Intel Looks to Be Catching Up with AMD's Discrete GPU Market Share

Nvidia predictably retains the discrete GPU crown in Q4 2022.

Less than a year after Intel began shipping its Arc Alchemist discrete GPUs for notebooks and desktops, the company's share on the market of standalone graphics processors increased so significantly that on paper it looks like it is catching up with AMD, according to numbers released by Jon Peddie Research this week. There may be a catch with Intel’s discrete GPU shipments market share number though. Meanwhile, Nvidia easily held onto its discrete GPU lead, with over 80% of the market.

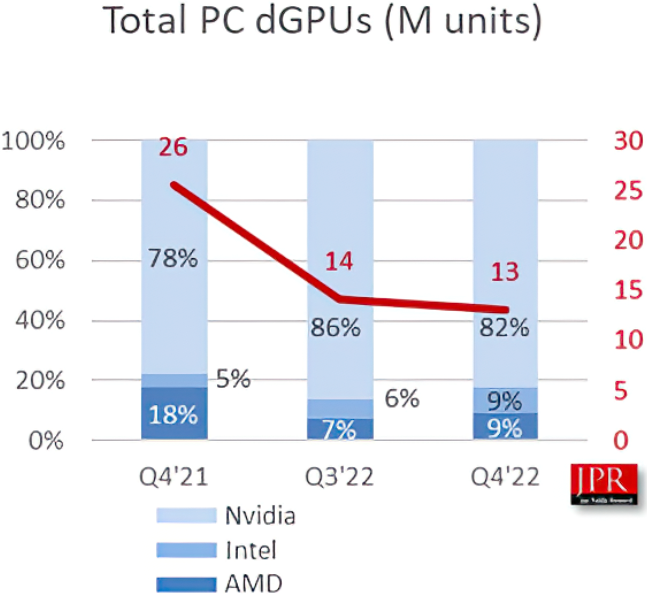

Three suppliers of discrete graphics processors — AMD, Intel, and Nvidia — shipped a total of 13 million standalone GPUs for desktops, notebooks, and embedded PCs in Q4 2022, according to estimates by Jon Peddie Research. This is a major drop from 26 million discrete GPUs shipped by these companies in the fourth quarter of 2021, which is not surprising as demand for PCs (especially mainstream systems) weakened in Q4 last year.

Nvidia retained its position as the world’s leading supplier of standalone GPU with 82% of the market, which is not surprising as this is one of the company’s main businesses. Meanwhile, AMD’s share declined to 9% from around 18% in the same quarter a year before, whereas Intel’s share increased to 9% from around 5% in Q4 2021. That means the two smaller GPU players shipped around 1.17 million discrete GPUs each in the fourth quarter.

While this seems like a big win for Intel and a major loss for AMD, it is not that simple. Intel’s numbers are estimates based on the company’s financial statements and ASPs, so they may or may not be completely accurate. In fact, AMD likely still leads Intel in terms of discrete GPU unit sales.

"The Intel numbers are an estimate based on their financial report," said Jon Peddie, the head of Jon Peddie Research. "I would not get too excited about the closeness in shipping levels as Intel’s numbers are influenced by ASPs and that is soft data."

Put another way, this data represents sell-in for dedicated graphics cards into the channel. Sell-out — the number of dedicated graphics cards sold to actual consumers and businesses — would tell us what people are actually using, but we don't have that data. Right now, we know sell-in is higher than sell-out and that inventories at OEMs, distributors, and retailers have increased, but we don't know exactly how much inventory is available in the channel. It's possible, for example, that Intel has pushed a ton of Arc inventory into the channel but that it hasn't been sold yet.

Still, Intel’s success on the discrete GPU market should not be underestimated. The blue company has been the biggest supplier of integrated graphics processors for a couple of decades now, but it came back to the discrete GPU market only in late 2020 with an arguably mediocre offering. But Intel’s Iris Xe Max still won some designs and captured some share. With the Arc Alchemist GPUs that began shipping in early 2022, Intel won many more designs with notebook makers — and notebooks are sold in relatively high volumes.

While Intel still may not be shipping as many standalone GPUs as AMD, it's clear now that because the company addresses both desktops and notebooks with its Arc offerings, its discrete GPU shipments are indeed increasing.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

PlaneInTheSky I won't buy any GPU until shader compilation stuttering is fixed on PC .Reply

Wo Long Fallen Dynasty is launching tomorrow, and the demo I played was another shader compile stutterfest.

After the 4th PC game I played from 2023, with stutters, I really had enough. I have started to buy all my games on PS5. -

kerberos_20 well they mixed notebooks with those dGPU results...intel doesnt have to stuff nvidia/amd in notebooks anymoreReply

desktop story shouldnt have that much traction....unless there was some big order for chinese PC caffes -

-Fran- Just to point this out, but... Shipped units is NOT equivalent to SOLD units, which imply "market share". GPUs on store shelves are not getting used and do not represent someone replacing one brand for another. Sure, a supplier bought them, but it doesn't mean that is going to be a trend going forward if they stay on shelves in the long run (just to point out: this apply to all of them, obviously).Reply

If you can find evidence that shipped GPUs correlate 1:1 to sold ones then that would make more sense to me, otherwise this is misleading as heck.

Regards. -

PEnns Reply-Fran- said:Just to point this out, but... Shipped units is NOT equivalent to SOLD units, which imply "market share". GPUs on store shelves are not getting used and do not represent someone replacing one brand for another. Sure, a supplier bought them, but it doesn't mean that is going to be a trend going forward if they stay on shelves in the long run (just to point out: this apply to all of them, obviously).

If you can find evidence that shipped GPUs correlate 1:1 to sold ones then that would make more sense to me, otherwise this is misleading as heck.

Regards.

Exactly.

There are tons of warehouses stuffed with merchandise that nobody ever bought!! -

JamesJones44 ReplyPEnns said:Exactly.

There are tons of warehouses stuffed with merchandise that nobody ever bought!!

Most companies don't pre-stuff warehouses these days. That usually only happens these days when a retailer mis-judges the market, in which case they would be sales by the producing company. I can't say that is the case here, but I can't image any modern company pre-producing millions of product without knowing there is demand for the product like they did back before the 2000s. -

healthy Pro-teen Reply

Personally, the AMD 6650XT has better Performance, is more stable, and costs less. Intel will get my money when (or If) they will be better value for money.Amdlova said:I'm waiting the stalker 2 launch, if works good on intel gpu I will get one 770. -

dalek1234 ReplyPlaneInTheSky said:I won't buy any GPU until shader compilation stuttering is fixed on PC .

.... I have started to buy all my games on PS5.

There is an interesting comment on Broken Silicon, why the stuttering is there on PC but not on PS5, plus a potential solution:

iFwtE2fh-y0View: https://www.youtube.com/watch?v=iFwtE2fh-y0

Watch these two segments from his time-index menu:

16:48 Are recent "bad console ports" in reality a sign of things changing?

25:03 Should Devs require NVMe 3.0 SSDs and 32GB of RAM? -

dalek1234 "shipped" doesn't mean "sold". In fact, a few retailers mentioned by Moore's Law is Dead said that newest gen AMD is outselling Nvidia's, and Intel's graphics cars are sitting on helves with hardly anybody buying them.Reply -

JarredWaltonGPU Reply

This is the "business as usual" state of affairs, but right now things are NOT in that state. There's plenty of evidence that sell-in and sell-out are unbalanced and that inventories have increased substantially in some cases. I would wager heavily that Intel Arc GPUs have a lot of sell-in and much lower sell-out, probably Intel stuffing the channel at OEMs in particular with relatively cheap Arc GPUs. It makes their numbers look way better than they are, for example. We'll have to see what happens in the coming months. I can't imagine Intel is continuing to produce a ton of Arc wafers at TSMC, given they cut the price of the A750 by $40 just a couple of months after launch. That's a clear indication that the parts aren't selling fast.JamesJones44 said:Most companies don't pre-stuff warehouses these days. That usually only happens these days when a retailer mis-judges the market, in which case they would be sales by the producing company. I can't say that is the case here, but I can't image any modern company pre-producing millions of product without knowing there is demand for the product like they did back before the 2000s.