No, Intel Didn't Actually Sell More GPUs Than AMD, Firm Overcounted 60,000 GPUs

60,000 Ponte Vecchio GPUs were inadvertently added.

When earlier this week it turned out that Intel sold as many discrete graphics processors as AMD in the fourth quarter of 2022, based on data from reputable Jon Peddie Research, we felt something was off. It turns out that JPR had inadvertently included 60,000 Ponte Vecchio data center GPUs in his calculations. Naturally, that threw the numbers off significantly.

Jon Peddie himself was kind enough to warn us that JPR's unit shipment estimates were based on Intel's recent financial report and ASPs and could be inaccurate. Indeed, they were, and Intel did not sell as many standalone GPUs as AMD last quarter.

6%, Not 9%

Intel included revenue it got from selling Ponte Vecchio compute GPUs into earnings of the division that sells consumer GPUs, which significantly increased its revenue.

Meanwhile, JPR assumed that the business unit only sold graphics processors from client PCs, so when it divided revenue by average selling price (ASP) it considered accurate for Intel Arc products, it got an incorrect number of client GPUs sold by Intel last quarter.

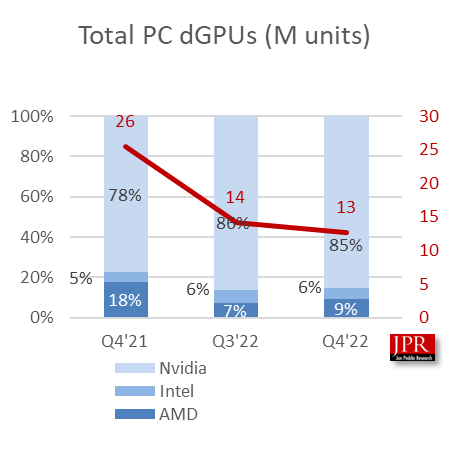

After correction, it turned out that out of 13 million standalone GPUs for desktops and notebooks sold last quarter, Nvidia shipped 85%, AMD supplied 9%, and Intel sold 6%.

In fact, controlling of 6% of the discrete GPU market is a big deal for a company that has been on this market for only two years. Keeping in mind that the bulk of Intel's GPU shipments are probably inexpensive notebook GPUs, its ASPs are behind those of AMD and Nvidia, but eventually the company will likely catch up on this front as well.

Here Is What Happened

While Intel is a relative newbie on the discrete GPU market, its product portfolio is now pretty broad. The company sells standalone Arc Alchemist GPUs for desktops and notebooks, it has Flex Series graphics cards tailored for remote rendering and media streaming (yet based on the same silicon as Arc products for client PCs), and it has Data Center GPU Max compute GPUs formerly codenamed Ponte Vecchio.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

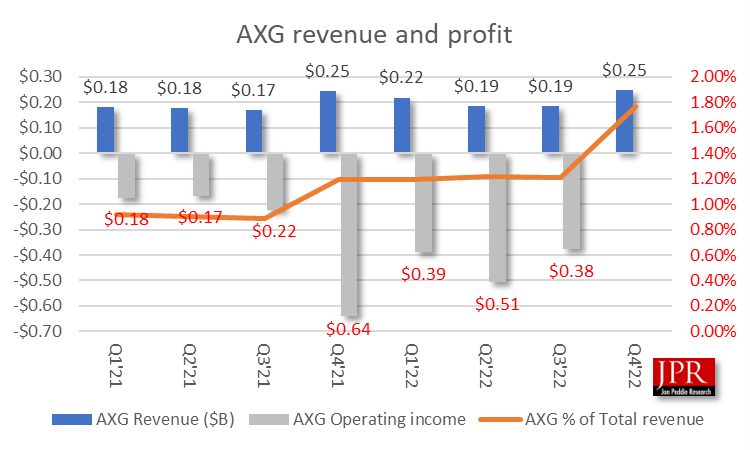

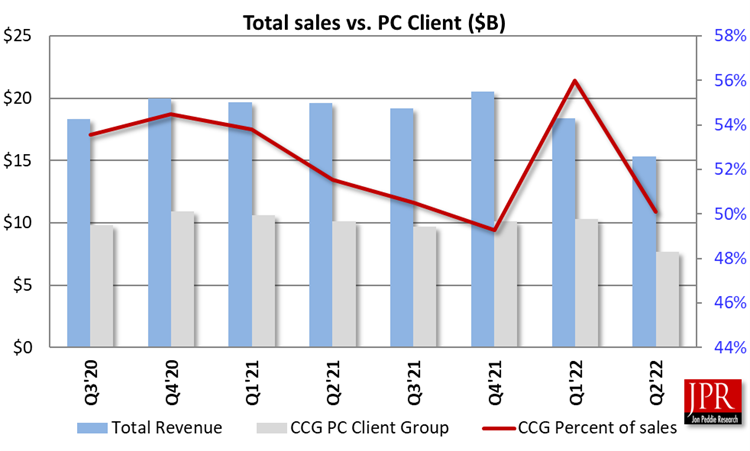

Intel typically included sales of its discrete graphics processors into revenue of its Accelerated Computing Systems and Graphics Group (AGX), but in Q4 2022 that division was split into two different branches with consumer GPUs moving to Client Compute Group (CCG) and server GPUs became part of the Data Center and AI (DCAI) division. Analysts from Jon Peddie Research asserted that sales of compute GPUs in Q4 were already folded into results on the DCAI, whereas sales of consumer GPUs in Q4 were included into results of AXG.

Meanwhile, AXG substantially increased its revenue in Q4, which JPR attributed to increased sales of its consumer GPUs. But in Q4 2022, Intel shipped its first large batch of Ponte Vecchio compute GPUs presumably for Argonne National Laboratory Aurora supercomputer. The machine requires 60,000 of Intel's Data Center GPU Max and a substantial part of them were shipped in Q4 2022, according to JPR's estimates. JPR now believes that sales of Ponte Vecchio were reported in AXG's results, so its unit shipments estimates were incorrect.

"We had been using an ASP for the dGPUs from AXG to arrive at unit shipments, assuming Ponte Vecchio was rolled up in the data center (DCG) group, renamed DCAI," the explanation by JPR reads. "The tricky part is the split of Xe to computer (DCAI) and AGX, and which bucket got credit for the Aurora shipments.

Since the split of the GPU group took place in Q4, we think the AXG got credit for all Xe shipments, which would include the 60,000-plus Ponte Vecchio dGPUs," JPR explained. "That spike in revenue threw off our ASP modeling and made it look like Intel had a big jump in shipments, and that dGPU shipments had gone up more than they had."

Jon Peddie Research has remodeled its Intel’s Q4 discrete GPU shipments by subtracting the 60,000+ expensive Ponte Vecchio compute GPUs and naturally got different results.

"We have never counted AMD or Intel GPU-compute GPUs in our quarterly reports and got caught by surprise by Intel," the company wrote. "We don’t think Intel intended to deliberately mislead the industry and simply isn’t used to dGPU consumer vs. data center GPU shipment differentiation — a dGPU is a dGPU (except they aren’t)."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

jkflipflop98 I mean that still a heck of a turnout for a first run at it. It can only get better from here.Reply -

PlaneInTheSky The fact Intel grabbed 6% of the consumer dGPU market is still insane.Reply

The fact it came at the cost of AMD GPU sales shows what a weak position AMD is in. AMD has always had issues with poor drivers, poor encoding performance, poor raytracing, etc.

Intel seems to be aggressively improving drivers, raytracing and encoding support. -

Giroro Intel is doing better than expected, considering they put Koduri in charge and let him permanently ruin the Arc brand with gamers.Reply

But maybe the brand will have a fighting chance with a bit of corporate restructuring and advertising focusing on their strengths for media creation/streaming and business use.

As it stands, good luck finding accurate information about whether you can use Arc graphics to run a plex server, which is something it should be very good at. -

JarredWaltonGPU Replyjkflipflop98 said:I mean that still a heck of a turnout for a first run at it. It can only get better from here.

As noted in our previous report, JPR data is based on dGPU sell-in to the channel and says nothing about dGPU sell-out to consumers and businesses that are actually using the dGPUs. I would still wager (heavily) that there are a lot of Arc GPUs in warehouses sitting in large containers rather than in PCs and laptops. Those will inevitably get moved out to consumers over the coming year, and I suspect Intel isn't ordering more Arc wafers from TSMC at this stage. Intel grabbed 6% of the sell-in market last quarter. That is not the same as 6% of the consumer GPU market.PlaneInTheSky said:The fact Intel grabbed 6% of the consumer dGPU market is still insane. -

Alvar "Miles" Udell Intel aside, it does show again that while AMD positions themself as a "value alternative" essentially to nVidia, people are still not flocking to buy their cards, something we see year after year. It could be exclusive features or it could be software stability (for me it's the latter), AMD needs to finally recognize that performance isn't what's holding them back.Reply

-

bit_user Reply

Is that AMD's positioning, or just how we're used to thinking of them?Alvar Miles Udell said:it does show again that while AMD positions themself as a "value alternative" essentially to nVidia,

Nvidia is definitely seen as the premium brand. So, it makes sense to me that when availability returned and prices dropped, people who might've "settled" for an AMD GPU were instead opting for Nvidia - even at a price premium.

People expecting to hold onto their GPU for a while might also really be starting to weight ray tracing performance more heavily.Alvar Miles Udell said:It could be exclusive features or it could be software stability (for me it's the latter), -

waltc3 Glad Peddie caught it, because it certainly was not believable. But it does spotlight the problem with these companies that do estimates, like Peddie. Lots of stuff gets mixed up and things can be misunderstood or overstated easily. All such estimates should be taken with a grain of salt, imo.Reply -

waltc3 Replybit_user said:Is that AMD's positioning, or just how we're used to thinking of them?

Nvidia is definitely seen as the premium brand. So, it makes sense to me that when availability returned and prices dropped, people who might've "settled" for an AMD GPU were instead opting for Nvidia - even at a price premium.

People expecting to hold onto their GPU for a while might also really be starting to weight ray tracing performance more heavily.

Yes, nVidia is definitely the premium-priced brand, no question...;)