Intel Posts Record Earnings, Desktop Volume Down 10 Percent YoY, First Discrete GPU Power-On

Intel posts great financial results, but desktop PC volumes fell 10% year-over-year.

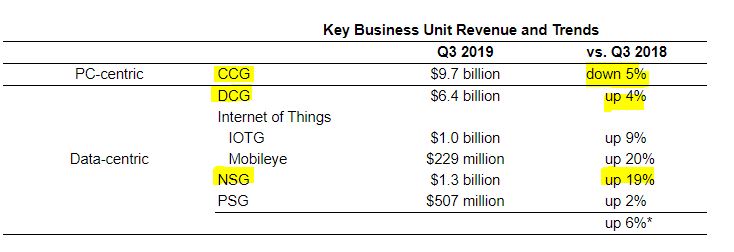

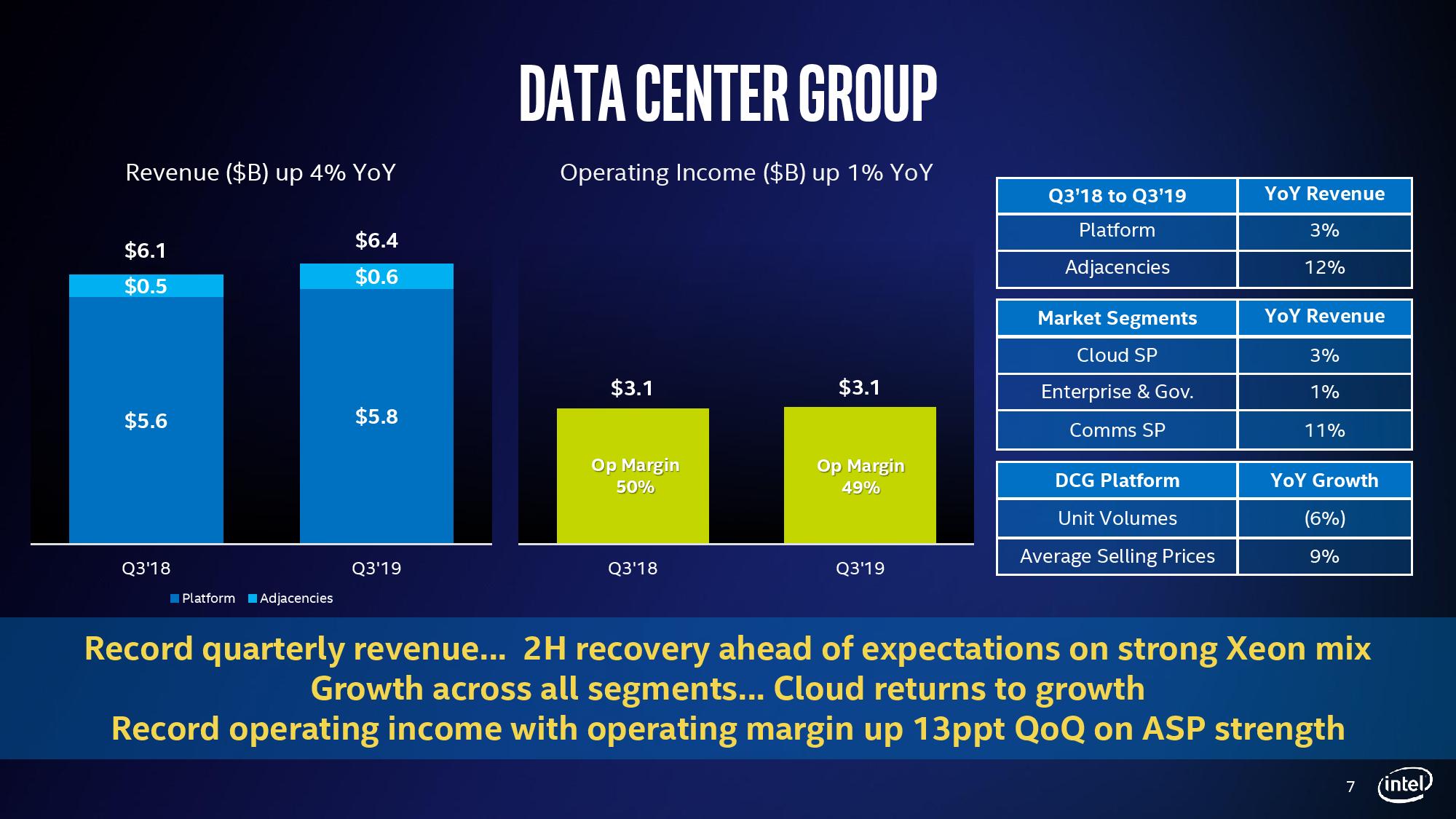

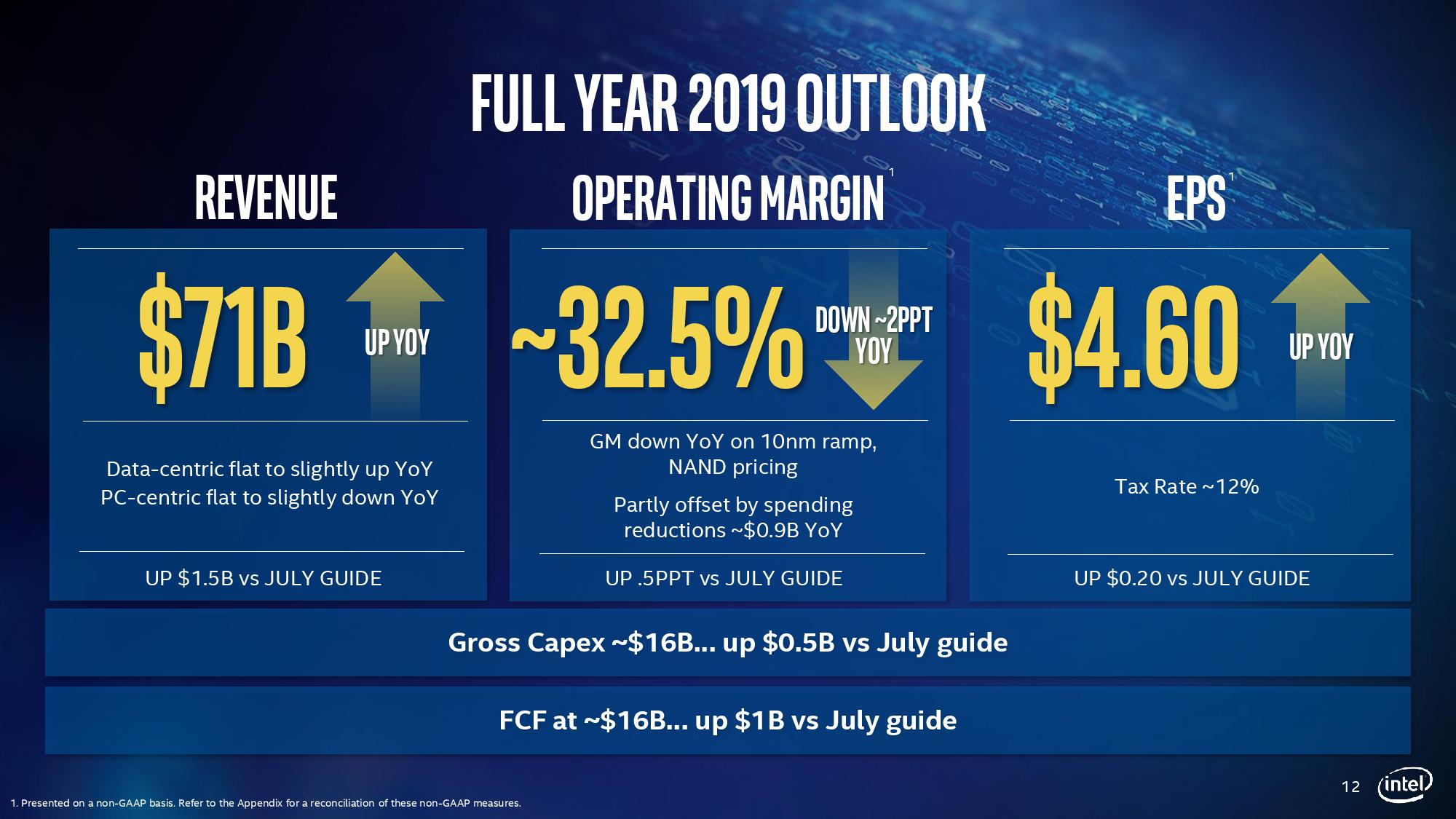

Intel posted what CEO Bob Swan characterized as the "best quarter in company history" today, exceeding its revenue targets by $1.2 billion on its way to a record $19.2 billion in overall revenue. The impressive results were fed by a record $9.5 billion in revenue for Intel's data center group, which now comprises 49% of the company's revenue (another record).

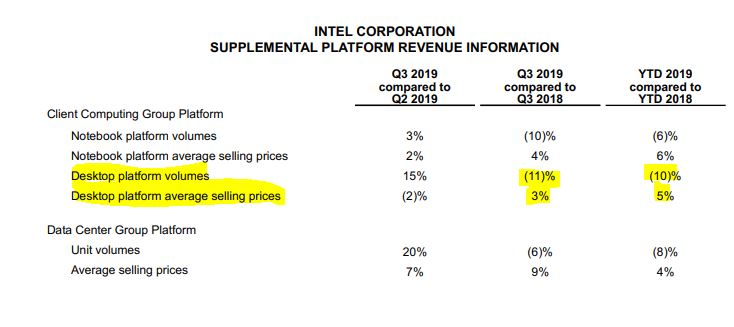

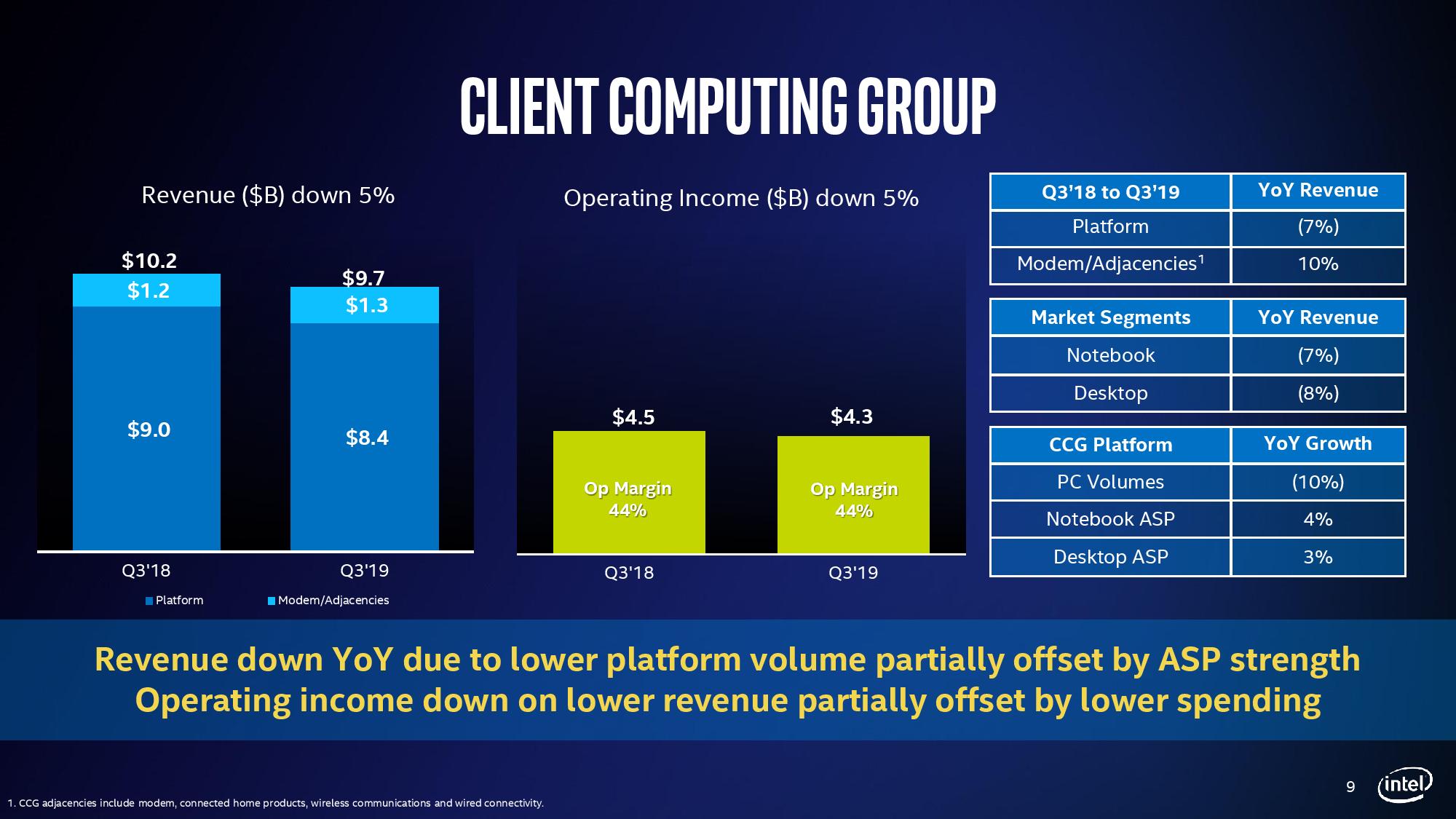

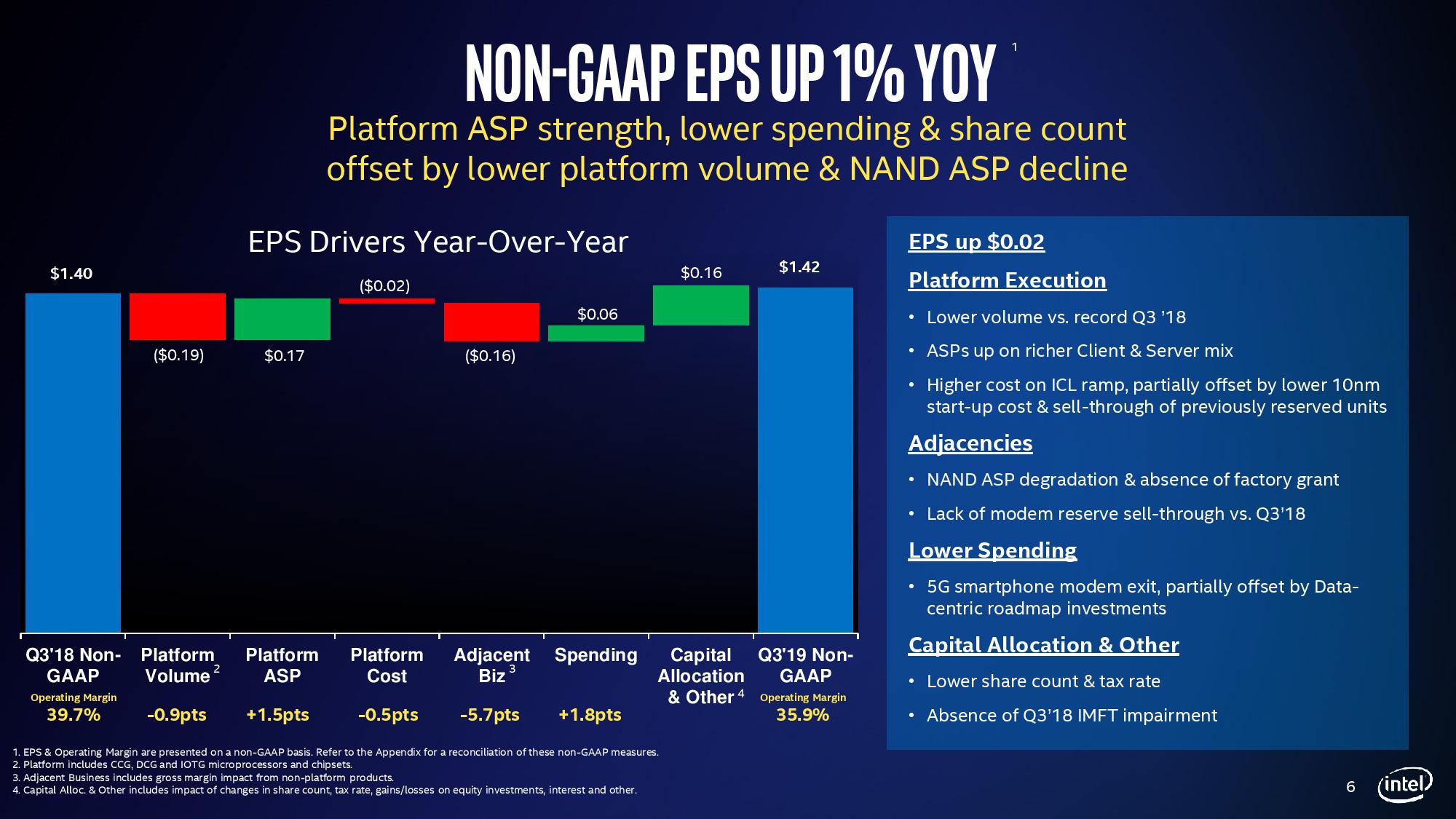

Meanwhile, client computing (aka desktop PCs) revenue fell five percent on the year, which Intel attributed to a 'tough compare' to last year's strong performance. However, Intel's volume in desktop processors dropped 10% year-over-year, but higher average selling prices (ASPs) from high-performance products helped buoy revenue.

AMD's surging presence in the do-it-yourself market may be partially responsible for the decline, but we'll have to wait until AMD's earnings report next week (and concrete market share data) to assess the impact.

Intel noted that one of the key challenges for the company's margins next year would be the "competitive impact" on average selling prices, alluding to price pressure from competitors. Swan elaborated that "we've tried the best we can take into account competitive dynamics as we exit this year and going into next year in our quest to play a bigger role in our customers success. We're going to compete to protect our position and expand the role we play." It's easy to assume the statements refer to pricing pressure due to AMD's expanding portion of the desktop PC market.

Swan announced during the call that Intel had powered on the company's DG1 GPU, its first discrete graphics card based on the 10nm process and Xe architecture, for the first time during the quarter, which "is an important milestone." The 10nm DG1 is expected to launch next year, and Swan also revealed that the company is on track to deliver its 7nm discrete GPU in the fourth quarter of 2021. That indicates that Raja Koduri's graphics group is on schedule with a regular cadence of products in the pipeline.

Intel has increased 14nm wafer starts by 25% this year, and plans to increase both 14nm and 10nm production by another 25% next year. In spite of these capacity increases, Swan said the company is still struggling to meet demand. Swan said the shortage of 14nm production capacity would extend into the fourth quarter of 2019, noting that "we're letting our customers down and they're expecting more from us."

Intel's OEM partners are now shipping eighteen 10nm Ice Lake designs into the market, out of 30 planned models. The company is producing 10nm chips in its Israel and Oregon fabs, with additional capacity coming online in Arizona soon. Intel plans to return to a two-year to 2.5-year node shrinking cadence with 7nm and following nodes and is "well down the engineering path on 5nm" development.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Swan also seemed to concede, for the first time, that the company no longer holds the lead in process technology, remarking that "We're working to recapture process leadership."

Intel's data center group remains a bright spot. Intel said that it had sold 23 million Cascade Lake data center processors to date and that a high mix of premium chips led to a 9% increase in ASPs. Again, this richer product mix offset a 6% decline in platform volumes. Swan also mentioned that two customers had selected the company's rare 9200-series Cascade Lake-AP Xeon processors for volume deployments.

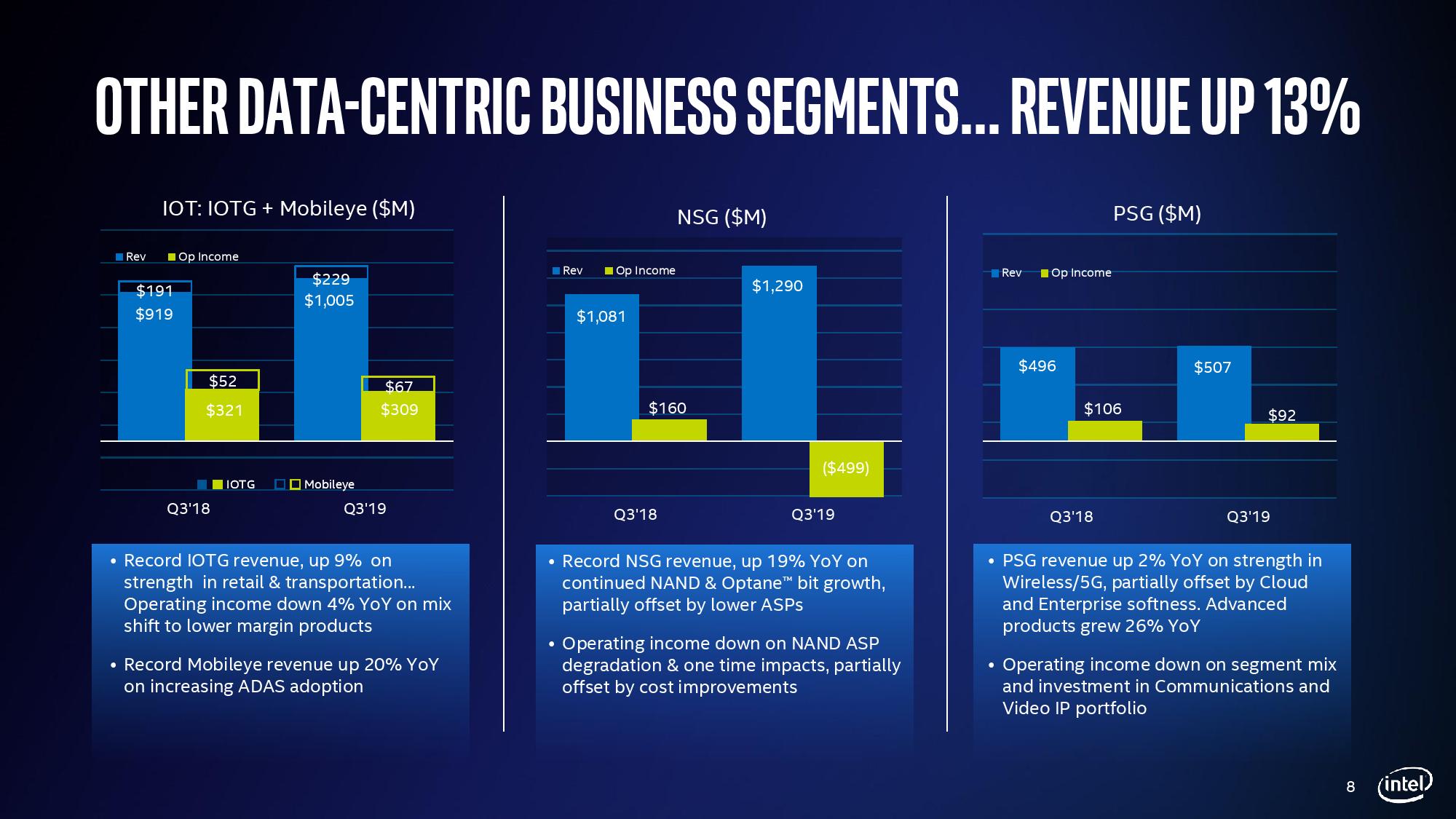

Other notable gains include Intel claiming it has now taken the lead in the networking market with $5 billion in revenue forecast for this year, and that its IoT division has now broken $1 billion in quarterly revenue for the first time. AI-centric revenue also topped $3.5 billion, which is an important achievement for Intel as it continues its full-court press on multiple segments of the AI market.

Intel's gross margin also fell to 58.9%, down appreciably from 64.5% during Q3 2018. The company chalked that up to ongoing investments in its transition to the 10nm node, among other factors.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

kinggremlin These quarterly results seem to indicate Intel is bulletproof. Intel's price cuts haven't really taken hold yet so that impact wasn't seen in the Q3 results, but I certainly expected to see some more significant negative impact on Intel's bottom line from the AMD resurgence. However, it is a bizarre situation that Intel just posted a record revenue quarter, and is continuing to be unable to meet demand yet they plan to roll out massive price cuts starting this quarter. Not sure how that is supposed to improve product availability. It's like they are dropping prices just to avoid getting insulted by internet trolls, even though they are selling everything they can at the current inflated prices.Reply

With reports of TMSC struggling with 7nm demand, it really makes AMD look like a bunch of morons. If Intel can't meet demand at their prices, and AMD's primary fab is struggling to meet demand as well, with sporadic outages of Zen 2 CPU's, why on earth would they price their CPU's so far below Intel? Sure it sort of benefits the consumer in the short term (Intel's announced price cuts in the mainstream are highly underwhelming), but how many millions is AMD leaving on the table that could fund R&D for future generations and benefit us for the long term? AMD could easily charge 25% more for their Zen2 CPU's and not see any drop in volume. AMD can't ever seem to get pricing right. Either they charge too much for garbage (their video cards now), or they charge too little for their good products (CPU's now). -

InvalidError Reply

Intel isn't bulletproof. Corporate sales are the bulk of Intel's business and corporate buyers have very high latency with adopting unknown parts from new vendors. AMD knew from the beginning that it'd be about three years before Zen got significant traction in the corporate world beyond early adopters. By the same token, Intel knew the competitive threat would be limited for the first couple of years. 2020 is where things may heat up for real should supply on both sides allow.kinggremlin said:These quarterly results seem to indicate Intel is bulletproof. -

twotwotwo Agree with the first poster that Intel can remain very healthy through a lot. Good to see the boss acknowledge some of the tricky things--price pressure and currently lacking process leadership.Reply

Still a big unanswered question for me is how the rest of the 10nm rollout will go. If this were a typical rollout, the 10th gen would be Ice Lake: there would be a plentiful enough supply of the chips, and they'd be a clear step up from the 14nm chip for everybody, instead of this productivity/graphics split they're talking about.

The 14nm shortages are also confusing. Did they have to convert a bunch of 14nm capacity to 10 to get this far on Ice? Some mysterious issue with their operations/execution they're keeping totally silent about? I'd also offer bad market forecasting as a guess, but shortages have gone on too long for it to just be forecasting.

I'm suspicious, with the unusual rollout of 10nm so far, that high volumes of high-end desktop/server 10nm CPUs will actually happen closer to the launch of 7nm+ Zen 3 than Zen 2. By mid-2021, maybe they're against 5nm and another new core design. Does not feel like Intel puts this behind them with their next big product launch anyway.

The dGPU stuff is interesting, also because it goes after one of AMD's other sources of profit. A sort of analogous thing on AMD's side is the (probable) 7nm Renoir laptop chips next year. They probably won't match Intel since AMD never got as good at power management; what I wonder is if they can get close enough to put pressure on Intel's prices. I'm sure each company's happy to take a shot at chipping away at the other's "safe" businesses. -

Mileta Cekovic Reply

Actually these quarterly results indicate only that Intel is selling overpriced processors to an non-educated market :(. But as much as these results are financially good, they do not show that things will change unless Intel reacts quickly, as customers will start to understand who is offering better value. It will take some time though, but customers will understand at the end of the day.kinggremlin said:These quarterly results seem to indicate Intel is bulletproof.

It is just a matter of:

How long AMD is able to maintain technical leadership (10 years ago AMD could not maintain it longer then 1-2 years with Athlon 64 and that was not enough).

Will Intel respond quickly enough and establish at least technical parity with AMD. -

digitalgriffin ReplyInvalidError said:Intel isn't bulletproof. Corporate sales are the bulk of Intel's business and corporate buyers have very high latency with adopting unknown parts from new vendors. AMD knew from the beginning that it'd be about three years before Zen got significant traction in the corporate world beyond early adopters. By the same token, Intel knew the competitive threat would be limited for the first couple of years. 2020 is where things may heat up for real should supply on both sides allow.

Agreed. Intel's shrinking margin is a sign that pressure is on. Shrinking margin is something you try to avoid as a CEO because it tends to make investors panic. So they will often implement tactics like layoffs, and sales of unprofitable assets to boost the bottom line and make things look better than they are to keep investors from leaving. -

kinggremlin Reply

Customers won't understand because they don't care and don't buy CPU's. They buy Intel systems from Dell or HP because they know the brand. The vast majority probably don't even know that Intel makes the CPU. Computers are an appliance to the general public and they don't feel like wasting time researching them.Mileta Cekovic said:Actually these quarterly results indicate only that Intel is selling overpriced processors to an non-educated market :(. But as much as these results are financially good, they do not show that things will change unless Intel reacts quickly, as customers will start to understand who is offering better value. It will take some time though, but customers will understand at the end of the day.

It is just a matter of:

How long AMD is able to maintain technical leadership (10 years ago AMD could not maintain it longer then 1-2 years with Athlon 64 and that was not enough).

Will Intel respond quickly enough and establish at least technical parity with AMD. -

InvalidError Reply

For a large chunk of the general public, researching PCs really is a waste of time since any potato from recent years will do just fine... except perhaps for those countless poorly optimized FB games that no amount of over-building can help. (My mother complained continuously about laggy FB games on her AMD E-series laptop, upgraded to a Ryzen 2500U which is 3-4X faster, still complains about FB game lag just as much.)kinggremlin said:Computers are an appliance to the general public and they don't feel like wasting time researching them. -

bit_user ReplyIntel had powered on the company's DG1 GPU, its first discrete graphics card

Sounds too much like:

https://www.nvidia.com/en-us/data-center/dgx-1/ -

bit_user Reply

Fab capacity is neither cheap nor quick to add. So, even if you realize you mis-forecast demand, then you have to be really sure that you were really far off and that it will continue to hold true, to then go and justify adding capacity of an old node fairly late in the cycle. Maybe they lost further time, as that reckoning slowly sank in. Plus, don't forget they had some shakeup in their management, over the past couple years.twotwotwo said:The 14nm shortages are also confusing. Did they have to convert a bunch of 14nm capacity to 10 to get this far on Ice? Some mysterious issue with their operations/execution they're keeping totally silent about? I'd also offer bad market forecasting as a guess, but shortages have gone on too long for it to just be forecasting.

The other thing is that because Intel got stuck on 14 nm and AMD is churning out CPUs with way more cores, Intel had to add more cores per CPU, on 14 nm, to stay competitive. This means fewer chips per wafer, so their existing capacity is no longer good for as much volume as before. So, it's kind of like a double-hit to their capacity. -

hotaru251 is it a surprise tbh?Reply

Intel hasnt done much in past few years to make ppl wanna upgrade to em.

nobody wants a refresh of a refresh for more $.