This seems a concerted effort by manufacturers to kill the computing industry completely.

This sounds like a problem I'm having locally: "My favorite restaurant is sure to fail, I don't even go there anymore because they have raised prices and the wait for service is terrible with the line of customers always going out the door."

-

toffie47 @TANYAC AMD motherboard expensive? AMD motherboards cost slightly less than their comparable Intel counterpart.Reply -

johnrob I was planning to build a new computer in march but I think intel prices are already bloated and now they are expected to go up?Reply

All i wanted was 144+ fps on a 2k display for less than $2,000. Oh well it's been fun to dream. -

Onus Fredfinks, I'm indeed interested in what was in the "return box," but also, and a lot more importantly, why it was there. In all my years in IT, I've read from time to time about processor bugs (typically Intel!), but not dead CPUs or dead chipsets. Motherboards, yes; I've personally had some die on me (mostly S775 Biostar and Gigabyte), or read of horrendous problems (mostly AM3 MSI), but not dead CPUs themselves.Reply

Also, and I believe this is a big deal, companies trying to make the cheapest junk possible typically use AMD because it costs less, and low-end junk is junk, no matter who makes it; that's not the fault of AMD either; there are plenty of high-end AMD systems still out there. I could not claim to be suffering if I were still running my Asus 990FX Sabertooth, no matter how many cheap MSI G43 and G46 boards fill the dumpsters (and catch fire). So, I'm willing to bet the return box was indeed full of AMD-based systems, as various other cheap parts croaked (e.g. insufficient VRMs, overrated PSU-shaped objects), performance was dismally unacceptable (e.g. 5400RPM hard drives, IGP graphics), or other inadequacies reared their ugly heads (e.g. not enough RAM, undersized PSUs when trying to upgrade graphics).

-

redgarl Reply21433276 said:21433173 said:This is quite sad tbh, how can we expect AMD to complete when they make 1.5 billion a quarter next to Intels 19.....and there is also nVidia who also makes more money that AMD....

AMD was nearly dead a few years ago. Different ballpark.

Competition is good but based on what i saw while working at major retailer, regarding quantity of RMAs, led me to build a particular disdain for that brand.

21433272 said:AMD offers great value. Still, there are too many ignoramuses out there that rather overpay for INTEL CPU.

Get the product that suits your needs. If on par, id pay extra for intel. no hesitation. ive seen what the return box is full of and its not coloured blue.

Like early SSD days, you had your supertalents and OCZs but there was one that you could trust.

Theyre doing better than Cyrix so credit where credits due.

You are obviously working in retail with OEM systems like ACER, Lenovo and HP which choose the most abysmal junk for their system wearing the AMD logo.

I am a DIY builder and all my AMD/ATI product were faring a lot better than my Intel/Nvidia builds.

My BFG 8800 GTX died within a year, my Gigabyte GA-965P-DS3 died 3 times in 18 months, my EVGA 1080 FTW died twice in a year...

My only problem with AMD/ATI was when Asus was involved.

Not to say that my mini-ITX 4770k build with a dGPU was running like garbage in comparison to my 2400G with my MSI B450i which use the iGPU.

I had the total opposite experience from you and I have been building PC for 20 years.