Intel Is Back to Profitability But Lowers Expectations for Q4 2022

Intel's CCG and NEX groups are profitable, DCAI group posts zero profit.

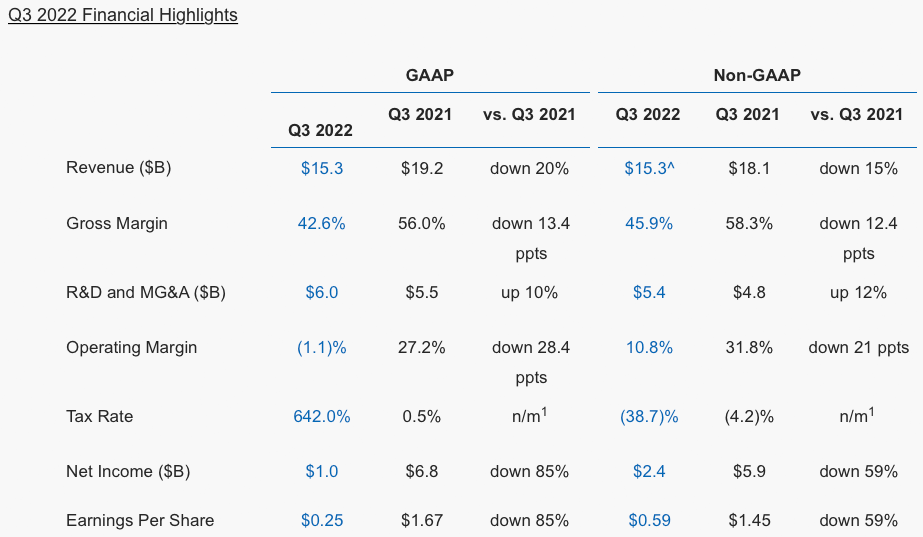

Intel has announced its financial results for its third quarter of fiscal 2023. Intel is back to profitability after earning $15.3 billion in revenue, down 20% year-over-year. Still, the company had to lower its guidance for the fourth quarter due to macroeconomic weakness and continued challenges for its client and data center business units.

Revenue Flat, Margins Up

Intel's Q3 FY2023 revenue totaled $15.3 billion, down 20% compared to the same quarter a year ago, but what was within the company's guidance was provided back in July. In addition, Intel's gross margin was down to 45.9%, which is higher when compared to the company's gross margin in Q2 but is still well below the company's historical results or long-term goals. As for the company's net income, it dropped 85% YoY to $1 billion.

"Despite the worsening economic conditions, we delivered solid results and made significant progress with our product and process execution during the quarter," said Pat Gelsinger, Intel CEO.

Client PC Group Makes Some Money as Data Center Unit Posts Zero Profit

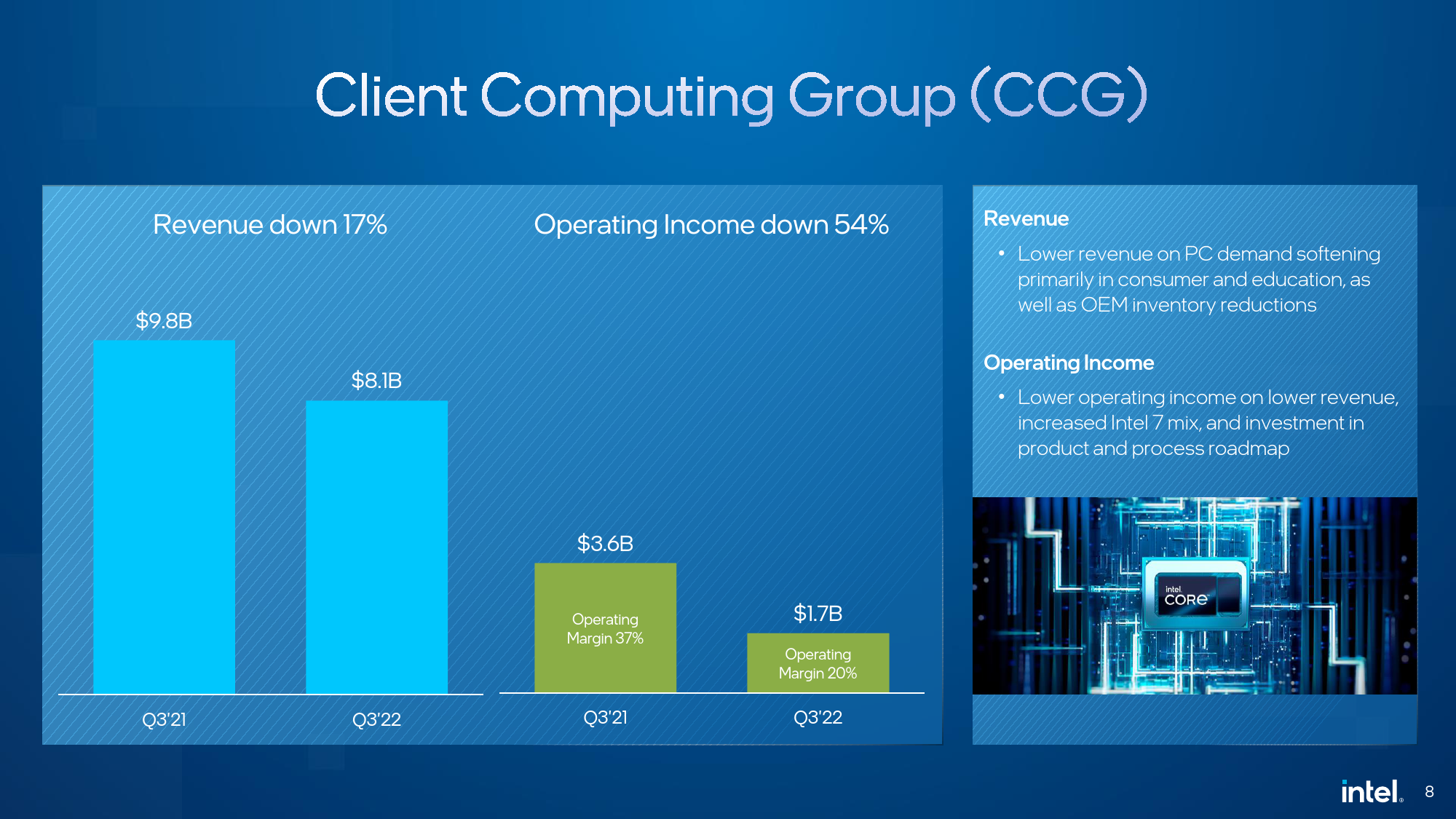

Intel's Client Computing Group earned $8.1 billion in Q3 2022, down 17% from the same quarter a year ago, whereas operating income for the group totaled $1.7 billion, down from $3.6 billion in Q3 2021. Sales of Intel's processors and chipsets for client systems dropped because of softening PC demand by consumers, the education sector, small businesses, and OEM inventory reductions. Intel stressed that while inventory levels at PC makers somewhat reduced during the quarter, they are still high enough to affect the company's CPU and chipset shipments for quite some time.

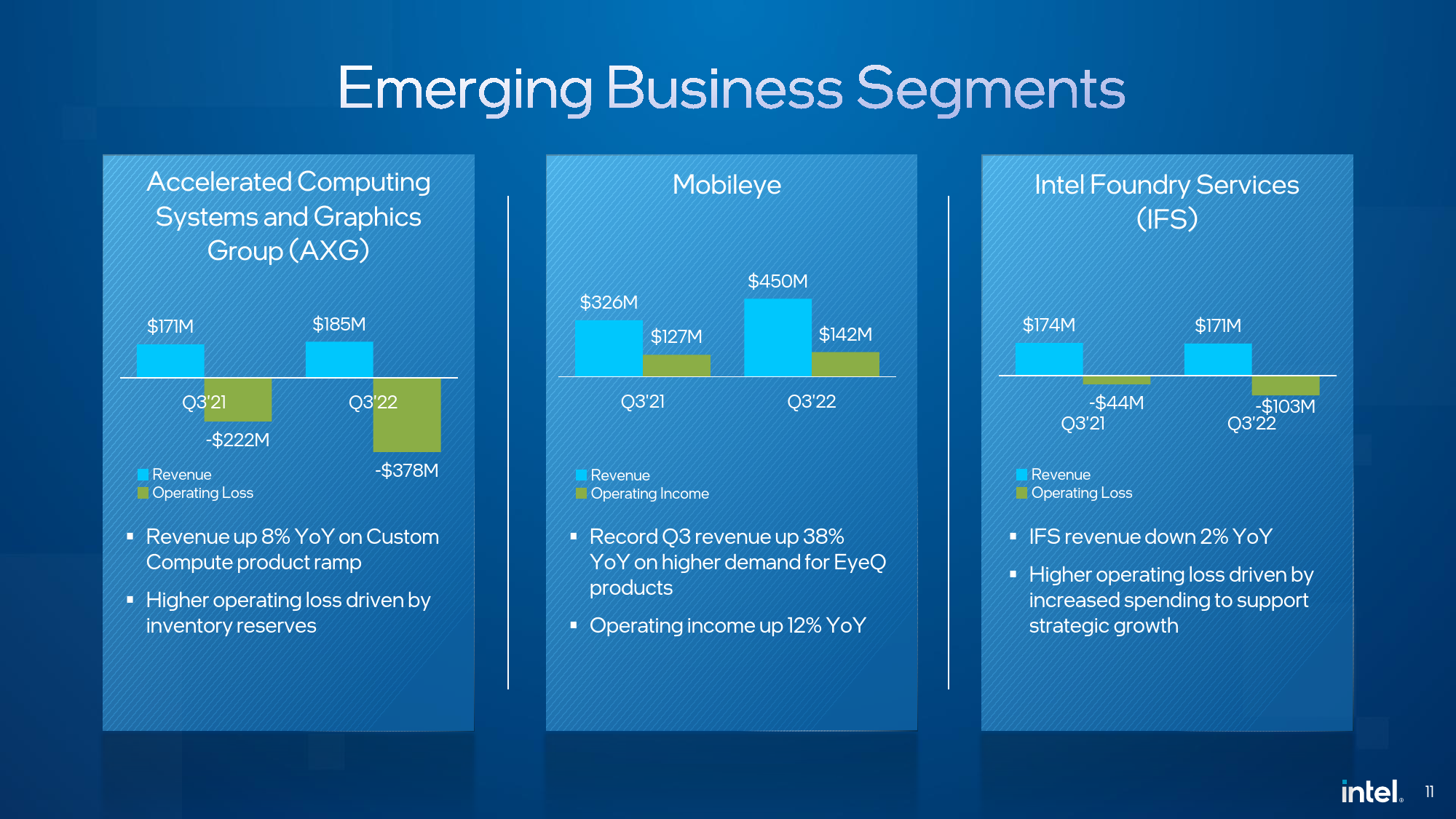

Intel's Accelerated Computing Systems and Graphics Group (AXG) earnings grew to $185 million from $171 million in the same quarter a year ago. It happened not because the company finally started to ship its long-awaited discrete graphics processors for desktops, laptops, and servers but because of a 'custom compute product ramp.' While Intel does not name the product, we might speculate that the device in question could be Intel's cryptocurrency mining chip. While Ponte Vecchio compute GPU is now in production, Intel did not announce its volume shipments, so it is likely that a cryptocurrency mining chip drove AXG's results.

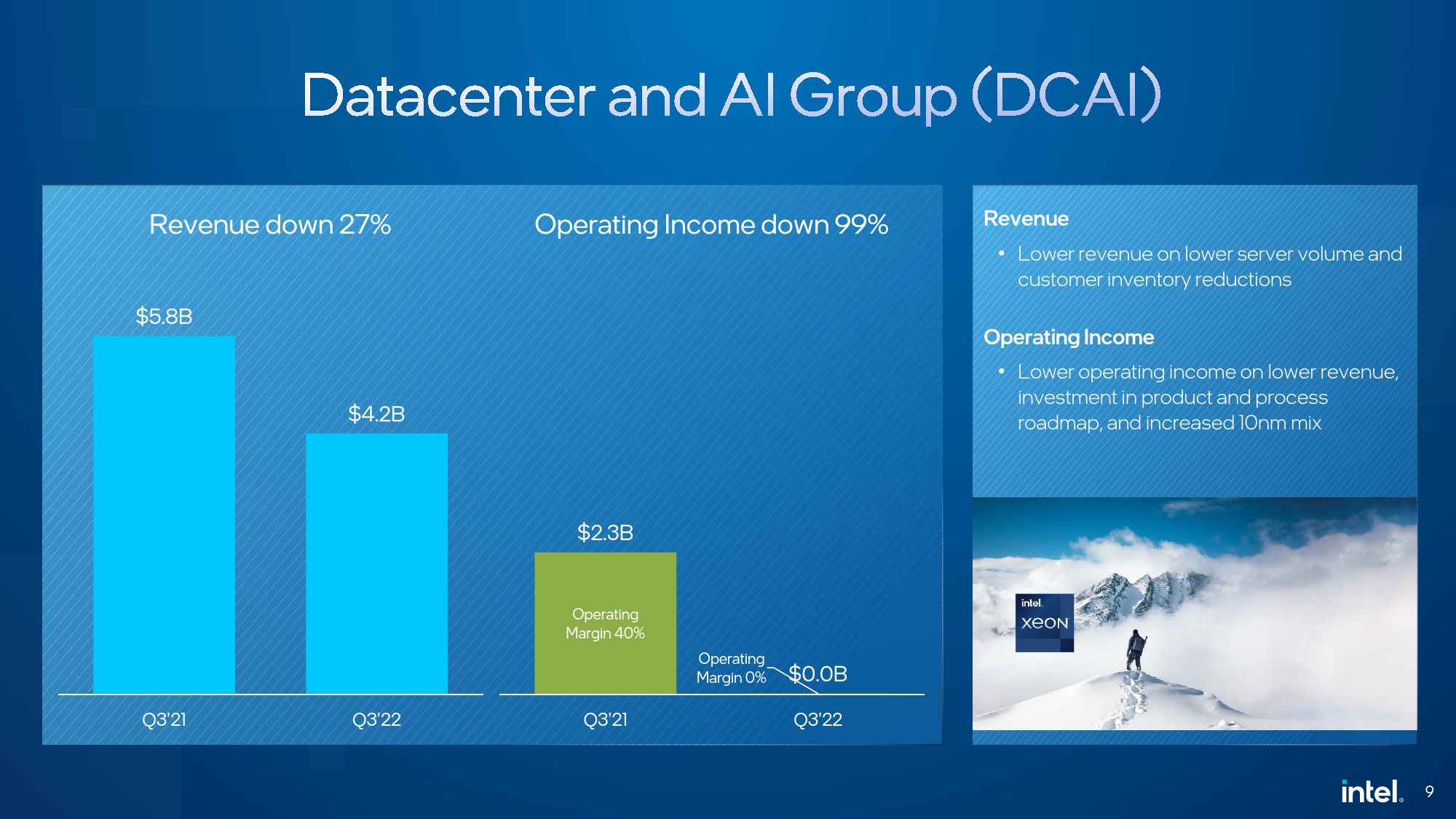

Intel's Datacenter and AI Group (DCAI) generated a $4.2 billion revenue (down 27% YoY) and earned zero operating income. Intel blames lower server volumes and customer inventory reductions for such horrible results, though growing competition from AMD and delayed Sapphire Rapids ramp-up also significantly affected DCAI's results.

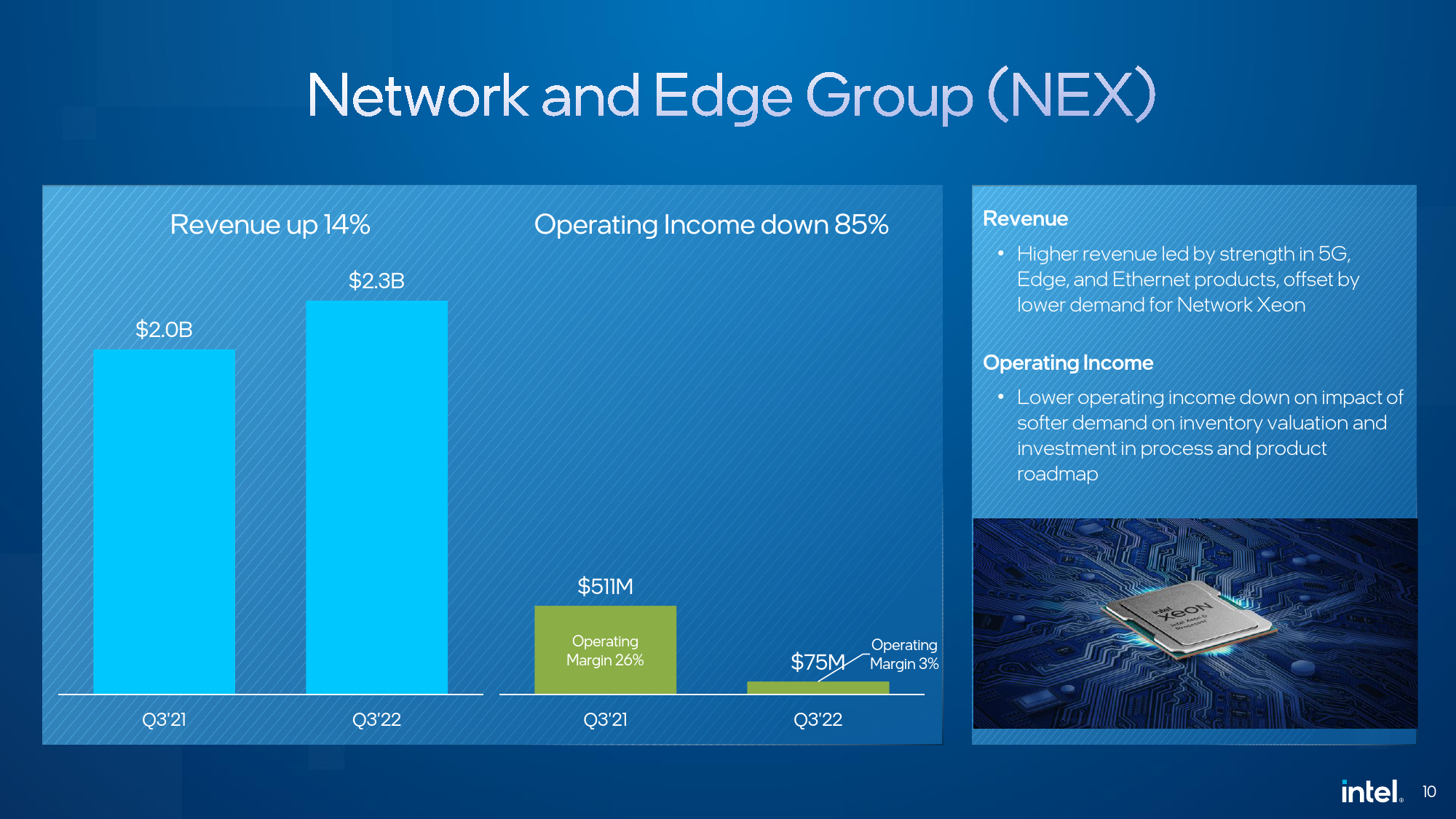

Intel's Network and Edge Group was the only business unit whose revenue increased yearly. NEX generated $2.3 billion, up 14% compared to the same quarter a year ago, but its operating profit dropped to $75 million from $511 million in Q3 2021. Intel says that as demand for 5G, Edge, and Ethernet products was strong, demand for its Xeon CPUs aimed at networking slumped, offsetting gains.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel's Mobileye business, which just went public earlier this week, generated $450 million in sales, up 38% from a year ago, and its profitability climbed to $142 million, or by 12% YoY.

As for Intel's Foundry Services, its revenue of $171 million was essentially flat, with $174 million in Q3 2021, whereas its losses deepened to $103 million as the company increased its spending on new fabs and tools.

Revises Full Year Forecast, Braces for Global Recession

Intel expects its fourth-quarter revenue to be $14 billion – $15 billion (down 23% – 28% YoY) and its gross margin to remain at around 45%. Since there is no chance that Q4 2023 will be a breakthrough quarter for Intel, the company now expects its full-year revenue to be between $63 billion and $64 billion, a decrease of 14% – 16% compared to the previous year and a decline of $2 billion – $4 billion from the July guidance. The company's gross margin is expected to be 47.5%.

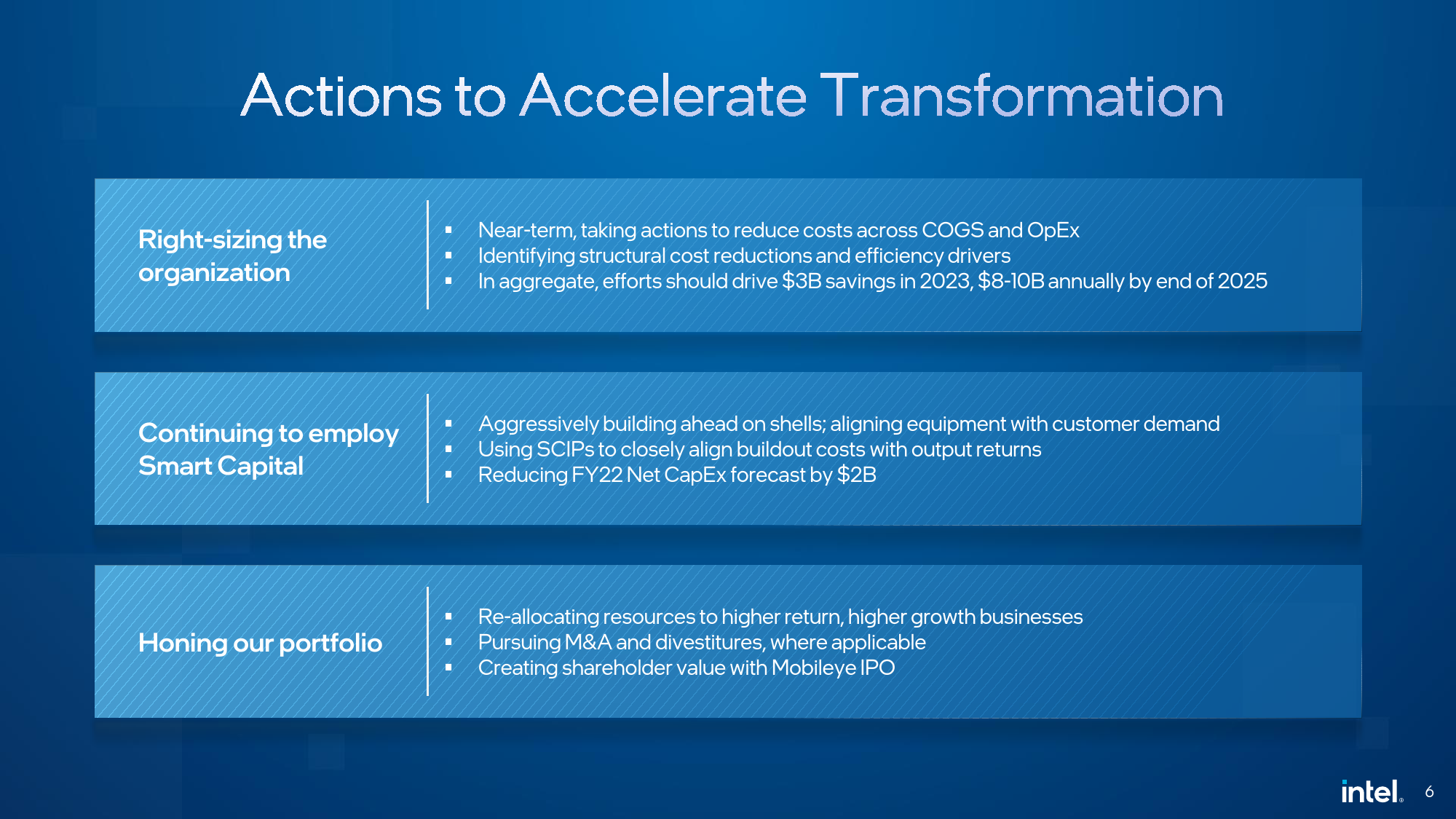

Intel expects macroeconomic weakness to last for several quarters at least, which is why it is implementing a program to cut costs by $3 billion in 2023 and by $8 billion – $10 billion by the end of 2025. Essentially, this confirms Intel's intention to reduce its workforce significantly.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

watzupken The result looks good only because the last quarter they made a loss, and now back in the black. But the reality is that they are far from where they used to be when they mostly monopolized the CPU market. With the retail market mostly back to pre-COVID demand level, there will be little growth in this market segment. In the DC side of things, they are also facing strong competition from AMD and ARM, which from the business results over the last few quarters, have shown that Intel is struggling in this space.Reply -

Reply

Nice summarywatzupken said:The result looks good only because the last quarter they made a loss, and now back in the black. But the reality is that they are far from where they used to be when they mostly monopolized the CPU market. With the retail market mostly back to pre-COVID demand level, there will be little growth in this market segment. In the DC side of things, they are also facing strong competition from AMD and ARM, which from the business results over the last few quarters, have shown that Intel is struggling in this space. -

rluker5 Reply

I did a search for Intel's annual/quarterly numbers for the last 15 years or so and I don't know where you got this from. 2022 looks like a relatively bad year. So were 2009, 2012, 2013 and 2015. Been bad for tech in general and AMD is struggling as well. The numbers are there for anybody to search so don't trust only my statement, evaluate for yourself. The market does seem to have largely abandoned traditional financial measures in exchange for chasing growth, sometimes even just price growth not attached to anything else, but now that growth is scarce IDK what will happen with stock valuations. I wish I did.watzupken said:The result looks good only because the last quarter they made a loss, and now back in the black. But the reality is that they are far from where they used to be when they mostly monopolized the CPU market. With the retail market mostly back to pre-COVID demand level, there will be little growth in this market segment. In the DC side of things, they are also facing strong competition from AMD and ARM, which from the business results over the last few quarters, have shown that Intel is struggling in this space.

But I've seen enough anonymous armchair experts be wrong that I don't go by what they say. Especially when they seem to be using one sided information to push a narrative. -

JamesJones44 Replyrluker5 said:I did a search for Intel's annual/quarterly numbers for the last 15 years or so and I don't know where you got this from. 2022 looks like a relatively bad year. So were 2009, 2012, 2013 and 2015. Been bad for tech in general and AMD is struggling as well. The numbers are there for anybody to search so don't trust only my statement, evaluate for yourself. The market does seem to have largely abandoned traditional financial measures in exchange for chasing growth, sometimes even just price growth not attached to anything else, but now that growth is scarce IDK what will happen with stock valuations. I wish I did.

But I've seen enough anonymous armchair experts be wrong that I don't go by what they say. Especially when they seem to be using one sided information to push a narrative.

I agree don't listen to talking heads/analysts, they are talking their book, not what is good for you. However, you can make an educated guess, Intel's growth rate has largely been flat for the last 10 years. Companies that don't grow and have a 5% dividend usually trade 12.6 times their forward earnings (or so a quick search shows). Intel has said they expect to earn around $2 a share next year, put a 12x on that and you get $24. I would put good money that if things don't change for Intel on the growth front the stock will be between $20 and $30 in a year from now. This of course assumes that their foundry business won't take off or completely flop out in the next 12 months, same with Meteor Lake. Those could move that earnings and p/e ratio, but that gets into speculation and to each their own on that. -

rluker5 Reply

What would that put AMD at? $20-$30? Not arguing, just pointing out a disparity.JamesJones44 said:I agree don't listen to talking heads/analysts, they are talking their book, not what is good for you. However, you can make an educated guess, Intel's growth rate has largely been flat for the last 10 years. Companies that don't grow and have a 5% dividend usually trade 12.6 times their forward earnings (or so a quick search shows). Intel has said they expect to earn around $2 a share next year, put a 12x on that and you get $24. I would put good money that if things don't change for Intel on the growth front the stock will be between $20 and $30 in a year from now. This of course assumes that their foundry business won't take off or completely flop out in the next 12 months, same with Meteor Lake. Those could move that earnings and p/e ratio, but that gets into speculation and to each their own on that. -

JamesJones44 Replyrluker5 said:What would that put AMD at? $20-$30? Not arguing, just pointing out a disparity.

AMD has grown, the probably deserve a growth premium (though one could argue their growth may be leveling off). If we give them the same 12x as Intel they would be $3.90 x 12 it would be $47. If we apply an 30% growth premium (that has been about their average the last few years) you come to about 16-18x earnings which is $62 to $71 next years earnings you get (16x and 18x respectively) (different houses use different formulas for growth premiums so this is a bit harder to compare overall). So I would say the window for AMD is somewhere between $55 and $80. I'm personally not sure they can keep up 30% growth, even with the Xilinx acquisition, but that gets back into speculation which is really person dependent. -

rluker5 Reply

30% growth is rather suspect. Their earnings estimate for this quarter has dropped by 33% over the last 30 days and they are giving away 32GB DDR5 and $50 off mobos just to sell their new CPUs at Microcenter. Not to mention the post crypto hit. And AMD has no dividend. And their P/E ratio is still over 4x what Intel's is for what little that matters in today's market.JamesJones44 said:AMD has grown, the probably deserve a growth premium (though one could argue their growth may be leveling off). If we give them the same 12x as Intel they would be $3.90 x 12 it would be $47. If we apply an 30% growth premium (that has been about their average the last few years) you come to about 16-18x earnings which is $62 to $71 next years earnings you get (16x and 18x respectively) (different houses use different formulas for growth premiums so this is a bit harder to compare overall). So I would say the window for AMD is somewhere between $55 and $80. I'm personally not sure they can keep up 30% growth, even with the Xilinx acquisition, but that gets back into speculation which is really person dependent.

But really one has to go with the predictors that have been working and not just some of the countless other details and reasons. The goal of the markets isn't to be right, but to make money. Thanks for your reply.