Kingston dominates DRAM third-party market

El Segundo (CA) - Surging demand for semiconductors in 2004 allowed virtually all major third-party DRAM module suppliers to boost sales results over the prior year, according to a report released by market research firm iSuppli. Kingston padded its leading position and expanded its market share to 27 percent.

2004 saw rapid growth in DRAM module sales which particularly fueled due to a corporate upgrade cycle and the continued success of notebooks. Overall DRAM market volume jumped 53 percent, with DRAM module sales including devices from third-party module makers, white-box PC makers and OEMs climbed to $21.7 billion, up 55 percent from $14 billion in 2003.

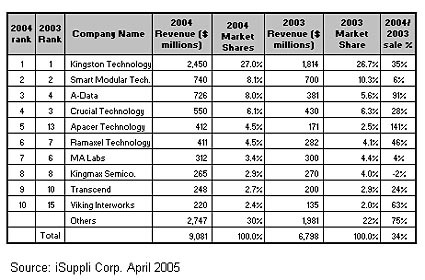

According to iSuppli, sales of DRAM modules by OEMs continued to represent the bulk of the market in 2004, accounting for 59 percent of revenue. Module sales by white-box PC makers accounted for 19 percent of sales. An estimated 12 percent of sales were made by third-party aftermarket manufacturers. The third-party module market reached $9.08 billion in 2004, a 34 percent increase from $6.8 billion in 2003.

Third-party sales were again dominated by Kingston, which grew its sales from $1.8 billion to $2.5 billion and increased its market share from 26.7 to 27.0 percent. Smart Modular Technologies, whose sales grew to $740 million in 2004, up 6 percent from $700 million in 2003.

A-Data Technology broke into the top-three rankings for the first time in 2004, rising from fourth place in 2003. The company's DRAM module sales exploded by 91 percent in 2004, rising from $381 million in 2003 to $726 million last year, according to iSuppli. Crucial slipped from third to fourth place with sales growing 28 percent.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Wolfgang Gruener is an experienced professional in digital strategy and content, specializing in web strategy, content architecture, user experience, and applying AI in content operations within the insurtech industry. His previous roles include Director, Digital Strategy and Content Experience at American Eagle, Managing Editor at TG Daily, and contributing to publications like Tom's Guide and Tom's Hardware.