Graphics Cards Shipments Hit Three-Year High in Q3 2021: JPR

Unit shipments of desktop graphics cards hit 12.7 million units.

Unit sales of discrete desktop PC graphic cards hit a three-year high in the third quarter of 2021. A 25.7% year-over-year increase, according to market research firm Jon Peddie Research. Average selling prices (ASPs) set another record during the third quarter as demand for these products once again exceeded supply. Nvidia continues to dominate the market of discrete GPUs in general and desktop graphics cards in particular, but sales of AMD's Radeon graphics boards also increased in Q3 2021. What remains to be seen is how Intel's entrance into discrete GPU market will affect AMD's and Nvidia's businesses.

Shipments of Graphics Cards Hit 12.7 Million Units

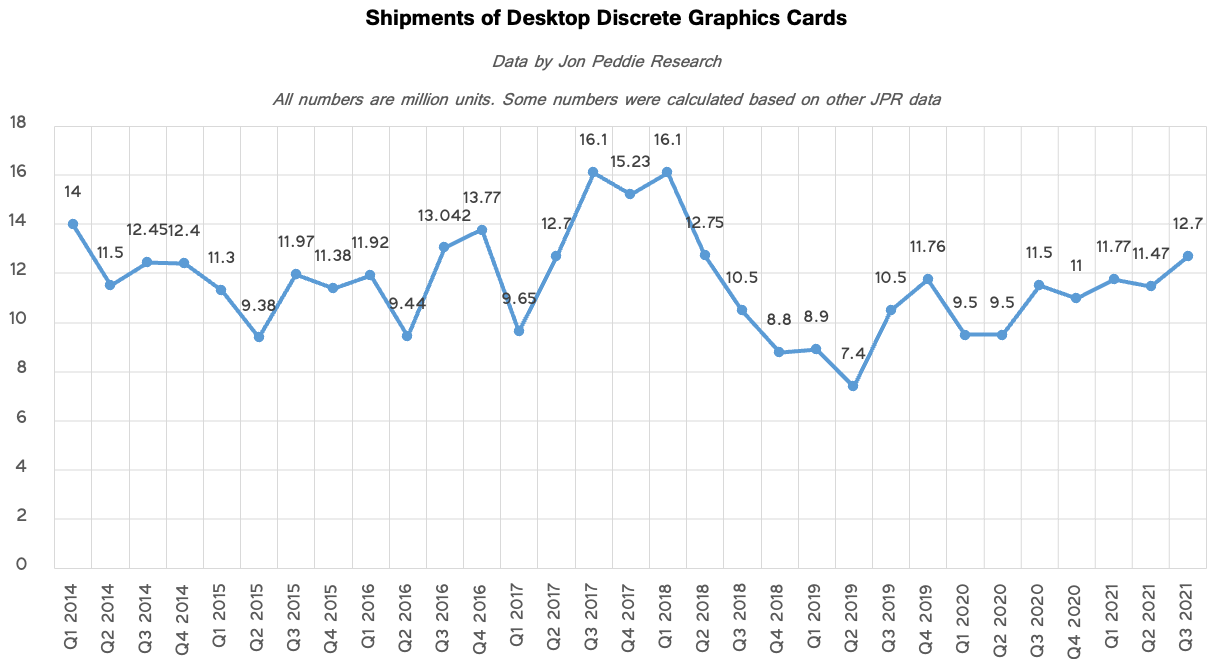

Makers of graphics cards shipped 12.7 million standalone add-in-boards (AIBs) for desktops in Q3 2021, up from 11.47 million in Q2 2021. Based on data from JPR, sales of graphics cards were up 25.7% year-over-year and 10.9% quarter-over-quarter. 12.7 million graphics boards per quarter is more AIBs than there were sold per quarter since Q2 2018, a clear indicator that demand for discrete graphics is very strong.

AMD introduced its Radeon RX 6600-series entry-level desktop GPUs in the third quarter, which impacted its shipments. Meanwhile, Nvidia ramped up production of its GeForce the RTX 3080 Ti and RTX 3070 Ti, which happen to be among the best graphics cards for performance-demanding users. Overall, discrete GPU line-ups from both vendors became significantly more competitive,

Normally, the third quarter is the best quarter of the year as far as unit shipments of hardware is concerned. Since demand for graphics AIBs is clearly exceeding supply, actual unit shipments are probably controlled by AMD and Nvidia rather than demand from end users. As a result, it remains to be seen how many graphics boards will be shipped in the fourth quarter, but it looks like unit sales of standalone desktop GPUs will set a multi-year record in 2021.

Discrete Desktop AIB Sales Hit $13.7 Billion

While 12.7 million discrete graphics cards for desktops sounds a lot, and is more than the number of standalone desktop GPUs sold by the industry per quarter in the recent years, in past years hardware makers could ship well over 20 million discrete AIBs for desktops per quarter. What the computer graphics industry has not seen are the revenues it sees today. Sales of graphics cards reached $13.7 billion in Q3.

"Average selling prices of graphics cards are still high, and AIBs are still difficult to get," said Dr. Jon Peddie, President of JPR. "The costs are driven by two factors, fab costs have gone up, and the GPU builders have raised prices. And the channel still continues to raise prices as long as supply is constrained, which is expected to last until Q2 2022."

Average selling prices (ASPs) of graphics cards continue to set records. In Q2 2021, an ASP of a graphics card totaled nearly $1,100 per unit, which is a historical record. Such a high average selling price was conditioned by two factors: short supply of GPUs and other components, as well as strong demand for expensive workstation-grade graphics boards, according to JPR.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"The workstation segment surged to another volume record in Q3 2021, OEMs and VARs are having a major impact by stocking up on inventory, the pandemic showed us what a disruption in the supply chain can do to availability, so we are seeing system integrators plan ahead," JPR explained.

Nvidia Retains Standalone GPU Crown

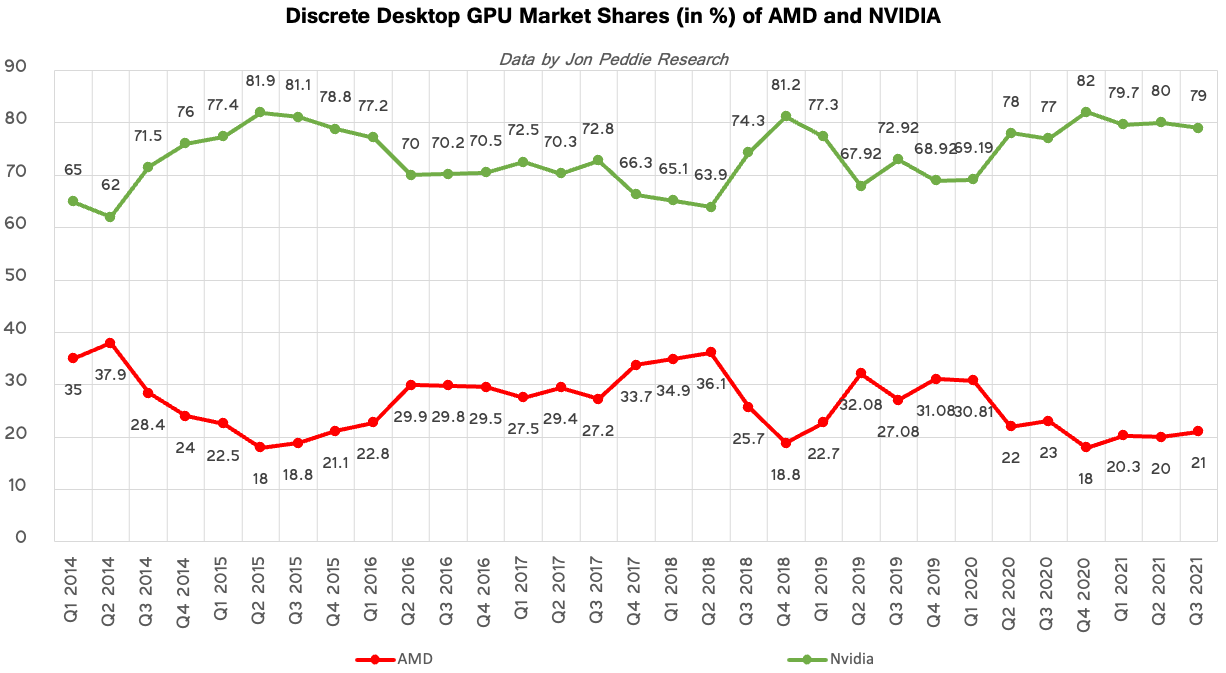

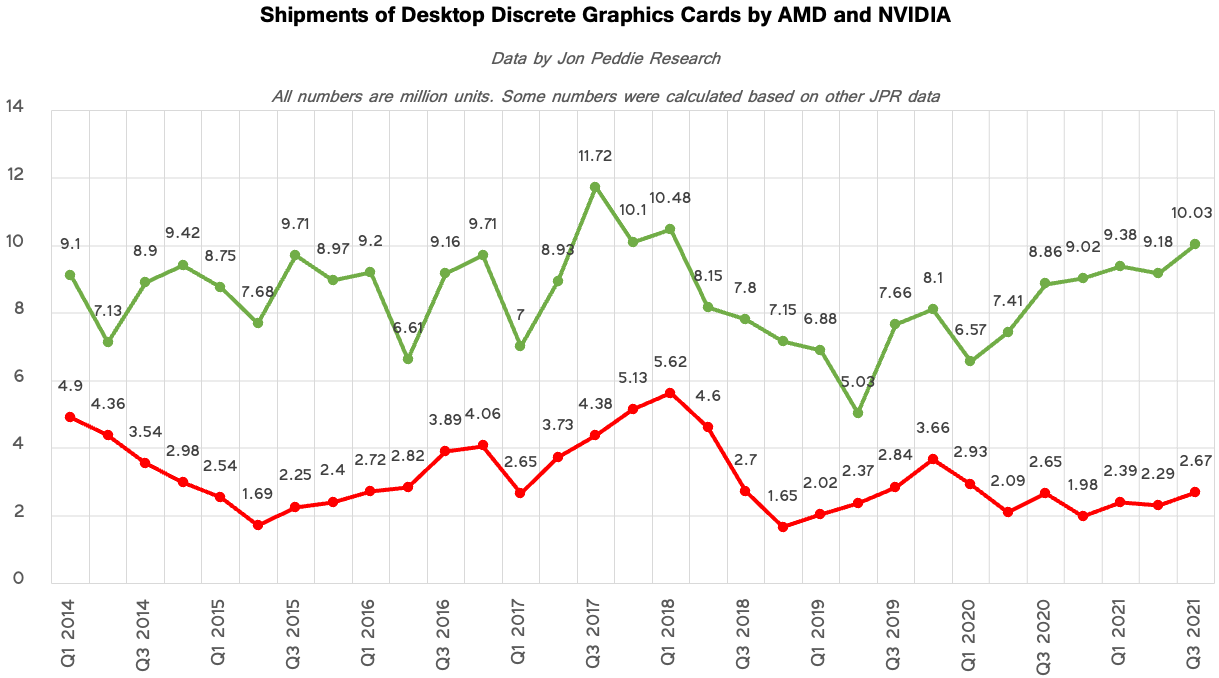

Although AMD gained some share on the desktop discrete market in the third quarter, Nvidia continued to command 79% of the standalone desktop GPU market. Furthermore, Nvidia increased its share compared to the third quarter of 2020.

The green company sold around 10 million graphics processors for desktops in Q3 2021, up from around 8.9 million in Q3 2020. By contrast, AMD's shipments of discrete desktop GPUs totalled approximately 2.6 ~ 2.7 million GPUs, which is in line with the company's standalone desktop GPU shipments in the third quarter last year, according to numbers estimated by Tom's Hardware based on data from JPR.

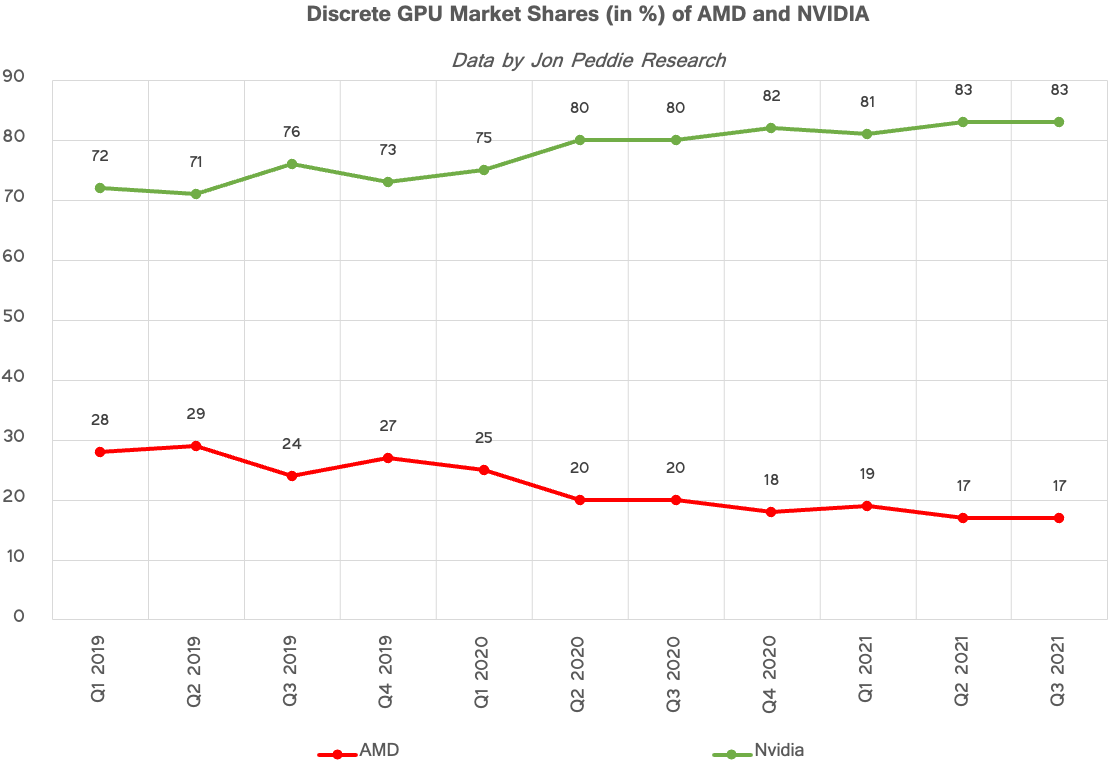

As far as overall standalone GPU shipments (both for desktops and for laptops) are concerned, Nvidia kept its positions and continued to command 83% of unit shipments in the third quarter, whereas AMD share remained at 17%, its lowest in years. In fact, Nvidia's lead is even more solid in laptops as the company sold 85% of discrete notebook GPUs, according to Jon Peddie Research.

Keeping in mind that AMD prioritizes production of system-on-chips for game consoles as well as CPUs for servers and high-margin client PCs, it is not particularly surprising that AMD cannot win any significant discrete GPU market share from Nvidia, which solely sells graphics processors.

Good news for AMD is that shipments of its standalone GPUs are growing albeit very slowly.

Changes Are Coming

In the past few months AMD's management stressed that it was working hard to get some additional production capacities in a bid to support its future growth. Hopefully, that additional capacity will enable it to increase shipments of its GPUs in 2022 ~ 2023 timeframe, which will bring changes to the market now dominated by Nvidia.

Another factor that will impact the market of discrete GPUs is Intel's plans to launch high-performance standalone graphics processors early next year, which will affect both AMD and Nvidia. Yet, it is inevitable that Intel will take market share from existing players.

"Intel is poised to enter the AIB market in 2022," said Peddie. "It is unknown if the company will sell add-in-boards as AMD and Nvidia do, or just offer chips. The company is entering the market at a high point and may be surprised when the hangover of Covid and Cybermining falls off. The big question most people are asking is how much market share will the company take?"

Summary

Demand for latest graphics cards from AMD and Nvidia remains record high both among gamers and professionals since modern GPUs provide tangible benefits when compared to their predecessors. In Q3 2021 average selling price of a graphics card increased to nearly $1100, which means record profitability for the two suppliers of standalone graphics processors.

Nvidia continues to dominate sales of discrete GPUs both because its very competitive lineup of products and because AMD has to focus on high-margin CPUs and game console SoCs and can allocate little capacity for GPUs. But when Intel enters the market of standalone graphics processors next year, it will compete against both players and only time will tell how this will affect positions of AMD and Nvidia.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Endymio Reply

This may surprise you, but miners are people too, and scalpers sell to gamers as well as anyone.Mandark said:All to miners and scalpers so who cares

The article takeaway is that total supply increased in Q3, which should (but probably won't) put to bed some of the conspiracy theories about manufacturers manipulating the market to increase pricing.